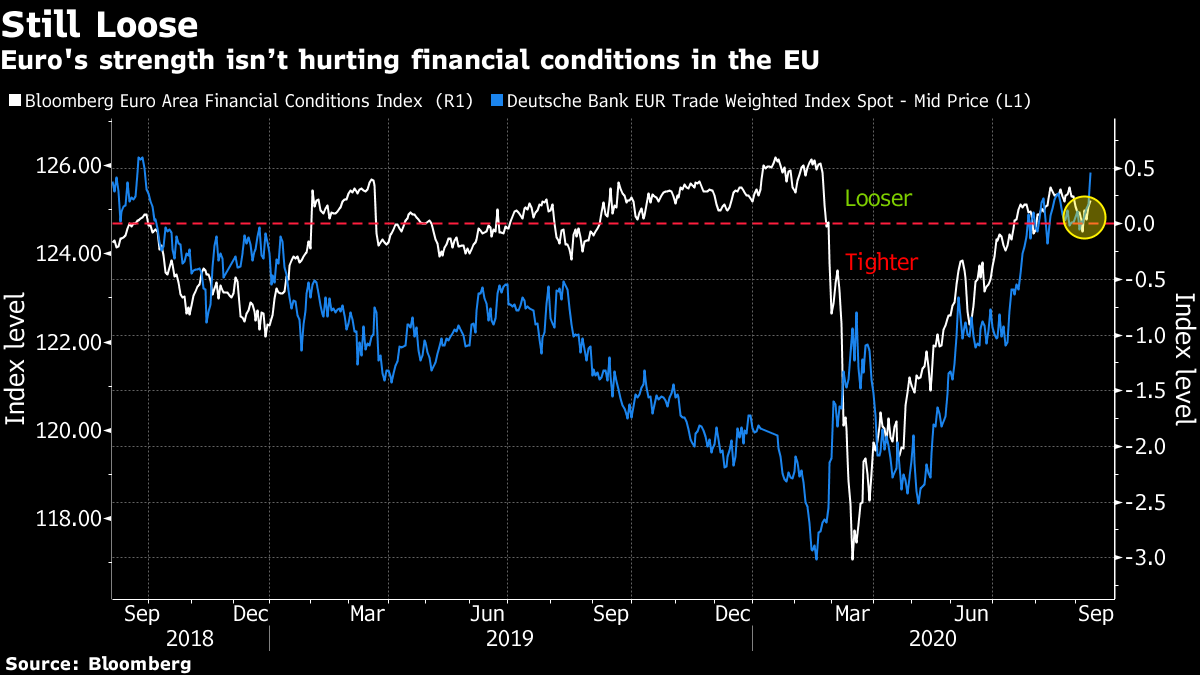

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Europe becomes a virus hotspot again, the ECB's policies will be pored over and Brexit is getting even messier. Here's what's moving markets. Hotspot The signs are not good. Western Europe surpassed the U.S. in its new daily Covid-19 infections, re-emerging as a global hotspot for the virus having seemingly brought it under control before the summer. France recorded nearly 10,000 new cases on Thursday, the most since its lockdown ended four months ago. A government meeting is due to take place on Friday to discuss measures to curb the spread. Cases are rising in Denmark too, surpassing neighbor Sweden, which didn't impose a lockdown. Adding to the woes, particularly for the battered travel industry, the U.K. added Portugal and Hungary to its quarantine list. The Euro The day after the European Central Bank's latest policy decision, as ever, is likely to be filled with pontificating over the bank's strategy. The bank left its asset purchases and interest rates unchanged but the main area of interest was the strength of the euro, which President Christine Lagarde said the bank is keeping an eye on but sees no immediate need to intervene. Her comments provided the single currency license to resume its bounce against the dollar. Some ECB officials are also said to have wanted Lagarde to provide a more optimistic view of the economy. Multiple policymakers are due to speak over the course of Friday to provide more to pore over, so watch for more comments on the euro and perspectives on how the economy is recovering. Messy Brexit Anyone hoping for some substantial progress on Brexit will likely emerge from this week disappointed. The U.K. and European Union appear to be headed for a chaotic split with no trade deal in place, the two sides pushed further apart by the U.K. government's plan to rewrite the withdrawal accord already in place. The EU demanded that plan be scrapped. The U.K. government refused and the EU gave Prime Minister Boris Johnson until the end of the month to back down. It all points to more tension and more volatility in the pound and domestic U.K. stocks as we head towards these deadlines though, in one bright spot for Friday, the U.K. and Japan are set to conclude a post-Brexit trade pact. Weekly Decline U.S. stocks are headed for a second week of declines after the selloff in megacap tech names resumed, highlighting the lingering concerns over lofty valuations in certain pockets of the market. Thin liquidity is still is leaving stocks vulnerable to exaggerated moves around big options trades and stock buyers still have plenty of reason to be concerned that a surge in volatility lies ahead. Some funds are sticking to bets on high-flying tech stocks, however, as the pricey valuations may be justified by the quality of the businesses. European stock futures, meanwhile, are trending lower going into Friday but the Stoxx 600 is still on track to register a gain for the week. Coming Up… U.K. GDP, in the shadow of Brexit, tops the economic data agenda. The earnings calendar is quiet, headed up by emerging markets fund manager Ashmore Group Plc, and watch for any reaction to the departure of mining giant Rio Tinto Plc's chief executive following concerted pressure from investors. Watch too for any developments around La Nina, the weather phenomenon which promises to bring more images like these to California. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Euro bulls breathed a sigh of relief Thursday when European Central Bank President Christine Lagarde signaled her interest in the resurgent currency is still very much as an observer, even if its recent strength has made her a keen one. And as my colleague Ye Xie pointed out afterwards, that looks like the sensible approach. The Bloomberg Euro Area Financial Conditions Index — a gauge of the level of financial stress in the region — is still in positive territory, showing no signs of negative impact from the currency's rise. The measure has even improved despite a climb in the Deutsche Bank Trade-Weighted Euro Index to a two-year high. Yet there's a lot coming up for Lagarde to observe. Close to home is the collapse in sterling as a result of the increased concern of a no-deal Brexit. And it seems some policymakers wanted the president to take a slightly more optimistic view on the European economy, which could help sentiment toward the currency — although that seems to be a nice problem to observe. More pressingly, the upcoming Federal Reserve meeting has the potential to kick start a fresh wave of bearish dollar commentary, should policy makers skew dovish. That could put the $1.20 level back in play, suggesting all eyes — including Madame Lagarde's — will be across the Atlantic next week to observe the euro's next move.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment