Another New World OrderIs it time for a New World Order? Ever since the double shock of collapsing oil prices and the advent of the pandemic six months ago, it has looked as though the existing order cannot hold. That order, associated primarily with the names of Paul Volcker, Margaret Thatcher and Ronald Reagan, was built around independent central banks and aggressive globalization, and oversaw some two decades of impressive growth, then another two decades marked by repeated crises and deepening inequality and discontent. Covid-19 appeared to administer the coup de grace. You can find the pieces I wrote on this here, and here. For a more outspoken take, listen to the inimitable Paul McCulley on the Odd Lots podcast with Joe Weisenthal and Tracey Alloway. He says we are "unambiguously" on the verge of a "profound change" in the global economy. This will involve a move away from capitalism and toward democracy, which he says is inherently socialist. (I don't necessarily agree with that last formulation but it makes for interesting listening.) If the Volcker/Thatcher/Reagan era is now finally over (and many of us thought the financial crisis must have ended it more than a decade ago), what comes next? And what are the implications for long-term asset management? None of what follows has any bearing on how you should navigate the latest ructions in mega-cap tech stocks. For anyone involved in managing very long-term money, however, the latest Long-Term Asset Return Study by Deutsche Bank AG's veteran financial historian Jim Reid should be useful. He suggests we have seen five distinct global economic eras since 1860, and are now entering a sixth, labeled the Age of Disorder: 1. The first era of globalization (1860-1914)

2. The Great Wars and the Depression (1914-1945)

3. Bretton Woods and the return to a gold-based monetary system (1945-

1971)

4. The start of fiat money and the high-inflation era of the 1970s (1971-1980)

5. The second era of globalization (1980-2020?)

6. The Age of Disorder (2020?-????)

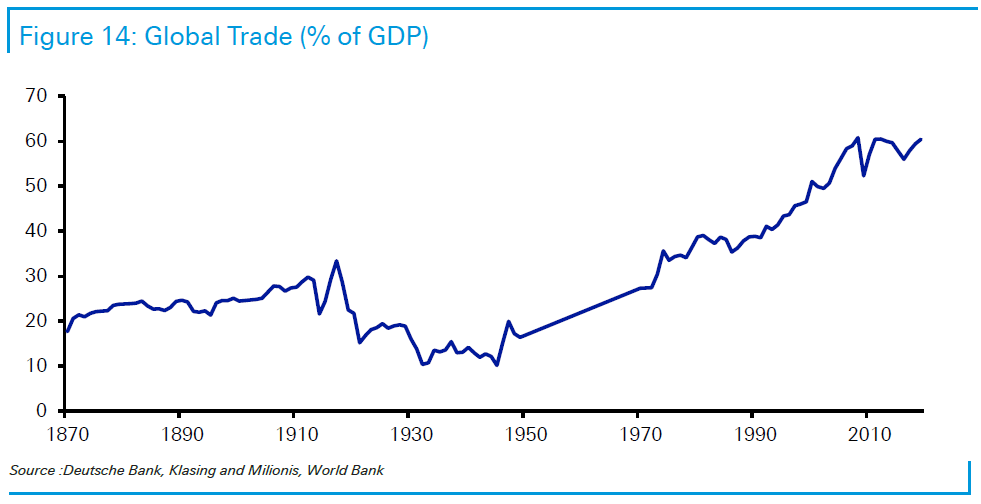

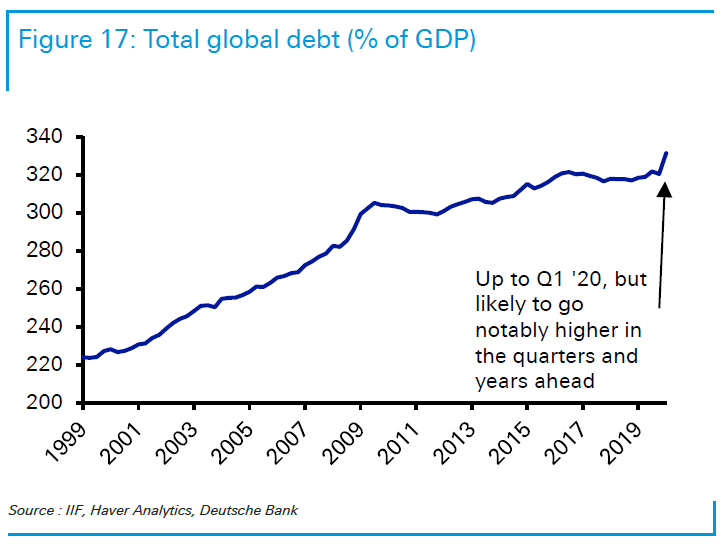

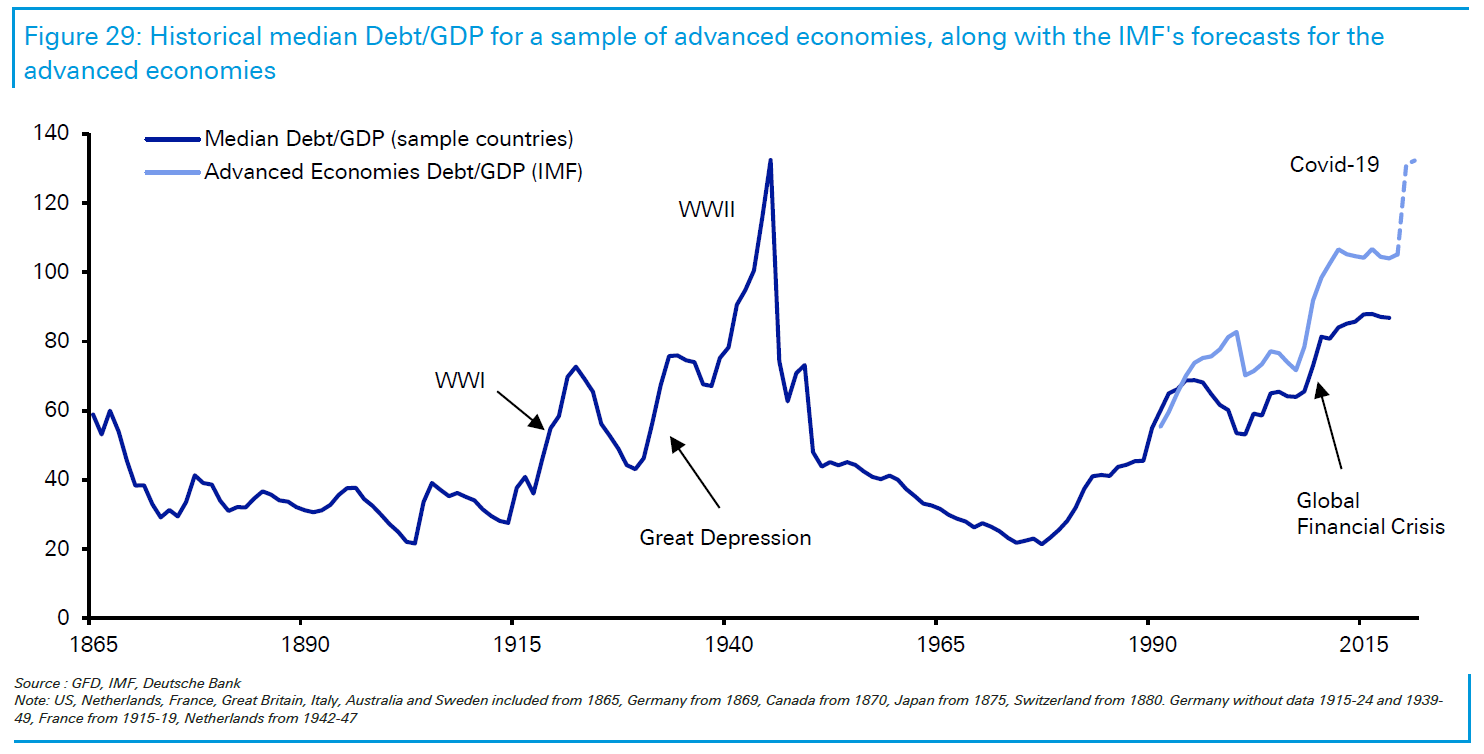

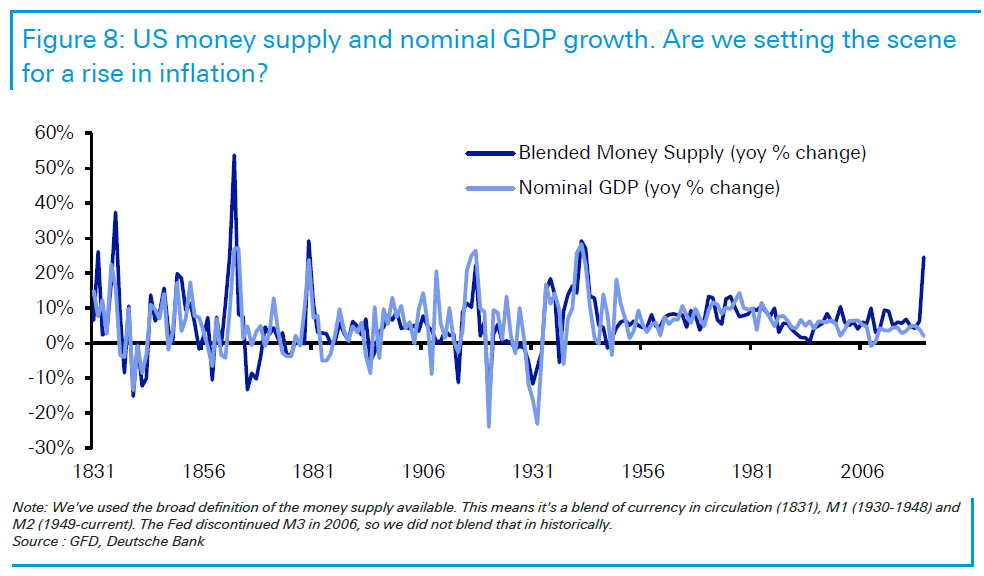

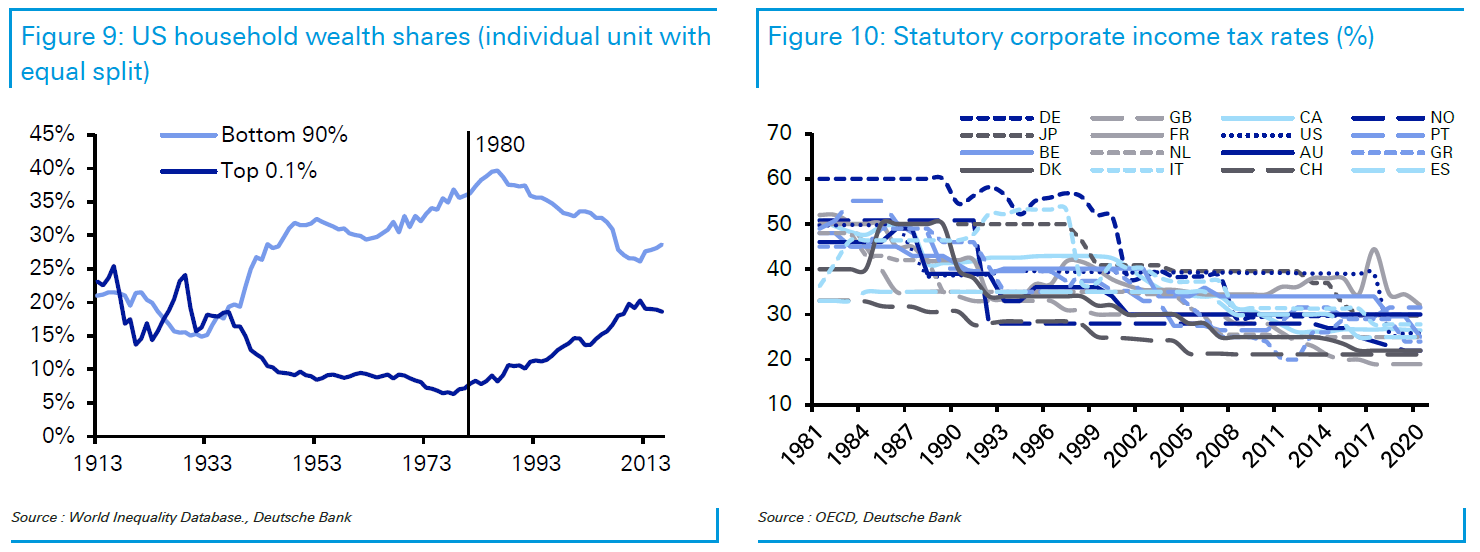

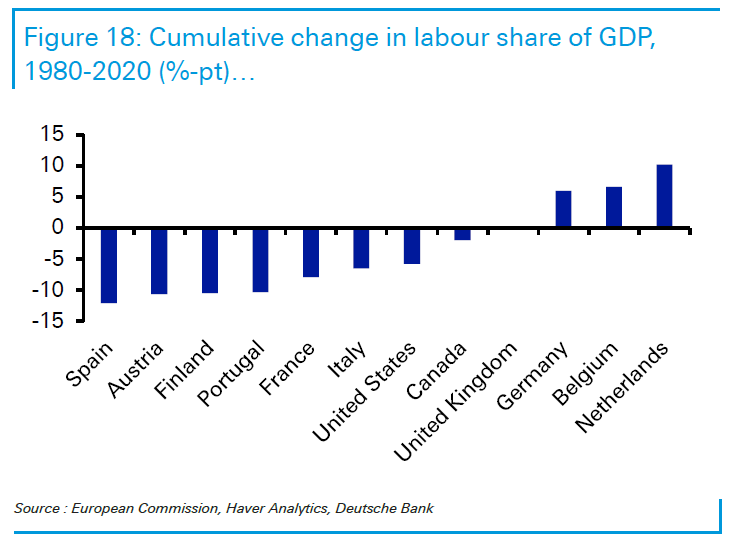

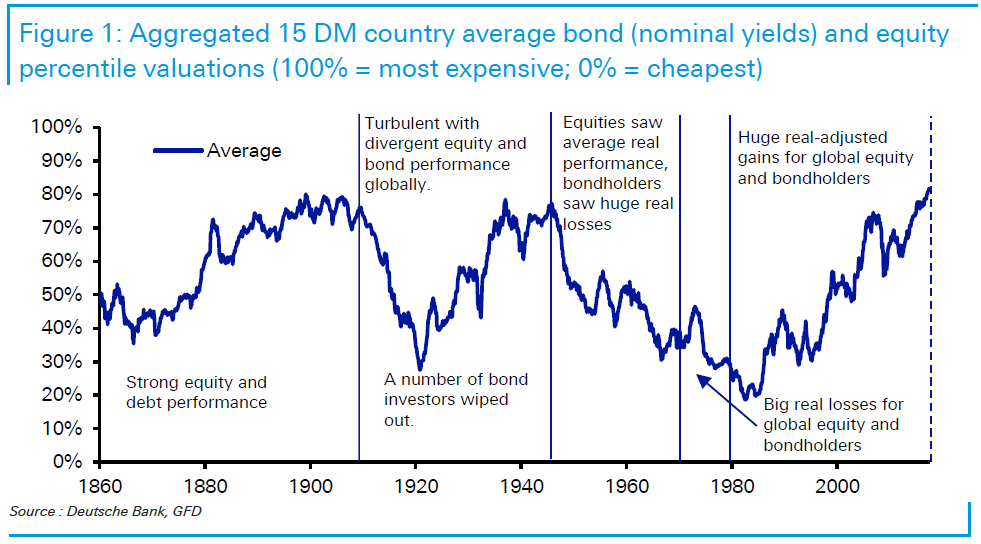

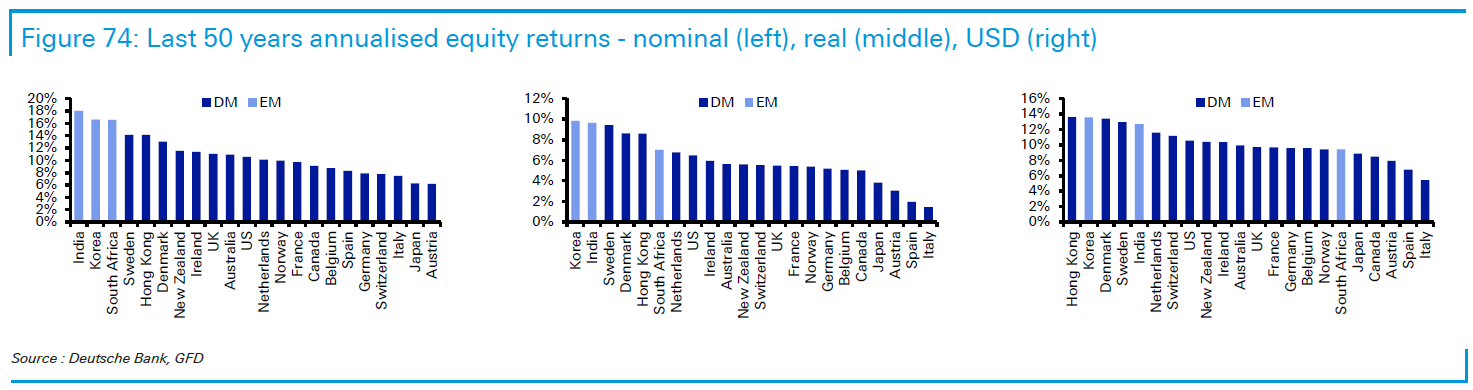

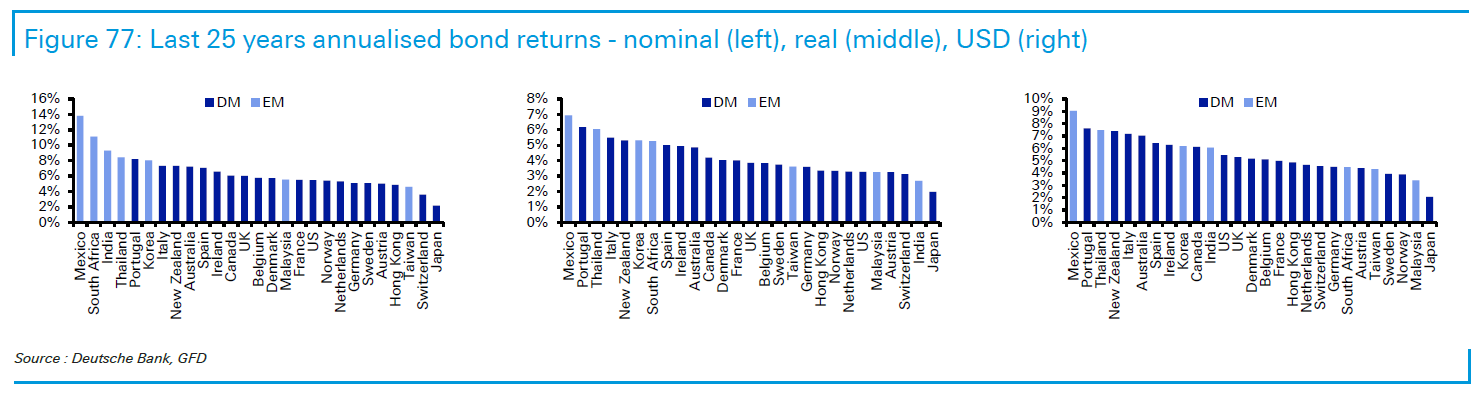

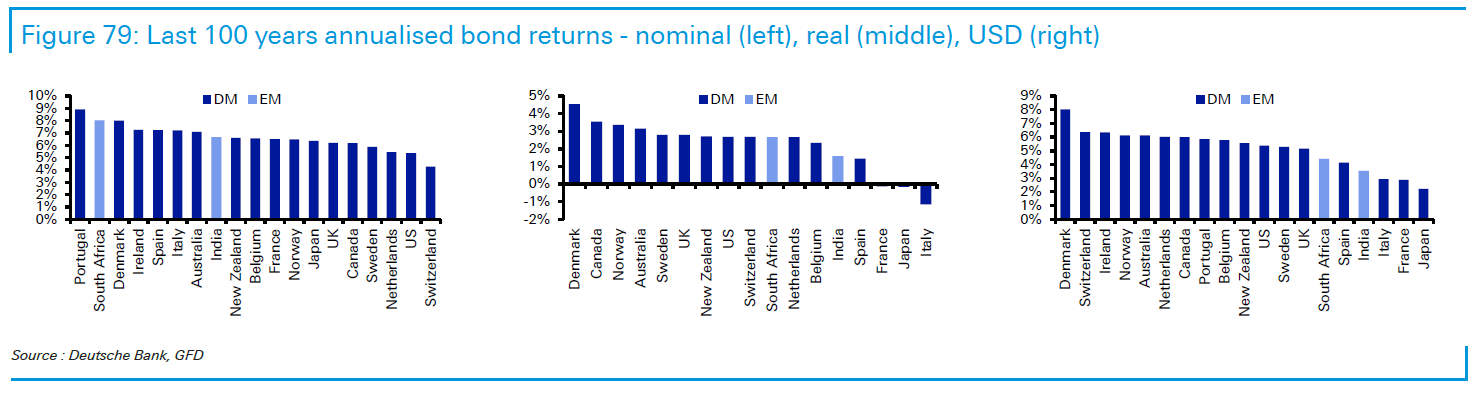

The two eras of globalization stand out in the following chart from Reid, which tracks trade as a share of GDP:  At the point when President Nixon ended the Bretton Woods tie to gold, 50 years ago, trade was no greater as a proportion of the world economy than it had been on the eve of the First World War. It now makes up roughly double that share. The collapse of the Berlin Wall and then China's entry to the World Trade Organization really made a difference. The problem, as Reid makes clear, is that for the last two decades, the current order has required ever greater reliance on debt. This chart doesn't even include the huge debt issuance in the second quarter to deal with the pandemic's hit to economic activity:  If you want to include the Covid impact, then this chart includes IMF estimates, which show that debt as a proportion of GDP could move to levels only previously seen to fight the Second World War:  Covid-19 is catalyzing a breakdown in confidence in the existing order. Critically, the pandemic forced governments across the world into expansive fiscal policy to match the expansive monetary policy that has lasted a decade. If we combine that spending with a huge increase in the money supply, inflation may at last be ready to take off:  Reid isn't the first to point out that inequality is reaching politically intolerable levels, but he illustrates the phenomenon well. Wealth has become far more concentrated in the U.S. since Volcker and Reagan. And lenient taxation of companies is common to all major developed economies:  That means labor has lost out to capital to an ever greater extent. Thatcher arrived in the U.K. at a point when the population decided that the power of the unions had been taken too far. Great growth followed. Now, judging by this chart from Reid, the power of capital has been taken too far:  So we can expect democratically elected governments to enact policies that favor labor at the expense of capital. Meanwhile, the fissure between the U.S. and China promises a retreat for globalization. That implies greater power for workers, as they no longer have to compete with cheaper labor overseas, and a return to inflation. The move toward a bipolar rather than a globalized world seems inexorable. What does all this imply for asset returns? This chart smooshes together equity and bond returns for 15 developed markets since 1860. We most likely have to look forward to a period that combines elements of the Bretton Woods era (when equities had average performance while bonds did terribly), and the messed-up decade of the 1970s between Bretton Woods and Volcker (when stocks and bonds both did badly):  This isn't appealing. Betting on a return to inflation might be a good idea. And indeed, the only period in which commodities outperformed was the stagflationary 1970s. As commodities (excluding precious metals) have been mired in a bear market for more than a decade, and have a historical tendency to move in long waves, maybe that is one asset class to look at. But many trends of the last decade seem to have been taken as far as they can go, if not too far. Extrapolating them further into the future would be a bad idea. The Judgment of TimeLong-term financial histories are often dismissed as meaningless comparisons of eras that can't be compared. I think that is a mistake. To show this, let me offer three of Reid's rankings of performance over time. All tell us something interesting and non-obvious. First, here is the performance of equities over the last 50 years, which aligns almost exactly with the end of Bretton Woods. With hindsight, we can now see that the thing to do was to dive into emerging markets. Those who took the risk of investing in countries like South Korea and India were rewarded:  Now, here is a ranking of returns on government bonds over the last 25 years, which neatly captures the era following the Tequila Crisis. Mexico's sudden devaluation of December 1994 led to a default, and sparked a series of emerging-market crises. Again, fortune favored the brave. The best-performing bonds in the last quarter-century were issued by Mexico, which has made it a cornerstone of its policy never to be put in such a situation again. Impeccable monetary and fiscal discipline under a variety of different administrations hasn't been rewarded with great economic growth for Mexicans, but it has paid off very well for those who lent to the country in its hour of need:  Finally, here is the ranking of bond returns over the last 100 years. Over the very long term, it turns out that risk was rewarded and the best returns were made by lending to small European countries like Portugal and Denmark:  In the long term, sensible risk-taking is rewarded. That's good to know, as we all face up to the necessity to take some risks. Following the HerdAs I tried to explain yesterday, a new trade is under way in markets, based on the belief that "herd immunity" has already been achieved in many large countries, so a return to full normality doesn't need to await a vaccine. To be clear, I am not myself convinced of the argument, which is still the subject of fierce debate between scientists. But a lot of investors have come to the same conclusion. Here is a white paper from Terence Moll, head of investment strategy for Seven Investment Management in the U.K., which I received Thursday: herd immunity can be reached when about one in five people has had the virus. In places where it surged initially, it has burned out. There will be no scary second wave in London, New York, Johannesburg or Santiago... People will get back to work, they'll start going out and travelling again, and they'll be able to shake hands and hug their friends without feeling uneasy. Children will go back to school, and students will go back to university. Aided by the biggest government stimulation packages in history, we expect most of the world's economies will recover quickly. Manufacturing production will recover strongly, which will benefit equity markets in countries with a manufacturing bias. Company sales and earnings will bounce, particularly in the US, and equities should stay strong. We expect stocks beaten-up by Covid-19, like airlines, cyclicals and industrials, to make a comeback. The world should get back to normal within the next 12 months, at the latest. Sooner than you think, coronavirus will begin to seem like a horrible nightmare.

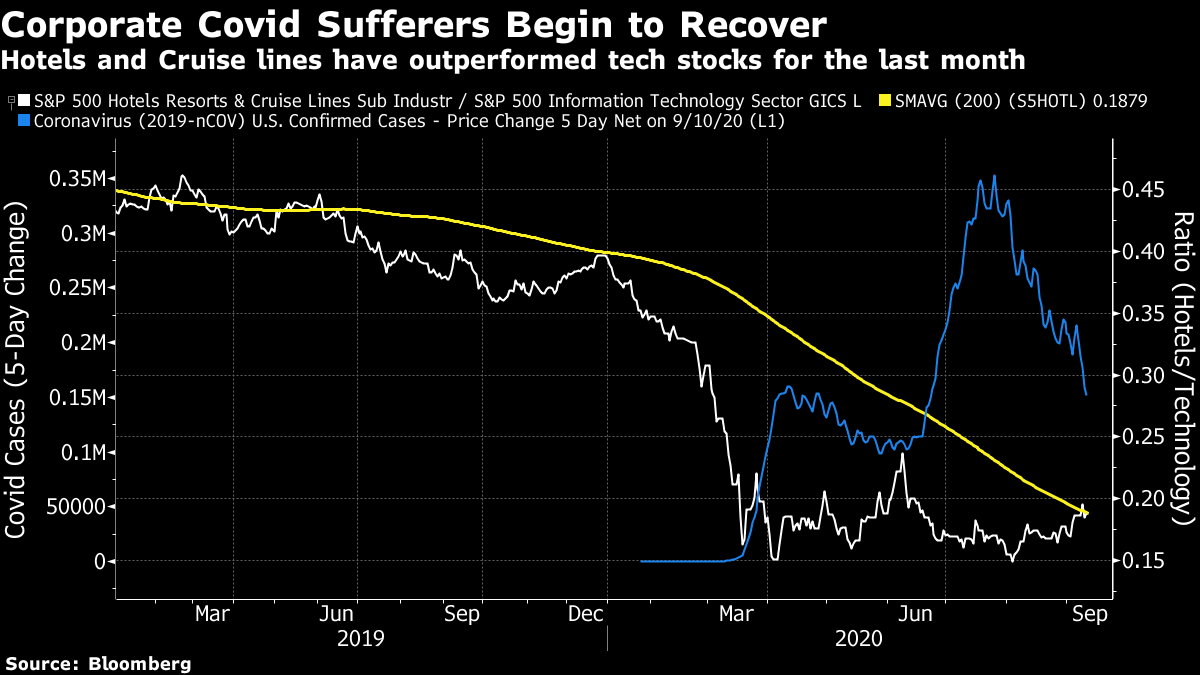

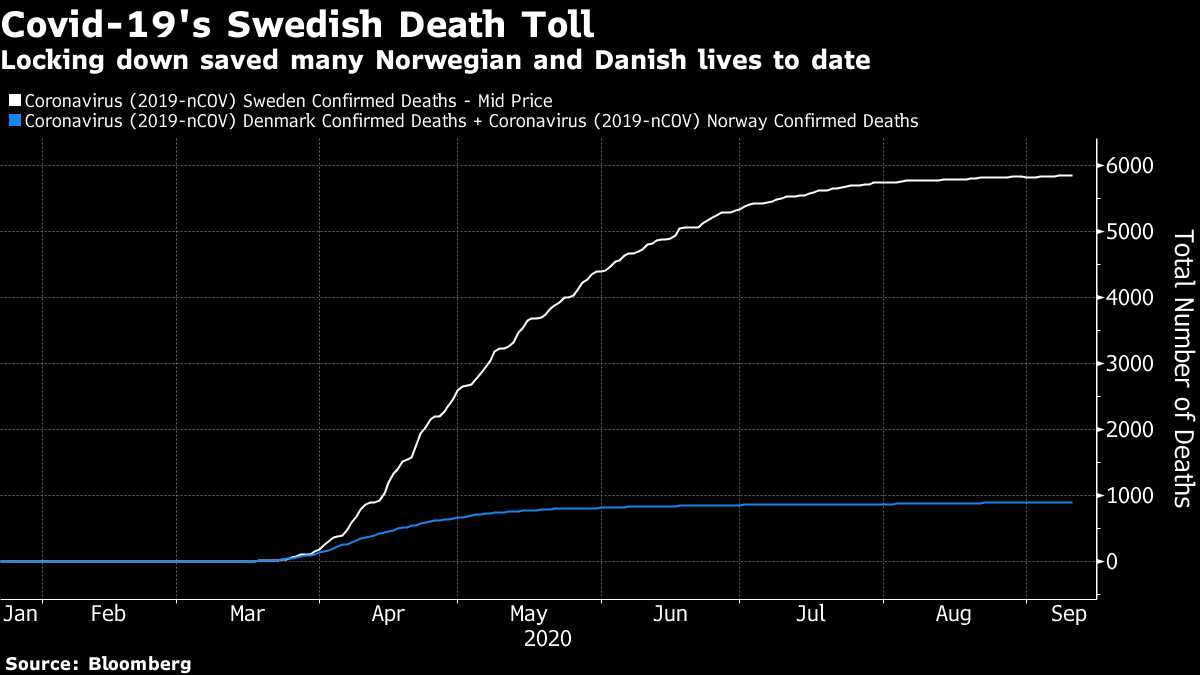

If this happens, rates may rise quicker than expected, and there should be a huge rotation within the stock market. Money is already being allocated on this basis. Look at the recent turbulence in tech stocks. Optimism about the pandemic does play into the problems for big tech names, which are viewed as benefiting from lockdown conditions. The last few days saw hotels, resorts and cruise lines sector outperform information technology by enough to break a long-lasting trend:  Are investors right to be this optimistic? Many academic papers circulating among hedge-fund managers were originally written in opposition to lockdown policies earlier this year. Obviously, the pandemic has been nowhere near as bad as the worst-case scenario visible in March, when there were real fears of a repeat of the 1918 Spanish Flu. It's notable that the research most popular with investors justifies a bullish market outlook. That doesn't mean it can be ignored. Perhaps the most impressive statement of the case is here, produced by Adam Patinkin of David Capital Partners LLC in July. Intellectual curiosity is always laudable. But the classic injunction to recognize what you don't know when investing remains in place. Should we really work on the assumption that the virus will go away of its own accord? The strongest argument in favor of herd immunity is that every serious breakout has followed a similar pattern. The virus spreads quickly, plateaus for about a week, and then steadily declines. I tried comparing the New York outbreak with later waves in California, Texas and Florida using data available on the terminal:  We don't know counterfactuals, and in all cases states started to clamp down on mobility as the virus took hold. But something predictable seems to be happening. Does this mean we shouldn't have bothered with lockdowns? It remains a hard moral case to make. The following chart compares deaths in Sweden — the one major country that deliberately eschewed lockdowns so it could pursue herd immunity — with those in Norway and Denmark, which jointly have a population about 10% bigger than Sweden's. Far more Swedes have died of Covid-19 than Danes and Norwegians:  If a vaccine arrives in a few months, and Norway and Denmark never suffer a renewed outbreak, then Sweden's policy will look hard to justify on moral grounds. There are still two reasons for concern. One is that mobility remains depressed. We don't know what would happen to infections and deaths if we returned to music festivals and crowded sports events. The second is that we have to establish whether this virus is seasonal. But the case for optimism looks stronger than it did. Moving to the much more mundane world of investment decisions, that is reason to rotate out of tech stocks. Survival TipsHere are two more songs for when you need to press the panic button. Both involve the solo voice. First, this is Senza Mamma from Puccini's Suor Angelica, as performed by Renata Scotto. And this is John Ireland's The Bells of San Marie. performed by the great Bryn Terfel. Both move me. I hope you enjoy them. Have a good weekend. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment