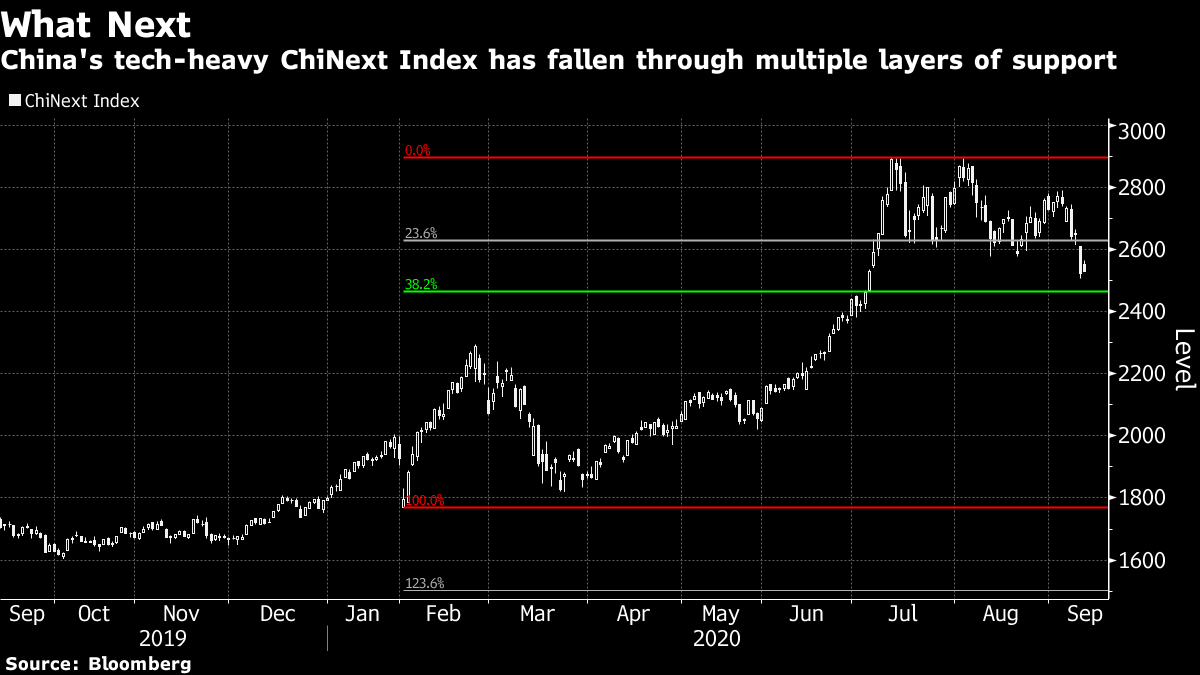

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Brexit gets more acrimonious, the ECB's latest decision arrives and vaccine watchers get a reality check. Here's what's moving markets. Legal Troubles The U.K. published its Internal Market Bill on Wednesday, which it has already conceded breaks international law. That may mean it is somewhat unsurprising that the European Union considers that it has grounds to take legal action against the U.K. over those plans to breach the withdrawal agreement the two sides previously sealed. U.S. House Speaker Nancy Pelosi also said the U.K. can forget a trade deal if Brexit imperils peace in Northern Ireland. U.K. Prime Minister Boris Johnson is already facing heavy criticism, including from his own party, over the move and the impact it could have on Britain's standing in the international community. And it may also provide fuel for another major headache, that of the question of Scottish independence. ECB Strategy The European Central Bank's latest policy decision is coming on Thursday with the focus on any clues on how the bank intends to shift its strategy. Some of the ECB's policy makers are said to have become more confident in their forecasts for a recovery in the region's economy, which could reduce the need for more monetary stimulus later in the year, and ECB watchers will also be on the lookout for any hints about intervention to tackle the strong euro. Central banks globally are taking different approaches. Canada's is dialing back willingness to take more aggressive action, while New Zealand is looking to Sweden as an example as it move towards negative rates. Reality Check The halt to AstraZeneca Plc's vaccine trial provided a reality check on the safety risks involved in clinical development, particularly in testing a medicine where the stakes are so high. The head of the U.S. National Institutes for Health, Francis Collins, said there is no way to know if a safe vaccine will be available before the U.S. election this year, contradicting President Donald Trump. Elsewhere, New York is partially relaxing restrictions on indoor dining, airlines want gate checks to help revive international travel and the U.K. followed through on clamping down on social gatherings, a well-trailed move that hit the country's leisure stocks on Wednesday. It's part of a patchwork of strategies Europe is employing to battle virus flareups. Trump Tapes President Trump, fresh from being nominated for the Nobel Peace Prize by a right-wing Norwegian lawmaker, told journalist Bob Woodward that he deliberately downplayed the seriousness of the coronavirus in a series of interviews conducted in March. Trump defended the move, saying he didn't want to cause panic. Democratic presidential candidate Joe Biden said the comments, captured in audio tapes aired by CNN, show that the president "failed to do his job." Biden also outlined a series of proposals that would punish companies for moving operations overseas and reward firms that create U.S. jobs, while also saying the Trump broke his promise to bring jobs back to the country. Coming Up… A rebound in U.S. tech stocks on Wednesday has fizzled into Thursday, with Asian stocks coming off session highs and futures drifting for Europe and the U.S. Industrial production data from France and Italy tops the economic data agenda ahead of the ECB, though note more data showing rising house prices in the U.K. Europe's earnings calendar is still quiet, though will include some insight into the U.K.'s food retail market via grocer Wm Morrison Supermarkets Plc. Watch too for any fallout from luxury giant LVMH pulling out of its deal to buy U.S. jeweler Tiffany & Co. and for reaction to news that a major payments merger between Italy's Nexi SpA and SIA SpA is close to clearing a major hurdle. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning It seems you're nobody in stock markets this year unless you have a day trading problem. From the U.S. to Malaysia, stocks are being pumped up and blown down by the impact of short-term speculators, often new to equity "investing." This time it's China's ChiNext gauge of small-cap tech stars, which at one point were the world's hottest trade, up as much as 60% this year. But no more. The index is down more than 7% this month, easily outpacing the near 4% decline in the Shanghai Composite and the 2% drop in the MSCI AC World Index. The move can be linked to broader weakness in the Chinese market as overseas investors offload shares and authorities tighten liquidity — a big problem in a country where traders borrow a lot to invest. But the ChiNext is also being singled out. The official news agency Xinhua said in a commentary late Wednesday that regulators should take action against the "false trend" of speculative trading in companies with low market values, low prices and poor fundamentals. The gauge has fallen through some key technical resistance and looks to have further downside until its next support level. Where U.S. day traders can take comfort from the Powell Put, where authorities step in to arrest any major decline, their China equivalents need to take heed of the Xinhua Call.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment