Stock traders size up the second half, Angela Merkel finally becomes Europe's leader and yield-curve control may come to a market near you. Now what?Stock traders celebrating their best quarter since 1998 face an uncertain second half. Potential killjoys include tomorrow's job report, the course of a new wave of coronavirus taking hold in the U.S. and mounting business troubles. Soon, earnings seasons kicks off -- and the prognosis on how well corporate America survived the lockdown. Deutsche Bank AG strategists are optimistic about the third quarter for economies and risk assets, but warn that the fourth quarter could bring about a quick reversal, as social distancing and the approach of winter keeps people indoors. Merkel's momentAngela Merkel steered Europe through two economic meltdowns and a migration crisis but her final months as German chancellor may mark her legacy. Germany takes over the European Union's rotating six-month presidency today, with the bloc reeling from the blow of coronavirus and the departure of the U.K. The member hardest hit by the infection, Italy, plans to pass another 20 billion euros in economic stimulus in July, according to two sources familiar with the matter. Merkel has a hospitable backdrop in stock markets, at least, after the European benchmark clocked the biggest quarterly gain in five years. Curve control For markets that have enjoyed trillions of dollars of Fed largesse and the benefits of zero rates there may be more in store from policy makers. The release of minutes from the latest Federal Reserve meeting today may offer insights into forward guidance on rates and the balance sheet, and whether central bankers will adopt Japanese-style yield curve control to suppress short-term borrowing costs. Markets mixedOvernight the MSCI Asia Pacific Index was little changed while Japan's Topix index fell 1.3%. In Europe, the Stoxx 600 Index was 0.1% lower at 6:26 a.m. with automakers, travel and banks suffering the biggest losses. S&P 500 futures were pointing to a small drop at the open, the 10-year Treasury yield was at 0.682% and oil was up. Coming up...Aside from the release of FOMC meeting minutes at 2:00 p.m., Markit Manufacturing PMI data for June due at 9:45 a.m. is expected to remain below the 50 threshold. U.S. crude inventories from the Department of Energy are due at 10:30 a.m. A separate report from API suggests they dropped by the most this year. Earnings are due from Capri Holdings Ltd., General Mills Inc., Constellation Brands Inc. and Macy's Inc. What we've been readingThis is what's caught our eye over the last 24 hours. - Hong Kong makes first arrest under new national security law.

- How everybody learned to love the euro.

- Wildfires are taking an unexpectedly huge toll on America's lungs.

- A case for turning empty malls into housing.

- When the coronavirus outbreak could peak in each U.S. state.

- Airlines risk extinction as India refuses to rescue billionaires.

- The key device needed for a quantum internet.

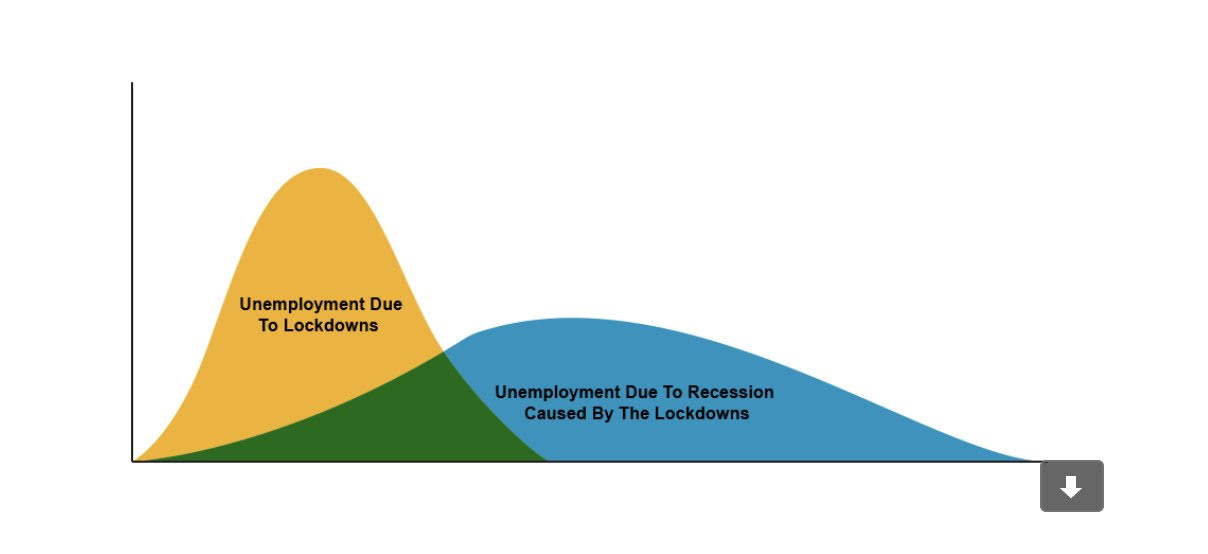

And finally, here's what Joe's interested in this morningMillions of Americans have been thrown into unemployment this year due to the coronavirus crisis. The reasons can be broken down into two distinct categories. The first are people who can't do their jobs safely amid the virus. The second are people who lost their jobs due to the economic weakness associated with the virus. Last month I made a crude chart illustrating the two separate but related unemployment curves.  Tomorrow we get the June jobs report, and we'll learn more about both curves. But in the meantime, there's reason to believe that unemployment due to the economic downturn itself (as opposed to just the virus) continues to grow.

Yesterday Daniel Zhao, a data scientist at Glassdoor, published his latest look at job openings data, and what it showed is that in industries directly hit by the virus (like tourism and fitness) job openings are on the rise. Whereas in sectors more broadly exposed to the economy itself (media, IT, software, accounting, legal, etc.) employers continue to slash job openings. Jed Kolko at Indeed.com pointed out in his look at the data that hiring is picking up, but mostly for low-paid work, and that the recovery for higher wage jobs is very minimal so far. When tomorrow's numbers hit, keep an eye on the number of unemployed workers whose job losses are categorized as permanent. So far that number is way below the total number of unemployed, but while the total number of unemployed already started to shrink last month, the permanent number continued to rise. That will be the key indicator of how much long-term damage we will suffer.

Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment