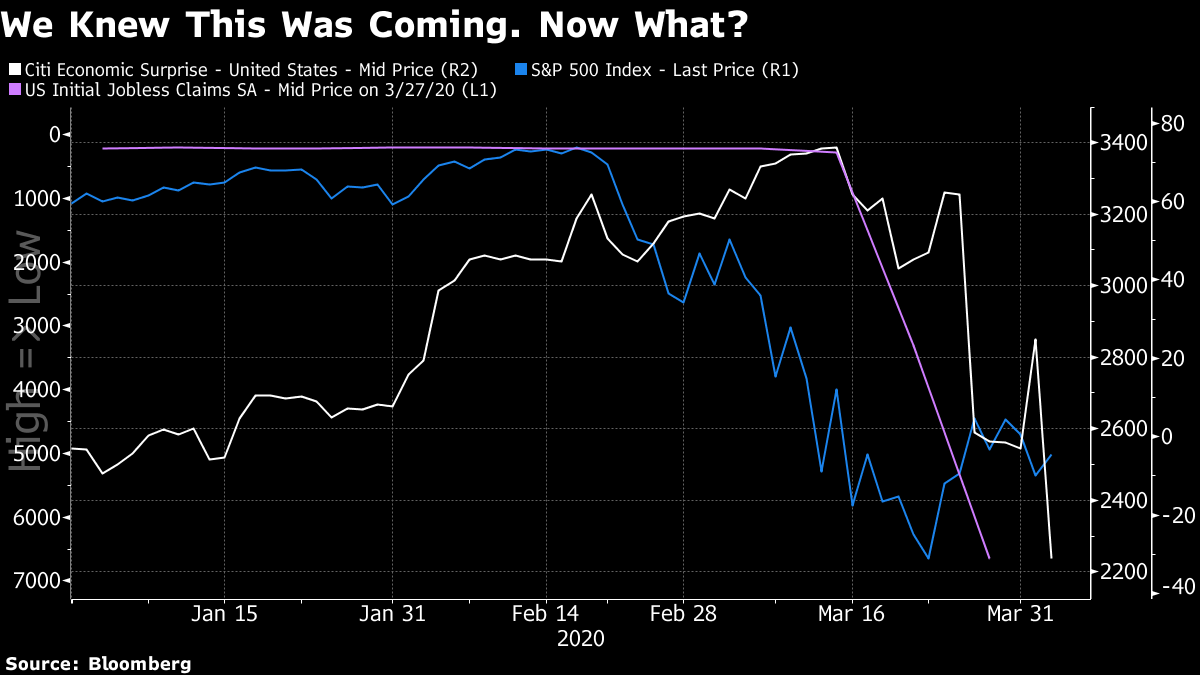

More virus restrictions and stimulus, OPEC+ set to meet, and European PMIs are dismal. 1 millionThe growth in the number of coronavirus cases globally shows little sign of slowing with the reported total passing 1 million yesterday, and more than 53,000 deaths. Governments continue to implement new restrictions on movement in an effort to contain the spread, with Singapore closing most workplaces and France among the countries expected to announce an extension of current measures. Japan, Italy and Thailand are looking at increasing stimulus. ECB policymaker Olli Rehn called for a Europe-wide systemic solution to the crisis. The Asian Development Bank estimated the economic cost could be as high as $4.1 trillion, or 5% of world GDP. Oil surgeIt has been a crazy 24 hours in the oil market. Crude jumped over 40% in minutes yesterday after President Donald Trump tweeted that the world's largest oil producing nations would agree to reduce output by about 10 million barrels or more. While the initial surge faded, with oil trading lower earlier this morning, that was again reversed by confirmation that OPEC+ will hold a meeting by video conference on Monday. A barrel of West Texas Intermediate for May delivery was trading close to $26 on renewed investor hopes that a deal could help reduce the global supply glut in the face of massive demand destruction caused by the pandemic. Terrible numbers Service and composite PMI readings from Europe this morning show the extreme effects on the economy from lockdowns across the region. The standout number was from Italy where a gauge of services activity came in at an astonishingly low 17.4, pointing to an economy which has basically ground to a halt. IHS Markit said that its monthly measure of services and manufacturing in the euro area points to an annualized contraction of about 10%, adding that there is "worse inevitably to come in the near future." The measure for the U.K. service economy showed the steepest downturn since the survey began in 1996. PMI data for the U.S. economy is published at 9:45 a.m. Eastern Time. Jobs dayThe rapidness of the slowdown in U.S. employment means that for the moment weekly jobless claims has overtaken the monthly payrolls report as the go-to indicator for the health of the economy. Today's jobs number will not reflect anything close to the 10 million that have registered as unemployed over the past two weeks, as the reference point for the new data was just before the full effect of business closures was starting to be felt. Even so, the median estimate from economists surveyed by Bloomberg is for minus 100,000 positions, a number which would end an amazing 113 consecutive months of payroll growth. The data is published at 8:30 a.m. Markets dropInvestor sentiment continues to be dominated by the coronavirus outbreak, and with little sign of an improvement in the outlook in the short term, stocks remain under pressure. Overnight, the MSCI Asia Pacific slipped 0.7% while Japan's Topix index closed 0.4% lower. In Europe, the Stoxx 600 Index was down 0.9% by 5:50 a.m. with all but one industry group losing ground. S&P 500 futures pointed to a loss at the open, the 10-year Treasury yield was at 0.606% and gold was broadly unchanged. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Luke's interested in this morningIn the economic expansion and bull market that followed the financial crisis, it became common to characterize each jobs report as The Most Important Jobs Report (since the last one.) The nature of the circumstances that conspired to bring about this bear market has turned this dynamic on its head. For the foreseeable future, every payrolls print could be the least important one since the last one -- at least from a market perspective. For every month over the past five years, the dominant question has been whether job gains would fuel a meaningful acceleration in wage growth that brought inflationary pressures to the fore. There's no such macro question with actionable implications that the jobs data will answer. March's non-farm payrolls report isn't even expected to display the magnitude of the damage that's already been revealed via record initial jobless claims. While it's jarring to see massive gains in the S&P 500 Index on the last Thursdays which showed unemployment benefit filings posted inauspicious record highs, there's no real cognitive dissonance there. Forward-looking markets were preparing for economic pain when they began to tumble 30% in the run-up to those bad prints when U.S. economic surprise index was ascending to multi-year highs. The timeliness of initial jobless claims relative to all other pieces of economic data won't even answer the two key questions on investors' minds, as identified by Naufal Sanaullah, chief macro strategist at EIA All Weather Alpha Partners. 1. What will be the duration of the economic shutdown and social lockdowns? 2. What will be the shape of the post-reopening recovery? Usually, forecasters are able to project data in accordance with a loose description of Newton's laws: a body in motion tends to stay in motion; recent past is a fairly good prologue. Health and fiscal policy responses are so integral to the economic outlook three to six months out that a traditional crystal ball-gazing approach is rendered useless right now. Markets might move on the March jobs results. They might do little. But any enduring inflection points in markets are likely to be linked to data or policies that revise conventional wisdom surrounding the two above questions.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment