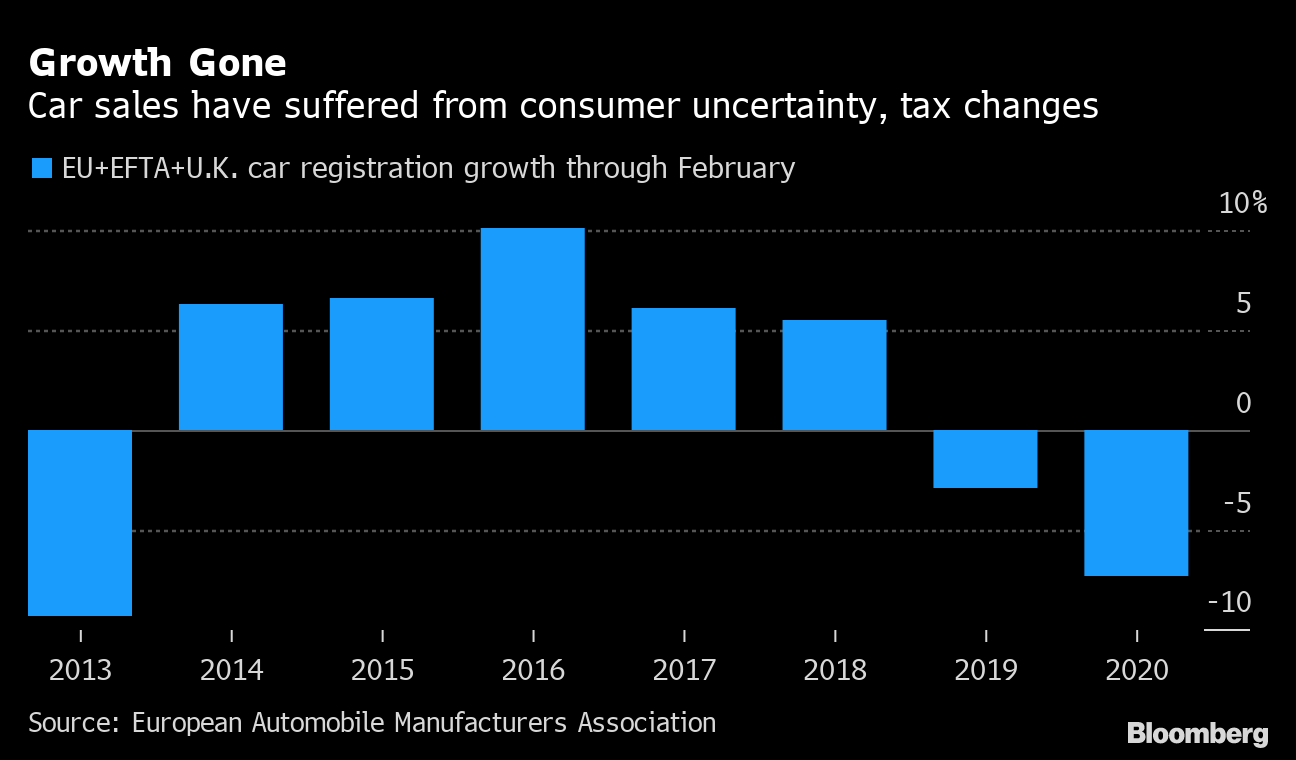

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. Each time Europe's leaders try to restore confidence, a new piece of research by epidemiologists is released to remind everyone that the choice we're facing in the months ahead is between a wartime-like recession and a wartime-like death toll. Equally perplexing is the question of who's going to pay for the EU's pledges to spend its way out of the pandemic. While you were sleeping, the ECB attempted to answer it, unleashing its vast firepower after an emergency call of its Governing Council. Here's everything you need to need to know about the 750 billion-euro Pandemic Emergency Purchase Programme — the most dramatic move so far to cushion the impact of the viral outbreak on the economy. — John Ainger and Nikos Chrysoloras What's Happening Market Turmoil | The lockdown across Europe is battering the region's markets. Borrowing costs have soared in Italy to levels last seen during the country's budget battle with the EU in 2018, kindling fears of another sovereign crisis in the region. The Stoxx Europe 600 Index has tumbled 38% since Feb. 19, while the pound is at the lowest level in 35 years. NATO Novelty | NATO Secretary General Jens Stoltenberg will for the first time hold a virtual press conference to present the alliance's annual report. Eyes will be on the latest 2019 defense-spending figures of European members struggling to meet a 2%-of-economic-output goal championed by the U.S. Wartime Mood | Indeed, global leaders are preparing for war. But this time, the fight is with a virus, and the weapon of choice is more debt. Governments from Berlin to Washington are finally getting the message that they'll have to run exponentially bigger budget deficits to stay afloat as the coronavirus outbreak grinds everything to a halt. Lockdown Life | When the movie about Italy's coronavirus outbreak is made, the hero will be a bespectacled doctor on the cusp of retirement, whose last rodeo is saving his city, his country and possibly the world. For now, Massimo Galli of Milan's Sacco hospital is not only well, but on a mission to make people who minimize the contagion's severity understand that they're quite simply wrong. In Case You Missed It Loan Relief | European regulators are considering giving the continent's banks more time before they have to set aside billions of euros for bad loans. It marks yet another in a series of unprecedented measures governments have taken in an attempt to insulate the region's economy as much as possible from the economic impact of the coronavirus. Existing Ailments | More than 99% of Italy's coronavirus fatalities were people who suffered from previous medical conditions — such as high blood pressure, diabetes or heart disease — according to a study by the national health authority. The country is weighing whether to extend its nationwide lockdown beyond the beginning of April. Fiscal Bazookas | Not to be outdone by their Western European peers, countries across the bloc's East are unveiling their own heavy-hitting spending plans. Poland's government unveiled a package worth $52 billion, or 9% of gross domestic product, while Czech Prime Minister Andrej Babis pledged aid amounting to $40 billion — twice as much as Poland's relative to economic output. Merkel's Moment | When Germans hear their chancellor say it's serious, they know she means it. Angela Merkel's speech on the unparalleled threat posed by the coronavirus was the first crisis address to the nation in her more than 14 years in office. And her matter-of-fact, scientist's approach may be just what's needed to reassure Europe's largest country. Chart of the Day  Europe got a nostalgic glimpse of what the world was like pre-virus, and it showed the region's trade surplus in goods with the rest of the world was widening at the start of the year. Alas, times are different now: Car sales are already off to their worst start since 2013 and things will likely only get worse. Volkswagen has joined European rivals from Daimler to Renault in closing assembly lines. Today's Agenda All times CET. - 10:00 a.m. German Ifo institute economic forecast

- 11:15 a.m. Release of NATO Secretary General's 2019 annual report

- 2:30 p.m. Extraordinary conference call of EU Health Ministers

Like the Brussels Edition? Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the Brexit Bulletin, a daily briefing on the latest on the U.K.'s departure from the EU. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Nice informatiom. Thanks for sharing. You may also check latest updates on Stocks like

ReplyDeletePM Modi stimulus package

SAMHI Hotels IPO

NSE Co-location

IndiaMart

DHLF

Thanks for sharing valuable information

ReplyDeleteICICI Bank Ltd

RBL Bank Ltd

Nice to be visiting your blog once more, it has been months for me. Well this article that ive been waited for therefore long. i want this article to finish my assignment within the faculty, and it has same topic together with your article. Thanks, nice share. ソフト闇金

ReplyDelete