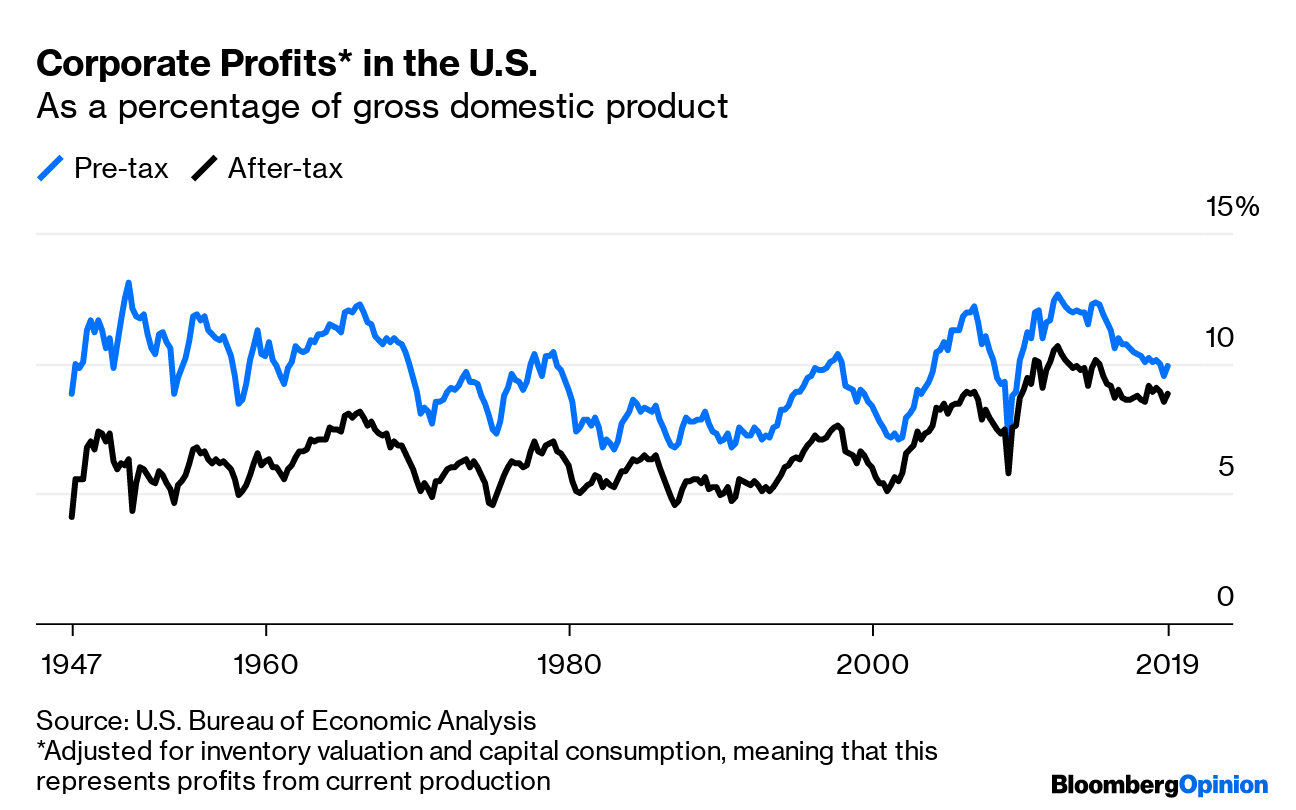

Today's Agenda  Brexit Chaos Goes to Eleven Lacking a written constitution, the U.K. sort of makes up its politics as it goes along, which is how it ended up with ceremonial cellar searches and no fewer than five maces in its parliamentary procedure. Sometimes you can even see these wild changes happening in real time. Today, for example, a Tory MP simply moseyed across the aisle during a Boris Johnson address to Parliament, thereby stripping the prime minister of his working majority. Brexit's rapid approach has dialed up the U.K.'s political chaos, with Johnson the prime chaos agent. That Tory's stunning act of defiance followed Johnson's equally stunning act of suspending Parliament to steer the country toward a disastrous no-deal Brexit. Soon Parliament will vote on taking power back from Johnson, which could trigger an election just ahead of Brexit's deadline. Nobody knows what will happen, including Johnson. But his power grab has forever shifted the balance in British government toward the executive, writes Therese Raphael: "If he wins, we might as well refer to him as President Johnson." Johnson's act was certainly within the bounds of the "rules," as they have been agglomerated since the Magna Carta. And his supporters suggest it was democratic, honoring the will of the slim majority that chose Brexit in 2016. But Parliament is in charge of interpreting that referendum, writes Noah Feldman; by trying to circumvent lawmakers, Johnson's act is undemocratic. Further Brexit reading: EU citizens living in the U.K. have no reason to trust Brexiters' promises they'll be able to stay. – Lionel Laurent Trade War Still Not Easy to Win Wall Street traders returned to work after a long Labor Day weekend and almost immediately had to start selling. A closely watched gauge of U.S. factory activity fell into negative territory for the first time since 2015, the latest harbinger of an impending recession, driven mainly by President Donald Trump's trade war with China. Between the economic numbers and signs that negotiations aren't going as well as Trump has suggested, stocks took a beating. This comes just as the latest round of U.S. tariffs on Chinese imports start to hit American shoppers' wallets, notes David Fickling. Consumers have until now been shielded from the trade war's effects, but trade headlines have recently sapped confidence. Paying more for stuff just ahead of the holidays won't help. Trump responded by tweeting warnings to Chinese negotiators and attacks on the Federal Reserve's competence. He seems to want the Fed to slash rates back to zero, if not lower, to compete with borrowing costs in Europe and elsewhere. But Anne Stevenson-Yang notes lower rates would just increase the flow of capital to China, helping it ride out the trade war. The Trouble With Negative Rates There's also the question of whether driving rates to zero and below is really desirable. Jim Bianco suggests it is not. Not only would American banks suffer, he writes, but it would freeze the plumbing of the financial system. That tends not to end well. Germany's rates are negative across the board, but the country is still teetering on the edge of a recession, if it's not in one already. And yet Berlin keeps dragging its feet on fiscal stimulus. It should loosen the purse strings now, to help its own economy and Europe's and to avoid rates going even more negative, Bloomberg's editorial board writes. Telltale Charts, Profits vs. Wages Edition For years after the Great Recession, a cocktail of record corporate profits and stagnant wages made the recovery bitter for many, fueling populist backlashes that still drive our politics. A funny thing has happened lately, though: Corporate profits have been shrinking as a share of the economy, notes Justin Fox.  Corporate tax cuts mean after-tax profits haven't shrunk as much; but Democratic politicians promise to roll back those cuts. Karl Smith argues that politicians of all stripes should want profits to rise, though, because this ultimately benefits workers.  But income equality is still out of whack, as even corporate America is realizing, writes Nir Kaissar. Recent corporate pledges to boost wages and serve society may be efforts to head off tougher redistributive policies — though their willingness to follow through is still in doubt.  Further Reading Universal pre-K would subsidize wealthy people, who already send their kids to preschools. We should target the assistance to the poor, who would benefit from it the most. – Bloomberg's editorial board It's been a year since that anonymous op-ed saying adults were quietly keeping Trump under control. Now most adults have left the administration, and quiet resistance isn't nearly as effective. – Jonathan Bernstein An effort to prop up Ohio's flagging coal and nuclear power generators uses China fear to make its case. It's not logical, but it may be effective. – Liam Denning Europe should tax short, cheap flights, which aren't necessary and contribute to climate change. – Leonid Bershidsky The burning Amazon and other effects of climate change directly threaten America's national security. – James Stavridis The late economist Martin Weitzman's work laid the foundation for the Green New Deal. – Noah Smith ICYMI Walmart Inc. will curb ammo sales in response to store shootings. Dorian is finally, slowly exiting the Bahamas, leaving Grand Bahama 70% underwater. The new American Dream mall will be a New Jersey nightmare. Kickers Tell your teens: An all-junk-food diet can cause blindness. (h/t Mike Smedley) Scientists created artificial memories in mice. These people can tell if you fake your own death. There's a whole town for people with chronic fatigue syndrome. Note: Please send artificial memories and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment