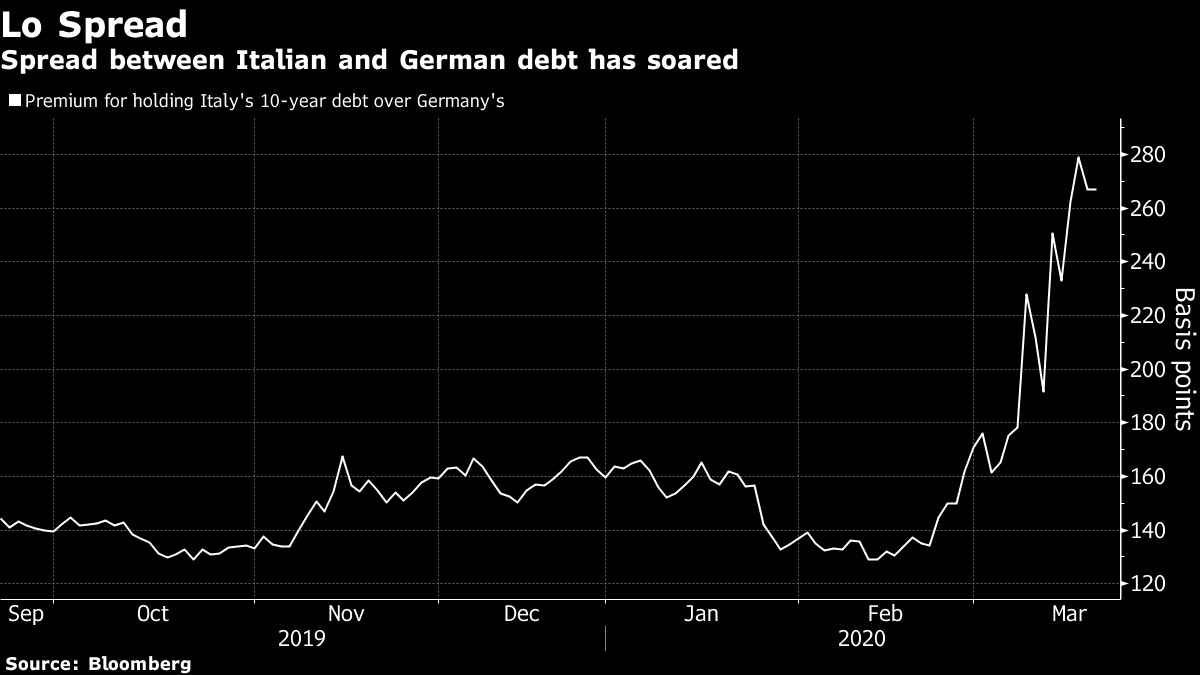

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. European equity futures are pointing lower despite a massive new stimulus announced by the European Central Bank, as coronavirus cases in this region exceed China's. Here's what's moving markets. Europe Surpasses China Europe's coronavirus cases officially surpassed those of China, with fatalities rising too. New evidence has suggested that younger people aren't as resilient to the illness as previously thought, though a study from Italy points out that more than 99% of the country's fatalities were people who suffered from previous medical conditions. Speculation is mounting that London could go into lockdown, while Belgium became the latest to announce restrictions on its citizens. And in Germany, chancellor Angela Merkel used a rare television address to urge people to abide by restrictions. Extraordinary ECB "Extraordinary times require extraordinary action," said the European Central Bank as it launched an extra emergency bond-buying program worth 750 billion euros ($820 billion) in the latest attempt to calm markets and protect a euro-area economy. The monster package looks set to rocket bonds higher after weeks of stress spurred large moves in poor liquidity. But for many investors, stimulus efforts from the ECB and counterparts around the world have not yet gone far enough. Trump Bump Flattened The U.S. Dow Jones Industrial Average has now lost more than 30% of its value in just over a month — helped partly by a huge drop for plane-maker Boeing Co. -- wiping out all of its gains since President Donald Trump was inaugurated three years ago. It's a remarkable comedown for a leader who's repeatedly touted the market's rise during his tenure. But perhaps even more worryingly for investors, on Wednesday we saw a synchronized drop that's not supposed to happen, as shares and bonds slid together, threatening classic diversification strategies. Perilous Pound Pound charts are pretty ugly right now. The U.K. currency had its biggest plunge against the dollar since the day after the Brexit vote on Wednesday, and now trades at its weakest level against the greenback in over three decades. Some investors expressed concern that Prime Minister Boris Johnson's initial response to the pandemic fell short compared to measures taken by other European nations, while sterling has also suffered due to a surge in haven demand for the dollar more broadly. Coming Up… After the Bank of Japan and Reserve Bank of Australia announced plans to buy up bonds overnight, we could see more easing in Europe later. A rate cut may be one of the options considered by the Swiss National Bank, with today's decision coming as the traditionally safer franc trades around a five-year high against the euro. Companies reporting earnings include Ocado Group Plc, which has temporarily closed its website as it struggles to cope with demand from shoppers trying to stockpile groceries, and Deutsche Lufthansa AG, as the airline plans to redeploy passenger jets to carry cargo in an effort to keep Germany supplied with goods. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Christine Lagarde has had a "whatever it takes'' moment. Instead of a speech like her predecessor Mario Draghi, the ECB president delivered her key line via Twitter, but it could prove to be as significant. Perhaps more important than the size of the emergency bond-buying program -- I fear 750 billion euro may come to look quaint when the final cost of the coronavirus outbreak becomes clear -- was the inclusion of Greece in the mix. It solidifies the sentiment that Europe is in this together and should obliterate any lingering concerns from Lagarde's recent remarks that the ECB wasn't there to "close the spreads.'' Europe's bonds looked set for gains with German bund futures pushing higher in Asia trading. The fact that the ECB stands ready to buy bonds knowing full well the region's governments are furiously adding zeros to any number of coronavirus stimulus packages won't be lost on investors. It could be argued the move is the first stage of a tacit approval for MMT, though no doubt the central bankers would disagree. In any case, investors will disregard that the bond-buying measures are supposed to be temporary -- after all so was income tax when it was re-introduced in the U.K. in 1842.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment