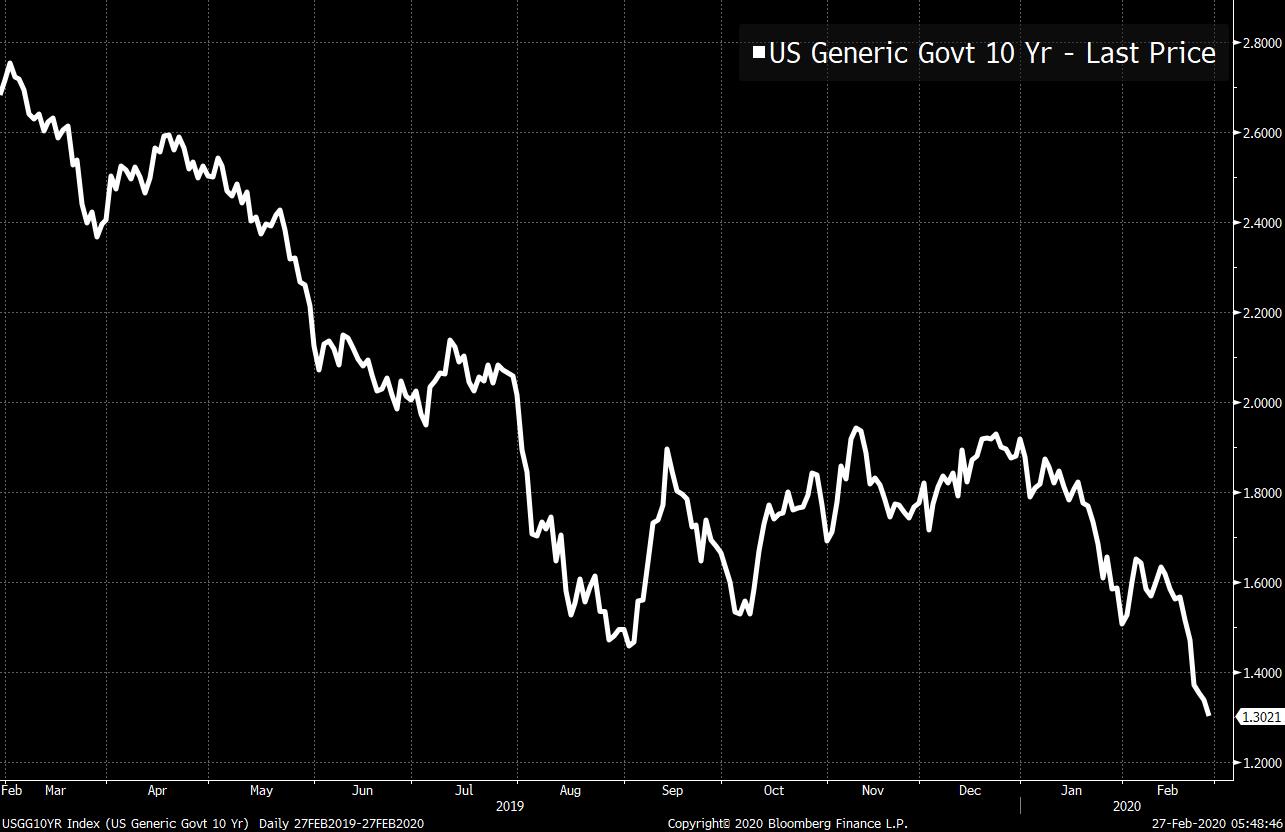

Stocks extend losses, coronavirus shutdowns widen, and policy response expected to increase. Still fallingGlobal stocks continue to drop as investor fears over the spread of the coronavirus increase. Indexes in Asia were lower with Japan's Topix closing down 2.4% as the strengthening yen further increased pressure on exporters. In Europe, another day in the red for the Stoxx 600 Index is pushing that gauge closer to correction levels. A survey of European companies in China showed that every one of the 577 respondents said they expected to be hit by the outbreak. S&P 500 futures pointed to another day of losses for U.S. stocks. The 10-year Treasury yield was trading below 1.3% and gold was higher. More cases, more closuresThe global spread of the coronavirus is pushing governments to take more measures to reduce the risk, with increased travel restrictions, school closures and cancelled events becoming a worldwide phenomenon. In the U.S. the first case where the person with the virus doesn't have known ties to an existing outbreak has been identified, a worrying sign that the infection is already circulating despite reassurances from President Donald Trump. The list of companies cutting their forecasts also continues to grow with Anheuser-Busch InBev NV, Aston Martin Lagonda Global Holdings Plc and Microsoft Corp. among the latest names to cite the outbreak. Response Bets on central bank easing this year are rapidly rising, with investors now pricing in a 90% chance of a Federal Reserve cut in April. Swap data shows rate reductions are also expected at almost every other major central bank by the end of 2020. On the fiscal side, Hong Kong and Malaysia have already announced increased spending to boost their economies. German Finance Minister Olaf Scholz is considering temporarily suspending the country's debt brake to allow more borrowing. Trump has asked Congress for $2.5 billion to help fight the outbreak, but has not suggested major fiscal stimulus yet. Brexit is backBritish Prime Minister Boris Johnson told the European Union he will end negotiations by June if it is not clear by then that he is going to achieve a Canada-style free trade agreement with the bloc. The pound, which had been higher earlier in the session, dropped against the dollar after the government published its negotiating mandate. The EU's mandate, published on Tuesday, suggests it too will take a hard line when negotiations about the future relationship between the two sides begin next week. Coming up…The second reading of U.S. fourth quarter GDP is at 8:30 a.m. Eastern Time. Durable goods orders for January are also published then, with the headline number expected to fall into negative territory. Initial jobless claims may show a small rise when that data is also released at 8:30 a.m. After yesterday's strong home sales numbers, pending home sales at 10:00 a.m. will give another indication of the strength of the market. There is a raft of earnings releases with Dell Technologies Inc., Best Buy Co. Inc, Beyond Meat Inc., and JC Penney Co. Inc. among the many companies reporting. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThere's some debate out there over whether the economic impact of the coronavirus crisis will be deflationary (because of a shock in demand) or inflationary (because of shock in supply leading to a shortage of goods). For now, financial markets are mostly concerned about the former. Brian Romanchuk has a nice, short post explaining this further. Nonetheless, it's the supply shock element (shuttering of factories, disruptions to chains) that make this situation unique among all other periods of volatility and instability over the last decade. On the latest episode of our podcast, Tracy Alloway and I talked to Dan Wang, an analyst at GaveKal Dragonomics about the impact of the virus on China's tech manufacturing industry. Without going into too much detail, the impact will be substantial and long-lasting. And when you combine this situation, alongside the trade war and standoff against tech companies like Huawei, it seems likely that there will be some sort of permanent shift in the way multinational companies and China do business. Anyway, I bring this up in the context of the inflation question, because I'm interested in seeing what happens after the acute phase of the crisis comes to an end. Following the Great Financial Crisis, governments around the world did a fair amount of stimulus (keeping nominal rates low, QE, running large deficits etc.) but there was also plenty of idle capacity. The question now is, could we see a situation here where demand eventually picks back up in a V-shaped manner, while supply comes back online in more of a U-shaped manner, and if so, does that generate the type of pricing pressure we're so unused to seeing these days?  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment