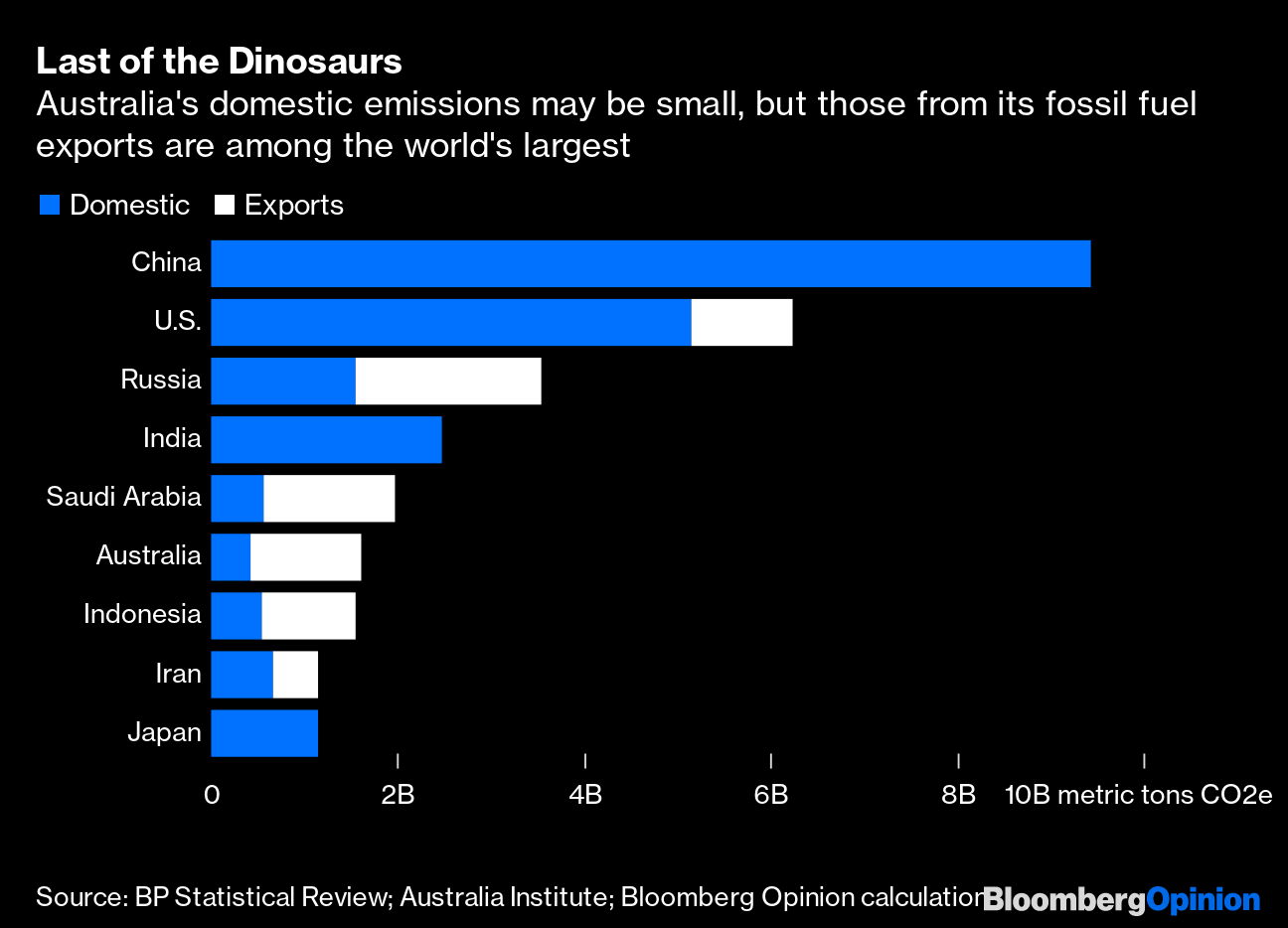

| This is Bloomberg Opinion Today, a ghormeh sabzi of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Cooler heads needed. Photographer: Bloomberg/Bloomberg Time for Some Game Theory, Iran Edition It may not reassure you that hopes for peace in the Persian Gulf and maybe elsewhere rest on President Donald Trump and Iranian Supreme Leader Ali Khamenei behaving rationally. But here we are. For Khamenei's part, he must know Iran would suffer badly in a military conflict with the U.S., writes Hussein Ibish. That helps explain why the country has lashed out against the U.S. through proxies and indirect attacks. Trump's unexpected assassination of Quds Force commander Qassem Soleimani should convince Khamenei retaliation will lead to even more dramatic losses, Hussein argues. Then again, we have years of evidence Khamenei is driven more by ideology and paranoia than reason, writes Bobby Ghosh. A rational actor would have long ago chosen to get rich selling oil, for example, rather than staying doggedly on track to become an impoverished pariah state. So how might Iran retaliate? Attacking oil-shipping lanes and Saudi facilities didn't raise crude prices much, or for long, last year. But the market has tightened since then, making such attacks even more effective weapons, writes Julian Lee. Of course, sanctions make it difficult for Iran to sell its own oil and enjoy the benefits of price spikes, making all this violence self-defeating. But then, that's what a purely rational actor would say. As for Trump, his warning that he could target Iranian cultural sites may have been a bluff, but it was also a threat of a war crime. It would certainly be bad policy, writes Tyler Cowen. But Trump's bluster highlights how American options are limited, too: More targeted assassinations would be preferable to, say, bombing Persepolis, but both choices would backfire in the long run, Tyler writes. Unintended consequences have already proliferated after Soleimani's death, writes James Stavridis, and Trump seems to have no strategy for dealing with them. We also have to wonder how Trump sees war affecting his reelection chances. Back in 2011 and 2012, he frequently warned that then-president Barack Obama would start a war with Iran to help his own reelection bid. Could that mean Trump thinks this is actually a good idea? A war certainly wouldn't help Trump politically, writes Jonathan Bernstein. Even decisively winning the Gulf War didn't get George H.W. Bush a second term. So we have to ask: Is Trump rational, and which choice would Rational Trump make? Further Iran Crisis Reading: American frackers should just ignore what the Iran crisis is doing to oil prices. — Liam Denning Music Plays, Investors Dance Any stock-market anxiety about the possibility of World War III has already been washed away in a soothing bath of Federal Reserve liquidity. It's enough to make you think the market's 2020 will look just like its 2019, no matter what happens: a steady climb to daily new records. Don't be so sure, warns John Authers: History suggests the sledding should be tougher this year. Meanwhile, though, you've got to dance while the music is playing. So public pension funds have lately been jumping into the private-credit market, which has already been on a years-long tear, notes Brian Chappatta:  This could be trouble for everybody involved. The arrival of all that new money, hungry for yield, could be a sign of the top for this market. And so many dollars chasing so few opportunities could lead to ever-shakier new offerings in an already riskier-than-usual field, Brian warns. What could possibly go et cetera? In its own hunt for ever-more-exotic sources of return, private equity has lately been dabbling in soccer teams, notes Alex Webb. But it's hard to make much money on already established teams, and up-and-comers are much riskier. These things still only make sense as vanity buys for the super-wealthy. Further SELL, MORTIMER, SELL! Reading: One man's lousy bet on Bear Stearns stock holds many lessons for investors. — Barry Ritholtz Telltale Charts American health care has changed a lot in the past decade, but still has very far to go before costs fall and more people have coverage, writes Max Nisen. The 2020 election will determine its course for the decade to come.  Australia tries to obscure this, but its fossil-fuel exports have played a huge role in the global warming that has the country choking on wildfires now, writes David Fickling.  Further Reading Nancy Pelosi's impeachment delay may be working. — Jonathan Bernstein The Fed shouldn't retreat to old practices in managing liquidity. — Bill Dudley South Korea is the perfect example of how Trump's mercenary approach to allies hurts American interests. — Hal Brands Slowing growth and rising inequality could stir protests in usually sleepy China. — Noah Smith Dominic Cummings wants to disrupt Britain's government a little more than is possible or desirable. — Therese Raphael The 2020 census will cause red states to gain congressional seats and blue states to lose them. But the red seats gained will be in cities and suburbs, which increasingly favor Democrats. — Conor Sen The New England Patriots have lessons for business. — Mohamed El-Erian ICYMI How Carlos Ghosn became the world's most famous fugitive. A $1 billion solar plant was obsolete before it even went online. New Jersey train stations attract New York gamblers. Kickers Tech-weary farmers covet 40-year-old tractors. Science has a possible answer for why social media divides us. The economics of unused gift cards. 68 movies possibly worth seeing in 2020. Note: Please send tractors and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment