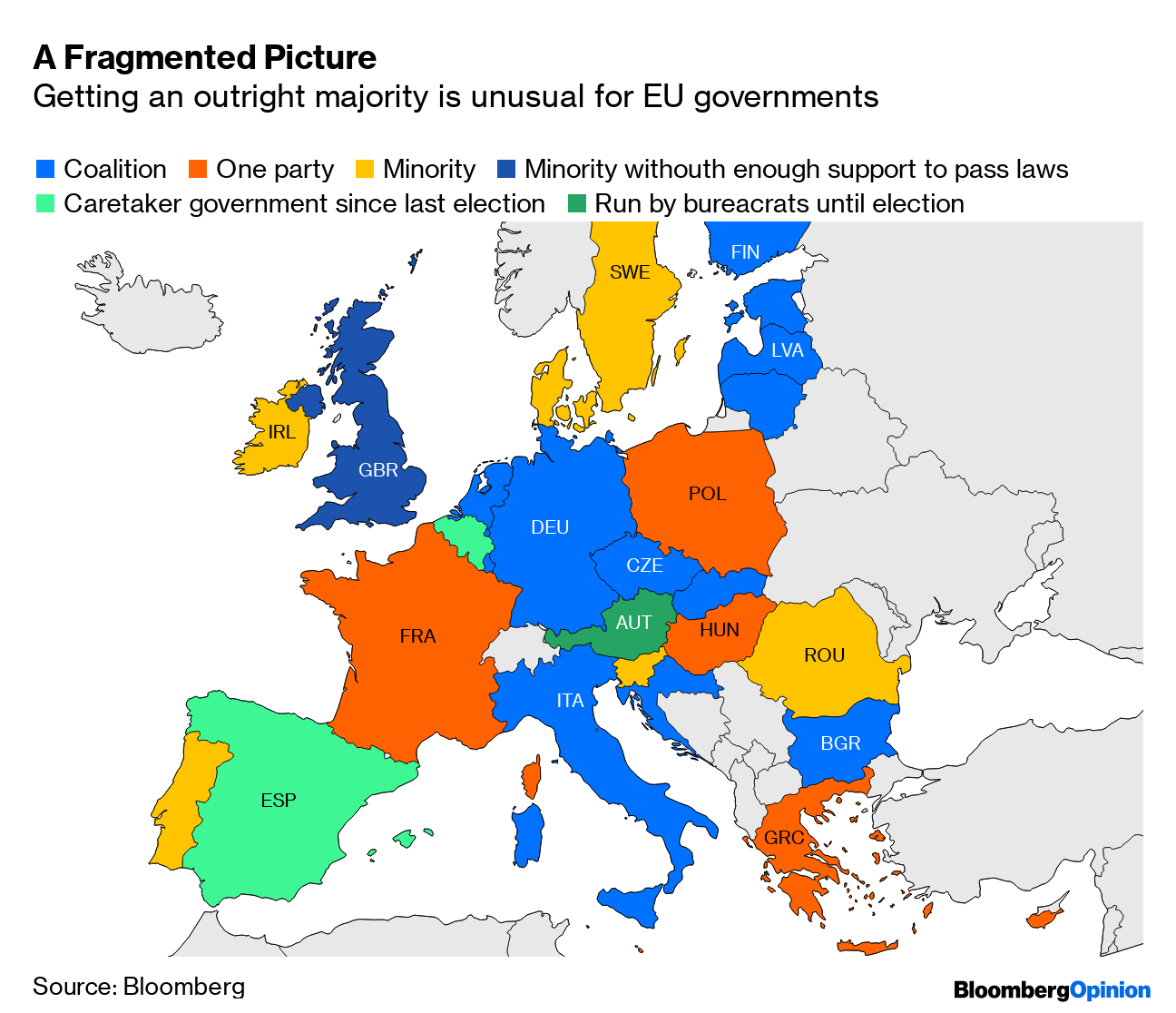

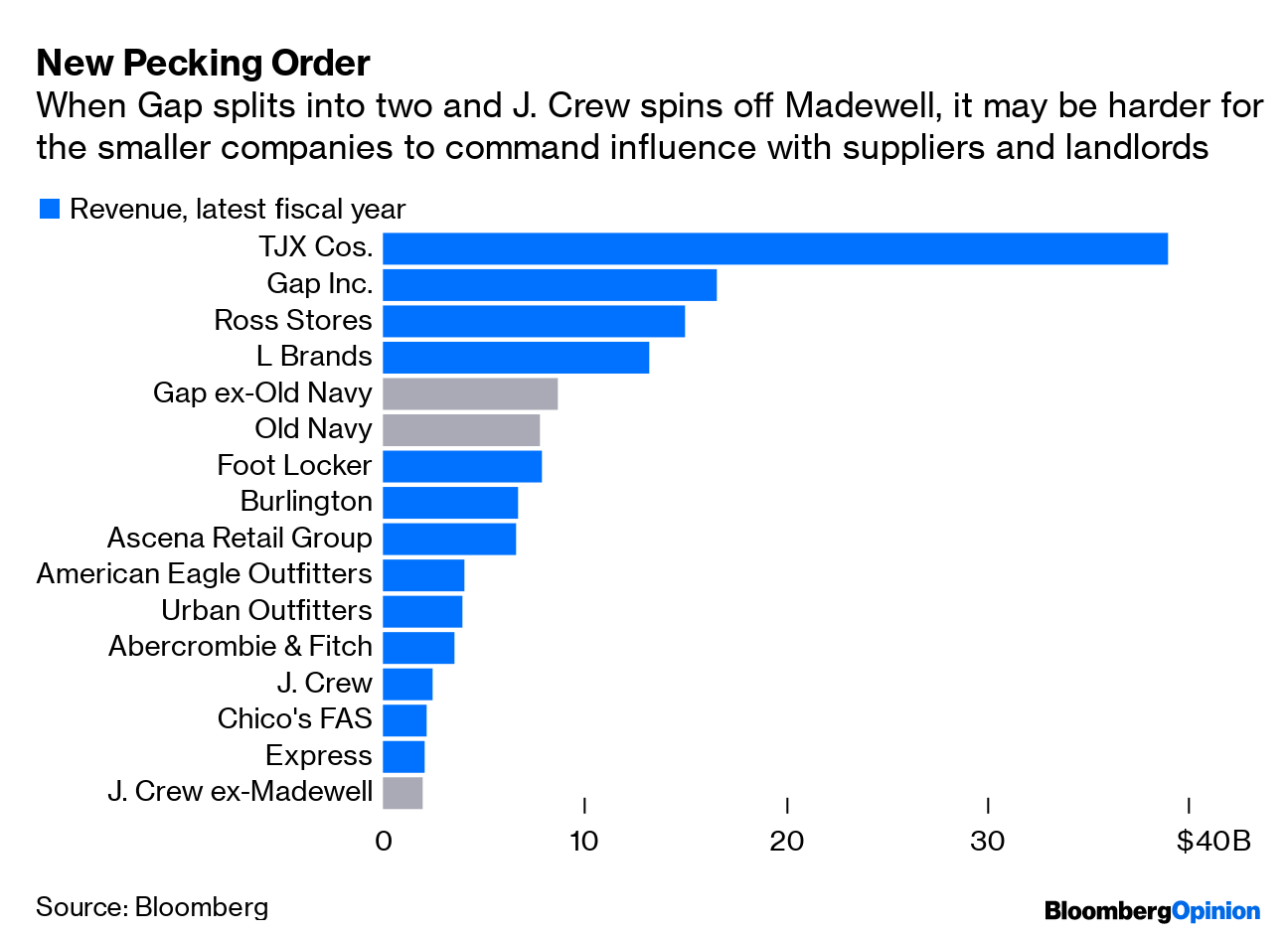

Today's Agenda  The Rise of the Banking Machines Two of the biggest political battlefields of the past decade have been Chinese manufacturing and Wall Street riches. Donald Trump, Bernie Sanders and Elizabeth Warren wouldn't be where they are today without them. But once all the fighting and voting is over, robots will get the last word about both. That robots are in factories will shock no one, though it may yet disappoint any Trump voters expecting the president's trade war (which heated up again today) to revive factory employment. The era of China's manufacturing dominance is certainly over, writes Noah Smith, as its labor costs rise and productivity stalls. Some manufacturing will even return to the U.S. of A. But much of that work will be done by machines. Not coincidentally, factory employment is falling in the swing states of Pennsylvania and Wisconsin. Somewhat more surprising is the robot takeover of banking. Algorithms already do a lot of trading, of course, turning the New York Stock Exchange into not much more than a colorful TV studio. But machines keep encroaching on more of finance all the time, leading to job cuts throughout the industry, writes Nir Kaissar. Retiring Goldman Sachs Group Inc. exec Marty Chavez calls non-coding traders an endangered species. Tech has certainly helped Goldman slash pay and jobs since the crisis, Nir notes, along with the number of highly paid partners needed to oversee it all. This has of course preserved Goldman's all-important profit margin. When protesters called for occupying Wall Street after the crisis, they probably didn't mean for robots to do the occupying. Laws? We Don't Need No Stinking Laws Much of the energy Trump has expended during his presidency has been in scrambling to place himself above the law, and this has been a milestone 24 hours for that effort, writes Tim O'Brien. Yesterday Trump's lawyers, fighting off the Manhattan DA's efforts to access his tax returns, told a court "the President cannot be 'subject to the criminal process' while in office." Meanwhile, his White House is stonewalling Democratic requests for information on a whistleblower's report that Trump made a shocking promise to a foreign leader on a phone call – possibly involving getting Ukraine to help his reelection campaign. This would clearly be an impeachable, and possibly removable, offense, writes Jonathan Bernstein. But that ultimately remains up to Senate Republicans, who must decide if a lawless president is the legacy they want to leave America. Johnson's Brexit Odds Go From 'Hopeless' to Merely 'Abysmal' Lionel Laurent has good news for Boris Johnson: European Commission President Jean-Claude Juncker actually seems open to other ideas on the "Irish backstop" that has frustrated British efforts to cut a deal to leave the EU. Now all the U.K. must do is come up with another idea that makes everybody happy. Should be a snap! We've poked plenty of fun here in the Colonies at Britain's struggles with Brexit. But America has a big stake in this outcome too, James Stavridis reminds us. Britain leaving the EU, particularly in a no-deal Brexit, will be detrimental to the world security order that has helped keep Americans safe since World War II. Bad Times for Oil Markets Imagine you'd been in a sensory deprivation tank for the past week and were just told somebody had attacked Saudi oil facilities and taken out half the country's production capacity. How much higher would you say oil prices were as a result? $10 a barrel? $20? Infinity dollars? Try five bucks, more or less – the price of one of your dumber Starbucks drinks, as Liam Denning notes. Traders quickly remembered there's already too much oil sloshing around the world and curbed prices. But the attacks, along with America's unpredictable response to them, highlight how oil markets are increasingly fragmented, Liam writes. And that makes them more vulnerable to surprises. Further Energy Reading: Telltale Charts Europe's politics look like a total mess right now, but this is actually a healthy sign voters are throwing off the constraints of both parties and populism, writes Andreas Kluth.  Splitting up may be the right thing to do for Gap Inc. and J. Crew Group Inc., but it will make it harder for them to negotiate with suppliers and landlords, writes Sarah Halzack.  Further Reading The Federal Election Commission is weak by design, but now it's getting ridiculous: Out of six possible commissioners, only three are left, all of whose terms have expired. Nobody is minding our elections in the meantime. – Bloomberg's editorial board The Fed can handle the repo market just fine. – Bill Dudley Universal basic income won't solve our economic problems and may even create more. – Satyajit Das Overstock.com Inc. has had a wild week. – Matt Levine Iran thinks it's winning against the U.S.; a tough international response (short of war) is necessary to change its mind. – Hussein Ibish Vladimir Putin keeps detaining political prisoners and then releasing them when public outcry gets too much. It looks chaotic, but it's a way of keeping elites in line. – Leonid Bershidsky ICYMI Rogue Mitsubishi oil trader loses $320 million. Walmart Inc. will stop selling e-cigarettes. Homeowners are abandoning the Florida Keys as the climate changes. Kickers Releasing genetically modified mosquitoes into Brazil: What could go wrong? (h/t Mike Smedley) Arctic scientists race to understand an alarming rise in methane levels. Area kid refuses to have a smartphone. Every "Between Two Ferns" episode, ranked. Note: Please send Florida real estate and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment