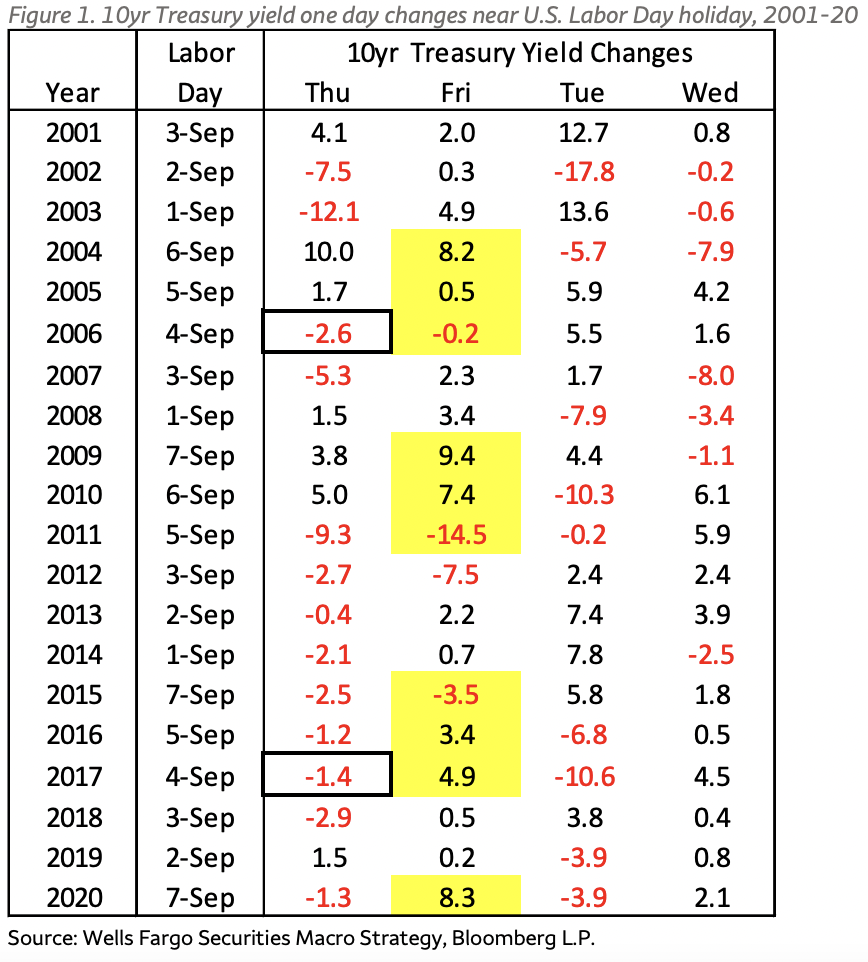

| Welcome to The Weekly Fix, the newsletter that made it out of the investment garbage can and into your inbox. I'm cross-asset reporter Katie Greifeld. One of the fun things about bond market holidays is the mental energy that strategists expend on trying to put numbers to just how weird trading can get. For example, we learned from JPMorgan Chase & Co. in July that for all U.S. payroll releases since 2007 that coincided with an early market close before the U.S. July 4th holiday -- I truly don't think you could get more niche -- the Treasury market is 1.5 times to 2 times more volatile than the average payrolls report day. Well, it's Wells Fargo's turn to shine when it comes to Esoteric Bond Market Holiday Trading Stats. Mike Schumacher and Zachary Griffiths crunched the numbers, and found that since 2013's taper tantrum, long-term Treasury yields have dropped on the Thursday before the three-day weekend in seven of eight years prior to 2021. Rates reversed course and rose on all but one of the pre-holiday Fridays during that period, their analysis showed.  Bloomberg Bloomberg So that's fun, and there's a few potential reasons why that pattern might exist. One theory comes from Wells Fargo Treasury trader Ray Johnson, who points out that month-end rebalancing effects might still be working through the bond market. Another is that traders likely want to offload duration heading into the long weekend and unofficial end of summer. Of course, the added wrinkle is that this pre-holiday Friday also brings August's employment report. That's been the case roughly half the time heading into Labor Day weekend since 2001, and three of the four "aberrations" -- Treasury yields fall on Friday -- over that 20-year span have coincided with payrolls prints. But to Schumacher and Griffiths, rates are more likely to push higher on the heels of an unexpectedly strong jobs print than they are to fall in the wake of a weak one. With that dynamic in mind, bet against bonds: With this dynamic plus the historical pattern in mind, we advocate being short duration, or at least neutral, at the close this Thursday.

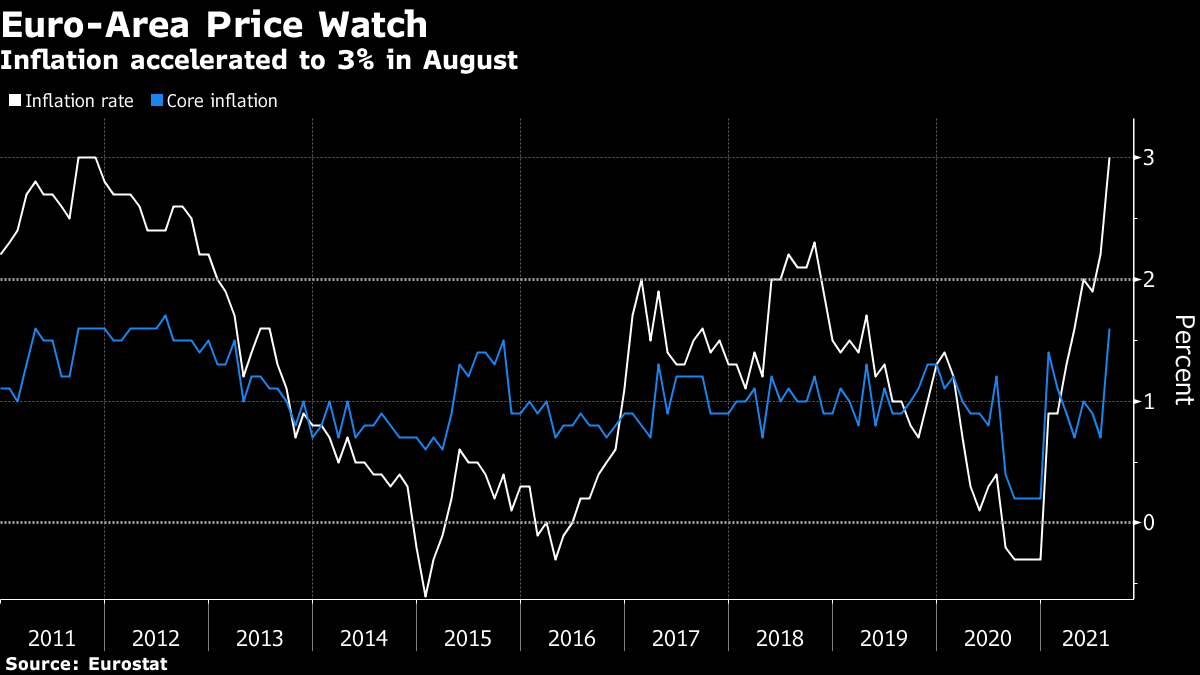

Remember when Jerome Powell told us that whittling down the Federal Reserve's mammoth bond-buying program could start this year, and American risk assets cheered? That was a far cry from the European Central Bank's taper trial balloon. ECB officials Klaas Knot and Robert Holzmann said in separate interviews this week that the central bank should dial back its crisis-era policies and slow down the pace of bond buying. Their comments came on the same day that data showed an inflation surge in the euro zone to 3%, and ahead of the ECB's policy meeting last week.  But while the S&P 500 closed at a record and Treasuries rallied after Powell's Jackson Hole performance last Friday, European investors were decidedly less thrilled. Yields on 10-year German bunds climbed as high as -37 basis points, the highest since mid-July. The disparate reactions are likely due to the fact that while the ECB's pandemic debt-buying program -- known as PEPP -- is expected to end in March rather than be extended, it's surprising to hear it discussed in September, according to Societe Generale's Subadra Rajappa. "The discussion on tapering was earlier than anticipated, perhaps owing to strong inflation prints. This was definitely a jolt and raises the importance of the September ECB meeting," Rajappa said.  In the eyes of Mizuho's Peter Chatwell, the uncertainty surrounding next week's ECB meeting -- which was only heightened by the Knot-Holzmann one-two punch -- explains the underperformance in German bunds. The end of PEPP shouldn't be spooking traders, given that the bank's more conventional quantitative easing program -- known as the APP -- likely isn't going anywhere, he said. "It is far too soon in the European rebound to be turning cautious on European risk assets. Instead, the market should remember the ECB's focus on financing conditions, and the likelihood that APP is increased to compensate for the end of PEPP in March 2022," Chatwell said. "The ECB balance sheet will be expanding long after the Fed's tapering has finished. Indeed, the ECB's balance sheet is likely to still be growing after the Fed's first rate hike." It's often difficult to find drama in the municipal bond market, but you didn't have to look too hard this week. For context, Bloomberg News reported last month that the $24 billion Nuveen's High Yield Municipal Bond Fund -- the largest junk muni fund on the market -- will close its doors to new investors at the end of September. The coming soft close could have widespread ramifications for the $4 trillion junk muni markets, according to Citigroup Inc. Strategists wrote this week that a certain behemoth's shuttering -- the report didn't mention the asset manager by name -- could dampen demand for high yield munis. Their logic is two-fold: one, Nuveen's plan could signal that the red-hot junk muni market is finally overheating. Two, given that the fund accounts for nearly a fifth of all high-yield muni assets under management, spreads could widen since Nuveen's demand for high-yield paper should diminish by about 50%, strategists led by Vikram Rai wrote. "You can expect spreads to cheapen because one, people will buy less and secondly the largest mission fund manager will also buy less," Rai told Bloomberg's Skylar Woodhouse in an interview.  It's not common to see a soft close among muni funds, which goes to show how frenzied the high-yield market has become. Investors have poured nearly $18 billion into such funds this year, with an index of junk munis sitting on year-to-date gains of over 7%. The Nuveen fund has fared even better -- it's returned about 15% over the past year, outperforming 98% of its peers, according to Bloomberg data. But the popularity of the Nuveen fund -- helmed by John Miller -- has become a problem. Demand has boomed relative to the actual supply of junk munis, making it difficult to accommodate new cash without straying from the fund's mission and being forced to buy, say, blue-chip debt. Instead, Nuveen has chosen to fall on its own sword, in a sense. "The fund's strategy is being threatened by the fund's size," Rai and company wrote. "Thus, the fund manager has taken the tough, yet somewhat selfless, decision to close its funds to new money to protect its existing clients. We say selfless because more assets entail more fees!" Remember when high-yield credit spreads widened for seven straight weeks? That's over now. The streak cracked last week with the biggest one-week tightening since April, and spreads look set to drop by another couple basis points this week. Powell's Jackson Hole performance kick-started the reversal, with a signal that tapering could commence in 2021, according to Richard Bernstein Advisors's Michael Contopoulos. Rates on Treasuries would likely rise at a quicker clip than junk yields in that scenario, pushing spreads tighter, he said. Combined with "rock solid" fundamentals and seemingly endless demand, the outlook for corporate credit is bright. "Default rates continue to plummet, deleveraging is accelerating and profits continue to recover, and the demand is insatiable," said Contopoulos, RBA's director of fixed income and portfolio manager. "Government yields likely leak higher as tapering approaches and starts and spreads probably can tighten more than most expect in that scenario."  That's likely welcome news for fixed-income managers in a world where rates on benchmark 10-year Treasuries clock in at just 1.29%. Yield is hard to come by these days -- by the way, Bill Gross thinks that funds that invest in Treasuries belong in the " investment garbage can" -- which makes the junk market attractive in the eyes of John Hancock Investment Management's Emily Roland. Even with junk bonds fresh off 11 straight months of gains, there's still some value to be found in double-B rated debt, she said. "You want to own high-yield bonds. Not to say the fundamentals are screaming a ton of value there," said Roland, the firm's co-chief investment strategist. "But we think that spreads could continue to hold in, and you need every percent you can get in fixed income right now." Traders Set to Test Powell Push to Delink Hikes From Taper States That Cut Unemployment Benefits Saw Limited Impact on Job Growth Why New York's Subway Keeps Flooding |

Post a Comment