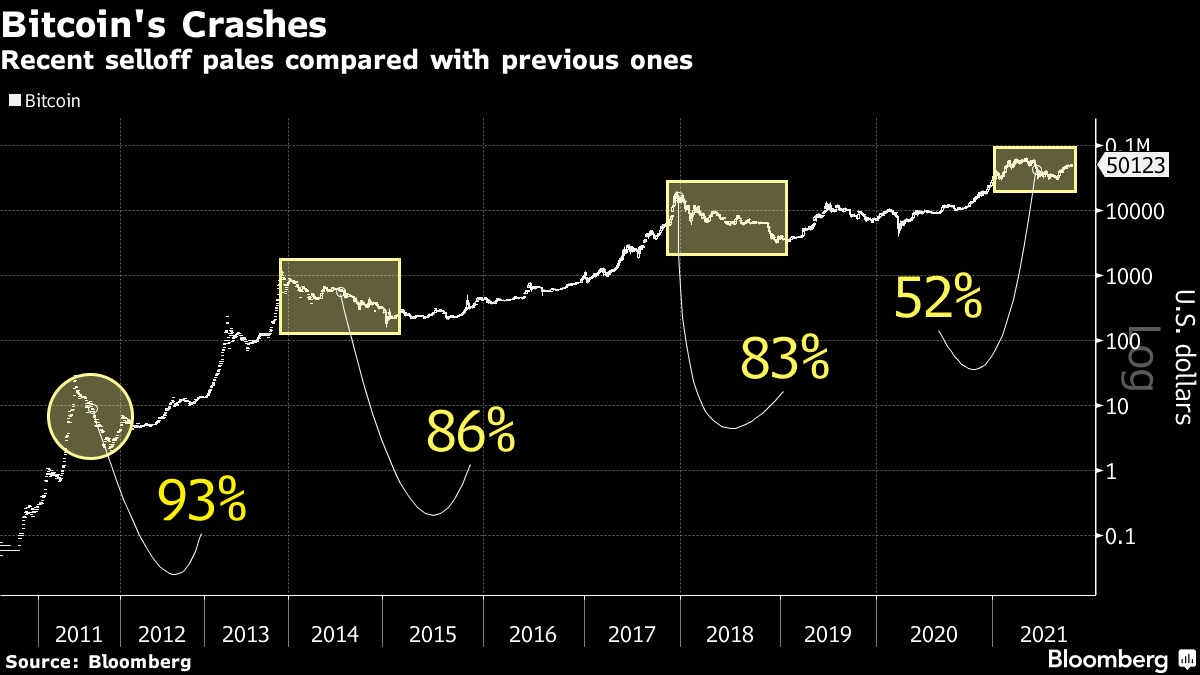

| Good morning. Germany's DAX is getting an upgrade, there's key U.S. jobs data and a political upset in Japan. Here's what's moving markets. Germany's prime equity index is about to undergo the biggest makeover since its inception in the late 1980s. After the introduction of a profitability requirement and other quality checks in the wake of Wirecard's explosive exit from the index, tonight operator Deutsche Boerse is set to announce which 10 companies will ascend to the venerable benchmark that's being expanded to 40 stocks. Candidates range from Airbus to Zalando and are expected to increase the DAX's total market value by about 350 billion euros. The rallies that gained support worldwide from Federal Reserve Chairman Jerome Powell's speech last week face a key test this afternoon as the U.S. jobs report provides a window into the strength of the economic recovery. Nonfarm payrolls for August are expected to show slower growth than in July. Still, stronger-than-expected job growth or steep wage increases could fuel bets that the Fed will speed up the rollback of its massive bond-buying program. A weak report could do the opposite, reinforcing the speculation that has helped stoke risk-taking sentiment. While third doses of mRNA Covid vaccines are planned for vulnerable people in the U.K. and EU, there's an ongoing debate whether they should be offered to fully vaccinated, healthy adults quite yet. EU health officials said there's no urgent need, especially when a third of European adults still aren't fully inoculated. Meanwhile in the U.S., the Biden administration is seeking booster shots for people who had their second shots eight months ago, drawing some resistance from the country's health authorities. Some Americans are finding other ways to get their boosters early. Japanese Prime Minister Yoshihide Suga said he plans to resign, a surprise decision just ahead of a vote for party leader as a general election looms. Suga told a news conference Friday in Tokyo that he won't run for leader of the ruling Liberal Democratic Party later this month. Whoever becomes the next LDP leader is virtually assured of becoming prime minister due to the party's dominance in parliament. Suga's support had slumped over his handling of the pandemic since he took office a year ago. His early exit brings Japan back to the days of short-serving prime ministers after Suga's predecessor Shinzo Abe lasted for almost eight years. Apart from U.S. nonfarm payrolls, today's macro event to watch is final purchasing managers' index data for the U.S., U.K. and Euro zone. It's very quiet on the earnings front, with a sales update due from U.K. homebuilder Berkeley and earnings scheduled from asset manager Ashmore. Wealth-tech Allfunds Group is set to release earnings for the first time since its April IPO in Amsterdam. This is what's caught our eye over the past 24 hours. This wasn't supposed to happen. Bitcoin wasn't supposed to bounce off the lows before wiping out all late-comers to the rally that started last year. It was supposed to drop at least 80%, as it did every previous time prices exploded higher. This time is different. The original cryptocurrency got above $50,000 on Thursday. As recently as mid-July, it changed hands below $30,000. Yet the total drawdown, which measures the peak-to-trough decline, was just 52%. The probable explanation is that it is now more integrated into the global financial system.  In the past, trading as an uncorrelated asset in a parallel system on its own unregulated exchanges, Bitcoin truly was the wild financial west. Investors were as likely to see their stake stolen as they were to realize profits. That's no longer the case. Today there are a number of recognized and trusted trading avenues, ironic for an asset that was supposed to solve the algorithmic problem of trust.

CME's futures give professional investors a mechanism to gain price exposure without holding Bitcoin. Retail investors can gain access on venues like PayPal, circumventing earlier problems with custody. Exchange-traded funds and contracts are available in many jurisdictions, albeit not the U.S. In short, the crypto universe is showing early signs of maturity, so its extreme volatility can be expected to subside. Just don't expect it to happen all at once. Eddie van der Walt is a Markets Live reporter and editor for Bloomberg News in London. @EdVanDerWalt Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment