| Hello. Today we look at a nightmare scenario for China's economy, accusations the IMF chief influenced a report in China's favor when she worked at the World Bank and differences in supply-chain pressures. The risks just keep piling up for China. Delta outbreaks. A regulatory crackdown on big tech. Surging commodity prices and freight costs hammering exporters. Fractious ties with America. And then there's China Evergrande Group, the embattled real estate developer groaning under the weight of a $300 billion pile of liabilities. Evergrande is the latest flashpoint in President Xi Jinping's battle against leverage, following a long line of predecessors which China bears have pointed to as the potential Lehman moment that triggers an economy-wide reckoning after years of excessive credit expansion. Just a few months ago, it was bad-bank China Huarong Asset Management Co. that was causing all the angst. Before Huarong there was the sprawling conglomerate HNA Group Co., and before HNA it was regional lender Baoshang Bank Co. And so it goes. But each time, Beijing has managed to contain the fallout and keep the China bears' dire predictions from materializing. The latest test will come next week: Evergrande's main banks were told by China's housing ministry this week that the developer won't be able to make interest payments due Sept. 20, according to people familiar with the matter. Then what? While a chaotic collapse remains a distant proposition, Bloomberg News's Shen Hong, Enda Curran and Sofia Horta e Costa have sketched out what such an outcome would look like. And it isn't pretty. Protests intensify at China Evergrande Group offices across the country as the developer falls further behind on promises to more than 70,000 investors. Construction of unfinished properties with enough floor space to cover three-fourths of Manhattan grinds to a halt, leaving more than a million homebuyers in limbo. Fire sales pummel an already shaky real estate market, squeezing other developers and rippling through a supply chain that accounts for more than a quarter of Chinese economic output. Covid-weary consumers retrench even further, and the risk of popular discontent rises during a politically sensitive transition period for President Xi Jinping. Credit-market stress spreads from lower-rated property companies to stronger peers and banks. Global investors who bought $527 billion of Chinese stocks and bonds in the 15 months through June begin to sell. Click here to read the full story

It's a nightmare scenario Beijing will be keen to avoid. —Malcolm Scott  IMF Managing Director Kristalina Georgieva shown in her office 2020. Photographer: Kim Haughton/IMF Kristalina Georgieva risks seeing her authority as head of the International Monetary Fund undermined just weeks before an annual meeting of global finance chiefs, after being accused of influencing a report in China's favor when she worked at the World Bank. Georgieva on Thursday said that she "fundamentally" disagreed with the finding — by an outside law firm engaged by the World Bank. The substance of the charge — putting "undue pressure" on World Bank staff to adjust the rating in the "Doing Business" report when she served as chief executive officer — was the latest in a series of scandals that have plagued the troubled report. So controversial is the methodology for the report, which measures the ease and transparency of operating in an economy, that the World Bank announced it will stop producing it. Click here to read the full story. Click on the blue links to read any of the stories in full: - More to come I | Federal Reserve Chair Jerome Powell's review of internal rules around investments by policy makers is a move in the right direction but won't stem pressure for more accountability.

- More to come II | The Fed will probably hint at its meeting next week that it is moving toward scaling back monthly asset purchases and make a formal announcement in November, according a Bloomberg survey.

- China wants in | China has submitted a formal application letter to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, a pact once pushed by the U.S. to isolate the Asian giant.

- China forecast | Tough virus curbs mean economic activity in the third quarter could be close to flat compared, according to the economist ranked as the best China forecaster by Bloomberg last year.

- British sales | U.K. retail sales fell unexpectedly for a fourth month in August, the longest stretch of declines in at least 25 years, raising concerns about the economic recovery.

- Germany's future | Giants of Germany Inc. such as Daimler and Siemens are overhauling themselves to remain relevant — a task Chancellor Angela Merkel's successor will need to apply to an economy reliant on the U.S. for security, China for growth and the EU for clout.

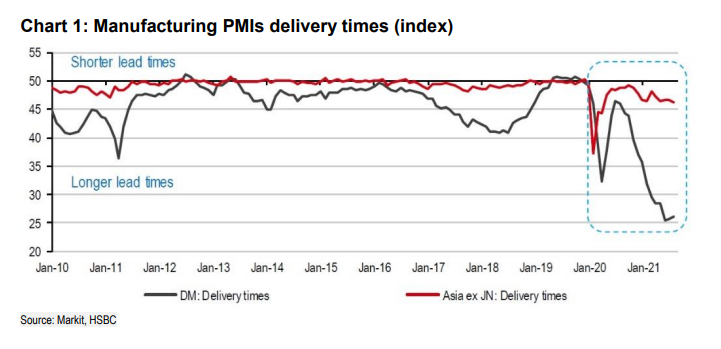

The chart above tracks changes in delivery times as reported by local producers, and shows that things are far worse in developed economies than in emerging Asia. That suggests the key crunch point in global supply chains are containers destined for the West stuck in Asian ports, not production per se, according to Frederic Neumann, co-head of Asian economic research at HSBC Holdings. "And that, one would assume, should prove to be a more surmountable obstacle — eventually," he says. A World Bank insider proposes a solution: Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here.

Delta Spread, Inflation Fear, Fed Taper - Bloomberg Economics Outlook Webinar: Join Stephanie Flanders, Head of Bloomberg Economics, at 10:00 Eastern Time on Sept. 23, as she leads a discussion with Bill Dudley, David Wilcox, Tom Orlik, and Dan Hanson on the outlook for 2022. Sign up here.

Bloomberg New Economy Conversations—Getting to Net Zero: The cost of scaling up renewable energy has fallen dramatically. Is 2021 the year in which we'll see major investments in areas like green hydrogen, carbon capture and other technologies needed to prevent environmental catastrophe? What are the most promising new areas and who is at the forefront? Join New Economy Editorial Director Andrew Browne on Sept. 28 at 10 a.m. as he discusses these issues with HSBC Group Chief Executive Noel Quinn, Hyundai Motor Co. Vice President of New Energy Business Development Jae-Hyuk Oh, and others. Register here. |

Post a Comment