| Hello. Today we look at the threat to Australia's economy from its fraying relations with China, trends in minority employment in America, and Asia's swelling middle class. Australia has ridden the China bonanza for nearly two decades, earning windfalls from mineral exports and income gains from cheap imports. That helped Australia power through the global financial crisis of 2008, and has helped cushion the economy's slide as Covid finally broke the lucky country's near three decade run without a recession. Recent trade reports have show record shipments, even as China's displeasure at perceived diplomatic slights from Australia prompted it to respond with measures against its wine, lobster and barley exports. That's because China has continued to snap up iron ore, pushing prices higher. But now, with relations still frosty, the recent slide in iron ore prices is spurring concerns that the export tailwind may soon fade, James Mayger and Michael Heath report here. And worryingly for Australia, China is targeting high-growth products that are key to future trade as firms down under eye the hundreds of millions of consumers set to join the Asian giant's middle class in coming years. "In the future that's where the growth will be, all this middle-income stuff, and unfortunately that's what's being impacted in this conflict with China," said Bob Gregory, a professor at Australian National University who has studied the economy for half a century. Relations have soured since 2018, when Australia barred Huawei from building its 5G network, and went into freefall last year as Prime Minister Scott Morrison led calls for an independent probe into the origins of the coronavirus that first emerged in China. Optimists argue that Australia's relationship with China is bound to improve, citing the experiences of Japan and South Korea: After a rocky patch a decade ago, Beijing came to realize it needed Japanese investment and technology and had limited leverage over Tokyo. And in South Korea, South Korea struck a compromise deal after a dispute with China over U.S. missile systems deployed in the country. Neither Canberra nor Beijing have shown a willingness to compromise. China has made clear it's waiting for Australia to make the first move, while Trade Minister Dan Tehan said Australia is prepared to "pay an economic price" to defend its sovereignty. Australia's economy, already facing the risk of a double-dip recession as Covid lockdowns shut the nation's biggest cities, hasn't had to pay that price yet. If China's demand for iron ore ebbs, it soon will. — Malcolm Scott The U.S. government has poured trillions of dollars into the economy to support pandemic recovery, with President Joe Biden and Federal Reserve Chair Jerome Powell vowing a rebound that's equitable. To monitor progress toward that goal, Bloomberg has been tracking unemployment rates by race and ethnicity in metropolitan areas across the U.S. Available data show an uneven picture, with minority communities in some areas faring much better than others elsewhere. - Coming up | The U.S. probably added 725,000 jobs in August, a more moderate pace than the prior two months but stronger than earlier in the year, according to a median forecast of economists. The actual report will come out at 8:30 a.m. in Washington.

- Suga rushing out | Japanese Prime Minister Yoshihide Suga announced plans to resign after barely a year in charge. The decision points to the failure of his bet that limiting the impact of Covid-19 on the economy would secure him popular support for his other plans.

- Hitting pause | Senator Joe Manchin is demanding a "strategic pause" in action on President Joe Biden's economic agenda, potentially imperiling the $3.5 trillion tax and spending package that Democratic leaders plan to push through Congress this fall.

- Paralympics | While Japan will share some reflected glory for raising the visibility of disabled sporting excellence, its track record for integrating people with disabilities into the workforce lags many peers.

- ECB plans | The European Central Bank will start slowing its pandemic bond purchases in the fourth quarter, according to economists surveyed by Bloomberg.

- Services slugged | China's services activity contracted for the first time since April last year, further evidence of the blow to the economy that's come from fresh virus outbreaks. Bloomberg Economics cut its growth forecast for the year to 8.9% from 9.1%.

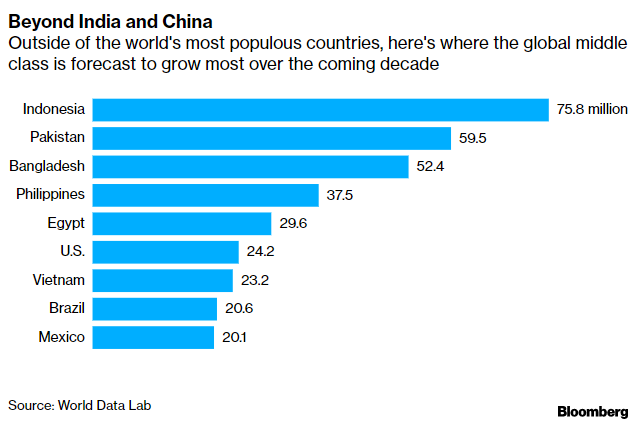

More than 1 billion Asians are set to join the global middle class by 2030, according to a new study that predicts the pandemic will prove just a temporary pause in the world economy's great demographic shift. The middle class — households where per-capita spending is between $11 and $110 a day — amounts to some 3.75 billion people this year, according to the World Data Lab. That cohort is projected to keep growing through 2030 with India and China, the most populous countries, adding about three-quarters of a billion members between them. Putting the inflation debate into historical context... Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

Bloomberg New Economy Conversations — China's Tech Crackdown: Join New Economy Forum Editorial Director Andrew Browne on Sept. 8 at 10 a.m. as he analyzes the sweeping regulatory crackdown underway in China. The private sector helped power China's economic rise, but President Xi Jinping seems determined to rein in what he sees as its excesses. Is this transitory or a game-changing shift? Joining Andy are Keyu Jin, Associate Professor of Economics at the London School of Economics & Political Science, and Kevin Rudd, President and Chief Executive Officer of the Asia Society. Register here. |

Post a Comment