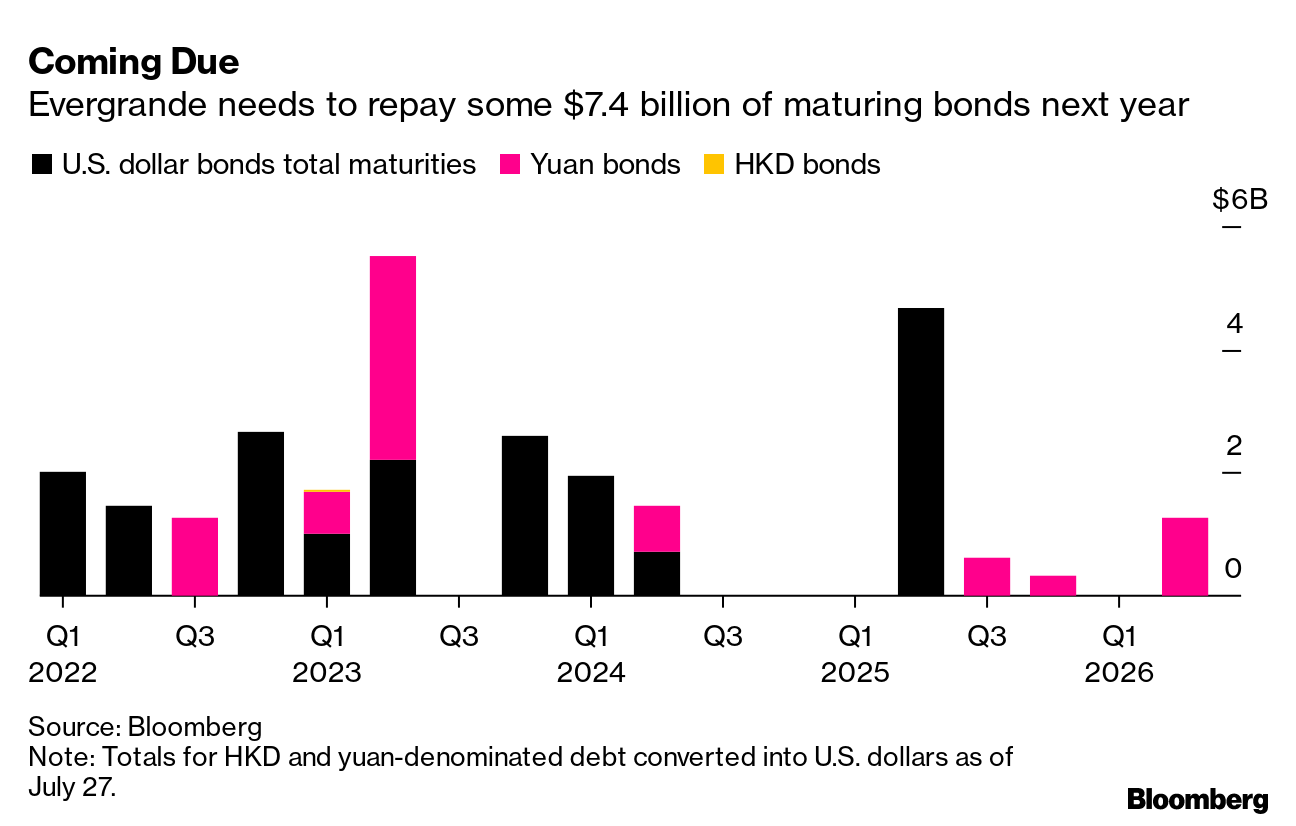

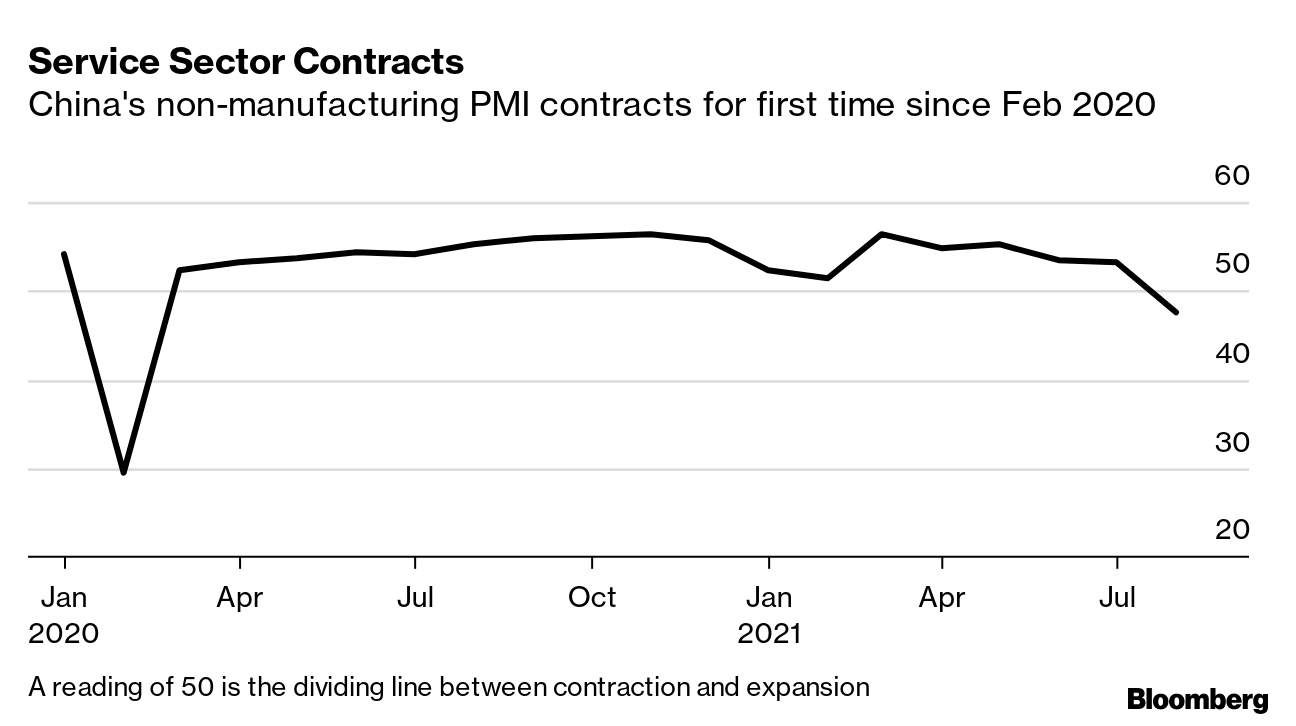

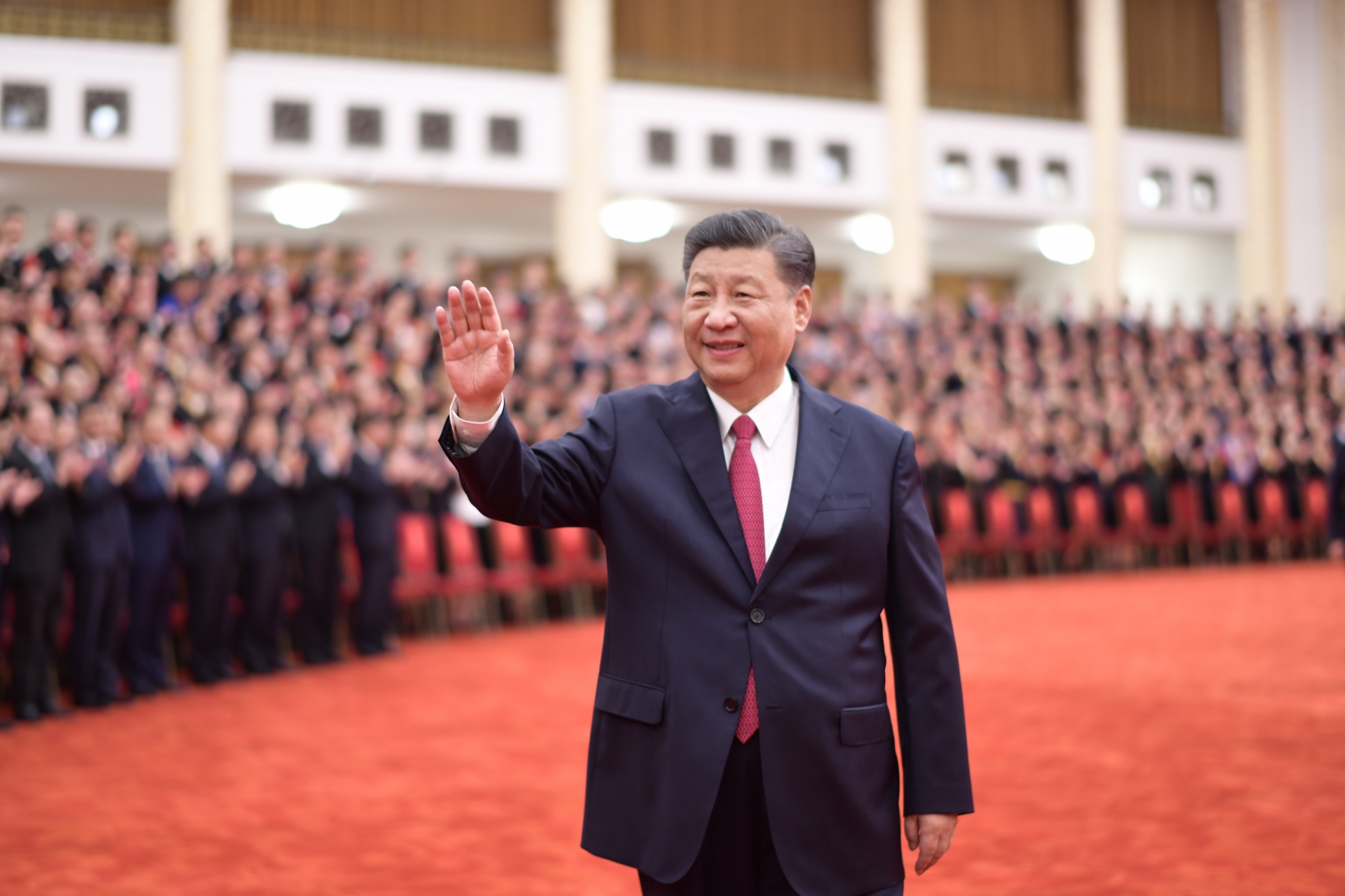

| There's never a good time to be a heavily indebted Chinese property developer, but now is certainly worse than most. Chinese President Xi Jinping's push for "common prosperity" has led to greater scrutiny of billionaires, debt and high home prices — none of which augurs well for the real estate industry. Indeed, economists at Nomura, Japan's largest brokerage, have argued that Xi's political priorities have laid the groundwork for China's battle with property to potentially become the country's "Volcker Moment." That phrase refers to the U.S. Federal Reserve's decision under former Chairman Paul Volcker to quickly raise interest rates in the late 1970s. Those actions caused a jump in unemployment but also tamed inflation, setting the stage for an economic boom over the next two decades. If policy makers in Beijing have in fact steeled themselves to tame home prices, the short-term pain could be tremendous, even if the longer-term implications are rosy. For a sense of what's at stake, look no further than the tumult unfolding around Evergrande, the world's most-indebted real estate company. The firm's finances have been under strain since late last year as Beijing began barring developers from additional borrowings until they brought their leverage down to within regulatory requirements. In response, Evergrande has been scrambling to sell assets so that it can secure the cash needed to pay off its debts. Whether it can do that quickly enough came into focus this week with the release of its first-half financials.  In the first six months of the year, Evergrande was able to cut the amount of interest-bearing debt on its books to a five-year low. Unfortunately, its overall liabilities increased thanks mainly to swelling bills it has yet to pay its suppliers. Cash and cash equivalents also plunged to a six-year low. The question for Beijing is whether Evergrande is too big to fail. China's leaders may ultimately decide they want to avert a costly collapse, even at the risk of appearing to tacitly condone the type of reckless borrowing that put Evergrande in the delicate position it's in. But with Xi's recent focus on reining in the disorderly expansion of capital, there are also plenty of reasons to think that they won't ease up on Evergrande and other overly indebted peers. Xi's campaign for "common prosperity" continued this week. Here are some of the latest developments: August was a tough month for China's economy. To bring an outbreak of the delta variant under control, authorities imposed quarantines, closed transportation links, cancelled events and administered more than 100 million tests. It worked, but there was an economic cost. Services industries suffered most notably, with a government-compiled gauge of activity in the sector falling into contraction for the first time since February 2020. Manufacturing weakened but still eked out an expansion in August, according to the official purchasing manager's index. A privately compiled measure, however, showed manufacturing contracted as well.  But don't expect weak economic data for August to dissuade Beijing from pursuing its Covid-zero strategy. Economists still expect the annual expansion to come in well ahead of the government's 6% target for the year — likely meaning it'll continue to prioritize virus containment over economic growth. Once every five years, China's Communist Party executes a carefully choreographed handover of power that culminates at a national congress in Beijing and the unveiling of a new Politburo Standing Committee. The year leading up to that event is one of intense politicking as cadres jockey not only for positions at the highest echelons of power but for promotions throughout the party's hierarchy. It was announced this week that the party's Central Committee will have its annual plenum in November. That gathering, which brings together about 400 senior state leaders, ministers, military chiefs, provincial bosses and top academics, will kick off the march to the next congress in late 2022. While every party congress is consequential, what will set this next gathering apart is that Xi, in a turn away from recent tradition, could be appointed for a third term. Indeed, in announcing the November plenum this week, the official Xinhua News Agency seemed to nod to that possibility. One of the topics to be discussed at the meeting, Xinhua reported, will be upholding Xi's core position within the party.  President Xi Jinping at the Great Hall of the People in Beijing on June 29, 2021. Photographer: Xinhua News Agency/Xinhua News Agency And finally, a few other things that caught our attention: |

Post a Comment