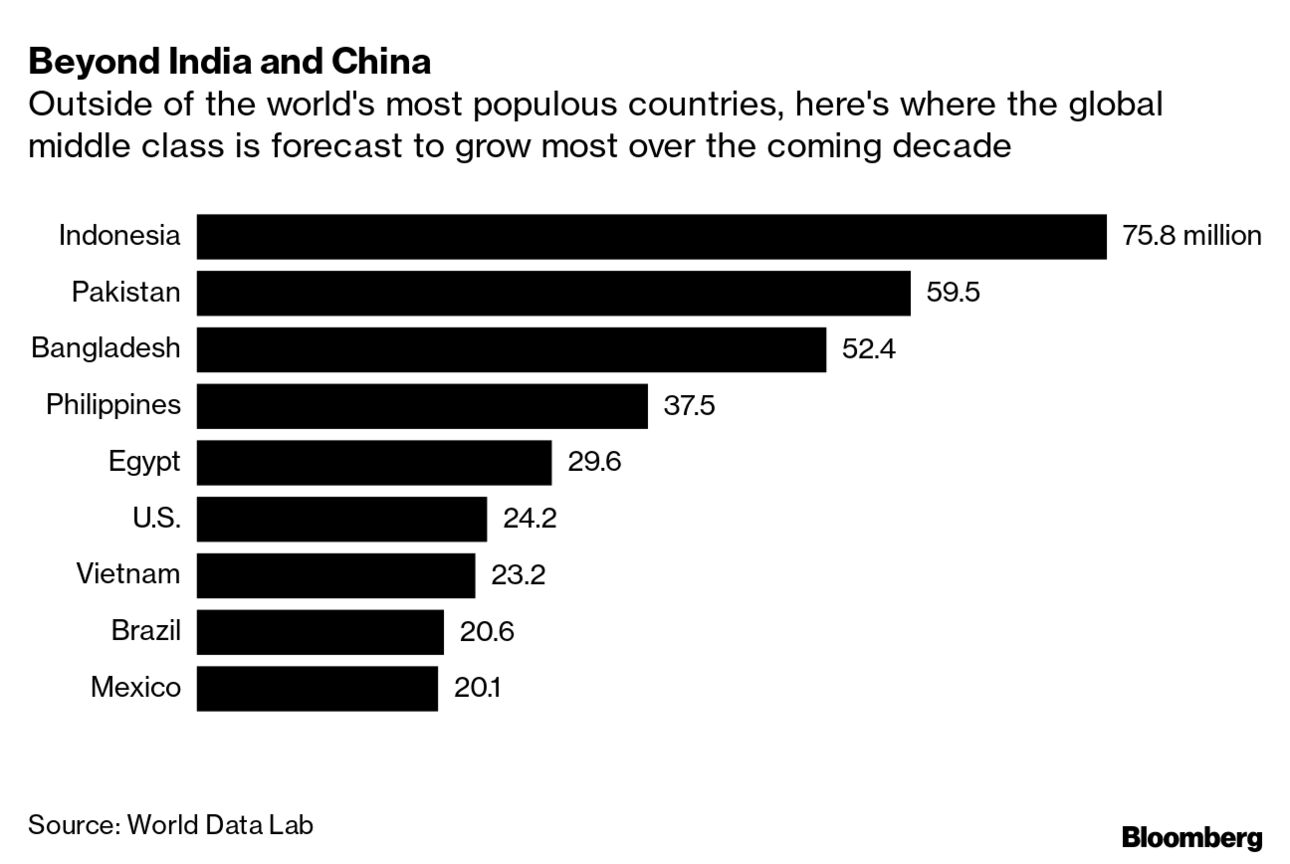

| Rich Asians are jumping the queue for Covid booster shots. China's diplomatic spat with Australia could yet prove economically damaging Down Under. More than a billion Asians are set to join the middle class by 2030. Here's what you need to know. Three doses of Covid-19 vaccine may become the standard regimen for most people in the U.S., White House chief medical adviser Anthony Fauci said. His comments came after a study in Israel showed a dramatic improvement in protection among recipients of three shots of the Pfizer-BioNTech vaccine. Meanwhile the drugmaker behind China's own mRNA vaccine — using similar technology to the Pfizer shot — hopes to have efficacy data available by the end of the year. Elsewhere, Saudi Arabia has the world's toughest vaccine rules that exclude the unvaccinated from offices, schools and most public places; Italy's prime minister says vaccinations will eventually become compulsory; and rich Asians in some of Covid's hotspots are jumping the queue for booster shots even as millions of people are yet to have their first doses. Finally, here's how cities battered by the pandemic are finding new ways to survive. Asian stocks look set for a steady start after cyclicals led Wall Street to a record and the dollar fell ahead of a U.S. jobs report that will shape views on the outlook for Federal Reserve monetary policy. Futures for Japan and Australia rose, but retreated for Hong Kong. U.S. equity contracts fluctuated after energy and industrial shares helped the S&P 500 scale a new peak. The U.S. 10-year Treasury yield edged down and a gauge of the dollar hit a four-week low. The payrolls report will color expectations about when the Fed might start tapering pandemic-era stimulus and how long it can wait before hiking interest-rates. More than 1 billion Asians are set to join the global middle class by 2030, according to a new study that predicts the pandemic will prove just a temporary pause in the world economy's great demographic shift.

The middle class — households where per-capita spending is between $11 and $110 a day — amounts to some 3.75 billion people this year, according to the World Data Lab. That cohort is projected to keep growing through 2030 with India and China, the most populous countries, adding about three-quarters of a billion members between them.  China's swelling middle class hasn't gone unnoticed by HSBC's CEO Noel Quinn, who is betting on the newly affluent even as President Xi Jinping cracks down on the country's richest. HSBC has hired 600 wealth managers there as part of plans to add 3,000 over the next three to four years, said Quinn. Singapore's OCBC is also on a hiring spree to tap China's riches, with plans to double the number of relationship managers for wealthy Chinese clients to 500 by 2023. Back to HSBC, Quinn said that the bank will not be reverting to its pre-pandemic business model, with as many as 70% of its staff in favor of hybrid working and its business travel budget slashed in half. HSBC isn't the only business planning for a radically different future. A Bloomberg survey showed 84% of large companies plan to spend less on travel when the pandemic is over. Australia's economic resilience in the wake of China's efforts to punish it for diplomatic slights has some Down Under declaring victory. They might be speaking too soon. Former Prime Minister Malcolm Turnbull said last month that China's campaign to "make us more compliant" has "completely backfired." But while Beijing has left the profitable iron ore sector untouched until recently, it's focused its wrath on Australian products that would form the backbone of future trade, such as lobsters and wine, and has warned its students against studying there. Here's why that could be very damaging indeed. This is what's caught our eye over the past 24 hours: It's Jobs Day. I started this week by observing that that the payrolls report could well turn out to be a more interesting event for markets than Jackson Hole, as investors who now understand the sequencing of tightening — tapering can start before interest rates are hiked — start grappling with the actual timing. If the report comes in stronger than expected then a tapering announcement could arrive as soon as November. If it comes in weaker, then the end-of-asset-purchases could be put off for a while longer. In that sense, bad news on the U.S. economy could end up being good news for stocks. For context, analysts are forecasting that the U.S. added 725,000 jobs in August, which would take the unemployment rate to 5.2%.  So the stakes for today's payrolls are already high, but there's another complicating factor for markets today. The payrolls report is sandwiched between a day which saw deadly flooding in New York and New Jersey and the start of the long weekend ahead of the U.S. Labor Day holiday on Monday, when both stock and bond markets will be closed. Both these events mean that liquidity in U.S. Treasuries is probably going to be pretty thin on Friday, which adds to the risk that we could see big moves in bonds if there are major surprises in the jobs number. It could be an interesting day. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment