| Hello. Today we look at surging commodity prices, China's power crunch and confusion at Russia's central bank. The price of everything seems to be going up. Gas, coal, carbon and electricity are all hitting record highs, while the price of oil this week passed $80 a barrel for the first time in three years and natural gas is the costliest in seven. Such gains pushed the Bloomberg Commodity Spot Index to its highest level in a year. Meanwhile, food prices are surging, too, with a UN index up 33% over the past 12 months. This is unwelcome news for the world economy as a whole at a time when supply chains are already strained, as Catherine Bosley reported here. Rising bills for consumers and companies threatens to both boost inflation and slow demand, a toxic mix known as stagflation. Of course, some will benefit but the aggregate effect on the global economy is negative. Bloomberg Economics calculates that a 20% increase in commodity price implies a transfer worth at least $550 billion — roughly equivalent to Belgium's annual output — from commodity consumers to those that produce the most. In dollar terms, the biggest losers are set to be China, India and Europe. Winners include Russia, Saudi Arabia and Australia. Measuring the ShocksAs for inflation, the Bloomberg Economics SHOK model suggests a $10 increase in oil prices adds about 0.2 percentage point to annual inflation across the U.S., euro area and the U.K. This all puts policy makers in a bit of a spot. "Will this renewed spike in energy costs mean central banks accelerate" their plans to reduce stimulus, said Jim Reid, global head of fundamental credit strategy at Deutsche Bank. "Or will it hit demand enough that it actually slows them down? This is an incredibly delicate and difficult period for central banks." He calculates the world is entering a "net hiking zone" and that the rolling 12-month average of hikes now exceeds cuts. Since May 2012, that has happened on just 10% of occasions. The big question is whether the commodity surge means those hikes continue or need to be reversed. —Simon Kennedy China is at the center of the commodity shock and its government is considering raising power prices for industrial consumers to help ease a growing supply crunch. The rate hikes for factories to textile mills could come in the form of higher flat fees, or in rates that are linked to the price of coal, according to people familiar with the details of the plan. And things could get worse if freezing weather exacerbates surging power demand and soaring fuel prices. Bloomberg Economics reckons the power squeeze will dwarf the hit of the delta virus. - Coming up | The central banking giants that are Christine Lagarde, Haruhiko Kuroda, Jerome Powell and Andrew Bailey all appear on a panel in the European afternoon.

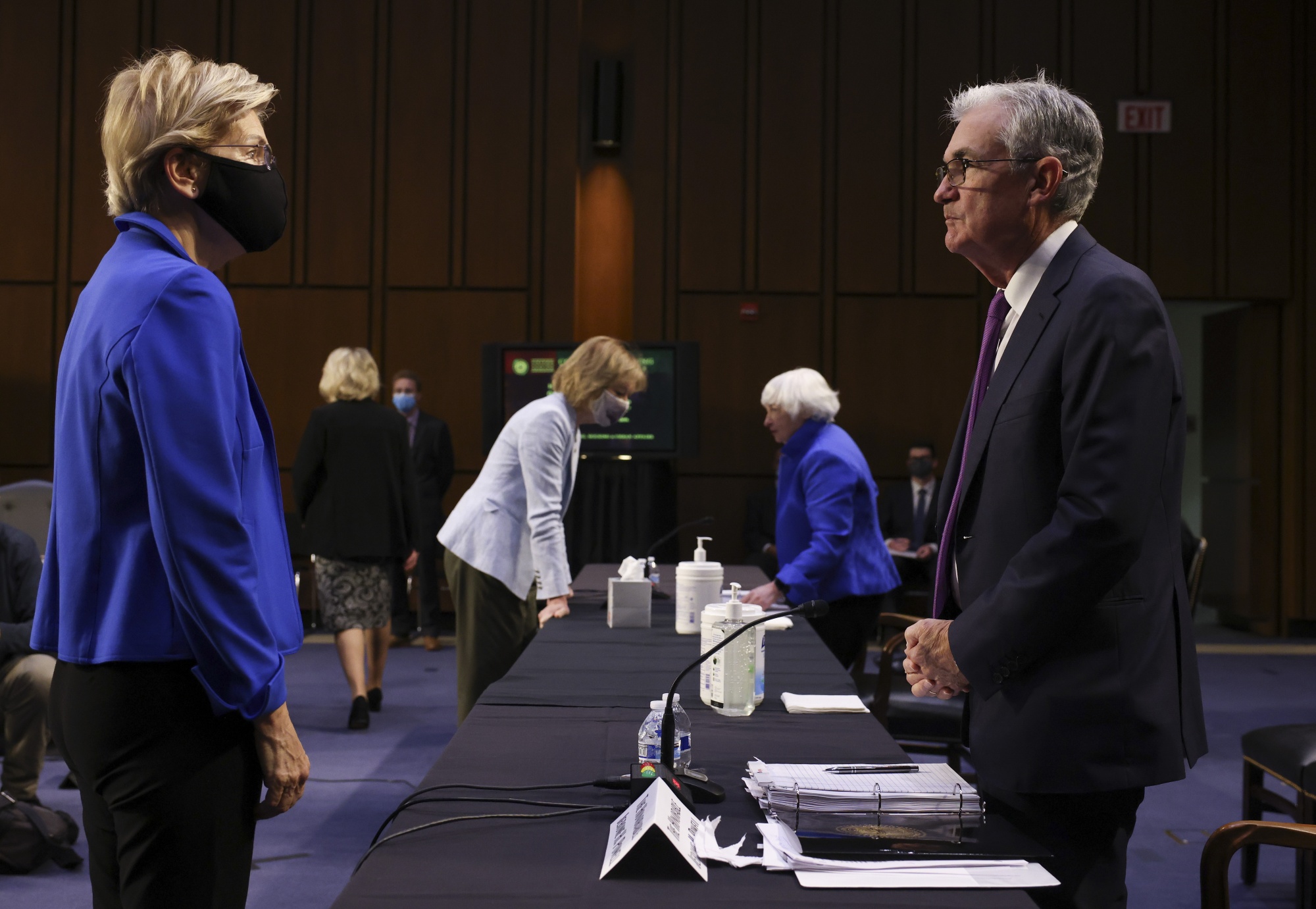

- Powell pressure | The question of whether Fed Chair Jerome Powell will be reappointed has suddenly become more clouded, with Democratic Senator Elizabeth Warren vehemently denouncing Powell as "a dangerous man" because of his record on financial regulation.

Photographer: Kevin Dietsch/Getty Images Photographer: Kevin Dietsch/Getty Images - Growth slump | Vietnam's economy shrank by the most on record as the country's tough anti-virus policies impacted almost every corner of its economy, disrupting supply chains and shuttering factories.

- Cash flowing | China's central bank injected liquidity into the financial system for a ninth day in the longest run since December. Meantime, Governor Yi Gang said quantitative easing can be damaging over the long term and vowed to keep policy normal for as long as possible.

- Trade talks | European Union countries agreed on a joint statement for its pivotal trade meeting with the U.S. scheduled for later Wednesday, with France successfully watering down aspects of it, including on semiconductors.

- Extending help | Brazil's government is considering extending Covid cash handouts through April as President Jair Bolsonaro seeks to boost his record-low popularity before 2022 elections.

A computerized neural network has spoken: Central banker Elvira Nabiullina needs to use simpler language if she wants more Russians to believe she can really reduce inflation. A study conducted by a pair of the Bank of Russia's own researchers came to the conclusion that figuring out central bank statements takes a degree in economics. The researchers ran the central bank's key-rate press releases, transcripts of Nabiullina's news conferences and other reports through a model to assess their complexity on a scale of 1 (accessible only to people with advanced economics degrees) to 10 (comprehensible to elementary schoolers). Most of the communications on monetary policy scored between 1 and 3. Read our report here Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment