| Hello. Today we look at fractures in emerging markets, German and British fiscal policy and China's property market. For all the angst among investors and central bank watchers alike early this year, the Federal Reserve's shift toward withdrawing its pandemic-era support for the economy has been proceeding without undue turmoil. But don't count out the possibility of pain just yet, especially for a number of emerging markets, Ziad Daoud at Bloomberg Economics warns. When the Fed moves to tighten policy, as it did in 2018 with interest-rate hikes, and in 2013 with a shift toward scaling back asset purchases, it can spur a flight of money back to the U.S., and away from riskier markets. The 2013 episode became famed for the "taper tantrum" turmoil it entailed. This time, despite the Fed penciling in a start to cutbacks of its bond purchases by year-end, emerging markets as a group have been holding up well enough. Stocks are up for the year, bond yields are off their highs and currencies — again, as a group — have advanced against the dollar. Trouble is, the Fed's timetable for raising rates may need to change. Next week brings another inflation reading, and economists see it coming in at 5% or higher for a fourth straight month. The following week, the Fed updates its economic and policy projections. If the Fed needs to move more quickly, those developing nations with debt loads bloated by pandemic-linked spending could be especially vulnerable, Daoud calculates. "Historical lessons suggest EMs will find it hard to avoid capital flight if the Fed slams on the brakes in 2022." Most exposed: "Brazil, Egypt, Argentina, South Africa and Turkey — let's call them the BEASTs."

- Brazil is weaker due to lower foreign-exchange reserves and higher debt owed to foreign investors

- Egypt's current-account deficit has widened and its reliance on foreign debt has increased

- Argentina, South Africa and Turkey — the hardest-hit economies in 2018 — have hardly seen their own external positions improved

The build-up of inflation risks in emerging markets, too, will only add to the burden on some economies. "The importance of EM policy credibility will be paramount in the months ahead, especially if interest rates rise," Jonathan Fortun, an economist at the Institute of International Finance, wrote in a note last month. —Chris Anstey German voters haven't heard much from Angela Merkel's potential successors about how they will reconcile their spending ambitions for Europe's biggest economy with the budget prudence that defined her chancellorship. Silenced by the electoral liability of such talk in a country that venerates fiscal reticence, politicians including Social Democrat candidate Olaf Scholz, whose party is leading opinion polls over the bloc she represents, are putting off a discussion on the need to finance massive investments to retool for a digital, climate-friendly future. Instead, the left-of-center Social Democrats and Merkel's conservatives are both publicly campaigning on platforms that insist a constitutionally enshrined limit on adding too much debt, suspended for the pandemic, should be eventually reinstated. Quietly though, leading officials from the two major parties are exploring ways to loosen or sidestep such rules in the wake of the Sept. 26 election. Read the story here. Click on the blue links to read any of the stories in full: - Coming up | Central bankers in Canada will likely tread carefully at today's rate decision, mutedly acknowledging a weaker-than-expected economy in the midst of a heated election campaign. Their counterparts in Poland also set stand pat, even in light of the EU's fastest inflation.

- U.K. blinks first | Britain is set to take the lead among developed economies by raising the tax burden to the highest in 70 years to help trim pandemic budget deficits.

- Rare debate | Chinese President Xi Jinping's push for "common prosperity" has triggered a spirited public policy debate.

- Better news | Japan's economy was expanding at a faster pace than initially estimated last quarter ahead of a record surge in virus cases that contributed to Prime Minister Yoshihide Suga's decision to step down.

- Slowing sales | Chinese consumers cut back on buying cars and apartments in August as stronger regulation of the property market and a broad Covid outbreak undercut the economy's already slowing recovery.

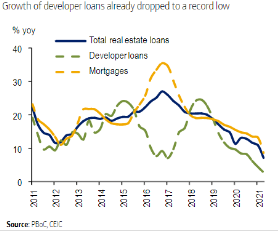

Developer financing conditions are the toughest in years. Source: BofA Global Research Speaking of risks, warnings that China's campaign to cool its property market will go too far are multiplying. Economists at Nomura are calling the curbs China's "Volcker Moment" that will hurt the economy. The credit squeeze in the property sector is "unnecessarily aggressive" and may weigh on industrial demand and consumption, wrote colleagues at Bank of America. A prominent Chinese economist cautioned of a potential crisis should home values drop below mortgages. Click here to read the story in full. Learn while you drink… Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment