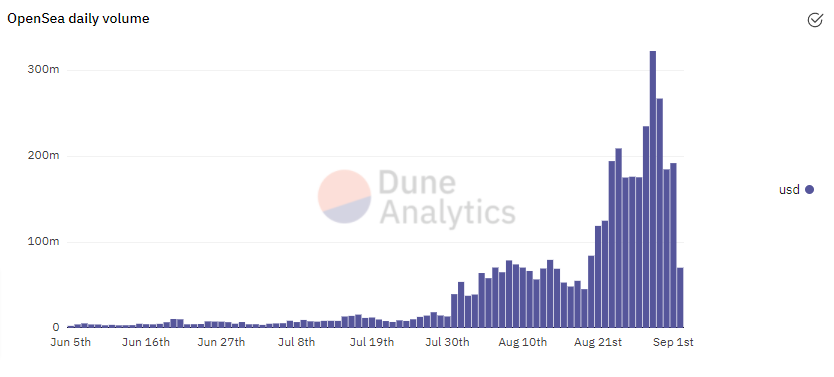

| Claims data due, New York floods, and China's tech yo-yo continues. With tomorrow's payrolls number seen as critical for the path of Federal Reserve policy, there should be plenty of interest in this morning's claims number. Economists expect today's to come in around 345,000, which would be the sixth sub-400,000 reading in a row. There was some cause for concern in yesterday's ADP Employment Report which showed employers added much fewer positions than forecast. There are also continued worries about how unequal the jobs recovery has been, and the lack of people willing to work in low-wage industries. The tail end of Hurricane Ida ripped through the Northeast U.S. early this morning bringing torrential rain to New York City. Mayor Bill de Blasio declared an emergency and Governor Kathy Hochul did the same for the state. There have been at least four deaths reported from the flooding. Meanwhile, in Louisiana, the insured costs of the hurricane are estimated to hit $18 billion. It is likely to be weeks before the full extent of the damage is know, particularly to the region's oil infrastructure. There is also fallout for American farmers far from the hurricane-hit regions as China has started shifting October orders for soybeans to Brazil amid concerns over the reliability of U.S. export infrastructure in Ida's wake. While investors in the West are focused on the Fed and payrolls data, in China all eyes remain on the government's latest moves to reign in the country's tech industry. After a July which saw giants such as Tencent Holdings Ltd. tumble more than 15%, the sector has seen something of a comeback as bargain hunters and strong results helped push prices higher. The recovery is far from robust though, and it seems the regulatory pressure on the sector is not letting up. Last week, China proposed new rules that would ban data-rich Chinese firms from U.S. IPOs. At the heart of all this is President Xi Jinping's rhetoric about "common prosperity" and authorities' commitment to closing the country's yawning wealth gap. Global equities investors are firmly in wait-and-see mode. Overnight the MSCI Asia-Pacific Index added 0.1% while Japan's Topix index closed broadly unchanged. In Europe the Stoxx 600 Index was 0.2% higher at 5:50 a.m. Eastern Time. S&P 500 futures pointed to a small rise at the open, the 10-year Treasury yield was at 1.287%, oil held under $69 a barrel and gold rose. Claims data is at 8:30 a.m. with the July U.S. trade balance also at that time. Factory orders and durable goods orders for July are at 10:00 a.m. Atlanta Fed President Raphael Bostic and San Francisco Fed President Mary Daly speak later. Broadcom Inc., Hewlett Packard Enterprise Co. and American Eagle Outfitters Inc. are among the companies reporting results. Here's what caught our eye over the last 24 hours. There's something apt about ending my stint as the writer of this newsletter's bottom bit with some thoughts on non-fungible tokens, the digital collectibles that have become the latest speculative craze. They've sucked a bit of air out of all the earlier speculative crazes. Small-lot option trades, a proxy of retail interest, have dropped to the lowest since April 2020 as a percentage of total volume, UBS data show. Retail buying of cash equities has cooled, according to Vanda Research, though Reddit has retained its sway over a few names. Among the biggest cryptocurrencies (I might have said "TradCrypt" in a meeting yesterday), even Bitcoin's rally has yet to lure back animal spirits to nearly the same extent as the run-up to the April record. Funding rates have increased so gently it's hardly noticeable. Just about half of outstanding Bitcoin futures hold the cryptocurrency itself as collateral, compared with 70% earlier, as more traders use stablecoins for margin instead, Glassnode data show. The total value locked in decentralized finance -- remember the yield-farming mania a few months ago? -- just rose to a record $95 billion, but the researcher Luke Posey at Glassnode points out that this rebound has been led by stablecoins deployed in lending pools and decentralized exchanges. A true sign of returning risk appetite would be for liquidity to shift to riskier assets like governance tokens. One take beloved by bulls is that this lukewarm sentiment is actually a positive because it means speculative excesses are not building and the recent Bitcoin recovery might be led more by institutions. So in that case, the NFT distraction might be helpful. But it's not necessarily at no cost to other parts of the crypto world either. With the largest NFT exchange OpenSea now routinely the no. 1 user of gas on the Ethereum network, the average gas price (or transaction cost) has increased to the highest since May. Posey points out that the current daily mean price to perform a swap on a decentralized exchange like Uniswap is now more than $50, which might turn many retail traders away.  Source: Dune Analytics Source: Dune Analytics So there appears to be some substitution effect across the major speculative pockets. Compared with all of these, there's a nice doge-like elegance to NFTs. You don't have to learn about Greek symbols, look up short interest or speculate on Saturday Night Live skits. Just think: Is this cute or not? Follow Bloomberg's Justina Lee on Twitter at @justinaknope Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment