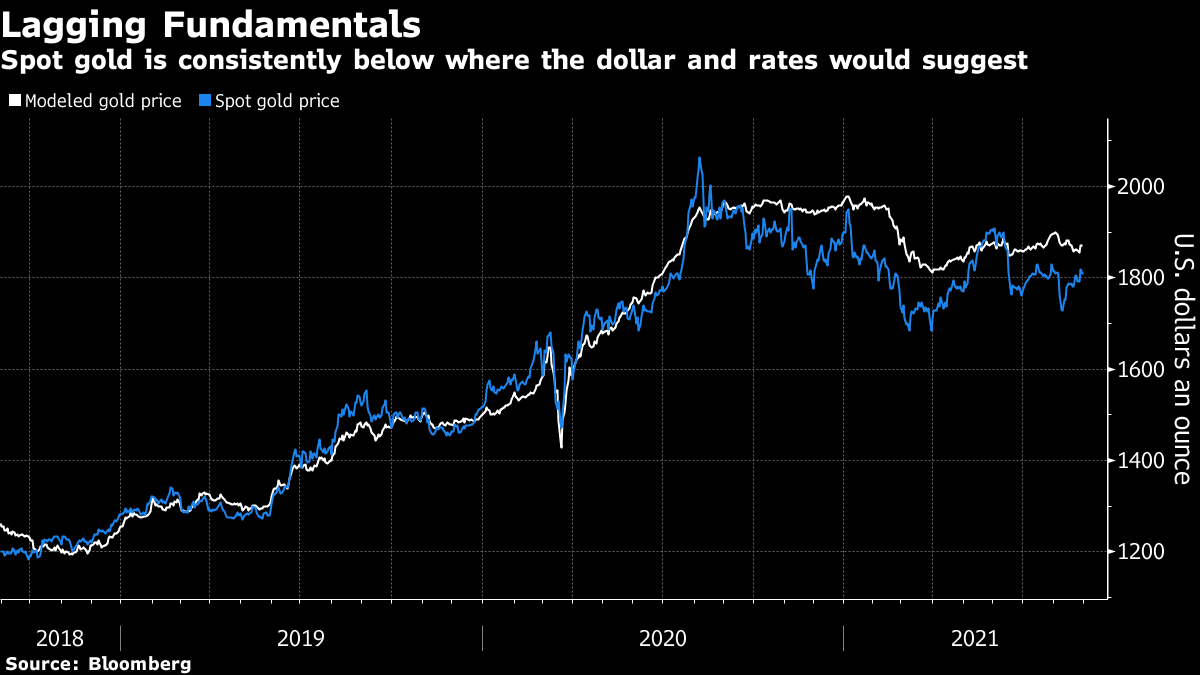

| Good morning. U.K. index changes are due and OPEC+ meets virtually. Here's what's moving markets. Index compiler FTSE Russell, operator of Britain's main stock benchmark, is set to announce the outcome of its quarterly index review after today's market close. The biggest expected change is the deletion of Just Eat Takeaway.com, after FTSE Russell ruled that the food-on-wheels firm is Dutch, not British. This followed the company's delay in delisting its Amsterdam shares after last year's merger between Britain's Just Eat and Dutch rival Takeaway.com. The ouster would dull the new-economy street cred of the FTSE 100, where tech firms already account for a smaller weight than in the U.S. or German benchmarks. As the coronavirus's delta variant threatens to overwhelm hospitals in some parts of the U.S. once more, Deutsche Bank will require anyone entering its New York City headquarters to be vaccinated, according to a person familiar with the matter. This is going a step further than many of Deutsche's U.S. peers, who require either proof of vaccination or wearing a mask. In other news on corporate Covid policy, a Bloomberg survey shows that business travel may never go back to normal. 84% of large companies surveyed plan to spend less on travel post-pandemic. OPEC+ meets today for the first time since July, with delegates expecting the group to stick to its planned production increase. The delegates, who spoke on condition of anonymity, predicted ministers would ratify October's 400,000 barrel-a-day supply increment at an online meeting this evening. Most of mid-August's oil price slump has been recovered, though West Texas Intermediate futures still concluded their worst month of 2021 yesterday. U.S. President Joe Biden declared an end to two decades of U.S. military operations in Afghanistan, offering an impassioned defense of his withdrawal and rejecting criticism that it was mishandled. "I was not going to extend this forever war, and I was not extending a forever exit," he said in remarks from the State Dining Room at the White House on Tuesday. About 200 Americans remain in Afghanistan, according to the State Department. European stocks are set to open higher after Asian equities hit the highest level in a month as Chinese tech stocks continued their rebound. French distiller Pernod Ricard, SAS and Polish game developer CD Projekt are among the biggest firms reporting in Europe today, while in the U.S., online pet food retailer Chewy is among the highlights. Bundesbank President Jens Weidmann is due to open the 2021 Bundesbank symposium in the afternoon. The U.S. reports weekly oil inventories. This is what's caught our eye over the past 24 hours. Gold has been particularly hard to trade lately. Its price can usually be fairly accurately predicted by the level of longer-term U.S. interest rates adjusted for inflation and the strength of the dollar against other major currencies. Yet for most of the past year, it has underperformed these fundamental drivers – and that has a worrying echo in history.  Statistical analysis using the Bloomberg Dollar Spot Index and the rate on 10-year inflation-adjusted Treasuries currently forecasts gold at $1,871 an ounce, 3.5% higher than it is actually trading. And that stands in stark contrast to the fact that the modeled price and actual price have a correlation of 0.6 on a weekly basis measured over a decade. Since mid-2020, the metal has been consistently lower than the predicted price. The last time gold was at such a big discount to its fundamentals was when ETF investors abandoned it in droves, just before the 2013 taper tantrum. Perhaps worries over tighter central bank policy haven't gone away yet. Eddie van der Walt is a Markets Live reporter and editor for Bloomberg News in London. @EdVanDerWalt Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment