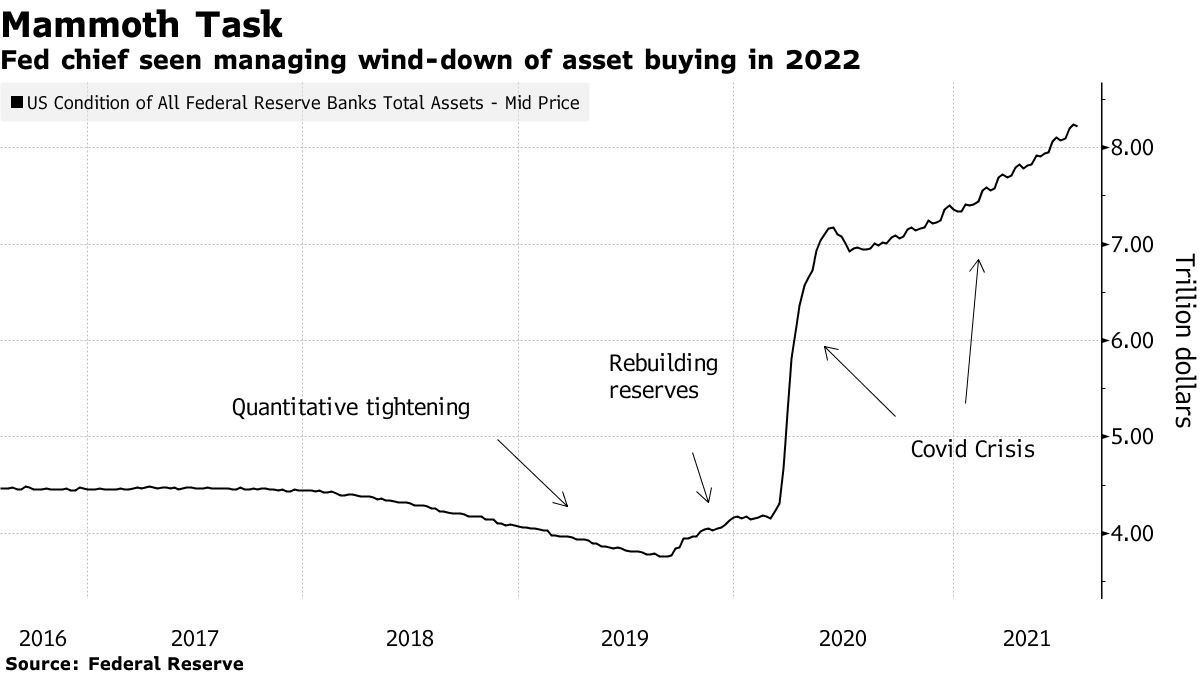

| Hello. Today we look at the potential for a vacancy at the top of the Federal Reserve, how China's dealing with the delta variant and a hiring announcement from Bloomberg Economics. As President Joe Biden's decision on whether to reappoint Fed Chair Jerome Powell for another four-year term comes ever closer, the battle lines are becoming increasingly clear both in Washington and on Wall Street. The consequences appear even greater than usual, given that Powell's term comes up in February — just when the U.S. central bank is likely to be in the midst of scaling back its monetary stimulus.  Investors and strategists are aligning with economists in expecting Biden won't want to rock the boat and will stick with Powell, Vildana Hajric, Max Reyes and Liz Capo McCormick report. "What worries me is that this is the first time in modern memory that a Fed chair position is open when Fed policy is not on an obvious course,'' said Roberto Perli, a partner at Cornerstone Macro LLC who previously worked at the Fed. "If Powell is not staying, what is going to happen? Nobody knows," and that will stoke market volatility, he said.

In progressive political circles in Washington, the concerns are altogether different, Steven T. Dennis and Saleha Mohsin report. There, the worry is the administration might let slip an opportunity to install a Fed chief dedicated to strengthening regulations on banks. "The Fed chair has two jobs. One is monetary policy, but the other is regulation — that's the part that keeps us safe,'' said Elizabeth Warren, a Massachusetts Democrat and member of the Senate Banking Committee. "And it requires significant independence from the big financial institutions, so it's an important issue for me."

The Fed board member seen as most likely to replace Powell if Biden opted for change, Lael Brainard, delivered remarks on Friday that served to highlight her differences on regulatory matters, Rich Miller notes. - Brainard said she's "much more willing" than the Fed has been in the past to use regulatory tools to try to prevent ultra-easy monetary policy posing risks to financial stability

- She also said "there is urgency" about looking into development of a digital version of the dollar, a contrast with Powell's more guarded approach

One more political consideration is whether Biden is up for a potentially bruising Senate confirmation fight if he opts for change. "You're going to create a lot of concern on the part of Republicans for somebody other than Powell," said Republican Senator Thom Tillis of North Carolina, a state with a big banking hub.

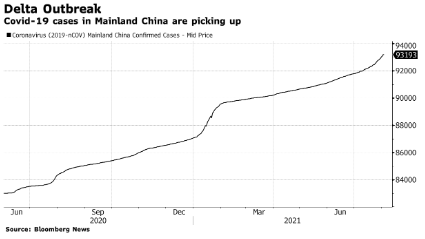

—Chris Anstey  China's broadest Covid-19 outbreak since the beginning of the pandemic in late 2019 is hampering tourism and spending during the peak summer holiday, prompting analysts to review their economic growth projections as risks escalate. At least 46 cities have advised residents to refrain from traveling unless it's absolutely necessary. Nomura lowered its projection for third-quarter growth to 5.1% from 6.4% previously and sees 4.4% expansion in the final three months of the year, down from 5.3%. For the full year, Nomura cut its GDP growth forecast to 8.2% from 8.9%. - Coming up | Brazil is today projected to deliver its biggest interest rate hike since 2003, as policy makers face inflation remaining above their target through 2022.

- No rush | Investors waiting for a heads-up from the European Central Bank on the future of pandemic bond-buying in September will probably be disappointed, Governing Council member Martins Kazaks told us in an interview.

- U.S. infrastructure woes | Tortured logistics at one factory in Pennsylvania reveal the economic toll of America's strained highways, rail lines and ports.

- Back-to-school fight | Children have to get vaccinated for less urgent threats before going to class — and it works. So why not require Covid shots to go back to school?

- Kiwi jobs | New Zealand's unemployment rate fell more than forecast as the economy's recovery boosted hiring and lifted wages. Its dollar rose as traders bet the central bank could increase interest rates in two weeks.

- Bloomberg Economics | David Wilcox, the former director of the Division of Research and Statistics at the Fed, is joining us as director of U.S. economic research. Meantime, former New York Fed President Bill Dudley will serve as a senior advisor.

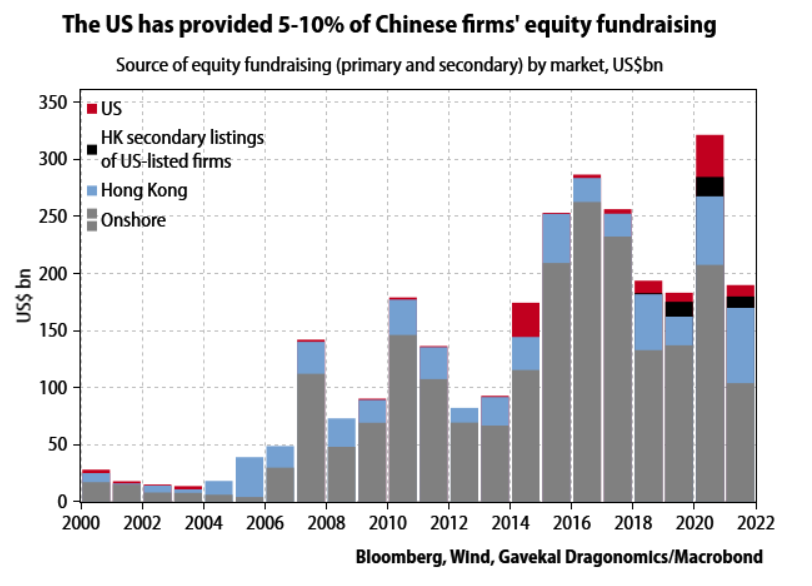

Recent regulatory moves in both Beijing and Washington suggest the era of major equity fundraising by Chinese companies in the U.S. is over, according to Thomas Gatley at Gavekal Dragonomics. Losing access to U.S. markets will be a "substantial blow" as Chinese companies have raised more than $100 billion" in New York since 2014, or some 40% of the equivalent funding mainland firms tapped in Hong Kong, according to Gavekal calculations. "China's policymakers and regulators are conscious that the well of domestic liquidity, while deep, is not unlimited, and will struggle to satisfy" corporate needs, Gatley wrote in an Aug. 3 note. And that suggests, going forward, Beijing will be mindful of roiling global investor confidence as it pursues regulatory reform, he concluded. A new history of economics is in the works…  Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment