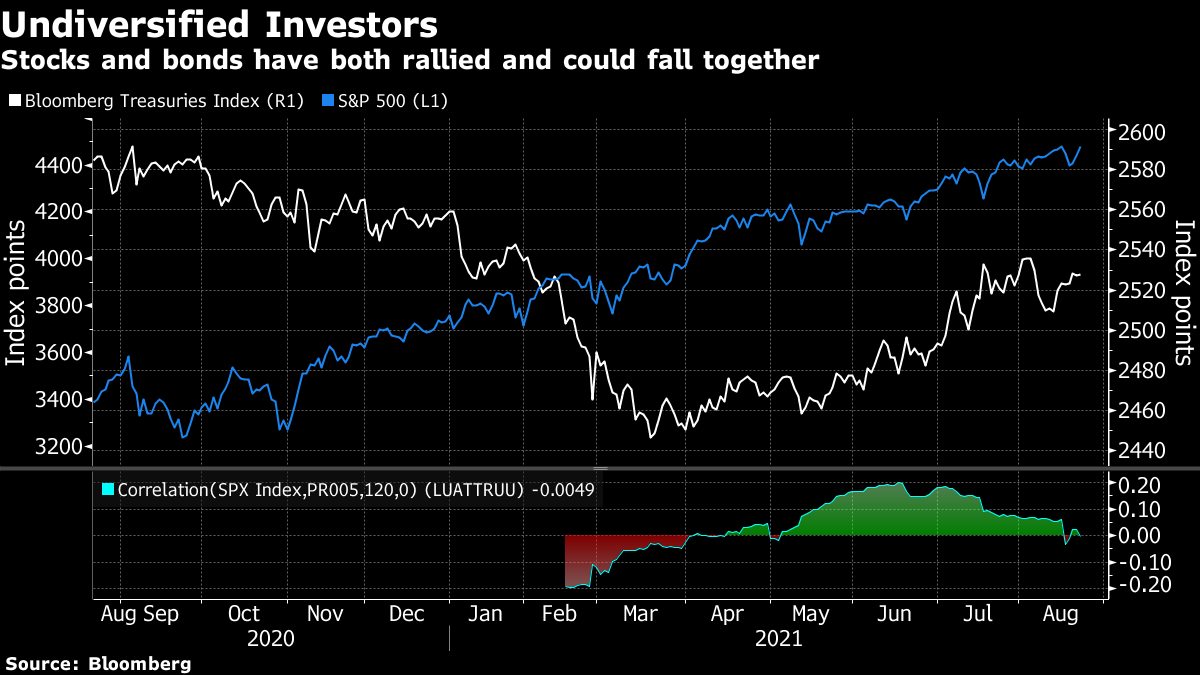

| Good morning. Afghan evacuation and refugees, vaccine mandates, German elections and U.S.-China talks. Here's what's moving markets. President Joe Biden resisted mounting pressure to keep U.S. troops in Afghanistan past his Aug. 31 deadline but ordered his national security team to come up with contingency plans if he determines that a delay is needed. The Biden administration is also said to have asked refugee aid organizations to prepare to receive and resettle as many as 50,000 Afghans evacuated under a stopgap program as the U.S. accelerates flights out of Kabul ahead of the deadline. Goldman Sachs Group Inc. reversed its back-to-office stance and said all staff must be vaccinated to enter U.S. workplaces or work from home. UPS and Deloitte also imposed some mandates to get inoculated. Meanwhile, a U.K. study showed immunocompromised patients had weaker immune responses after two doses of Covid vaccine than the general population, supporting the case for booster shots for vulnerable people. Bavarian Premier Markus Soeder, who heads a key faction in Chancellor Angela Merkel's conservative bloc, conceded that the alliance may fail to hit a goal of comfortably winning next month's election as a poll put the Social Democrats in the lead for the first time. The SPD hasn't led in that poll since October 2006, and it suggests Merkel's alliance may be in danger of losing its grip on power for the first time since she won her debut election in 2005. A contingent of Wall Street veterans and high-level Chinese government officials are seeking to open up talks again, as business leaders work outside of the Biden administration for greater access to the world's most populous country. An influential group conceived during escalating strains between the U.S. and China in 2018 is said to be preparing a new round of meetings before the end of the year. European stocks are set to open flat as equities in Asia fluctuated between gains and losses. In earnings, Eiffage, Aroundtown and Grafton report in Europe, while Chinese results will be in focus with battery supplier to Tesla CATL, mobile phone giant Xiaomi and short-video platform Kuaishou all reporting. In the U.S. it's a busy day for tech firms with cloud-computing platform Snowflake, Autodesk and Salesforce.com all reporting, with focus on the latter's recent acquisition of Slack. Finally Gamescom, the world's largest videogames event, begins its first day. The German event is being held digitally again this year. This is what's caught our eye over the past 24 hours. Let me start by saying that Margin Call is a better movie than The Big Short. But that shouldn't detract from how smart a call contrarian investor Michael Burry made. This, roughly speaking, is my best estimate of his latest positioning. In the darkest days of the pandemic in May 2020, something odd was going on: stocks were rallying. Perplexed, I naturally turned to Twitter for answers and was introduced to TINA - there is no alternative - which encapsulated the idea that bond yields are so low that buying equities is the only play for investors.  This was further illustrated earlier this year when bonds and stocks rose together. The two should normally be inversely, or at least not strongly-positively, correlated. Yet stocks rallied as longer-dated bonds rose and yields fell. But TINA's got a flipside. If indeed investors are snapping up stocks because bonds are as low as they can go, then equities should tumble if rates start to rise. Word has it Burry's Scion Asset Management held puts on long-dated Treasury ETFs and on Cathy Wood's ARK Innovation ETF. And that seems a pretty clear expression of the trade outlined above. Eddie van der Walt is a Markets Live reporter and editor for Bloomberg News in London. @EdVanDerWalt Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment