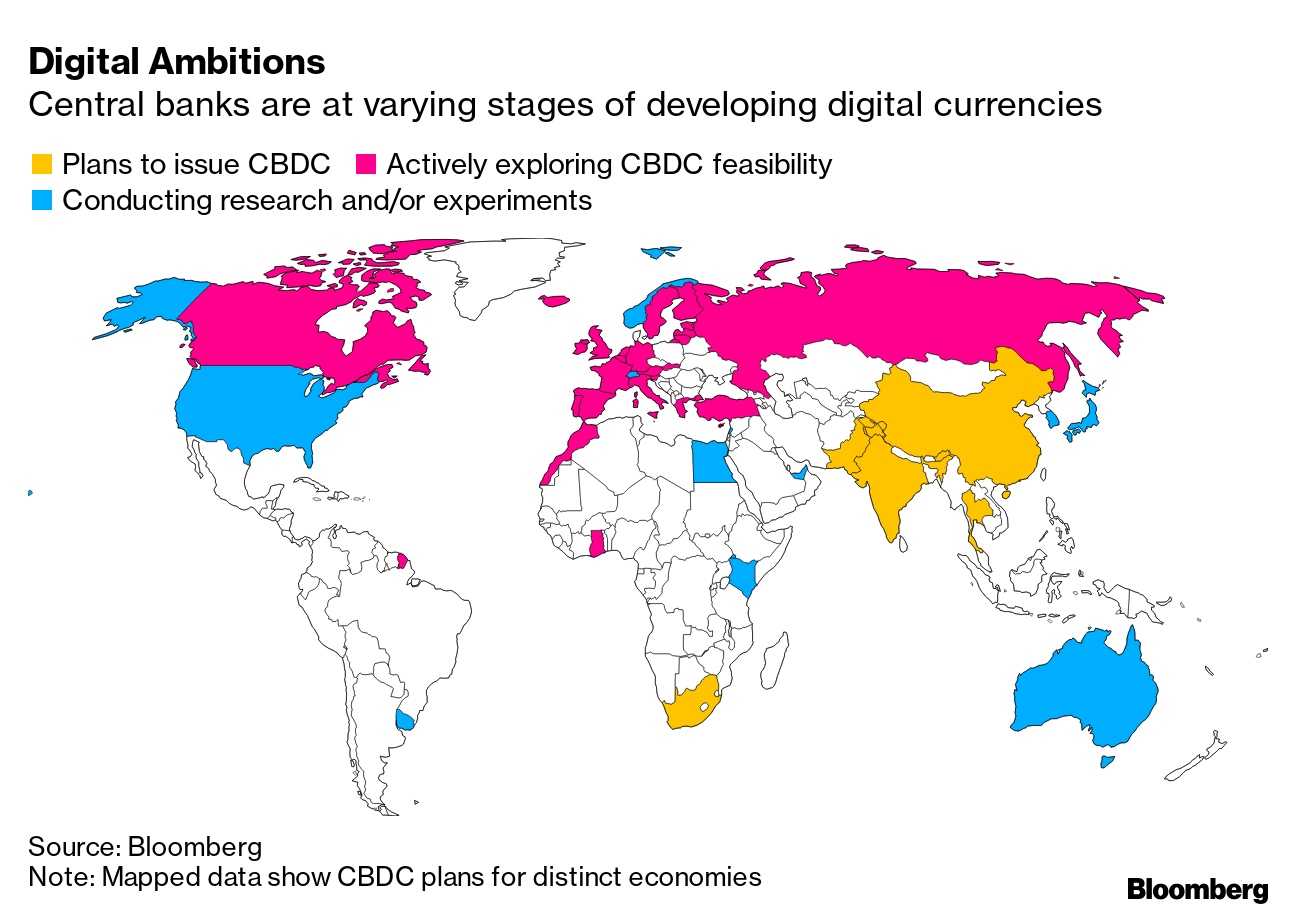

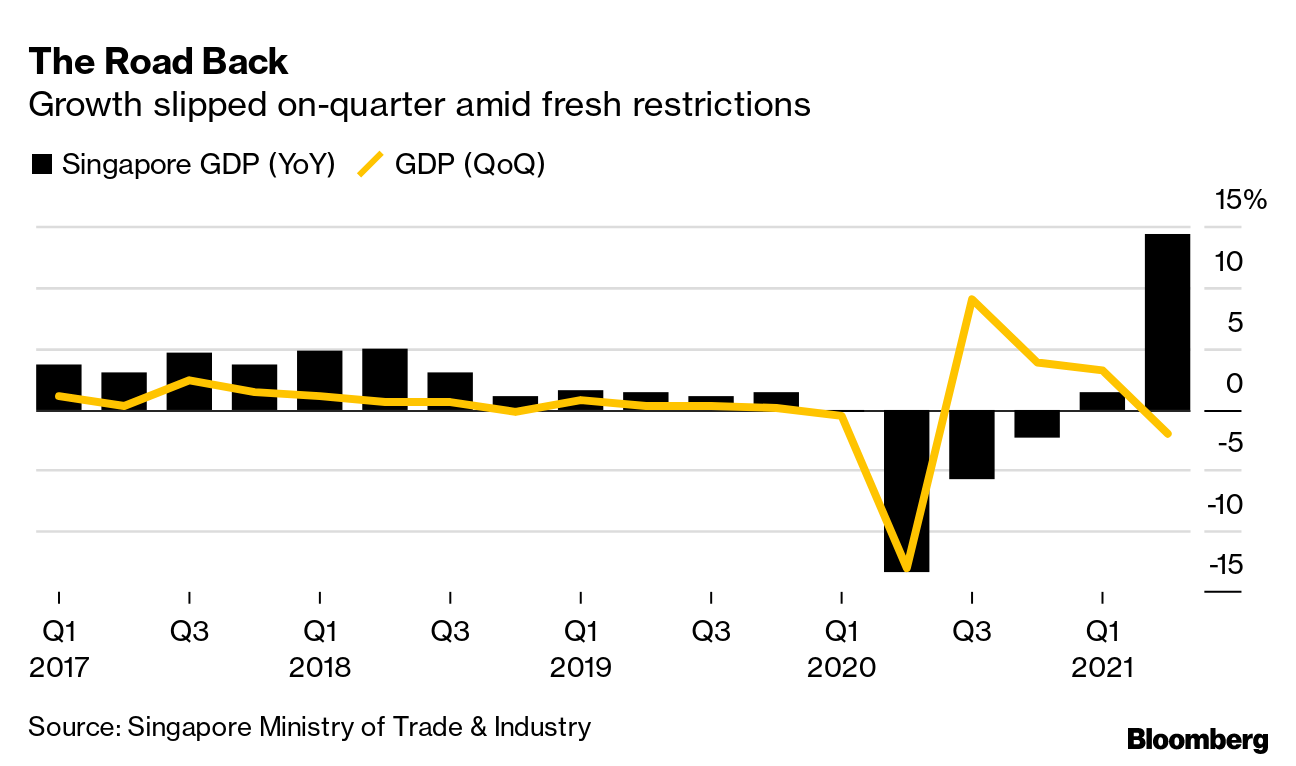

| Hello. Today we look at the ECB's digital currency plans, examine Singapore's lost economic momentum and ask what could make a transitory spike in inflation long-lasting. New FrontierThe European Central Bank is about to start reinventing the euro for the 21st century, as officials on Wednesday prepare to endorse an exploratory phase for a digital version of the currency. President Christine Lagarde reckons that period could take about two years, meaning ordinary citizens could ultimately be holding virtual central-bank money by the middle of this decade. As Carolynn Look explains, such a move by the ECB would follow in the footsteps of China, where trials have started in several cities. Some Caribbean islands sharing a central bank, including Grenada and St. Kitts and Nevis, have already launched their own digital currency, while the U.S. Federal Reserve and Bank of England are studying the possibilities.  A digital euro isn't yet certain, but its likely features are already crystallizing, including a payment system that is fast, easy to use, secure — and, crucially for Lagarde, who has lambasted private crypto-assets — not Bitcoin. The ECB says it would be "like banknotes but digital." But the ability to make payments that are simultaneously anonymous and offline, a key attribute of physical money, will be challenging to replicate. The institution has promised one outcome at least, saying "a digital euro would not replace cash, but rather complement it." Meanwhile a limit on individual holdings could perhaps safeguard commercial banks' business models. Other headaches to solve include what technology and infrastructure to use, and how to ensure it's environmentally sound. Officials will need to sign off on further developments for a digital euro to actually happen. Ultimately though, some of them are excited at the possibilities it could entail, perhaps as a tool to deliver new monetary policies such as cutting interest rates further below zero or as a way of delivering helicopter money. Whatever the ECB decides, it is already further advanced than the Federal Reserve. While U.S. monetary officials and lawmakers have begun considering what a digital dollar might look like, it might even need legislation ever to see the light of day. — Craig Stirling The Economic Scene Singapore's economy lost momentum in the second quarter as weeks of tightened mobility restrictions weighed on this year's expansion. Gross domestic product in the three months through June contracted a seasonally adjusted 2% from the previous quarter. After months of success limiting outbreaks, Singapore was forced to tighten restrictions in mid-May to curb the spread of the virus, halting dining-in at restaurants and limiting social gatherings. Still, it's faring better than most of its neighbors, which are seeing virus cases surge in a threat to the region's recovery. Today's Must Reads - China watch | Economists expect GDP growth to slow markedly to 8% in the second quarter from the record 18.3% expansion seen in the first three months of the year. The data are due Thursday.

- Hawkish central banks | New Zealand officials said they will reduce monetary stimulus by ceasing bond purchases this month, a surprise move that may be a prelude to an interest-rate increase later this year. Later on Wednesday, the Bank of Canada is expected to continue scaling back emergency stimulus. Chile, meanwhile, is set to deliver its first rate hike in over two years.

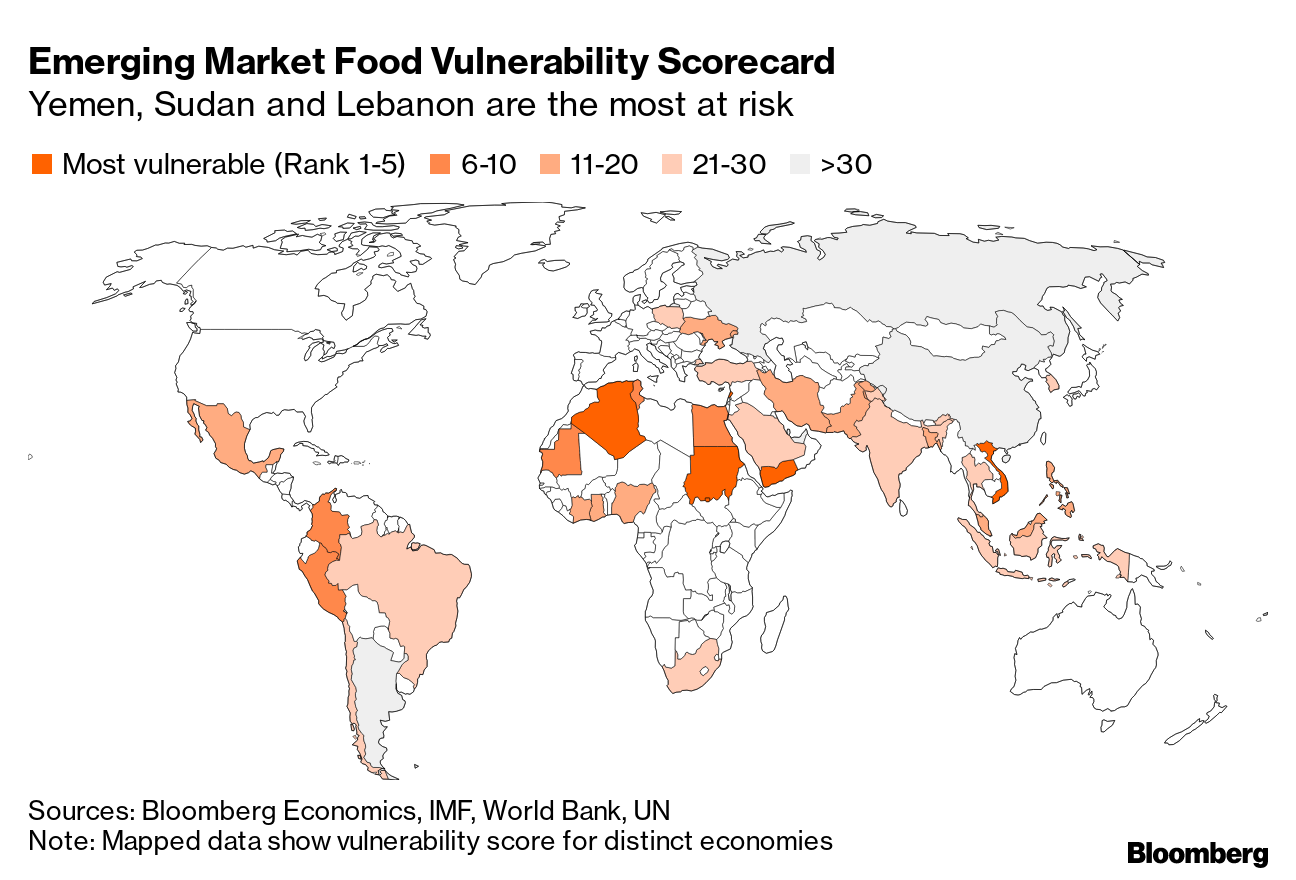

- Going hungry | South Africans are expected to face major food shortages in the wake of days of violent unrest as rioters upend supply chains by looting supermarkets and torching goods trucks. In India, food insecurity, particularly in urban areas, is on the rise. Meanwhile, North Korea told the UN it's facing the worst food shortages in more than a decade.

- New normal | Just a few months ago, Australia's virtually Covid-free status made it the envy of the world — then the delta variant flipped the script.

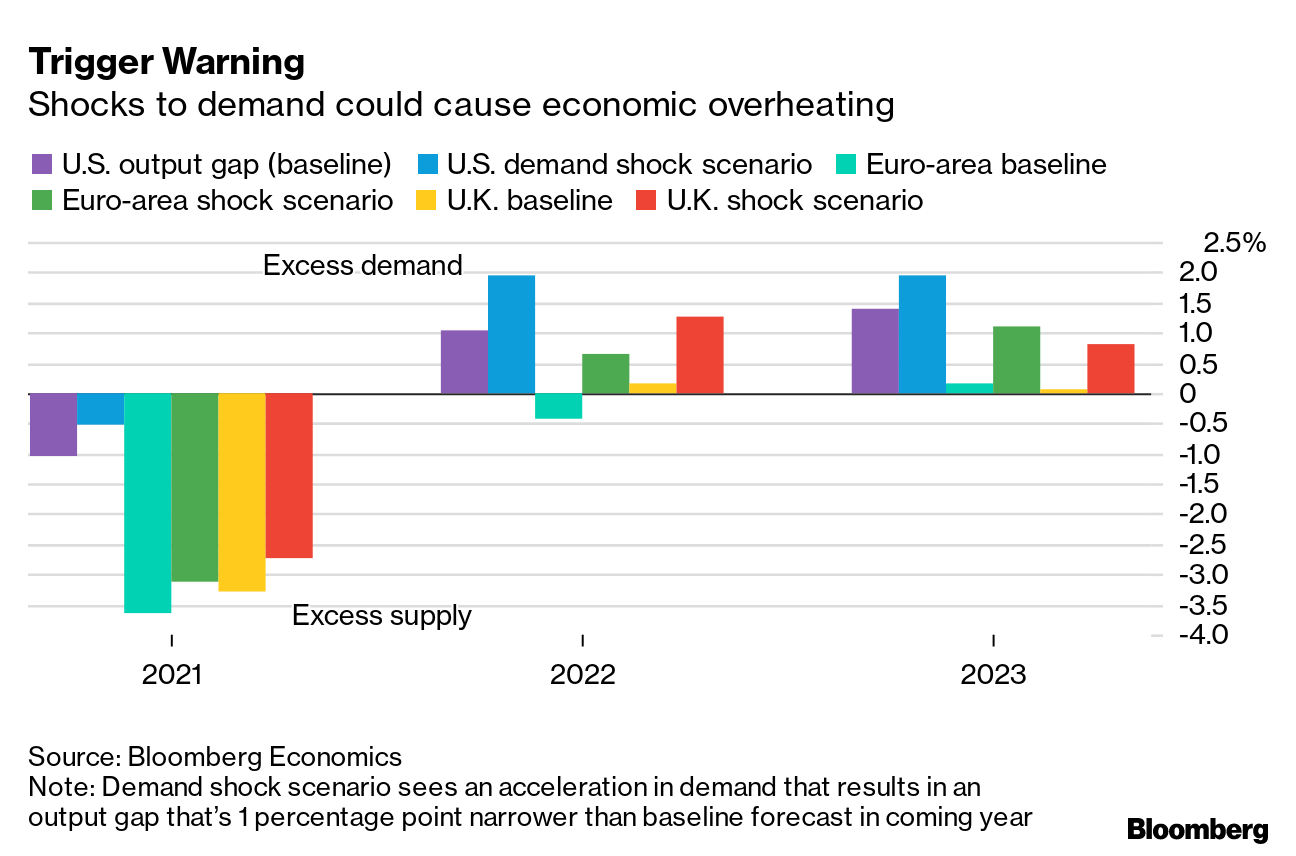

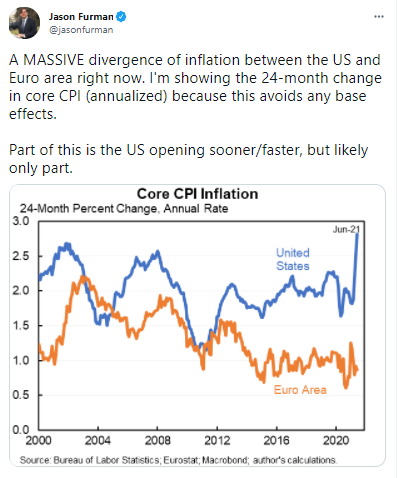

Need-to-Know Research With the latest inflation readings in the U.S. and U.K. topping forecasts and testing central bankers' resolve, economists Dan Hanson and Tom Orlik ask whether a more rapid recovery could turn transitory inflation into something more persistent, prodding monetary policy officials into earlier action? An overheating economy — either because demand rebounds faster than expected, supply disappoints, or some combination of the two — is the fastest route to durably higher inflation. If that occurs, Bloomberg Economics' general equilibrium models show inflation in the euro area and U.K. moving significantly above expectations. In the U.S., a flatter Phillips curve means a more muted impact. Read the full research on the Bloomberg Terminal On #EconTwitterA trans-Atlantic inflation divergence:  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment