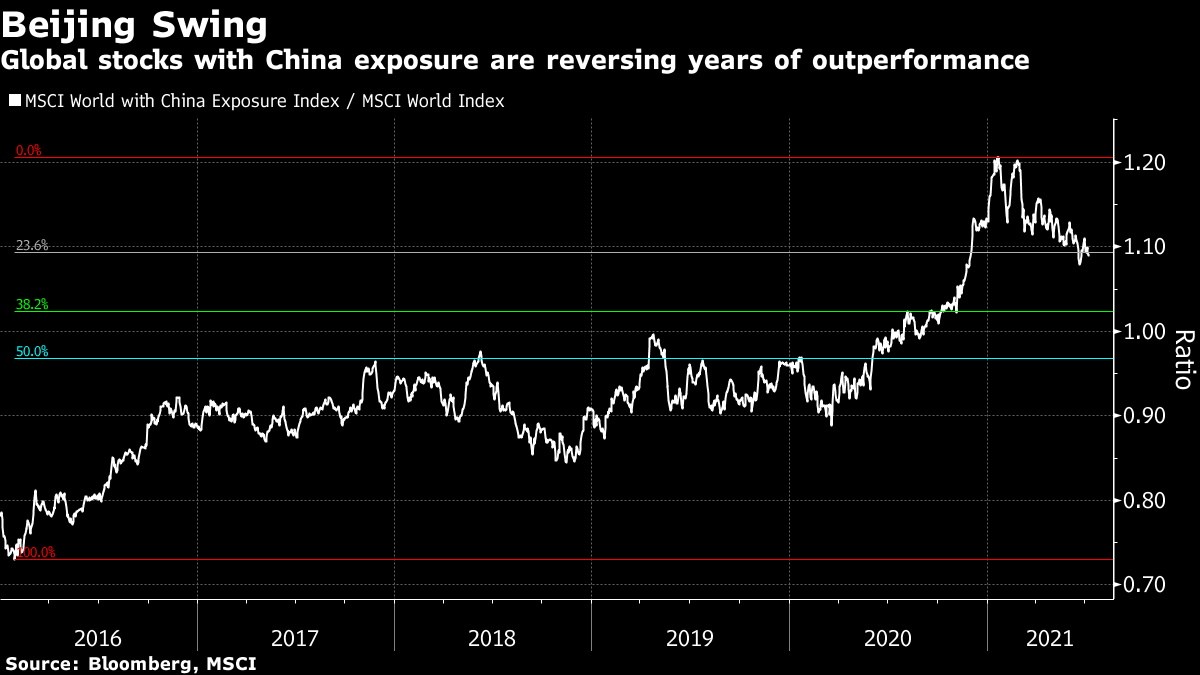

| Good morning. Central bank focus, Haiti assassination, pandemic death toll. Here's what's moving markets. ECB AgreementEuropean Central Bank policy makers are said to have agreed to raise their inflation goal to 2% and allow room to overshoot it when needed. The revamped strategy could give officials the justification for sustaining ultra-loose monetary policy for longer as they strive to reverse years of below-target inflation, which have weighed on the euro area's economic potential. It will also be crucial for guiding the central bank's actions as the economy recovers from the pandemic. Not ReadyOver in the U.S., Federal Reserve officials were not ready to communicate a timeline for tapering due to high uncertainty on the economic outlook, according to minutes from their June meeting. The gathering also marked a turn in the central bank's comfort with inflation risks amid heightened price pressures as the economy reopens from the pandemic. The minutes showed the committee had a lot of questions about how soon labor shortages and supply bottlenecks contributing to inflation would resolve. Haiti President AssassinatedThe president of Haiti, Jovenel Moise, was assassinated in a nighttime attack. The president was murdered by highly trained, armed killers who stormed his residence at about 1 a.m on Wednesday, the acting prime minister said. An injured first lady was medically evacuated to Florida. The National Police said later that four suspects had been fatally shot and two others arrested, according to the Associated Press. A nation of 11 million and the poorest in the Americas, Haiti has been terrorized by gang violence, while Moise was increasingly seen as an autocrat. 4 MillionThe global death toll from Covid-19 has reached 4 million as a growing disparity in vaccine access leaves poorer nations exposed to outbreaks of more infectious strains. The developing world is shouldering a rising death toll: India accounted for more than a quarter of the latest million, and Brazil about 18%. By comparison, the U.S. accounted for about 4% of the rise, and the U.K. just 1,000 of the extra deaths, amid the higher vaccination rates in both countries. Coming up today, the British transport secretary will set out changes to travel rules in a statement to the U.K. Parliament. Coming Up…European stocks are set to drop after a steep decline in Asia, as investors digested concerns over the extent of China's economic rebound, as well as the central bank updates above. Today, there's corporate updates from retailer B&M European, bookmaker Entain and clothier Superdry. Jeans maker Levi Strauss, Japanese convenience store giant Seven & I and India's Tata Consultancy are among the largest reports worldwide. Later, the U.S. will give weekly jobless claims and oil inventory data. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningA hawkish pivot from the U.S. last month jolted global markets, now it's China's turn -- only in the opposite direction. China's cabinet signaled the central bank could cut the reserve requirement ratio in order to aid the economy, in a surprise move that suggests the country's slowdown is really beginning to bite. The news is likely to weigh on the share prices of companies that generate significant revenue from the world's second-biggest economy, which had already begun to underperform. The MSCI World with China exposure index has lagged the global benchmark by about 5 percentage points so far this year -- after crushing it by over 30 percentage points from 2020's pandemic lows. A deeper-than-expected slowdown in China would also pressure a number of popular investment themes, such as the shift into global cyclical shares and the outperformance of European stocks -- which tend to have a greater proportion of sales to the country than their U.S. peers. It could also help bolster the dollar's recovery -- not just against the yuan -- but also against the euro, given the economic links between Europe and China.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment