| It's jobs day, difficult oil talks, and J&J effective against delta. PayrollsThe U.S. economy is expected to have added 720,000 positions in June, according to the median estimate in a Blomberg survey of economists. The unemployment rate is seen ticking lower to 5.6% while wages may have jumped 3.6%. The previous two months have seen the increase in payrolls fall well short of expectations, so this morning's data at 8:30 a.m. Eastern Time will be a test of economists' optimism. One of the key pieces of data to watch for signs of a return to normal will be the participation rate which has remained well below pre-pandemic levels. OilIntense negotiations are ongoing at the OPEC and its allies meeting as a resolution is sought to the dispute that's blocking measures to ease rising oil prices. The standoff between the United Arab Emirates and the rest of the cartel could mean there will be no production increase at all, according to a delegate. The UAE's request to adjust the production quota as the price of its support is seen as "opening a Pandora's box" as other states would likely follow suit if they were to succeed. Oil is holding just above $75 a barrel this morning as the futures curve moved deeper into backwardation. Delta Johnson & Johnson said that recipients of its single-shot coronavirus vaccine produced strong neutralizing antibodies against all Covid-19 variants, including delta. CDC Director Rochelle Walensky said the "hyper-transmissible" delta variant may eclipse other virus mutations in the U.S. within weeks. India's official death toll from the pandemic climbed above 400,000. Investors remain very cautious on the outlook for Southeast Asia, with data showing foreign funds leaving the region's stock markets as vaccination levels stay low. Markets mixedGlobal equities are relatively quiet ahead of U.S. data. Overnight the MSCI Asia Pacific Index slipped 0.4% while Japan's Topix index closed 0.9% higher. In Europe the Stoxx 600 Index was 0.3% higher at 5:50 a.m. with travel shares by far the best performers. S&P 500 futures pointed to a small gain at the open ahead of the jobs number, the 10-year Treasury yield was at 1.444% and gold rose. Coming up... The May U.S. trade balance accompanies the payrolls report at 8:30 a.m. May factory and durable goods orders are at 10:00 a.m. The latest Baker Hughes rig count is at 1:00 p.m. There are no earnings of note today, and the bond market closes early due to the Independence Day weekend. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Katie's interested in this morningCredit spreads have been Teflon for the past several months. Investment grade spreads to Treasuries sit at just 80 basis points, and junk spreads have tightened below 270 basis points, both the slimmest pickups in well over a decade.  It's been a seemingly one-way grind lower since March 2020, choking off any expectations for near-term turbulence. The gap between 6- and 1-month implied volatility on credit default swap contracts is close to an all-time high, Goldman Sachs Group Inc. strategists Spencer Rogers and Rocky Fishman wrote in a report this week. This current steep term structure of implied vol seems to point towards expectations that markets will remain unusually quiet over the summer with an outlook for a return to more traditional levels of volatility (albeit still on the low side) over a 3- to 6-month horizon.

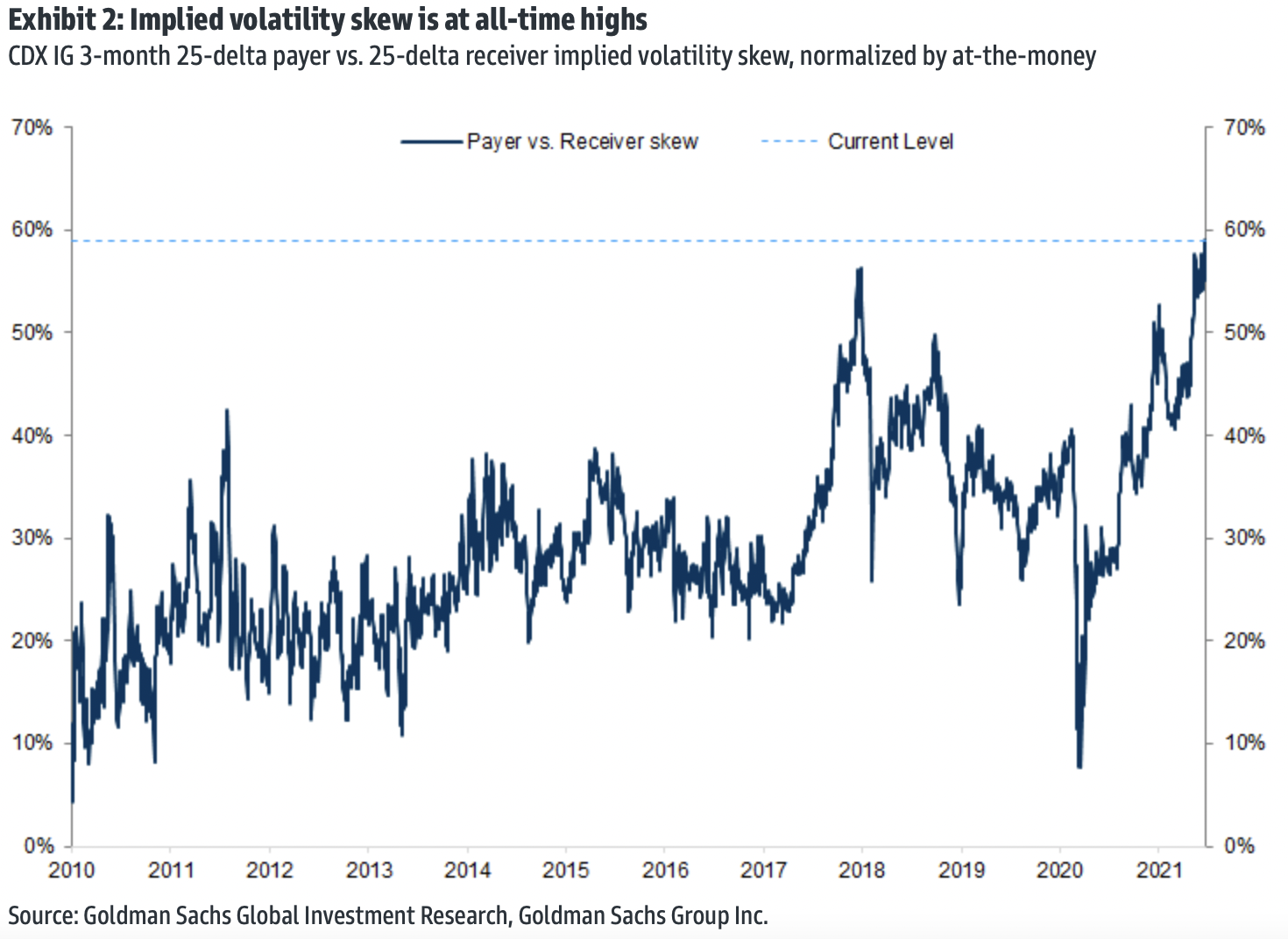

But while nothing has yet been able to shake credit spreads loose from their ultra-tight levels, low implied vol doesn't necessarily mean investors are complacent. Much has been made of the fact that equity market skew -- a measure of how expensive bearish bets are relative to bullish contracts -- has been hovering near all-time highs. However, it's a similar set-up in the corporate credit market, Goldman notes, where a large spread between implied vol on 25-delta payers and 25-delta receivers normalized by at-the-money contracts suggests "the relative price of downside protection has never been more expensive."  To Rogers and Fishman, now might be a good time to add a "dose of hedges" to your credit portfolio -- though it's unclear what the spark for any selloff would be. Credit spreads have soldiered past a pickup in inflation expectations, and barely flinched as evidence of climbing price pressures has surfaced. Nor did the Fed's pivot at June's meeting cause a quake. DoubleLine Capital's head of investment-grade corporates Monica Erickson isn't sure what that catalyst will be either, but stretched valuations leave little margin for error in high-grade debt. "Any hiccup in economic growth, earnings growth and Fed misstep, etc. could derail spread stability because of our current tight spreads," she said in a Bloomberg TOPLive blog this week. Analysts from Morgan Stanley, who expect IG spreads to widen by 15 basis points to 25 basis points over the next year, agree with that assessment. "Rich valuations, a hawkish Fed, and the risk of higher rates volatility make for a challenging near-term setup," analysts led by Vishwas Patkar wrote this week. Follow Bloomberg's Katie Greifeld on Twitter at @kgreifeld Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment