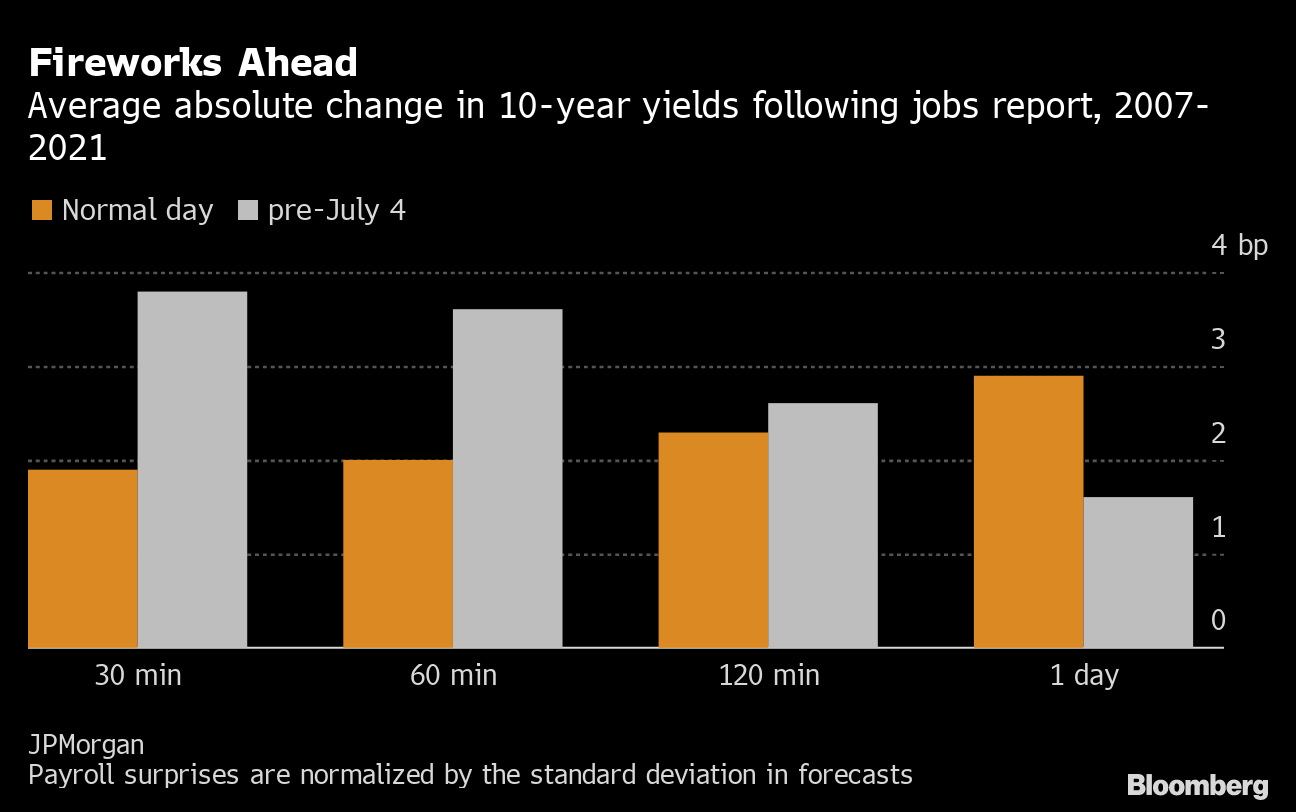

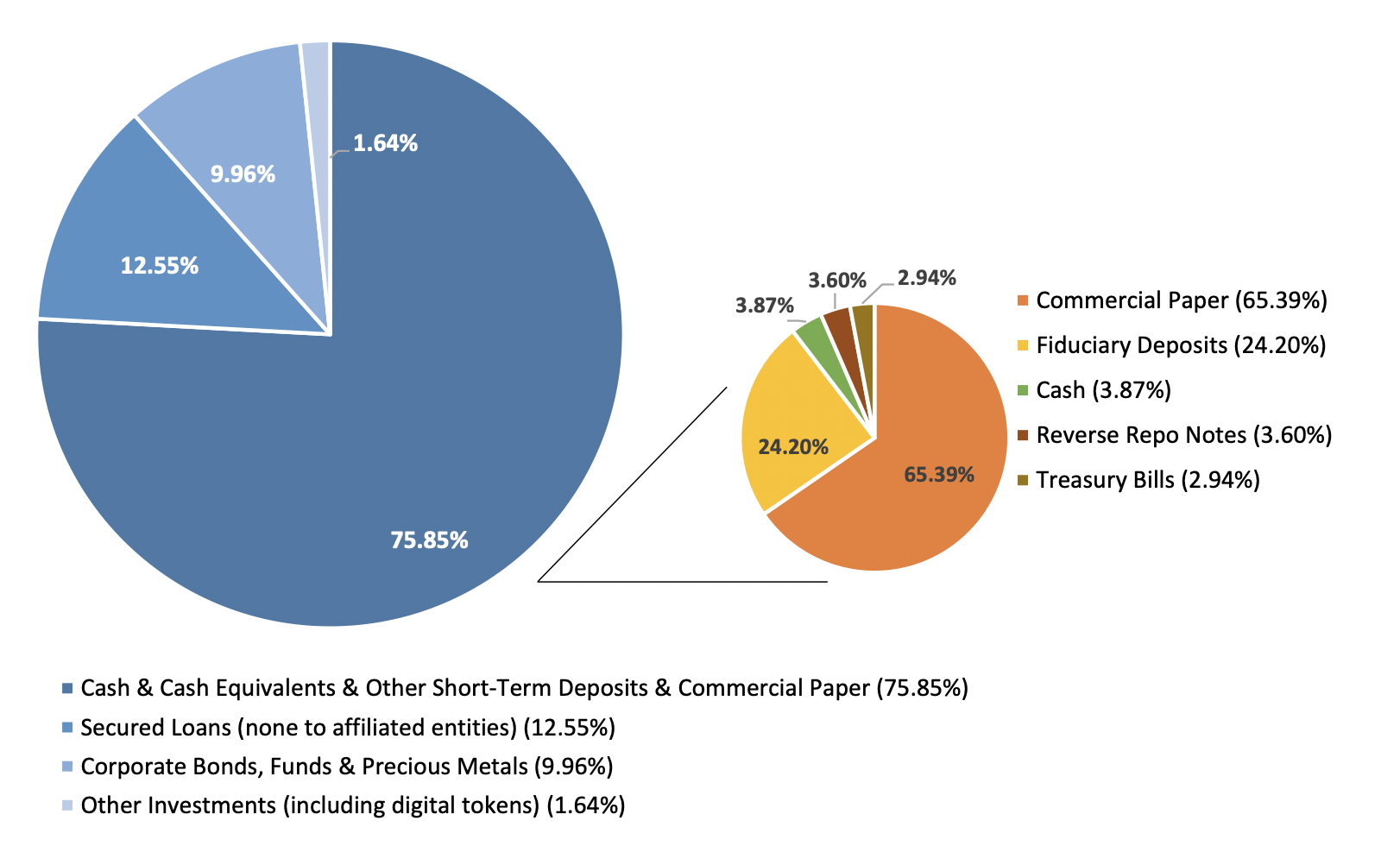

| Welcome to The Weekly Fix, the newsletter where word count isn't negatively correlated to the temperature. I'm cross-asset reporter Katie Greifeld. July 4th FireworksIn case you forgot, Friday brings the U.S. employment report for June ahead of a long weekend. Sifma has recommended a 2 p.m. close of trading for U.S. fixed income. That all adds up to some pretty tricky Treasuries trading after the data drop. JPMorgan Chase & Co. strategists crunched the numbers, comparing all payroll releases since 2007 with those that coincided with an early bond market close before the U.S. July 4th holiday (normalizing by the average size of the payrolls surprise). They found that in the 60 minutes after the release, the Treasury market is 1.5 times to 2 times more volatile than the average payrolls report day. Adding to the chop is the fact that most of the price action fades by the end of the trading day, analysts led by Jay Barry wrote.  Lousy liquidity helps explain why, Barry and company explained. Treasury market depth tends to run 15% to 20% lower on July 4th-adjacent payroll reports versus normal releases, and then wallows around there as bond traders hit the beach. According to the note, "depth and HFT participation tend to drop off around July 4th, holding around lower levels in the weeks thereafter, and it proves to be most negatively correlated with temperature during summer months." Some volatility might be welcome, since Treasuries have been fairly quiet since the Federal Reserve's dot plot drama. They rallied after ADP Research Institute data showed U.S. companies added more jobs than expected in June, though May's numbers were revised lower. Yields on 10-year Treasuries are still lower on the week as we slide into Friday's report, which is expected to show that the U.S. added 720,000 jobs in June. But if there is a dip to fade, BMO Capital Markets strategist Ian Lyngen thinks you should. Any spike in yields following the 8:30 a.m. New York time release would be a buying opportunity ahead of the long weekend, particularly given the "collective reluctance to carry meaningful positions into next week as the macro outlook continues to be refined," Lyngen wrote Thursday. Commercial Paper Scavenger HuntTurning next to the wild world of cryptocurrencies, it's been surprisingly hard to figure out what Tether -- a stablecoin -- actually holds. As this newsletter discussed last month, Tether initially pitched itself as being backed one-for-one by fiat currencies. We now know that's not the case: Tether was forced to release a breakdown of its reserves in May as part of a legal settlement with the New York Attorney General's Office, revealing the stablecoin is actually backed in a large part by unspecified commercial paper.  Bloomberg Bloomberg That revelation produced various degrees of hand-wringing over what threat that could pose to the commercial paper market if Tether were to rapidly depreciate. Tether has a market cap of $62 billion, meaning that it owns somewhere north of $30 billion worth of commercial paper -- that would rank it among the top 10 largest prime money market funds, JPMorgan rates derivatives strategist Josh Younger wrote in May. While that's a drop in the bucket relative to the entire market, Younger pointed out that Tether has the potential to grow significantly -- its market cap was just $21 billion coming into 2021. Perhaps if we knew which paper Tether actually holds, some of the existential dread would die down, but locating it is proving to be a difficult task. Bank of America strategist Mark Cabana said in a report this week that clients suggest every large CP dealer desk they ask haven't seen the Tether flow. That's pretty stunning, since back-of-the-envelope math suggests Tether bought the equivalent of 1% of the entire market in April alone, Yale Law School professor Jonathan Macey estimates. Cabana continues: Investors are surprised that a CP investor of this size and presence has so limited of a traceable footprint in the front end, especially since Tether has said their CP is largely from A-2 rated entities or higher.

Bloomberg Bloomberg Before you reach for your tinfoil hat, Cabana offers a few possibilities. One is that Tether and other stablecoins could be buying paper denominated in other currencies, and then hedging the currency risk. Another is that Tether could be acquiring commercial paper via the blockchain, which would be outside of the standard trading or settlement process. While Cabana says it would be "surprising" not to see some sort of guidance from a top-shelf issuer if such a large blockchain issuance were to occur, the upshot is that Tether acquiring paper that way would limit risks to the broader market: A blockchain CP forced sale would likely see elevated illiquidity on the blockchain and increase cost of funds for CP issuers; the spillover to the more traditional CP market would be limited to any associated spread widening by a blockchain CP issuer. Traditional CP investors would be protected from the crypto forced sale risk due market bifurcation.

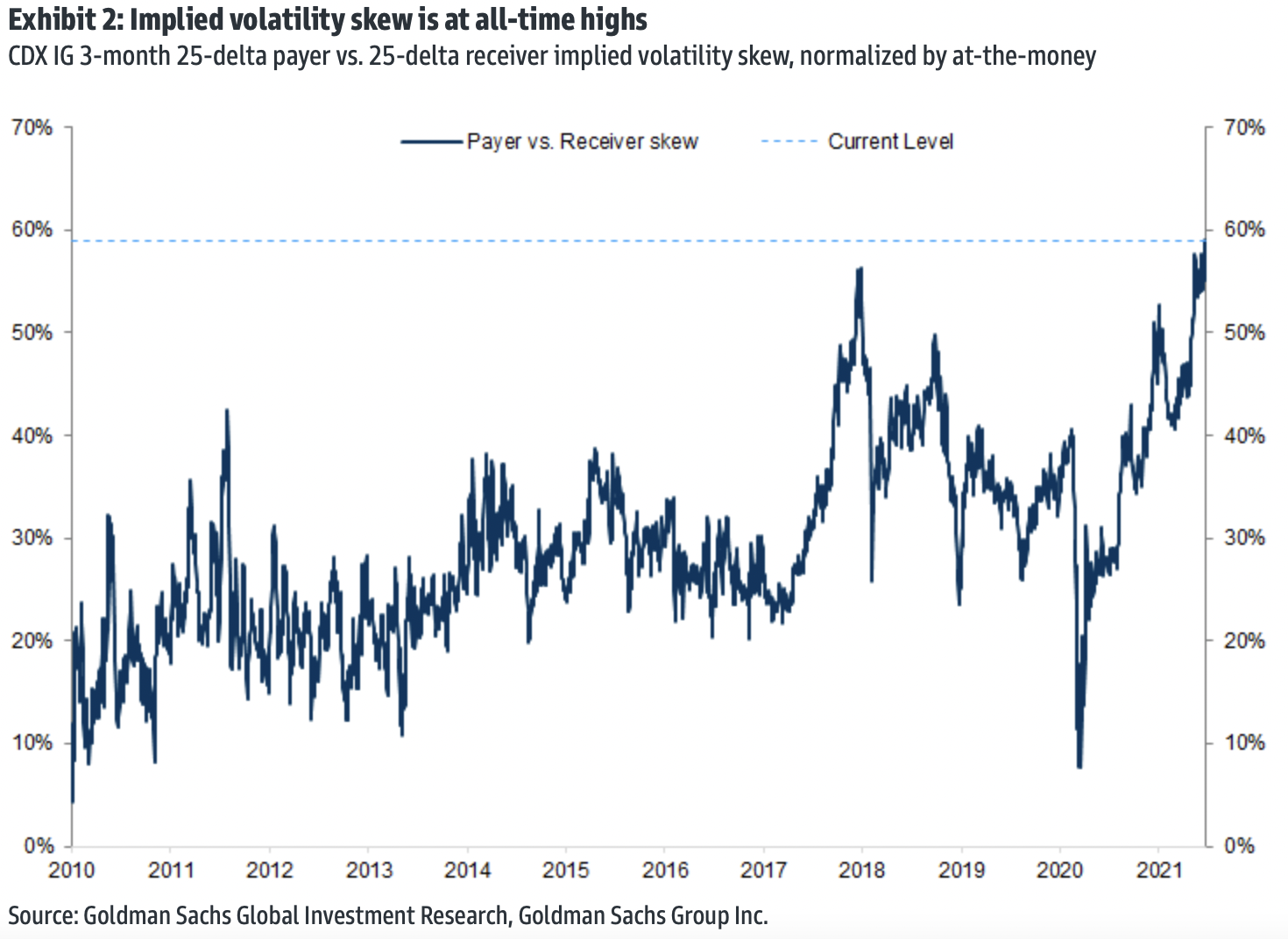

So, that would be good news. Even so, Fitch Ratings was out with a warning Thursday that booming stablecoin issuance could have "potential asset contagion risks linked to the liquidation of stablecoin reserve holdings." Calm, But Not CollectedCredit spreads have been Teflon for the past several months. Investment grade spreads to Treasuries sit at just 80 basis points, and junk spreads have tightened below 270 basis points, both the slimmest pickups in well over a decade.  It's been a seemingly one-way grind lower since March 2020, choking off any expectations for near-term turbulence. The gap between 6- and 1-month implied volatility on credit default swap contracts is close to an all-time high, Goldman Sachs Group Inc. strategists Spencer Rogers and Rocky Fishman wrote in a report this week. This current steep term structure of implied vol seems to point towards expectations that markets will remain unusually quiet over the summer with an outlook for a return to more traditional levels of volatility (albeit still on the low side) over a 3- to 6-month horizon.

But while nothing has yet been able to shake credit spreads loose from their ultra-tight levels, low implied vol doesn't necessarily mean investors are complacent. Much has been made of the fact that equity market skew -- a measure of how expensive bearish bets are relative to bullish contracts -- has been hovering near all-time highs. However, it's a similar set-up in the corporate credit market, Goldman notes, where a large spread between implied vol on 25-delta payers and 25-delta receivers normalized by at-the-money contracts suggests "the relative price of downside protection has never been more expensive."  Bloomberg Bloomberg To Rogers and Fishman, now might be a good time to add a "dose of hedges" to your credit portfolio -- though it's unclear what the spark for any selloff would be. Credit spreads have soldiered past a pickup in inflation expectations, and barely flinched as evidence of climbing price pressures has surfaced. Nor did the Fed's pivot at June's meeting cause a quake. DoubleLine Capital's head of investment-grade corporates Monica Erickson isn't sure what that catalyst will be either, but stretched valuations leave little margin for error in high-grade debt. "Any hiccup in economic growth, earnings growth and Fed misstep, etc. could derail spread stability because of our current tight spreads," she said in a Bloomberg TOPLive blog this week. Analysts from Morgan Stanley, who expect IG spreads to widen by 15 basis points to 25 basis points over the next year, agree with that assessment. "Rich valuations, a hawkish Fed, and the risk of higher rates volatility make for a challenging near-term setup," analysts led by Vishwas Patkar wrote this week. Bonus PointsRichard Branson plans to fly to space on July 11, days before a similar trip by fellow billionaire Jeff Bezos Fed Likely Needs to Raise Rates as Soon as Late 2022, IMF Says Robinhood Markets has plenty of reasons not to go public |

Post a Comment