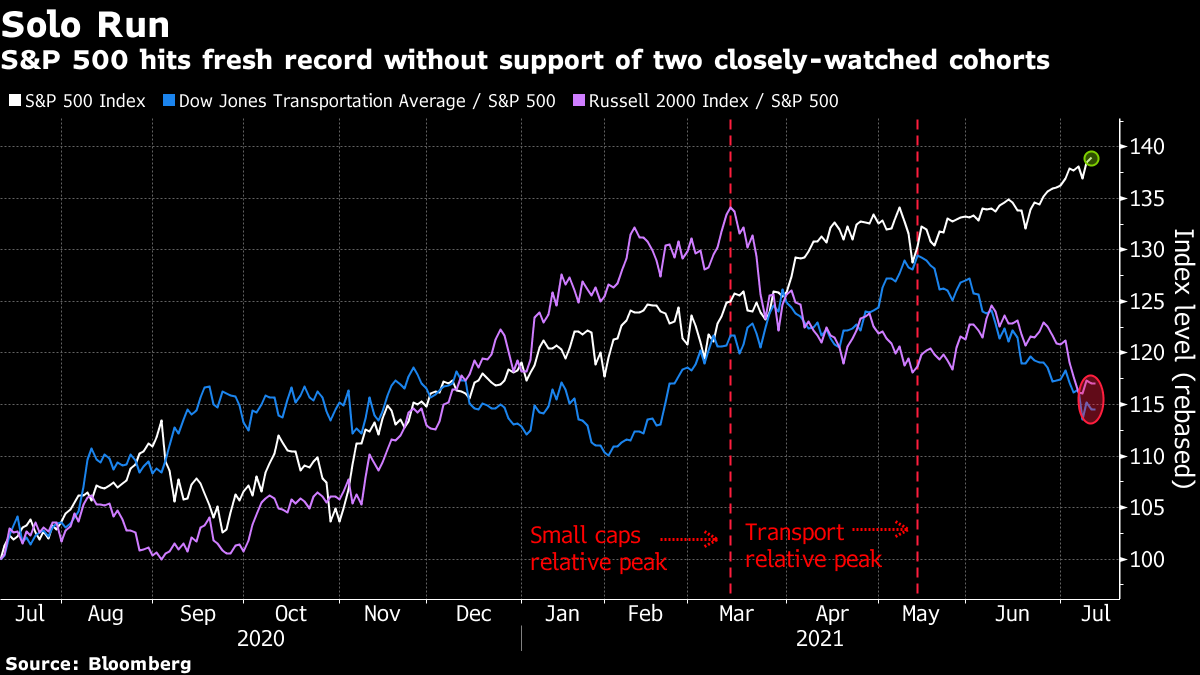

| Good morning. Cold water on European banking dividend expectations, additional shots for Israelis and a crucial U.S. inflation reading. Here's what's moving markets. Booster ShotsU.S. regulators added a warning to Johnson & Johnson's vaccine after a rare immune-system disorder was reported in about 100 of the more than 12 million people who received the inoculation. Data didn't show definitively the shot had caused the Guillain-Barré syndrome, they said. This comes as vaccination rates in the country falter and right after a 47% weekly jump in infections, the biggest since April 2020. Elsewhere, Israeli health providers will begin offering a third dose of Covid-19 messenger RNA vaccine to patients with weakened immune systems. Despite about 57% of the country having been fully vaccinated, it is experiencing a new surge in cases, foreshadowing that additional booster shots are also coming to Europe. No ExcessDon't expect a cash bonanza if the European Central Bank lifts its limit on dividends later this month, after capping them for the first nine months of the year. The ECB will push banks that propose excessive shareholder rewards "to go back to a more average distribution policy," said ECB supervisory board member Margarita Delgado. "We have other tools if the bank doesn't accept the recommendation of the supervisor." Such steps could -- in exceptional circumstances and after "constructive" dialogue -- include subjecting lenders to higher capital requirements or qualitative measures. Delgado's remarks dampen the possibility of a surge in payouts. Gauging the HeatThe June reading for U.S. inflation is due this afternoon. It will be the first glimpse at such data since Federal Reserve meeting minutes showed monetary policy officials' concern over rising prices, in turn signaling to investors that ultra-loose monetary policy has an expiry date. Today's data is likely to be dominated by reopening categories, according to Bloomberg economists, who expect a higher CPI print than other economists do on average, with the figure set to remain in the 4.5%-5% range through year-end. Aid MutinyU.K. Prime Minister Boris Johnson faces a rebellion in Parliament from a portion of his own Conservatives, who are hoping to force his government to abandon plans to slash its foreign aid budget by about 4 billion pounds. Though he enjoys a significant majority in the House of Commons, some Tory members of Parliament believe they have the numbers to defeat Johnson in a binding vote today, overturning his decision to cut international aid to 0.5% of gross national income, down from 0.7%. Coming Up…Despite gains in Asian stocks following another all-time high in the U.S., European equities look set for a more tepid open. Earnings season starts in earnest today in the U.S. with JPMorgan, Goldman and PepsiCo among the blue chips reporting. In Europe, Norway's DNB Bank and Nordic Semiconductor, Italian luxury fashion brand Brunello Cucinelli and Telekom Austria are among earnings highlights. Sweden Riksbank Governor Stefan Ingves speaks at a panel discussion, while stateside, three regional Fed presidents will speak at an event on racism and the economy. Finally, the Bloomberg Sustainable Business Summit Global, a two-day virtual event, begins. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningAnother day, another fresh record for U.S. stocks, but once more without the support of two closely-watched cohorts of shares. Small-caps -- often seen as an indicator of strength in the U.S. economy -- continue to lag after reaching a relative peak in March and are now trading close to their lowest in seven months against the larger-cap benchmark. Meanwhile, the Dow Jones Transportation Average -- a gauge of transport stocks often used to judge the strength of any rally -- reached their relative peak in May and have underperformed since. The two indicators call into question the robustness of the S&P 500's most recent gains, especially with other gauges of momentum flagging. The percentage of benchmark members above their 50-day moving averages has been languishing around the 50% mark for the best part of a month now. With investors awaiting the imminent arrival of second-quarter earnings season and profit expectations already sky high, the risk/reward of chasing the rally here must surely favor the prudent.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment