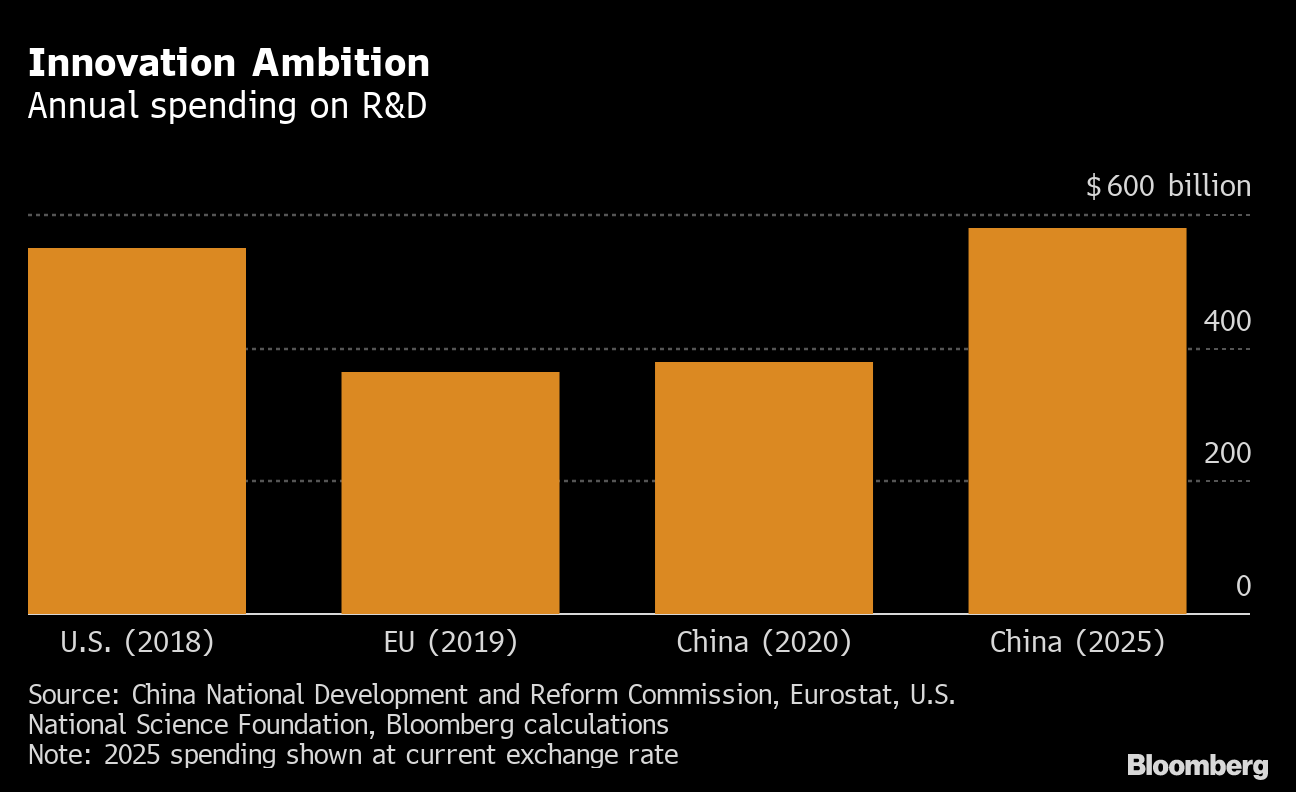

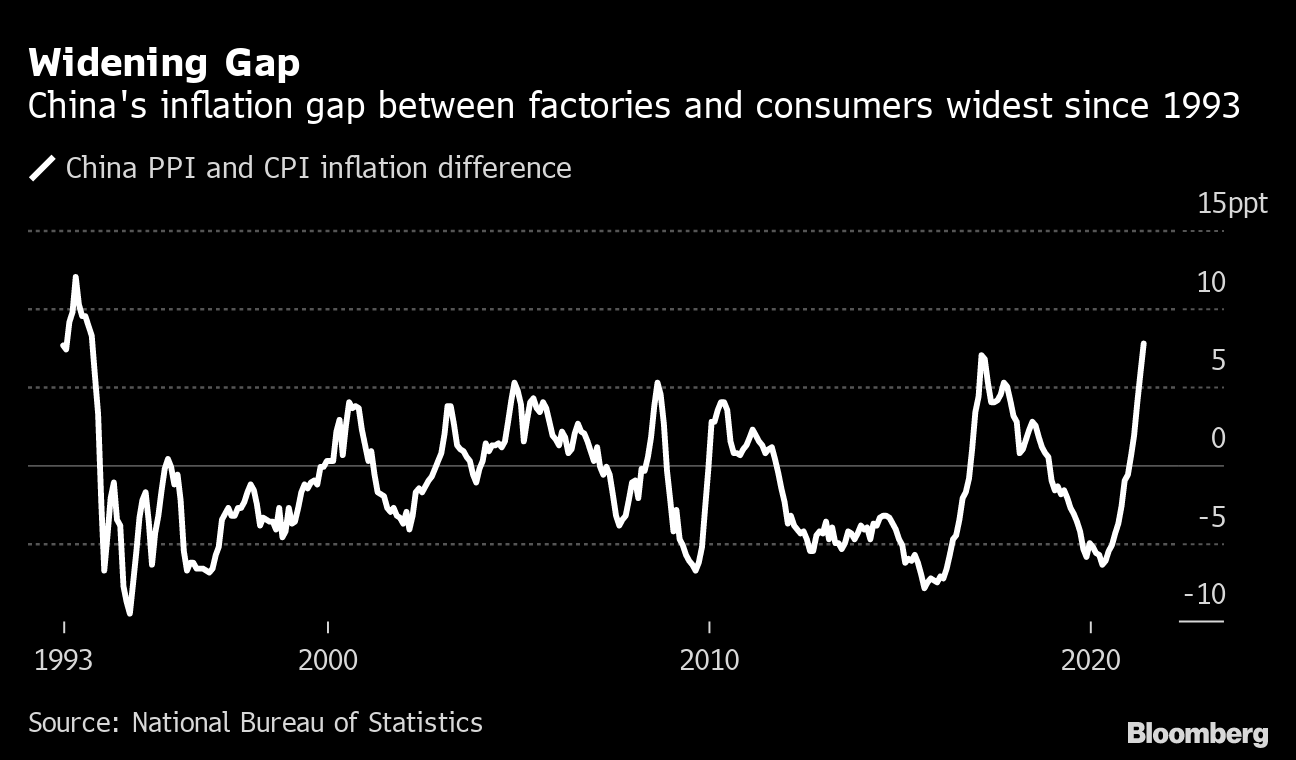

| President Joe Biden is beginning to tweak U.S. policy toward China in much more material ways, his decision this week to revoke Trump-era bans of TikTok and WeChat being a notable example. While that might redefine how the relationship moves forward, the ultimate destination seems unlikely to change. The two countries are headed toward a period of "extreme competition." That was how Biden described the relationship's trajectory in February, and an idea that was underlined this week by U.S. Defense Secretary Lloyd Austin, who issued a directive on Wednesday aimed at reorienting America's military to better compete with Beijing. Even the apparent reprieve for Bytedance and Tencent, the respective Chinese owners of TikTok and WeChat, belied that underlying sense of rivalry. Indeed, before Biden lifted the bans they'd already been blocked by U.S. federal judges who said the Trump administration had failed to show these apps in particular posed a national security threat. What the Biden administration will now do is a review of apps using a more precise criteria. They'll be looking to see if they reveal personally identifiable information and genetic information about their users to foreign adversaries, such as China. Any apps found to reveal such data would be in the crosshairs for new restrictions. Suffice it to say, TikTok and WeChat aren't out of the woods just yet. Open LineThis week, U.S. Commerce Secretary Gina Raimondo and Chinese Commerce Minister Wang Wentao spoke by phone, the latest in a series of exchanges between economic and trade officials from the two countries. Last week, Chinese Vice Premier Liu He spoke with U.S. Treasury Secretary Janet Yellen and the week before that it was U.S. Trade Rep Katherine Tai and Liu. Adding to the sense that these meetings are becoming a regular occurrence was Chinese Commerce Ministry spokesman Gao Feng saying that Washington and Beijing had started normal communications on economic and trade issues. A few phone calls, of course, are not going to solve the various disagreements that exist between the world's biggest economies. That's all the more true when noting that the two countries don't purely act on economics. The Biden administration's decision this week to hold trade and investment talks with Taiwan illustrates that complexity. While those talks will further strain America's economic ties with China, Washington is pursuing them because they demonstrate U.S. support for Taiwan.  That said, talking is almost always better than not talking. And if the exchanges that have happened over the past three weeks become something that happen with more regularity, that would be a bullish sign for the relationship. Virus OriginsPrior to the first cases of Covid-19 being identified in Wuhan, a group of researchers in the city was categorizing what animals were on sale at local wet markets in a bid to find the source of a tick-borne disease. The data they collected would ultimately evolve into a paper published this week in the journal Scientific Reports. The study — which shows 38 species including mink, masked palm civets and raccoon dogs were being illegally sold — offers the most conclusive evidence yet that animals susceptible to carrying the coronavirus were present in central Wuhan. The prevailing theory among virologists for where Covid came from is that it originated in bats and made its way into humans via an intermediary animal. While this study seems to add credence to that theory, it is also unlikely to dispel suspicions that the virus escaped from the Wuhan Institute of Virology. Indeed, having ordered U.S. intelligence last month to redouble efforts to determine the likelihood of a lab leak, President Joe Biden's administration this week secured backing from the G-7 for a renewed push to investigate Covid's origins. The question of where the coronavirus came will likely be with us a while. Innovation CompetitionThe great power rivalry that's developed between the U.S. and China has become increasingly focused on technology. Washington has undertaken that competition by not only denying Beijing access to cutting edge know-how, such as in semiconductors, but also by trying to bolster America's ability to innovate. That was what the U.S. Senate did this week in passing a $250 billion bill that aims to boost American spending on R&D. For its part, China has invested substantial amounts into its ability to develop new technologies. According to the Center for Strategic and International Studies, Chinese R&D expenditures in 2018 were second only to the U.S. globally and as big as the world's next four largest spenders — Japan, Germany, South Korea and France — combined. With Beijing having already announced plans to increase those outlays by 7% annually through 2025, the pressure is on Washington to keep up.  Inflation ConcernsDon't worry about inflation. That seemed to be the primary message Chinese central bank governor Yi Gang delivered this week when he spoke at a forum in Shanghai. It was a timely sentiment to express. Just a day earlier, data for May showed factory-gate prices increasing at the fastest pace in more than a decade thanks to the surging cost of imported commodities. And even though that same data showed consumer prices grew at a much tamer 1.3%, concerns mounted that businesses would have to start passing those higher costs to consumers and that could put pressure on the People's Bank of China to respond.  In his Thursday speech, Yi largely dismissed those worries. Consumer inflation is expected to remain below 2% this year, he said, adding that interest rates have been kept at an appropriate level. Yi also attributed surging factory-gate prices to being partially the result of a low base from last year, suggesting the central bank sees the gains as transitory. The result was a perky end of the week for Chinese financial markets. What We're ReadingAnd finally, a few other things that caught our attention: Something we think you'd like. We launched a new section called Odd Lots, an expansion of our popular markets podcast with Bloomberg News Executive Editors Joe Weisenthal and Tracy Alloway. Become a Bloomberg.com subscriber to get access to Odd Lots stories on the latest market crazes, Joe and Tracy's weekly newsletter, and more. Next China subscribers get 40% off. |

Post a Comment