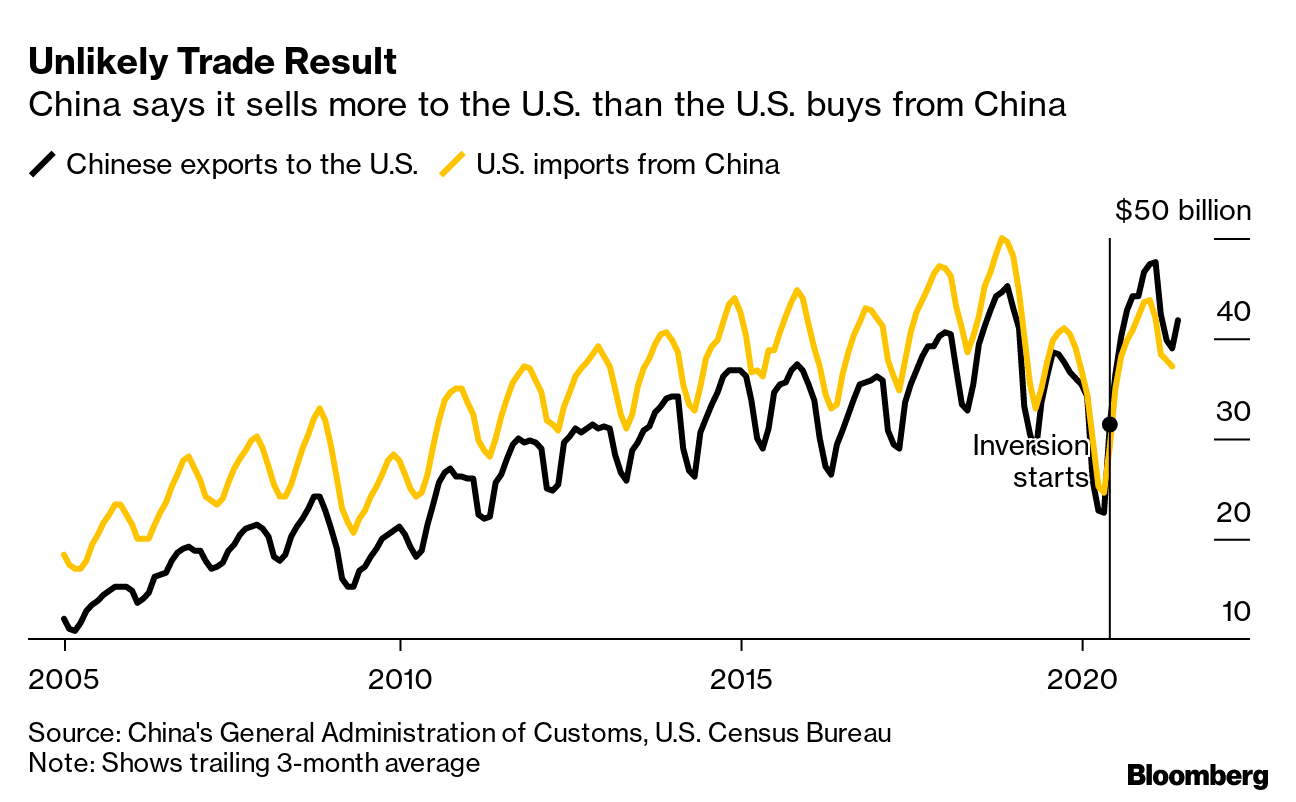

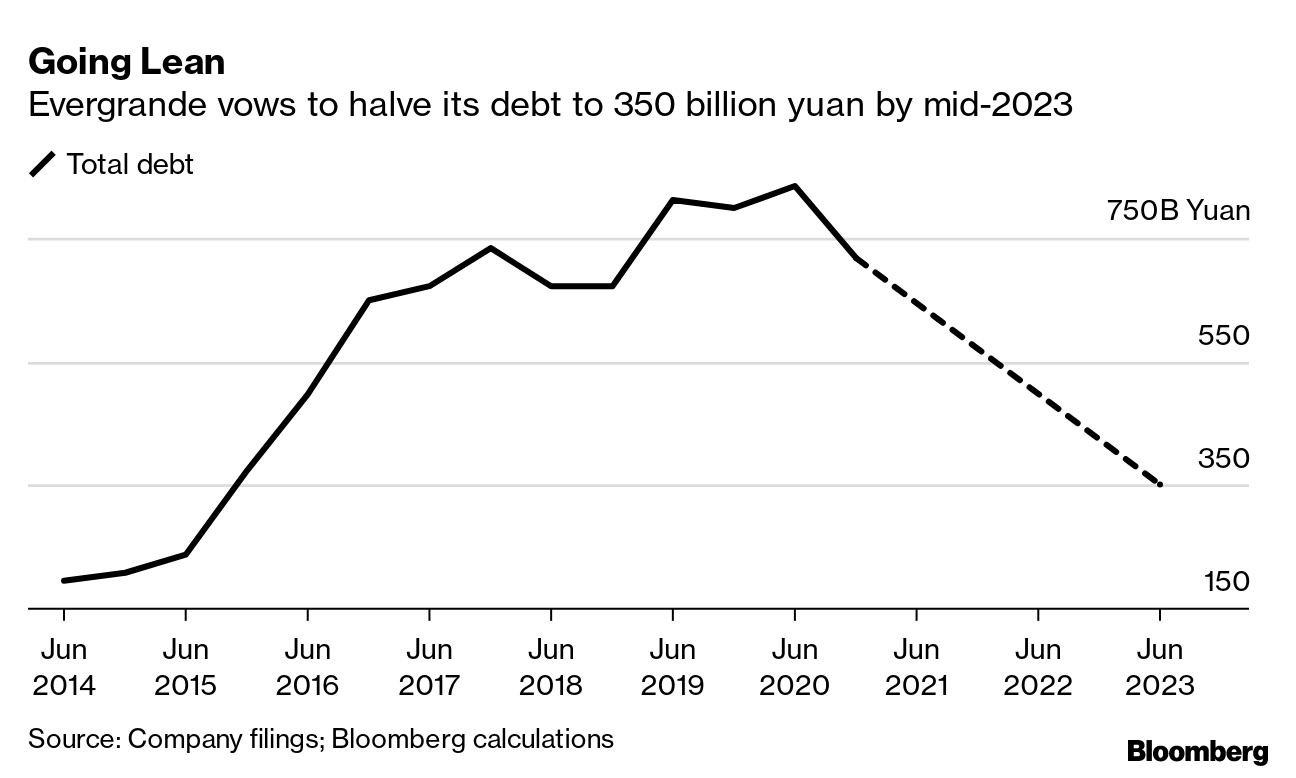

| Hong Kong this week bid farewell to Apple Daily. It was, as a former chairman of the city's journalist association described it, the newspaper people loved to hate. Over its 26 years, Apple Daily featured racy reporting on crime, celebrities and sensational paparazzi photos. But what really made the newspaper stand out — and what ultimately led to its demise — was its manifest opposition to Beijing. The final edition of the paper hit newsstands in Hong Kong on Thursday morning in an ending that has loomed since owner Jimmy Lai was arrested last August on charges he violated the city's national security law. Lai, who became one of Hong Kong's most prominent opposition voices during the 2019 protests, is now in jail awaiting trial.  Workers arrange bundles of the final edition of Apple Daily at a newsstand in Hong Kong early on Thursday, June 24. Photographer: Kyle Lam/Bloomberg The chilling effect Hong Kong's national security law has had on the city has been obvious for some time. There are no more protests. Opposition politicians are out of the Legislative Council, with many arrested. The shuttering of Apple Daily's presses begs the question of whether that chill will also spread to the city's once uproarious media. Trump's TariffsFormer U.S. President Donald Trump famously declared in 2018 that "trade wars are good, and easy to win." Fast forward three years, and there's more evidence to the contrary. New research published this week by the Federal Reserve Bank of New York suggests that a recent narrowing of the U.S. trade deficit with China may have largely been the result of American importers under-reporting shipments to evade tariffs. Starting in early 2020, China began reporting it sold more goods to the U.S. than the U.S. reported buying.  So while America's trade deficit with China was $88 billion smaller in 2020 than it was 2017, the Fed economists who authored the study estimate $55 billion of that was the result of practices to avoid U.S. levies. Such research strengthens the argument to remove Trump's tariffs, something Beijing has long wanted. Indeed, a Chinese commerce ministry researcher argued last week that removing them would also help America rein in inflation. Whether President Joe Biden would, however, is a very different question. On the one hand, a rollback seems within the realm of possibility given the recent calls between senior economic officials from both countries and the discussion for a potential meeting between Biden and Chinese President Xi Jinping. But strong bipartisan support in Washington for a harder line on China would also seem to limit how much Biden can do. Tensions over Hong Kong, Taiwan and Xinjiang make it even harder, as exemplified by U.S. sanctions against a number of Chinese solar companies. It may ultimately just depend on how good a deal can be struck. Evergrande's Debt WoesWorries about the financial health of Evergrande, the world's most-indebted real estate company, were in focus this week. It began with the revelation that three Chinese banks had decided not to renew loans to the company when they mature this year. That was soon followed by Fitch Ratings downgrading the developer further into junk territory. As concerning as these developments are, however, it remains unclear how this saga will ultimately end. This recent spate of turmoil is not the first Evergrande has had to face. Last September, the company was roiled by concerns it would face a cash crunch if a group of shareholders exercised an option to ask for their money back. That's not what happened though. Instead, billionaire founder Hui Ka Yan worked his magic and persuaded most of those investors to forgo that right. Evergrande's stocks and bonds soared as a result. But this most recent episode of turmoil is different. For one, it involves reports that Chinese regulators are scrutinizing Evergrande's financial dealings with Shengjing Bank, which counts the developer as its largest shareholder. Evergrande is also facing the threat of being barred from taking on additional loans if it cannot meet Beijing's "three red lines" requirement for developers. Of course, there could be more magic for Evergrande down the road. The company has been unloading assets with the aim of dramatically cutting its debt. But a look at financial markets, which have pushed Evergrande's stock down more than 25% year to date, would suggest that there are not many people betting there will be.  Crypto CrackdownChina's central bank called in some of the country's biggest lenders and the payment service Alipay this week to make it extra clear what Beijing's position is on facilitating cryptocurrency trading: Don't do it. While the government's opposition to crypto has been long standing, the intensity with which it is now cracking down has picked up markedly. The area where that escalation has been most pronounced is crypto mining, the energy-intensive computing process that creates digital tokens and verifies transactions. While Beijing banned crypto exchanges and barred its financial institutions from handling digital currencies in 2017, it had allowed miners to continue largely unaffected. That's now changing. Worried by its heavy energy usage and potential connection to illicit movements of money, Beijing is now pushing out the miners. That's translated into a drop in the hashrate, or processing power, for Bitcoin and a migration of mining operations to other jurisdictions. It increasingly seems that Beijing wants China to have nothing to do with crypto. What We're ReadingAnd finally, a few other things that caught our attention: It's almost time to Power On. A new weekly newsletter by Bloomberg's Mark Gurman will deliver Apple scoops, consumer tech news, product reviews and the occasional basketball take. Sign up to get Power On in your inbox on Sundays. |

Post a Comment