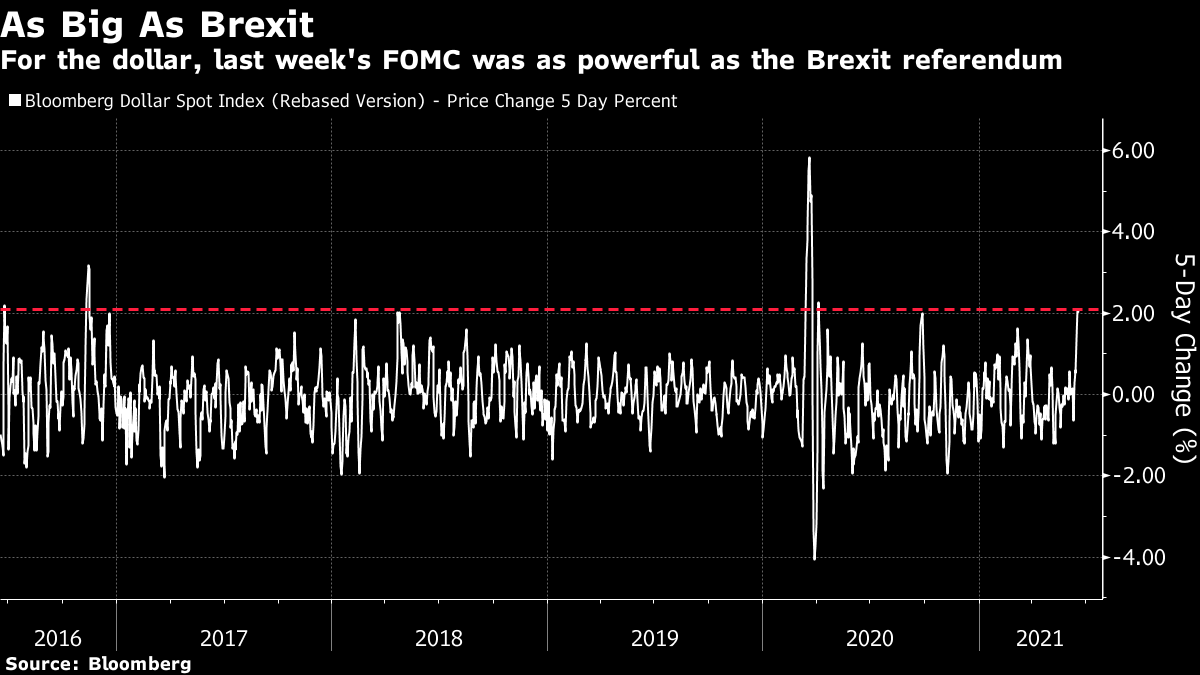

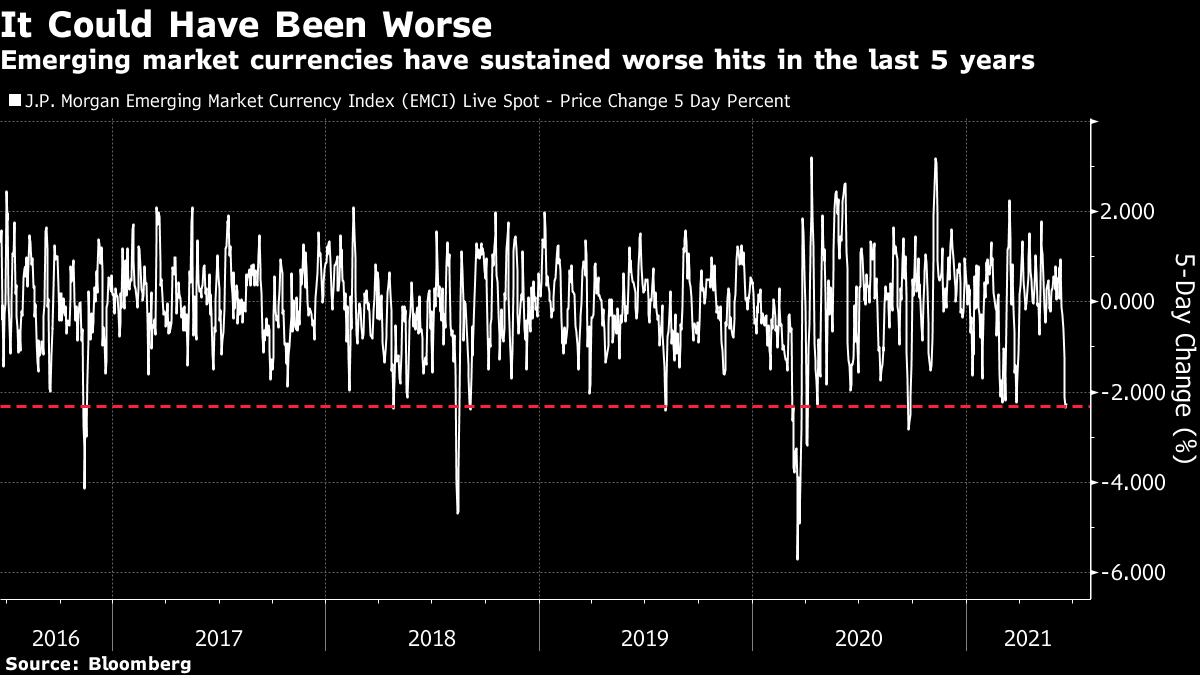

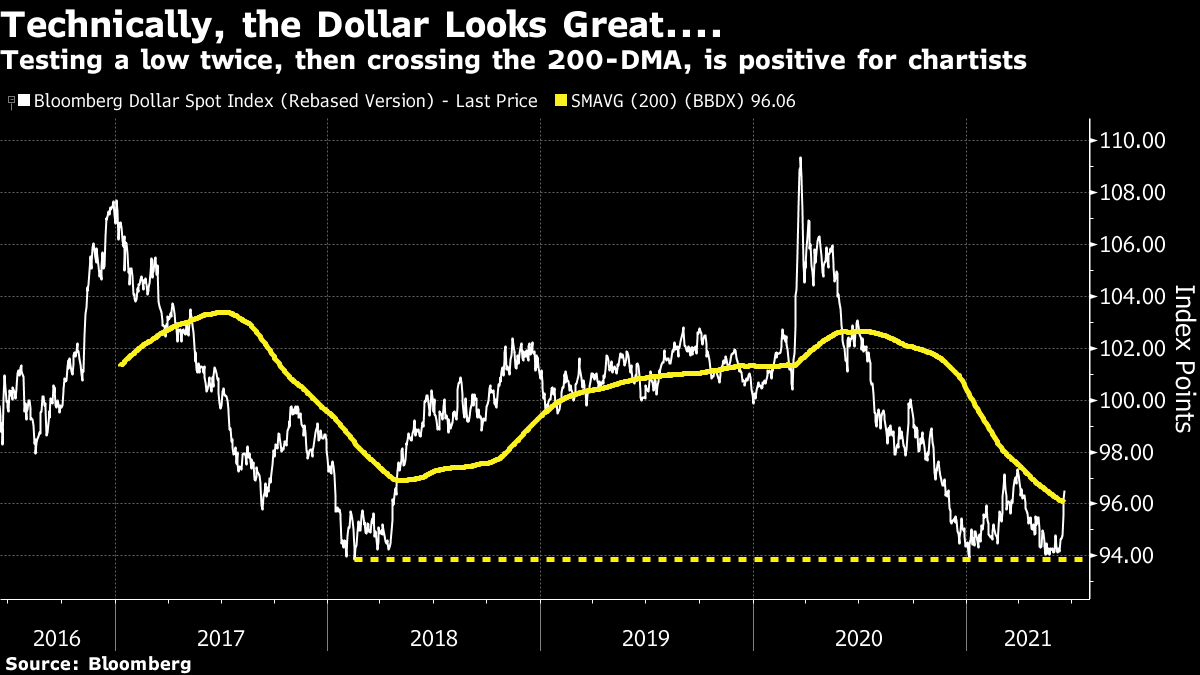

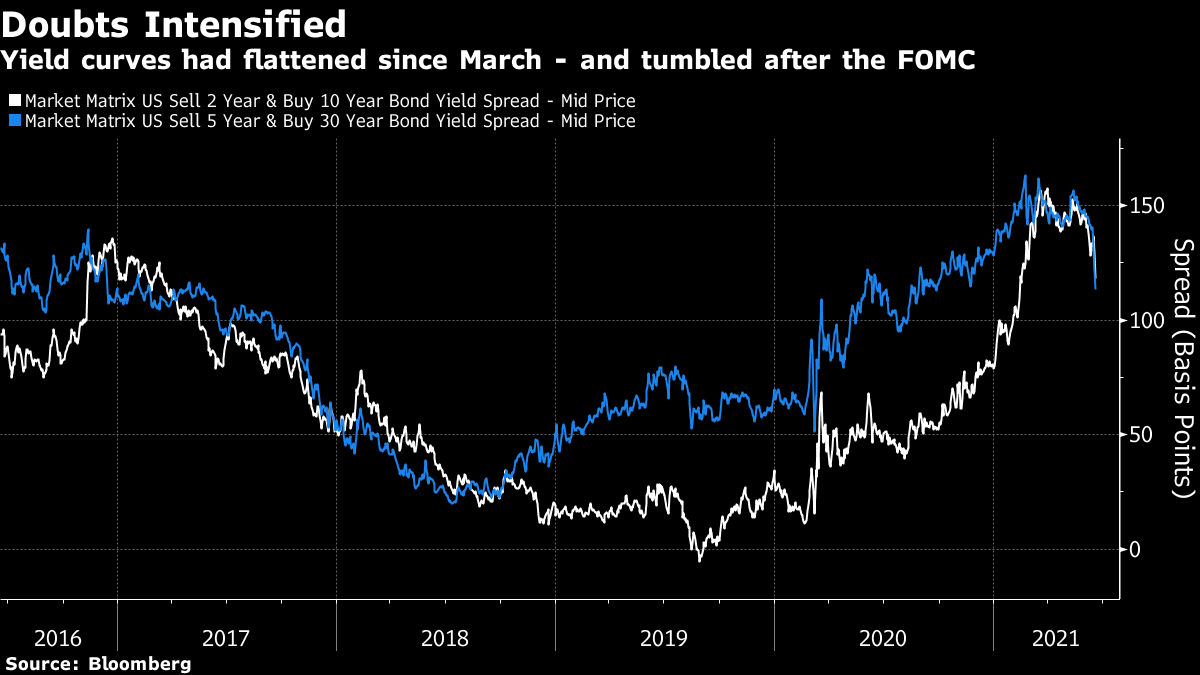

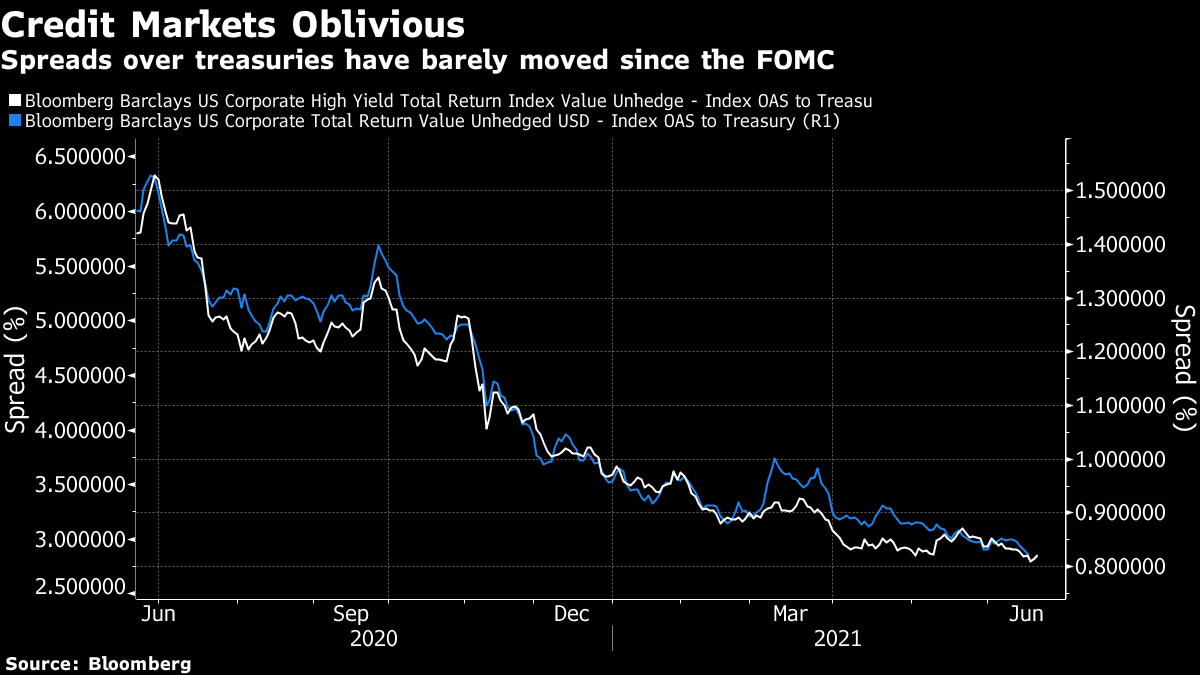

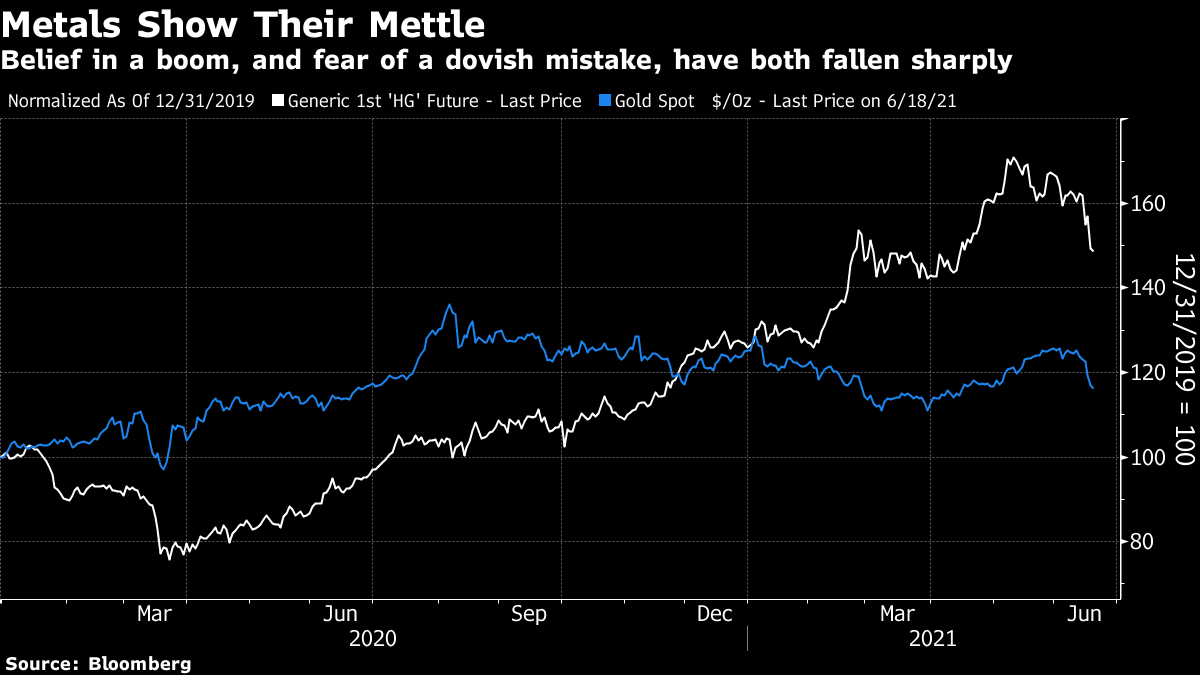

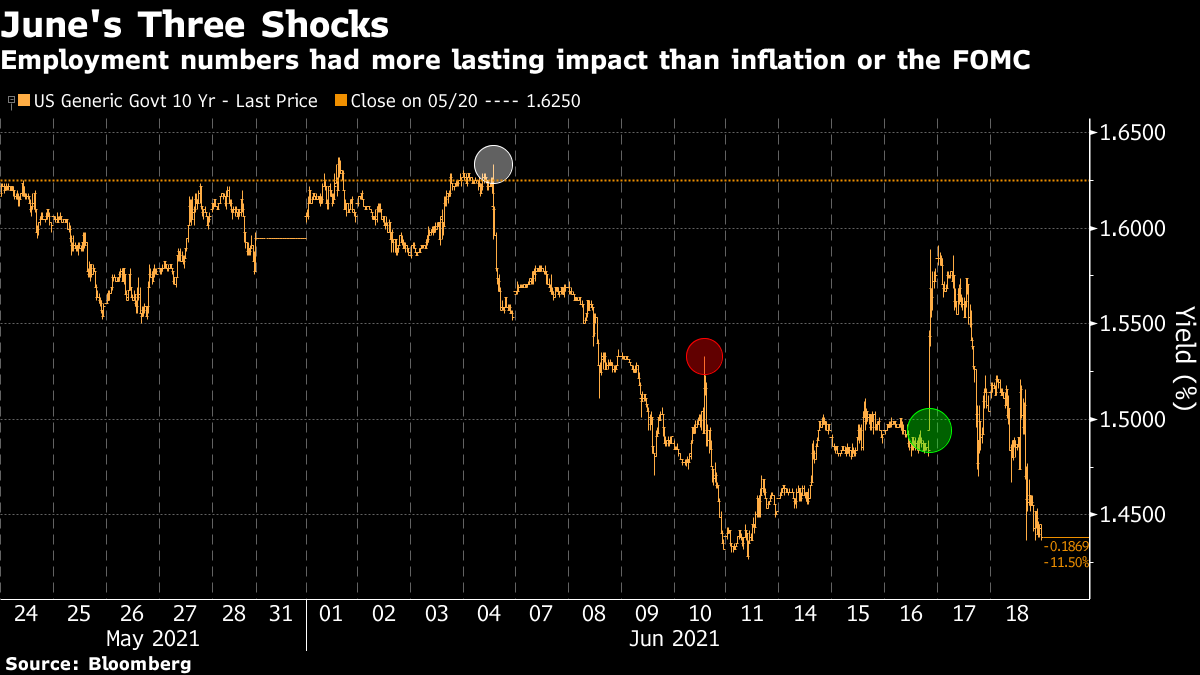

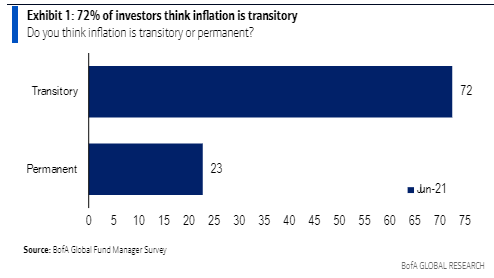

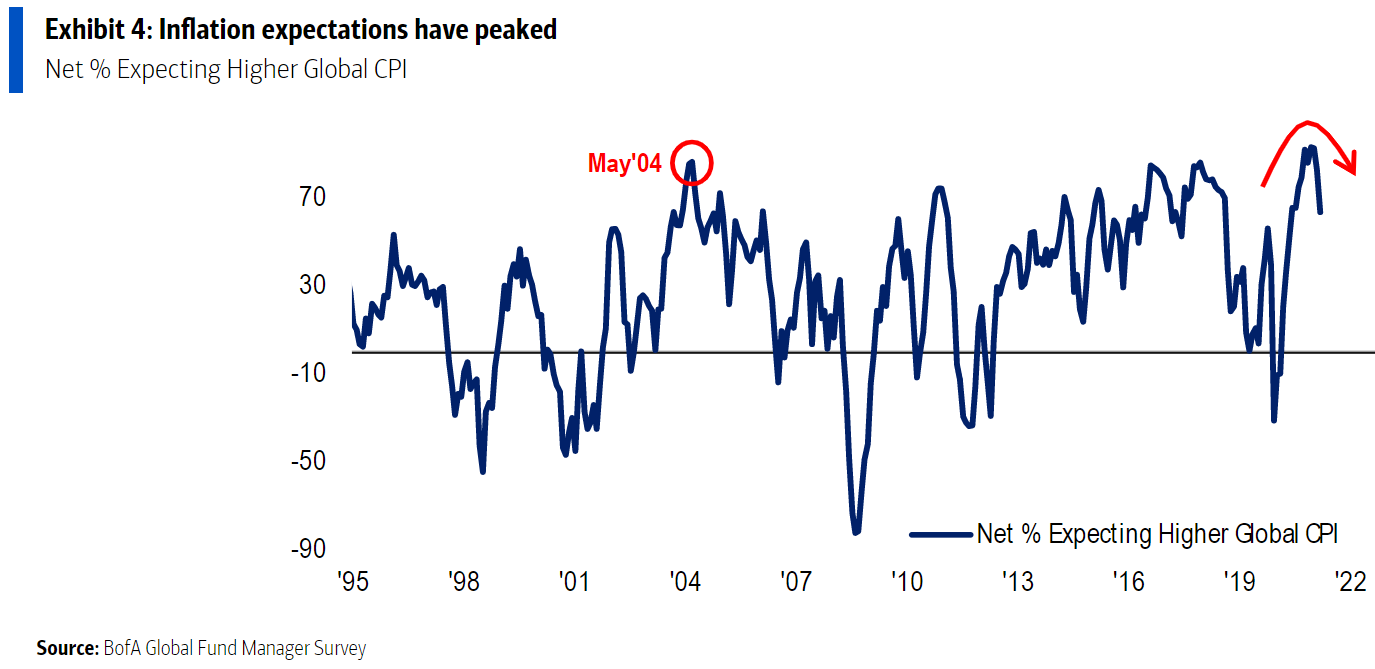

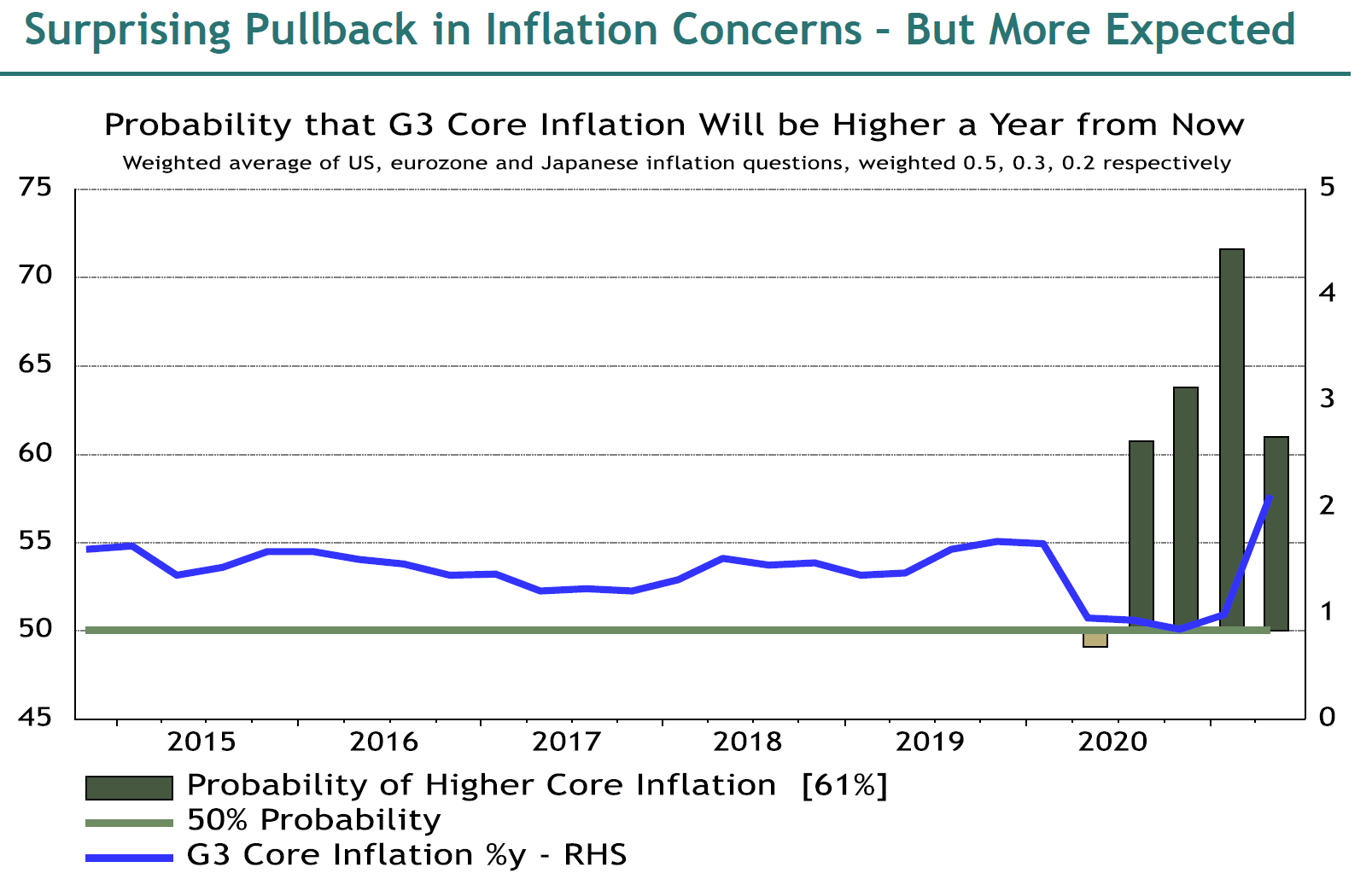

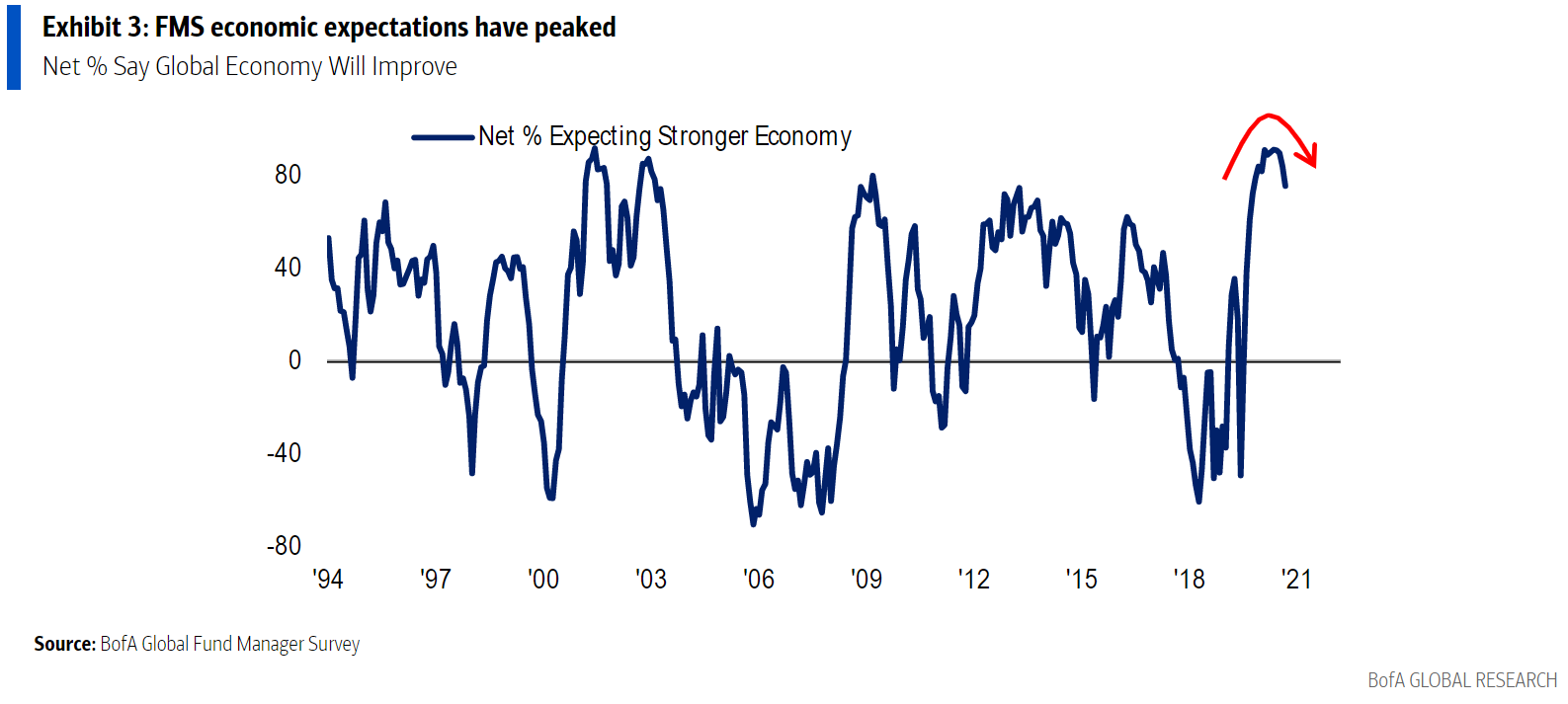

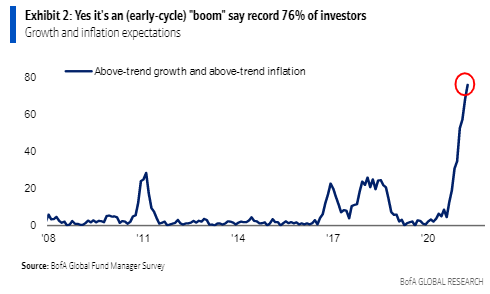

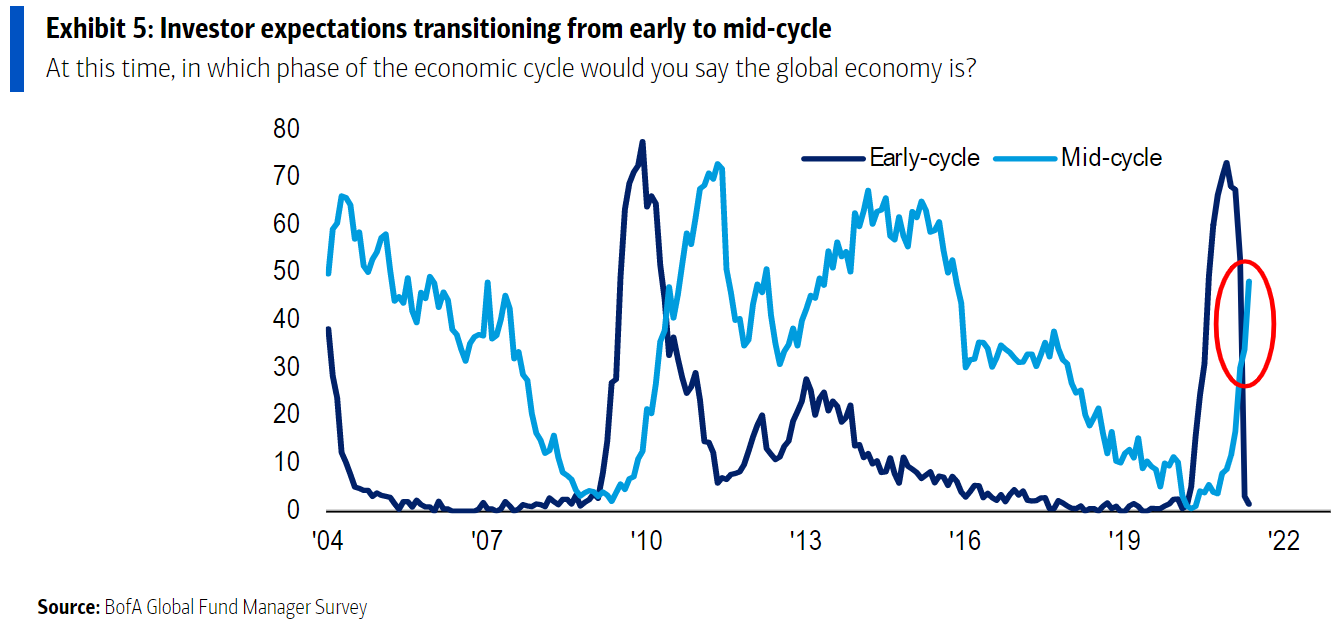

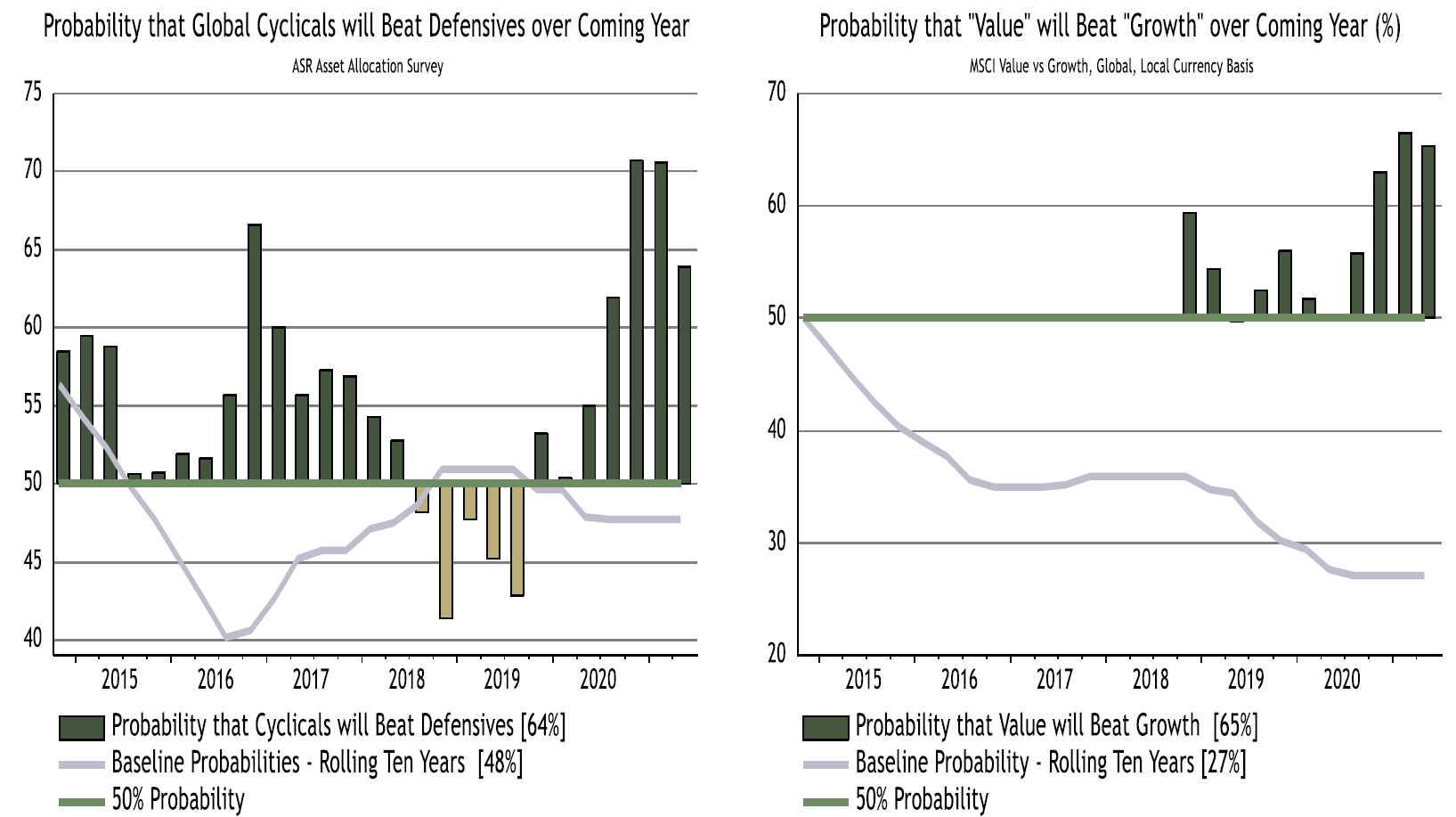

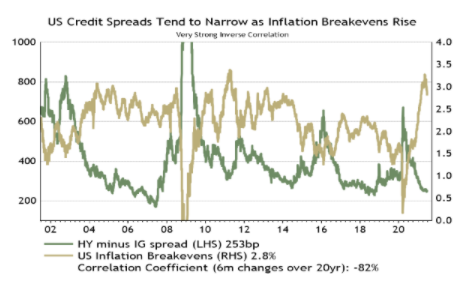

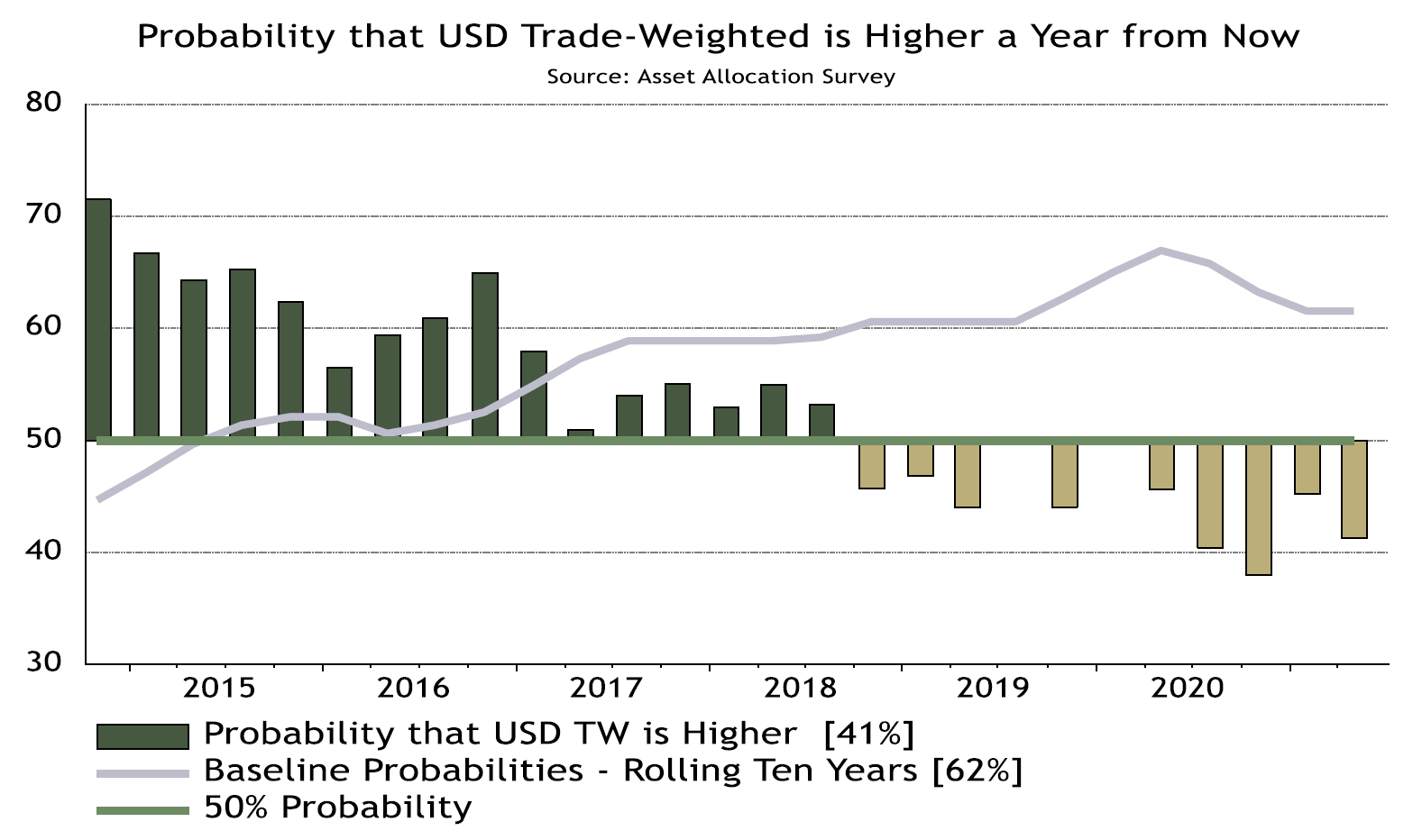

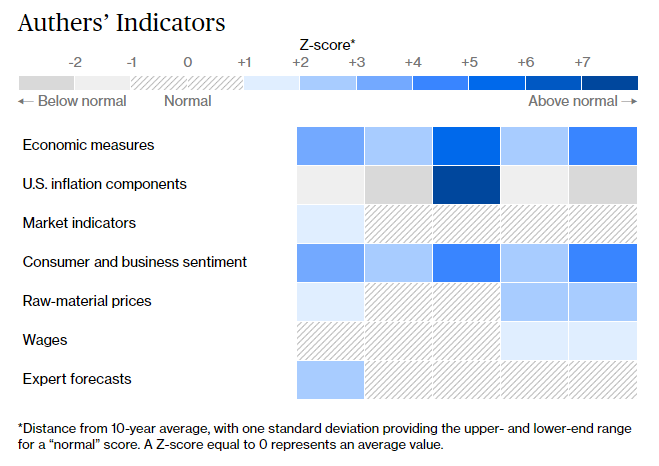

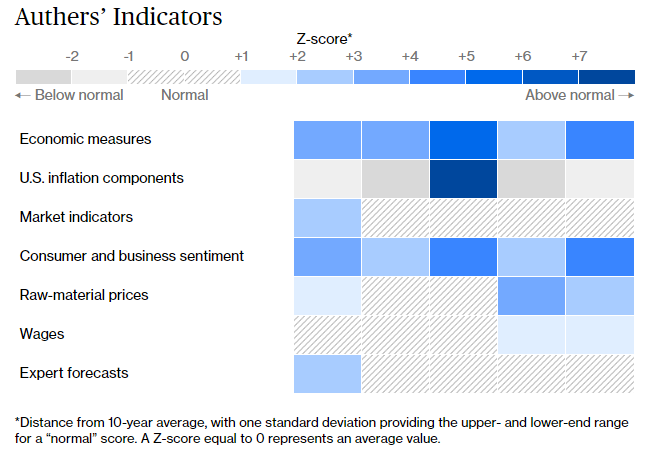

What Just Happened?Last week, I felt like kicking myself for not seeing the hawkish turn by the Federal Reserve coming. Jerome Powell gave himself plenty of outs after the Federal Open Market Committee meeting last Wednesday, but the moment when he tried to dial back expectations for extreme monetary accommodation long into the future came much earlier than many of us had persuaded ourselves to expect. Now I feel like kicking myself for not seeing the very surprising market reaction coming. As I am writing this on a Sunday, with markets closed and a fixed target, I will go through everything that was remarkable about that reaction, and try to explain it with surveys of investor expectations carried out ahead of the FOMC. As both the Fed and investors, with their narratives, can affect outcomes in the real world, we have reached an important juncture. Currency The dollar's rebound was startling. In the last five trading days, the Bloomberg dollar spot index, comparing to 10 major currencies, rallied 2.1%. In the last five years, it has topped this only in the worst week of the Covid-19 shock, and in the week after Donald Trump's 2016 election. That's it. The dollar's move following the Brexit referendum five years ago was almost the same. So as far as the market was concerned, the FOMC just provided as big a reason to buy the dollar as the Brexit vote did:  For emerging markets, the effect was slightly more muted. The JPMorgan Emerging Market Currency Index dipped by a little more than 2.1%, but volatility is more common in EM; there had been a number of similar incidents over the last few years:  As emerging markets have proved most vulnerable to abrupt dollar appreciation, this is encouraging. But the overall picture for the U.S. currency is one of sudden rude strength. The Bloomberg index tested its low from early 2018, made a double bottom, and then rebounded above its 200-day moving average for the first time in a year. The outburst of optimism for a stronger dollar is startling. That in itself should help limit U.S. inflation, and tighten American financial conditions:  Bonds A more aggressive Fed should mean higher rates ahead, and therefore higher bond yields now, and a steeper yield curve (with longer-term securities yielding more than than short-term ones). That is exactly what didn't happen. Yield curves, whether comparing two- and 10-year bonds, or five- and 30-year notes, had reached their steepest in some years, and then flattened swiftly. That trend started a couple of months ago, and became rout after the FOMC:  Inflation expectations declined. That is a direct sign that the Fed is expected to act in time to stop prices getting out of control. The 5-year breakeven dropped the most: the 5-year/5-year, measuring expected inflation between 2026 and 2031, fell back to a level where it traded throughout 2018. The pattern had implied a sharp increase in inflation in the next few years, brought under control somewhat thereafter. The market is now trimming that back to something much more within normal bounds:  Credit A hawkish Fed warning should be a shot across the bows for the credit market. It suggests higher risks, and more need for compensation for holding speculative debt. Absolutely nothing like this has happened. Both high-yield and investment-grade credits remain at historically low spreads over Treasuries, according to the Bloomberg Barclays indexes:  Commodities Commodity prices, particularly industrial metals such as copper, are virtually a self-fulfilling prophecy of inflation ahead. Meanwhile gold, while not a direct inflation proxy, has acted as a hedge against dovish central banking errors. When investors think the Fed or other central banks is on the verge of making a mistake, gold tends to do well. On that basis, the metals markets show a strong deterioration in the risk of inflation, because of a reduction in the risk that the Fed will make it happen. Prices suggests these beliefs were already beginning to take hold before the FOMC. The bad news is that the chance of a vintage reflationary cyclical boom are also deemed to have reduced.  Stocks To the extent that the central bank is acting because of the strength of the economy, that should be good for stocks. So a tilt toward tighter policy should mean that stocks beat bonds. In fact, the opposite has happened. After massive outperformance since the low in March last year, stocks had stalled relative to bonds, and declined at the end of last week:  That is in large part because of the awful performance of inflation proxy stocks such as resources companies. Societe Generale AG keeps an index of the most inflation-sensitive global stocks; it had outperformed the S&P 500 since the March low, and particularly since the good news on vaccines started to emerge in November. The stock market shifted sharply against inflation proxies last week:  Why Did It Happen?If we look at the 10-year Treasury yield over the last 20 trading days, we get a strong hint. I've circled the month's three key macro events — in order, non-farm payrolls (disappointing, for the second month in a row), CPI inflation (shockingly high for the second month in a row) and the FOMC. The employment numbers seem to have had by far the greatest and most enduring impact:  This may be transitory. When businesses have had more time to process applications, unemployment insurance has been reduced, and childcare is available again once schools fully reopen, employment might improve. Powell devoted some time to making this argument after the FOMC. But the market reaction suggests traders are worried about whether growth really will be as good as they had hoped. That would explain a fall in yields. And it's a tad concerning. With the Fed preparing to err in a hawkish rather than a dovish direction, such worries become greater. We have a good idea of what fund managers were expecting thanks to two surveys conducted after the unemployment and inflation numbers but before the FOMC. I've cited both of them often: the BofA Securities Inc. Fund Manager Survey, and Absolute Strategy Research Ltd.'s Asset Allocation Survey, which is overseen by David Bowers, one of the original developers of the BofA survey. Both are detailed, wide-ranging and respected. They might easily be wrong, like any opinion survey, but they tell a consistent story that does seem to explain the events after the FOMC. First of all, BofA asked managers if inflation was transitory or permanent, and a decisive 72% said it was transitory:  Further, the percentage expecting higher global inflation rates from here on has started to decline:  Meanwhile, the probability that asset allocators put on higher core inflation a year from now in the U.S., euro zone and Japan fell sharply in the Absolute Strategy survey. It remains just above 60%, but opinion is moving against the need for hawkishness:  Turning to growth, we discover that the proportion of BofA's respondents expecting the economy to continue improving has started to decline:  It's true that a majority still think that we should brace for both above-trend growth and inflation (in other words, a boom):  But when asked directly whether they think the economy is in early cycle or mid-cycle, a majority now thinks that in the accelerated conditions following the pandemic, we are already into mid-cycle:  Once into mid-cycle, stocks tend to find it harder to make headway. With growth more scarce, opportunities for growth investors to outperform also improve, while life gets harder once more for value investors. To confirm this, the Absolute Strategy survey found the probability of higher earnings a year from now had been marked down a little (although investors still seem very confident):  Consistent with this, the probability that cyclicals will beat defensives, and that value will beat growth have both also been cut back a little (although again, the survey does show overall bullishness for continuing growth):  Other details confirm this. For example, the BofA survey now finds that commodities are regarded as the most crowded trade — just before prices started to fall, and then the Fed frightened them down some more. What matters most in markets and the economy is what happens at the margin. The Fed's decision to start reining in excessive exuberance and inflationary psychology came just as the market was beginning to develop cold feet about these things. Rather than jolting the market out of an extreme position, the Fed may have given an extra shove to the direction in which it had already tentatively started to move. For further evidence, Bowers of Absolute Strategy notes that: - U.S. inflation breakevens peaked in mid-May ... and have been falling ever since;

- Quite a few commodity prices have peaked out

- U.S. Treasuries ignored not one, but two, atrocious CPI prints (totally unfazed - despite the negative surprises)

- Since May 12, the U.S. 30-year yield has fallen 40 basis points (from 2.4% to 2%) - which suggests the "long duration" trade is back in the driving seat

Bowers also draws attention to signs that China is tightening credit. What next? We hear from Powell on Tuesday, so if he is unhappy with the way his remarks have been interpreted, he can set the record straight. Meanwhile, the two areas that demand attention are credit and currencies. As I noted earlier, credit has barely been touched so far. Bowers suggests that this is "probably the one to watch" as credit spreads tend to widen when breakevens fall. They haven't done so yet.  As for currencies, the dollar has seen the most clear-cut shift since the FOMC. Yet the surveys suggested that dollar bears were still clearly in the ascendant before the Fed pronounced:  It looks like the dollar has passed some technical tests in the last week, but also that the move has been swift and little considered. We can expect a further test. Authers' IndicatorsContinuing on the inflation theme, we have updated the Authers Indicators for the first time; you can find the latest edition here. This is the heat map that looks at a range of 35 inflationary indicators. Compared to last week, the bottom line is that the apparent inflation risks have indeed fallen, but perhaps by not as much as you would have expected. This is the June 21 heat map:  And here is the initial June 14 heat map:  At first you might not notice the difference. Some raw-material prices have cooled, and the same is true of the market indicators. In both cases, this isn't as dramatic as you might expect because both inflation breakevens and the main commodity indexes were already in the middle of their ranges for the last decade. Now to see if the confidence in the Fed will cause inflation risks to decline further. Risk & ReturnMany of the ideas in this newsletter can be attributed to my conversation with my colleague Lisa Abramowicz in our second livestreamed Friday chat, which we are now tentatively calling Risks & Rewards. Lisa's call from the week before the FOMC that people were underestimating the risk of a failure for the economy to ignite certainly seems like a good one already. You can find the latest episode here. We're trying to get the format right so let us know of any ideas for improvements.  Survival TipsI've been writing this on Fathers' Day, which seems to have become an ever bigger event as the years go by. As it's a family occasion, let me offer two items from my own family. First, this is the playlist that my daughter gave me. Click the link and you should get the list; it's on Apple Music. Her taste is a bit different from mine. Songs I can vouch for include: The Dog Days Are Over by Florence and the Machine, Grease by Frankie Valli, In Your Eyes by Peter Gabriel and Do I Wanna Know by the Arctic Monkeys. A lot of it is more contemporary. And then you can see the Fathers' Day Shakespeare compilation put together by my sister, Lizzie Conrad Hughes, a theatrical director who has been working on a doctorate on performing Shakespeare during the pandemic. Performing Shakespeare on Zoom has led to some startling ingenuity; and there's a brief and beautiful tribute to our Dad within one of the soliloquys. Thanks very much for doing that Lizzie, and thanks for everything, Dad. Have a great week, everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment