| Hello. Today we look at rising inflation pressures and how policy makers are grappling with them, Latin America's poverty shock and the shift to the suburbs. Inflation Jitters

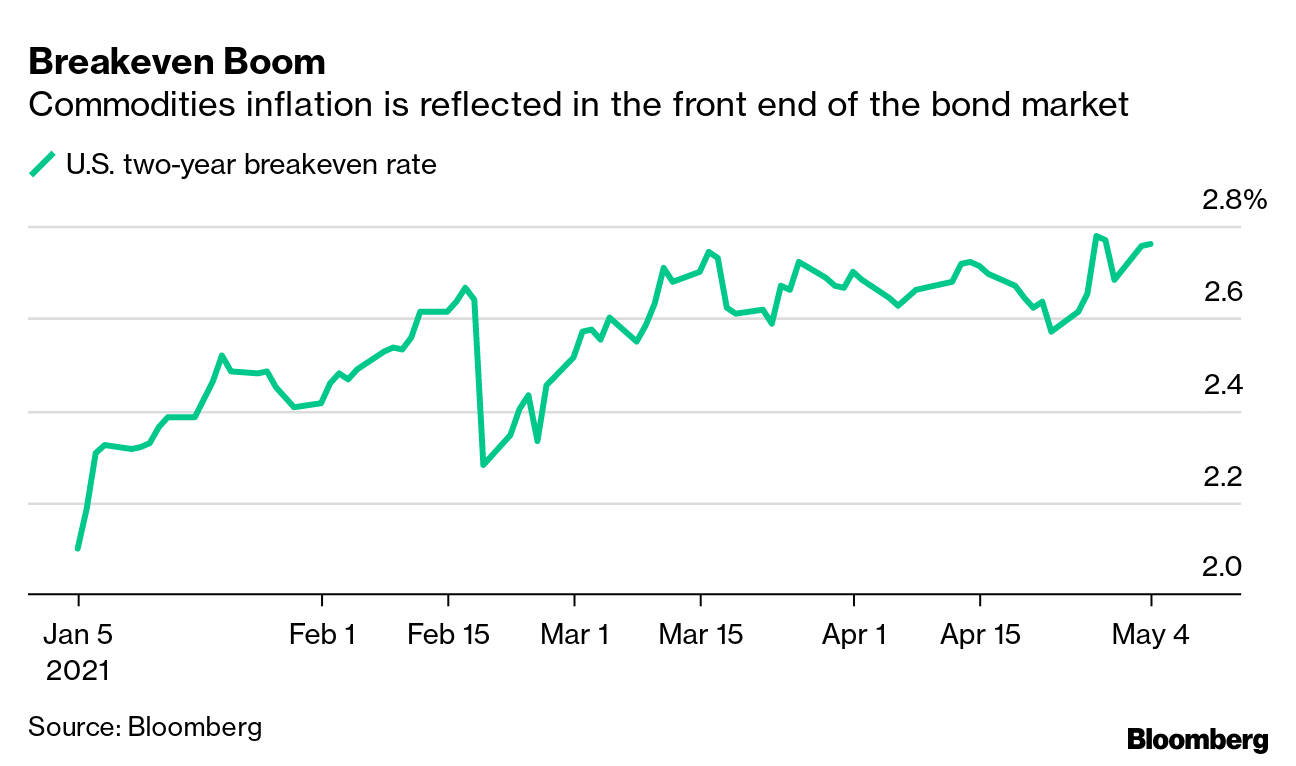

As soaring commodity prices, shipping costs and chip shortages work their way through the world's factories, the warnings of supply-side inflation pressures are starting to become a reality. At the same time, unprecedented fiscal and monetary stimulus is beginning to kick in as developed economies reopen from virus lockdowns, pumping up the demand side too. The key question for global central bankers and therefore financial markets is: Will the price increases be isolated and short lived, or will they swell into longer-lasting and broad-based gains that ignite inflation expectations? Investors are on edge, but for now, policy makers such as Federal Reserve Chairman Jerome Powell are discounting the threat of an inflation breakout, even as they acknowledge there may be a temporary bump. Remember: Virus worries linger and labor markets still have room to tighten. But Powell's predecessor on Tuesday inadvertently highlighted just how sensitive markets are and how careful officials need to be as they calibrate their messaging on the issue. Treasury Secretary Janet Yellen sent stocks down when she made the seemingly innocuous comment that "it may be that interest rates will have to rise somewhat to make sure our economy doesn't overheat." She later clarified that "it's not something I'm predicting or recommending."

In some pockets of the global economy though, the debate is no longer theoretical. As Michelle Jamrisko writes, a mounting number of consumer-facing companies are warning that supply shortages and logistical logjams will force them to raise prices. Among the hikers: Nestle and Colgate-Palmolive.

"One always has to be careful not to overplay a few anecdotes, and project that onto the broader economy," said Douglas Porter, chief economist at BMO Capital Markets. "But as the anecdotes accumulate, they eventually become data." "When you run things hot, you risk getting burned," he said. — Malcolm Scott - Bonus Fed Analysis: Craig Torres and Laura Davison explain the biggest source of market volatility for Fed watchers may not actually be inflation, but turnover at the top of the central bank. Powell is among the officials President Joe Biden could seek to replace in the coming year and the choice is even more crucial given Powell is deploying a new policy strategy.

The Economic Scene Brazil recorded more Covid-19 deaths in the first four months of the year than in all of 2020, breaching the 400,000 mark as it grapples with a shortage of vaccines. Photographer: Jonne Roriz/Bloomberg The pandemic has sent a wave of poverty racing across Latin America, deepening declines that began over the past decade and consigning millions to lives of deprivation. The world's most unequal region saw 22 million people — the equivalent of everyone in New York state — join the ranks of the poor from 2019 to 2020, unable to meet basic needs. Read here for more from Patrick Gillespie and Maya Averbuch Today's Must Reads - China worry. The Group of Seven nations is considering a U.S. proposal to counter what the White House sees as China's economic coercion. Meanwhile, the EU is backing "intrusive" rules to prevent foreign state-funded firms — such as those from China — from undercutting EU rivals.

- Emerging markets. India's central bank announced loan repayment relief as well as steps to boost credit to key sectors, seeking to cushion the blow from the world's worst outbreak of virus infections. Brazil is set to hike rates, but investors want to learn whether it plans to keep doing so.

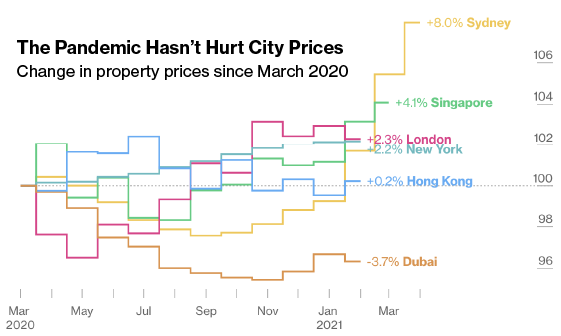

- City life. The pandemic hit London harder than other British regions as office workers stay home, shutting the U.K. capital's night life. Even as an end to lockdowns approach, Brexit means London may not spring back to life. Globally, the pandemic isn't just changing how we work, it's altering where we want to live too: apartment rents have plummeted and suburban bidding wars have erupted.

Bloomberg Bloomberg - Citi leave. Catherine Mann, Citigroup's chief economist, is departing the bank after three years. The former OECD chief economist said she had resigned, without elaborating.

- America's baby drought. U.S. births dropped 4% last year from 2019 to the lowest level since 1979. That's a global trend that has economists worrying about slowing long-term growth rates as populations age.

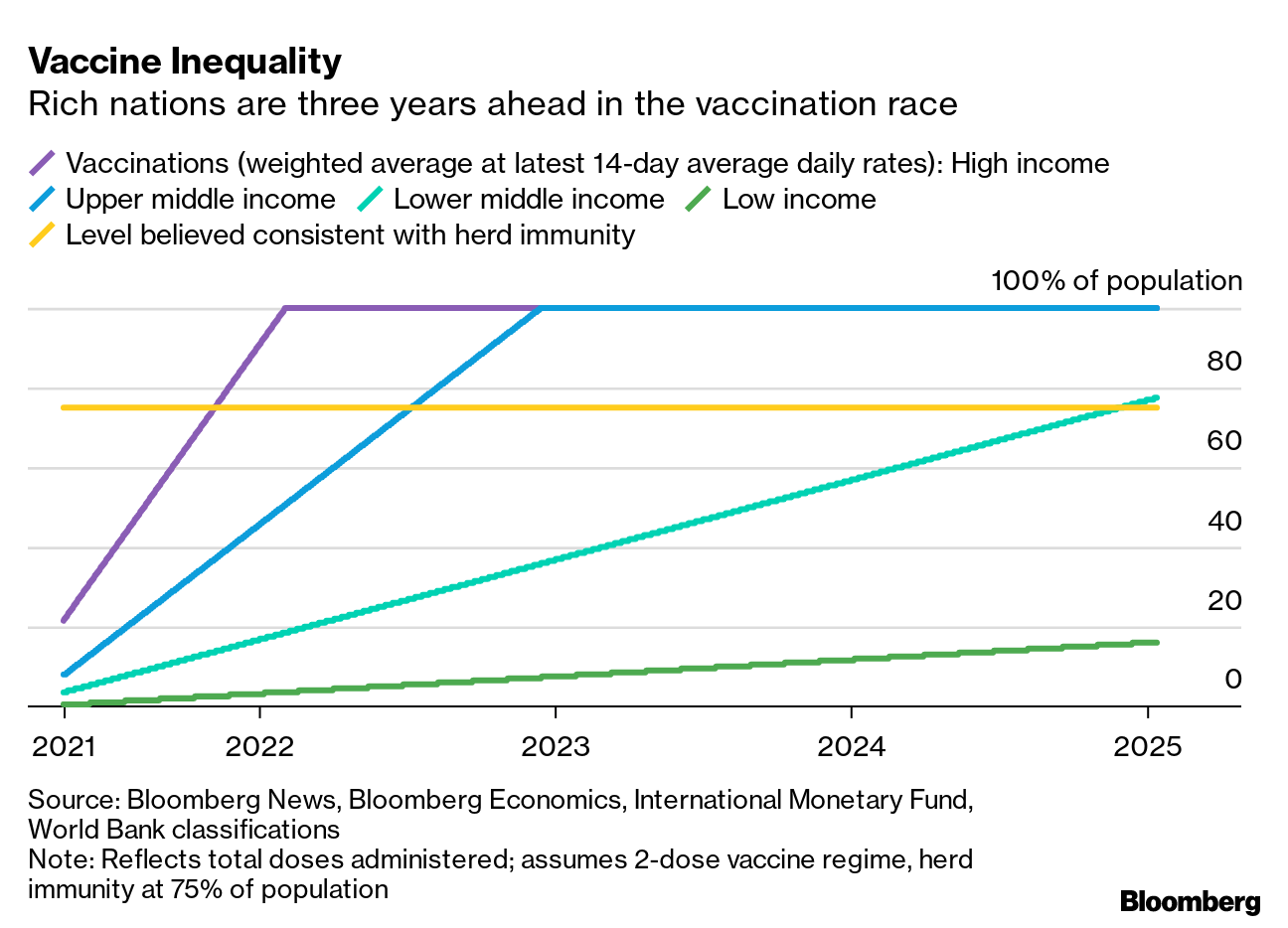

Need-to-Know ResearchInfectious disease expert Anthony Fauci asserts that vaccinating 70% to 85% of a population would enable its return to normalcy. At current rates, some rich countries will reach this milestone by August, but most poorer nations will remain below the threshold through 2024 or later, according to research by Bloomberg Economics' Ziad Daoud and Scott Johnson. That doesn't mean richer countries will be out of the woods. Billions of people in poorer nations provide a large pool for the spread and mutation of the virus. The pandemic won't be fully eradicated until vaccines have been rolled out worldwide.  Read the full research on the Bloomberg Terminal On #EconTwitterInequality starts at birth and the gap just keeps on growing.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment