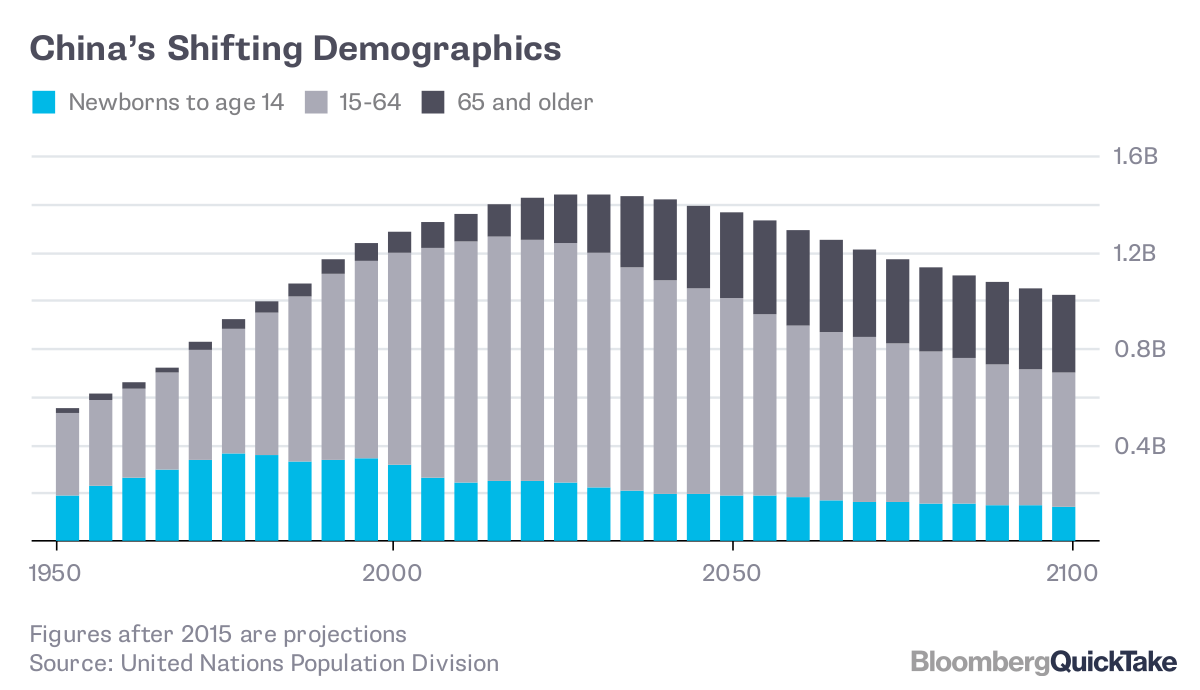

| There's a fight brewing in commodities. On one side are Chinese policymakers worried that surging prices for iron ore, copper, coal and other commodities will exact a damaging toll on the economy. Data released this week showing producer prices rose by the most in more than three years will have fueled such concerns. On the other side are markets, which have pushed the price of commodities ever higher this year as government stimulus and Covid vaccinations buoys expectations for a rebound in global growth. The week's first confrontation between these forces occurred after iron ore and coal futures surged on Monday. Chinese commodity exchanges responded on Tuesday by raising trading fees and margin requirements, steps meant to rid the market of speculators who might have been pushing up prices. It didn't quite work. Iron ore futures did pause their ascent, but by Wednesday were moving higher again. The price action for coal was even more pronounced, with futures contracts for the fuel shrugging off the fee increase on Tuesday to surge to a new record high.  China has sought to cool the sizzling rally in iron ore. Source: AFP/Getty Images But Chinese policymakers don't give up easily. Premier Li Keqiang — at a Wednesday meeting of the State Council, the country's cabinet — called on officials to effectively deal with commodity prices, and said better coordination of monetary policy would be crucial for doing so. Those comments, combined with data showing a slowdown in credit growth, pulled prices back during trading on Thursday. That doesn't mean the rally is over. While Beijing has a lot of levers it can pull in a bid to rein in prices, there are also a number of fundamental factors that Chinese officials will find a challenge to address. One reason iron ore prices have gained, for example, is concern that China's pledge to be carbon neutral by 2060 means authorities will further limit steel production. That's incentivized mills to ramp up production to get ahead of any curbs, fueling demand for iron ore. It's hard to imagine Beijing compromising its emissions commitments to rein in prices.  A similar quandary exists for coal. One of the notable drivers for the fuel's gains has been the ongoing spat with Australia. Beijing has accused Canberra of being a U.S. puppet and of discriminating against Chinese companies. It has also cut imports of a slew of Australian goods, including coal. With news this week that those curbs now appear to be spreading to include Australian liquefied natural gas, the relationship appears to be worsening. Beijing's fight against commodity prices could go on for some time yet. Fewer But More Productive WorkersChina's once-a-decade census was finally released this week and there was plenty in it to cause concern. Births have plunged, the ranks of those 60 and over have ballooned and the working population is quickly shrinking. But it wasn't all bad news. While the country has fewer working-age adults, that cohort is better educated and more productive. Almost 9 million people graduated from Chinese colleges last year, versus just 1 million in 2000. The ratio of urban residents also rose to 63.9% of the population last year from 49.7% a decade earlier, meaning an ever larger number of workers are employed in industries more economically fruitful than agriculture. Chi Lo, senior China economist at BNP Paribas Asset Management, estimates that by lifting the universal retirement age to 65 and loosening restrictions on internal migration, Beijing could actually add 150 million to the country's urban workforce by 2035.  That's easier said than done, of course. China's retirement age is currently 60 for men and 50 for women, ranking it among the world's lowest. It's not surprising, then, that the idea of raising that threshold is deeply unpopular. Whether Beijing has the political will to make the changes that China's rapidly aging population demands is a question no census can answer. Off the HookXiaomi is breathing a sigh of relief. Washington this week agreed to remove Xiaomi from its blacklist — after the maker of smartphones, robot vacuum cleaners and other devices was banned last year by the Trump administration, putting the company at risk of delisting from U.S. exchanges and getting removed from global stock indexes. But Xiaomi sued and a U.S. court in March sided with the firm, ordering a temporary halt to the ban. While the reversal is good news for Xiaomi, it does not seem to suggest a change in policy. The Biden administration extended a Trump-era executive order used to ban Huawei just a day before news of Xiaomi's exoneration was announced.  Xiaomi CEO Lei Jun. Photographer: Shawn Koh/Bloomberg Word of WarningIt was a challenging week for Meituan CEO Wang Xing. The 42-year-old entrepreneur posted on social media verses from a 1,100-year-old poem about the misguided attempts of China's first emperor to quash dissent. Wang later tried to clarify that he cited the poem because it reminded him of the competitive landscape in the nation's e-commerce sector, and that there was no implied criticism of the government. By then, however, the damage was done. Meituan's market value fell by $26 billion over the first two days of the week, underlining how nervous investors have become about what Beijing's ongoing campaign against big tech could mean for Wang and his company. After all, regulators had just two weeks earlier announced they were investigating Meituan for suspected monopolistic practices. These are cup-half-empty days for Chinese tech billionaires. Sinovac's SurpriseSome very good news emerged this week for Chinese vaccine maker Sinovac, which the company had no idea was coming. A study in Indonesia of some 128,000 health workers who'd been immunized with its CoronaVac shot showed it provided far greater protection than had been indicated in earlier clinical trials. That CEO Yin Weidong was not aware the study was coming highlights the disconnect that has dogged the company. In late 2020, the company couldn't explain why Brazil and Turkey released wildly divergent data on its shots within hours of each other. By January, four different efficacy rates were reported – ranging from 91% to 50% – spurring confusion and concern. Real-world results from Indonesia and Chile, which credited CoronaVac with a decline in rates of death and hospitalization, could assuage those worries. Whether that has helped Sinovac get better at communications is still uncertain.  An Indonesian study found Sinovac's shots protected 98% of people from death and 96% from hospitalization as soon as seven days after the second dose. Photographer: Dimas Ardian/Bloomberg What We're ReadingAnd finally, a few other things that caught our attention: Some big news. We launched a new section called Odd Lots, an expansion of our popular markets podcast with Bloomberg News Executive Editors Joe Weisenthal and Tracy Alloway. Become a Bloomberg.com subscriber to get access to Odd Lots stories on the latest market crazes, Joe and Tracy's weekly newsletter and more. Next China subscribers get 40% off. |

Post a Comment