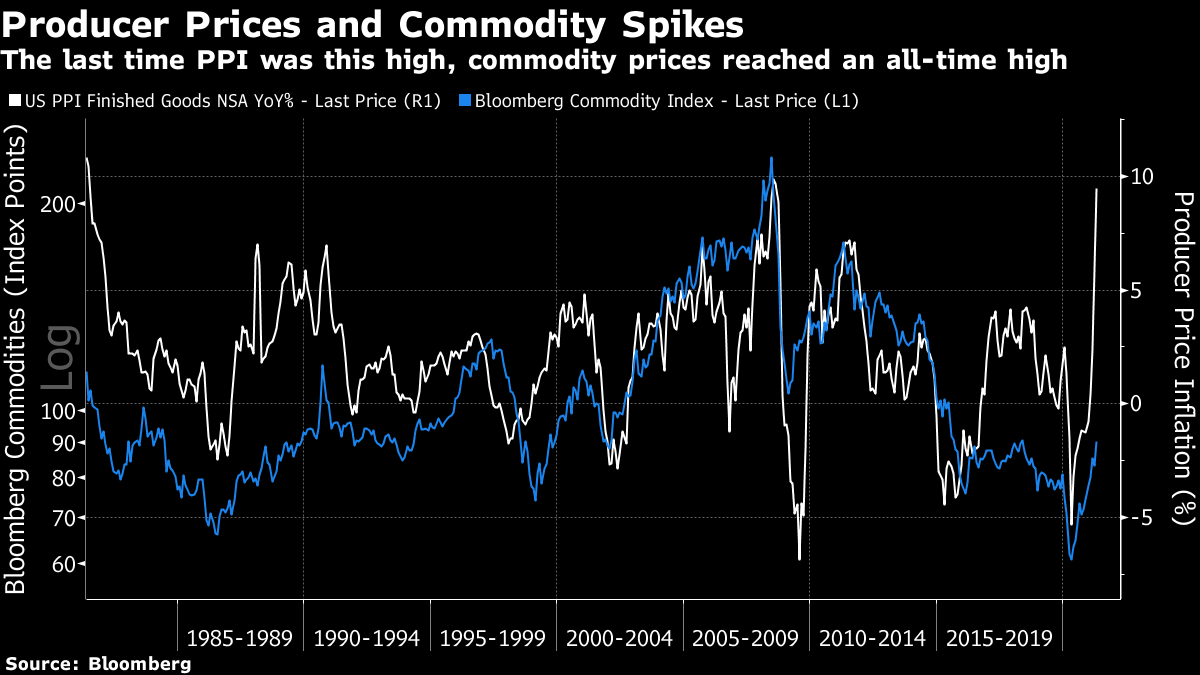

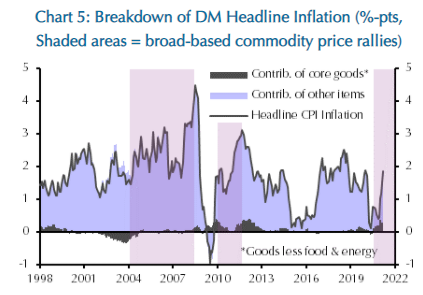

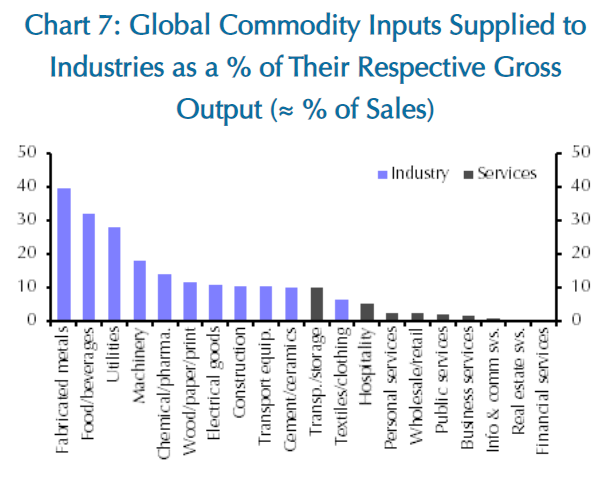

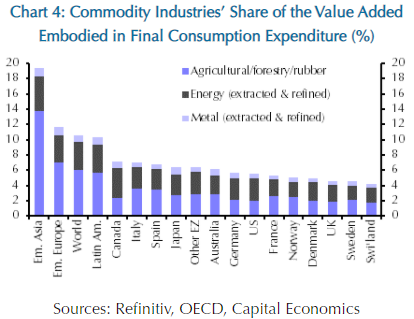

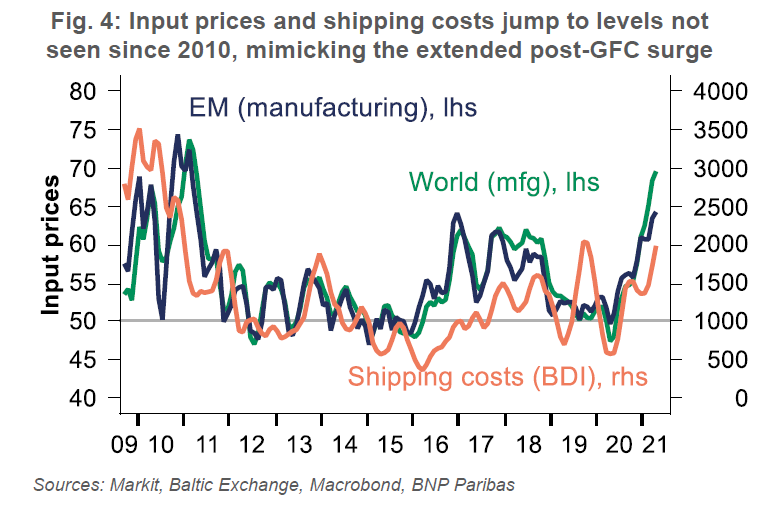

An Emerging ProblemCommodity prices are much higher than they have been for a while. Inflation in the U.S. is much higher than it has been for a while. How much are these things related, and what do they portend for the future? There's certainly some relationship between the commodity complex and companies' input prices. Producer price inflation provided another unpleasant surprise on Thursday, coming in at its highest in four decades, bar a brief peak in the summer of 2008 ahead of the global financial crisis — which uncoincidentally is when Bloomberg's broad commodities index hit an all-time high:  The 2008 price spike was driven by oil. There is nothing like such pressure now, although the latest 12-month increase for the Bloomberg index, at 48.4%, is the highest in four decades. However, in developed markets at least, the contribution of core goods — excluding oil and agricultural products — to inflation isn't very significant. The following chart, from London's Capital Economics Ltd., shows that the contribution is much lower than it was about 10 years ago, when the level of commodity prices was higher:  The steadily changing nature of the economy also makes basic commodity prices less important, They still matter greatly for the metals industry (obviously), and food business and utilities, but their contribution to the services that now dominate the economy is negligible. This chart is also from Capital Economics:  But while commodity inflation is no longer of such direct import to the developed world, it still has serious effects on emerging economies. When we look at commodities' share of final consumption, we find that emerging Asia is far more exposed to commodity prices than Europe and North America. Sub-Saharan Africa, not shown here, is even more commodity-dependent:  One further problem for the developing world is that rises in commodity prices tend to be sustained, and move in waves. BNP Paribas SA shows that input prices (as taken from the Markit ISM surveys) are rising sharply in emerging markets. The last time they reached these levels, in the wake of the GFC, prices stayed high for a couple of years before settling into the prolonged bear market that is now over:  This raises the disquieting prospect of social unrest in the emerging world. The spark that lit the Arab Spring revolts of 2011 was a protest in Tunisia over high food prices. As Jason DeSenna Trennert of Strategas Research Partners puts it: Only in a rich nation could one exclude nourishment and staying warm as anything other than "core." Commodity price inflation can thus be very politically destabilizing, especially in countries without strong and flexible systems of governance. It should be remembered that in the last financial crisis, America experienced both a significant decline in home prices (an event that hadn't happened since the 1930s) as well as $150 oil simultaneously. Sadly, riots for food in countries like India, Egypt, and Indonesia became commonplace. With America's twin deficits approaching 20% of GDP, it is difficult to get bullish about the U.S. dollar, especially against commodities and hard assets. In this way, the dollar is, as Treasury Secretary John Connally once said, "our currency and your problem."

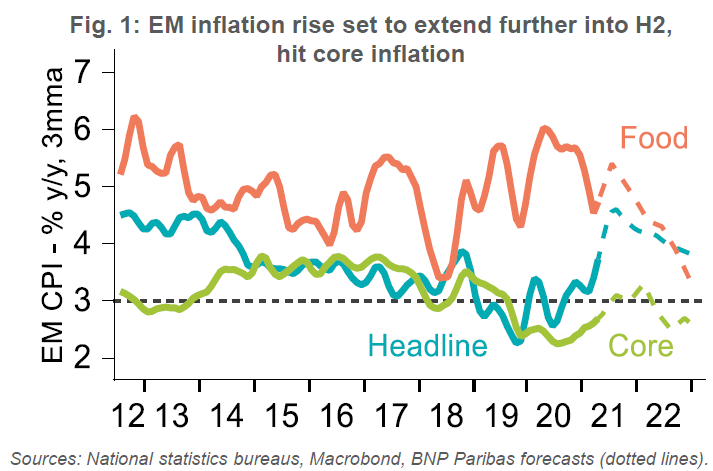

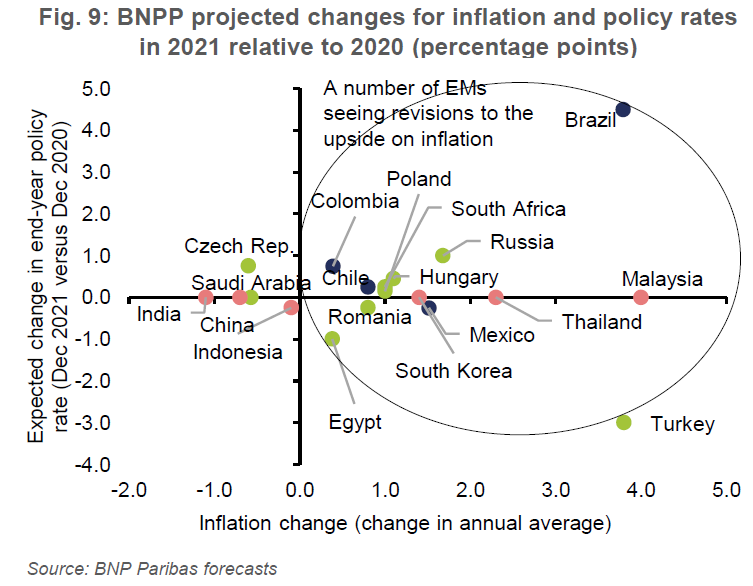

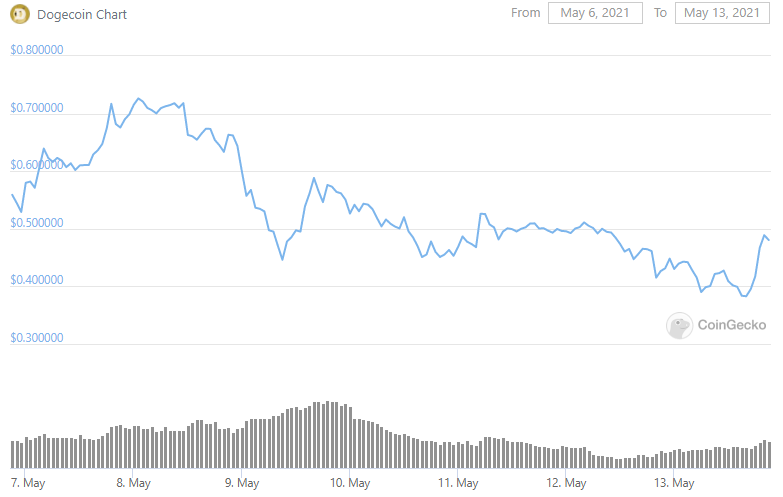

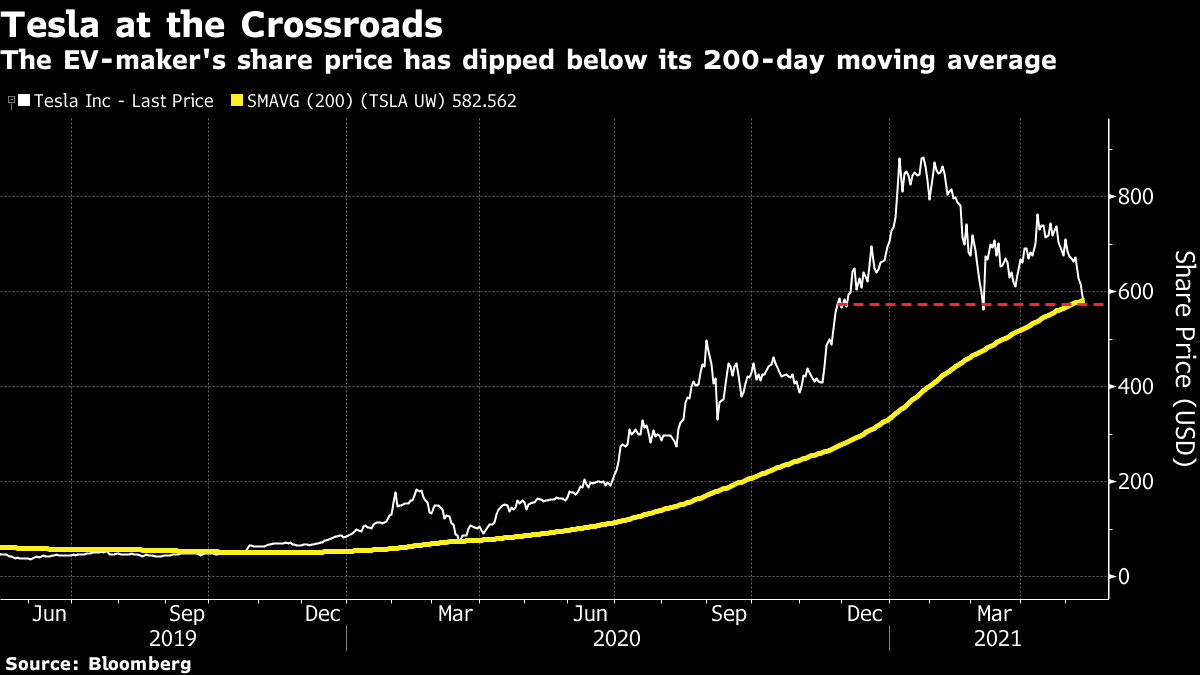

So while stronger commodity prices aren't in themselves too dangerous for inflation in developed countries, they could be profoundly destabilizing in the emerging world. Problems affording food would only exacerbate the pain for the countries like Brazil and particularly India that are currently suffering grievously from the pandemic. Food makes up 29.8% of consumer expenditures in India (and as much as 59% in Nigeria), and only 6.4% in the U.S. Food inflation feeds much more directly into headline inflation in emerging markets, and this will push headline and core inflation upward, according to BNP's estimates:  This could in turn force a number of countries into interest rate hikes at a point when their economies wouldn't otherwise be ready for them. Brazil in particular looks set for sharp tightening, as well as increased inflation. In much of the rest of the developing world, BNP Paribas shows, the expectation is that countries will endure a rise in inflation without adjusting monetary policy from their previously planned course.  Rising interest rates can be almost as unpopular as food price inflation in the developing world, particularly in a time of pandemics, so central banks will naturally try to avoid them. But this is where the most difficult inflationary challenges lie at present. In the developed world, the uptick in inflation might still prove a transitory quirk caused by reopening. In the emerging world, food price inflation is already forming a serious social and economic challenge. A Twist in the Tesla TaleThe saga of Elon Musk and Tesla Inc. has taken a new turn. Musk helped to hype cryptocurrencies last year by announcing that the company would move a chunk of its treasury into bitcoin. The fortunes of Tesla and of crypto then grew mutually reinforcing. Musk's excited followers bought up yet more bitcoin on the news, and the knowledge that Tesla's holdings had thereby grown in value helped to back up the share price. Tesla's core business remains inspiring and exciting, with battery and self-driving technology as well as some smartly designed cars. Whether these attributes justify its glorious valuation is another matter. But the narrative involving Musk and cryptocurrencies has taken a much darker turn. Musk said Thursday that he disliked bitcoin's negative environmental effects (of which he must surely have been aware before), which he described as "unsustainable." But he also said in a separate tweet that he was working with rival dogecoin (which famously was started as a joke) to improve its transactional efficiency. Whether he meant this seriously or as a joke, like his comment on Saturday Night Live last weekend that dogecoin was "a hustle," it had an impact. This is how dogecoin has moved over the last seven days, in a chart from coingecko.com. The effects of the joke on its price in the early hours of Sunday, and of the tweet Thursday afternoon, are clear:  Meanwhile, Musk might be in danger of turning himself into an unserious figure, which isn't a great narrative for the CEO of one of the world's largest companies. On Thursday, Tesla's share price dropped below its 200-day moving average for the first time in almost two years. It is still just above its low for the year set in March. The stock is down 35% from its peak, back to a level first reached in November:  Huge accumulated gains remain intact, of course. But charts like this don't look good. After years of triumphantly and cheekily proving the doubters and short sellers wrong, Musk is now on the wrong end of a nasty correction, and vulnerable to a new narrative that he has "jumped the shark" — taken his eye off the ball of his business, and enjoyed a second career as an entertainer. Hubris, or "pride comes before a fall" is one of the oldest human narratives. He doesn't want to play to it. And as there have been plenty of signs of investment bubbles, particularly in crypto but also in the range of growth and "meme" stocks that support them, a burst bubble looms as another potentially self-fulfilling narrative. That leads to the subject of the Bloomberg book club. The next volume up for discussion offers the perfect perspective on this excitement: Narrative Economics: How Narratives Go Viral and Drive Economic Events by Robert Shiller, the Nobel laureate best known for his success in spotting the tech and housing credit bubbles before they burst. It is an examination of how the human mind forms decisions based on narratives rather than numbers, and an attempt to imagine a new economics that incorporates narratives. It seems pretty relevant to me.

We will be discussing the book with Shiller on the New York morning of Tuesday, June 8. Please mark your diaries and try to read the book by then. If you have comments or questions, it's always useful to get them in advance. Send them to the book club email address: authersnotes@bloomberg.net.

Survival TipsMore signs that survival tips may not be needed for much longer, at least for those of us lucky enough to live in the Vaccinated West. New Yorkers — remarkably diligent wearers of face coverings for more than a year now — were already beginning to unmask on the sidewalks before the Thursday announcement that the government is recommending that vaccinated people can unmask in most places. There's room for plenty of argument about whether masks were truly necessary outdoors in the first place (probably not unless in big crowds), but the progress is exciting. Concerts long ago postponed are beginning to announce rescheduled dates. And most excitingly, the great musical of the age, Hamilton,

is coming back to Broadway, as of Sept. 14. Tickets are even affordable, available for under $200. We've had to wait for it, but soon we'll be back in the theaters. Congratulations to us all. And have a great weekend. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment