| Hello. Today we look at the man leading the charge to clean up China's more than $50 trillion financial sector, how Fed officials are downplaying inflation risks, and how U.K. workers are heading back to their offices. China's Bailout Sceptic

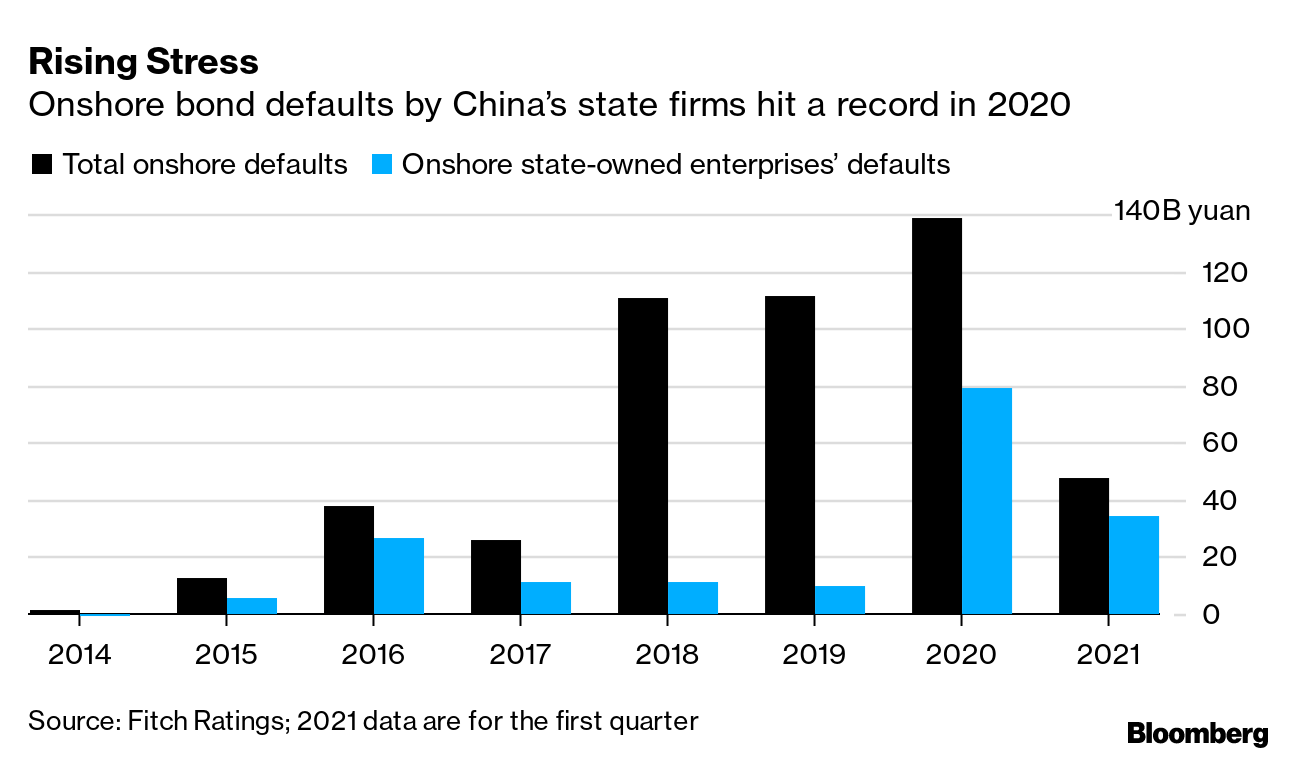

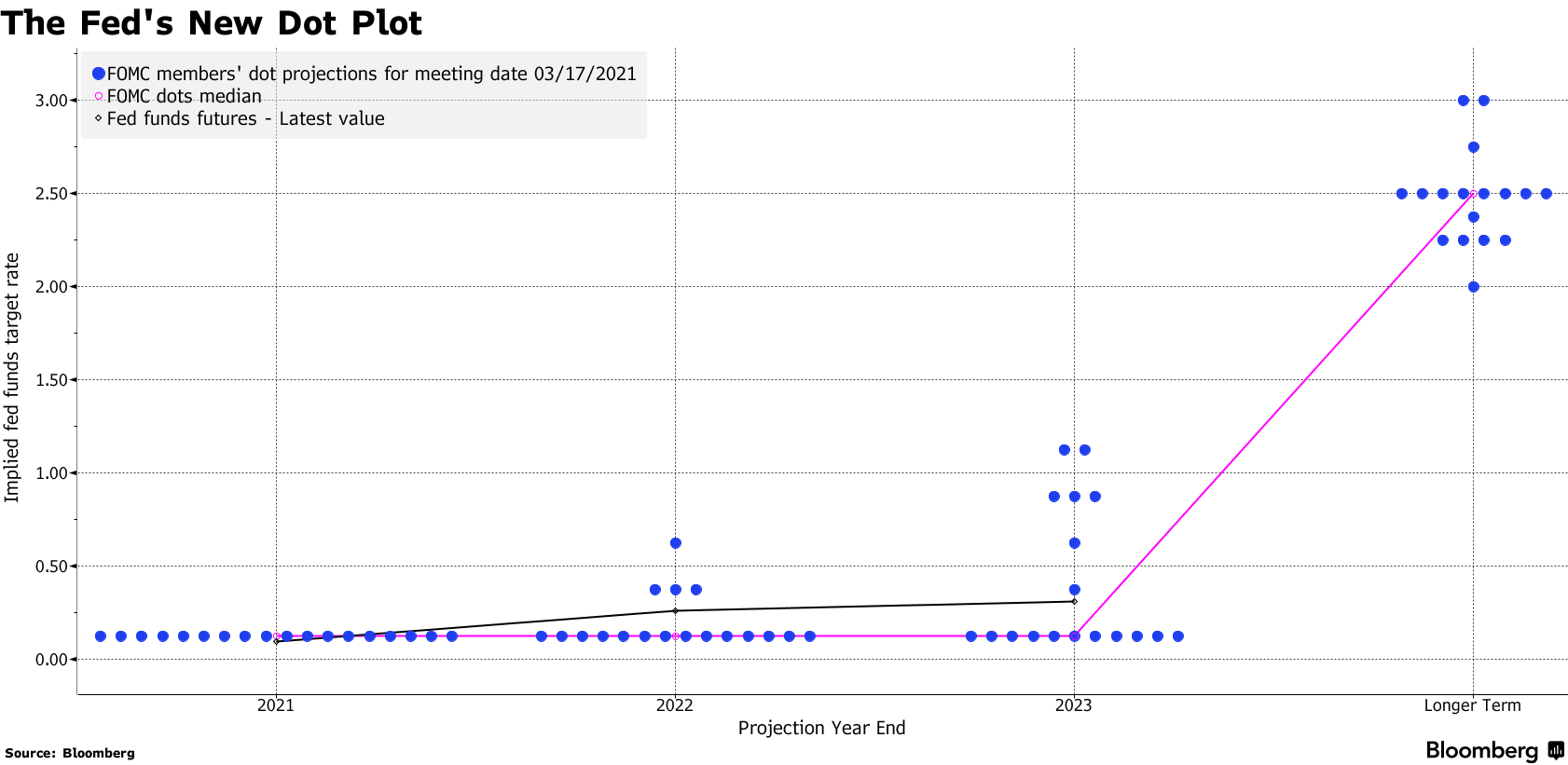

As global investors continue to pour into China's markets, there's one official in particular they should be watching closely: Vice Premier Liu He. Better known globally as the chief negotiator in trade talks with the Trump administration, Liu, 69, is President Xi Jinping's economy czar and has been leading the charge to curb risks in the nation's more than $50 trillion financial sector, as Tom Hancock writes today.  Photographer: WANG ZHAO Photographer: WANG ZHAO The silver-haired Liu has known Xi since childhood. Both are the sons of veteran Communist Party leaders, and both were among the masses of young people dispatched to work in impoverished rural areas during the Cultural Revolution. Liu is Chairman of the Financial Stability and Development Committee, meaning he outranks the top banking regulator and central bank governor. It also means the future of troubled conglomerate Huarong Asset Management may end up being in his hands. Huarong insists it's healthy enough to repay its debts, but markets have been pricing in the risk of default since the company missed a March 31 deadline to report 2020 earnings. With the equivalent of about $41 billion in bonds outstanding, investors would do well to read up on Liu's views on whether state-owned enterprises like Huarong should be bailed out.  While he's yet to speak publicly about Huarong's fate, Liu's past comments suggest he believes allowing SOEs to default is a necessary step to force lenders to price risk based on a borrower's business prospects rather than its Communist Party links. Last summer, while China was still struggling with fallout from the coronavirus pandemic and politicians in the U.S. and Europe were supporting their economies at almost any cost, Liu said the task of eliminating weak companies "must be handed over to the market." Foreign investors increased their holdings of local stocks by 62% last year and held about $518 billion worth of March, while their bond holdings rose 47% in 2020 and now total about $571 billion. That makes Liu a key man to watch, not just for China's investors, but for the world's. — Malcolm Scott Save the DateThe fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore this November 16-19, 2021 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. The Economic Scene In yesterday's New Economy Daily, we explored how rising commodity prices are fueling price gains in pockets of the global economy. Federal Reserve officials on Wednesday maintained that President Joe Biden's stimulus binge won't send prices spiraling higher. Vice Chair Richard Clarida told CNBC inflation will be "close to our long-run objective of 2%," while a number of his colleagues also hosed down price jitters. "The hawks are now doves," Neil Dutta, head of U.S. economics at Renaissance Macro Research, told clients. Today's Must Reads - Vaccine trade. The U.S.'s new support for a waiver of intellectual-property protections for Covid-19 vaccines heads to the World Trade Organization for potentially thorny talks over sharing the proprietary know-how needed to boost international supplies of the life-saving shots.

- Coming up. The Bank of England on Thursday is set to significantly upgrade its growth outlook as the debate shifts away from whether it should cut interest rates below zero to how fast can the economy recoup its pandemic-induced losses.

- Labor Shortage. On the eve of Friday's U.S. payrolls report, companies including Chipotle and MGM Resorts say they can't find enough workers. For now, economists and policy makers are hoping that is a temporary problem otherwise the recovery could be slowed.

- Yellen test. Even with Democrats controlling both chambers and the White House, Treasury Secretary Janet Yellen faces the challenge of speeding a debt-ceiling increase through Congress without shaking investor confidence. The current suspension of the U.S. borrowing cap — a political football in the past — expires on Aug. 1.

- Taxing times. Biden's proposal to set a minimum global corporate tax of 21% is gaining momentum, with the international negotiator saying a deal could settle near that rate. Meanwhile, his administration's domestic plan to to raise $700 billion over a decade from increased tax audits of the wealthy and corporations will probably take years to bear fruit and faces skepticism that the figure is realistic.

- Hikes ahead. Brazil lifted its benchmark interest rate by 75 basis points and promised another increase of the same size next month in a renewed push to bring inflation back to target. Norway's central bank says it's still on track to begin the first rate-hike cycle of the advanced world since the pandemic struck.

- 19th century economics. The theory that people assume they'll ultimately have to pay for the government's budget may deter consumers from splashing the savings accumulated during the pandemic, one European Central Bank official is musing.

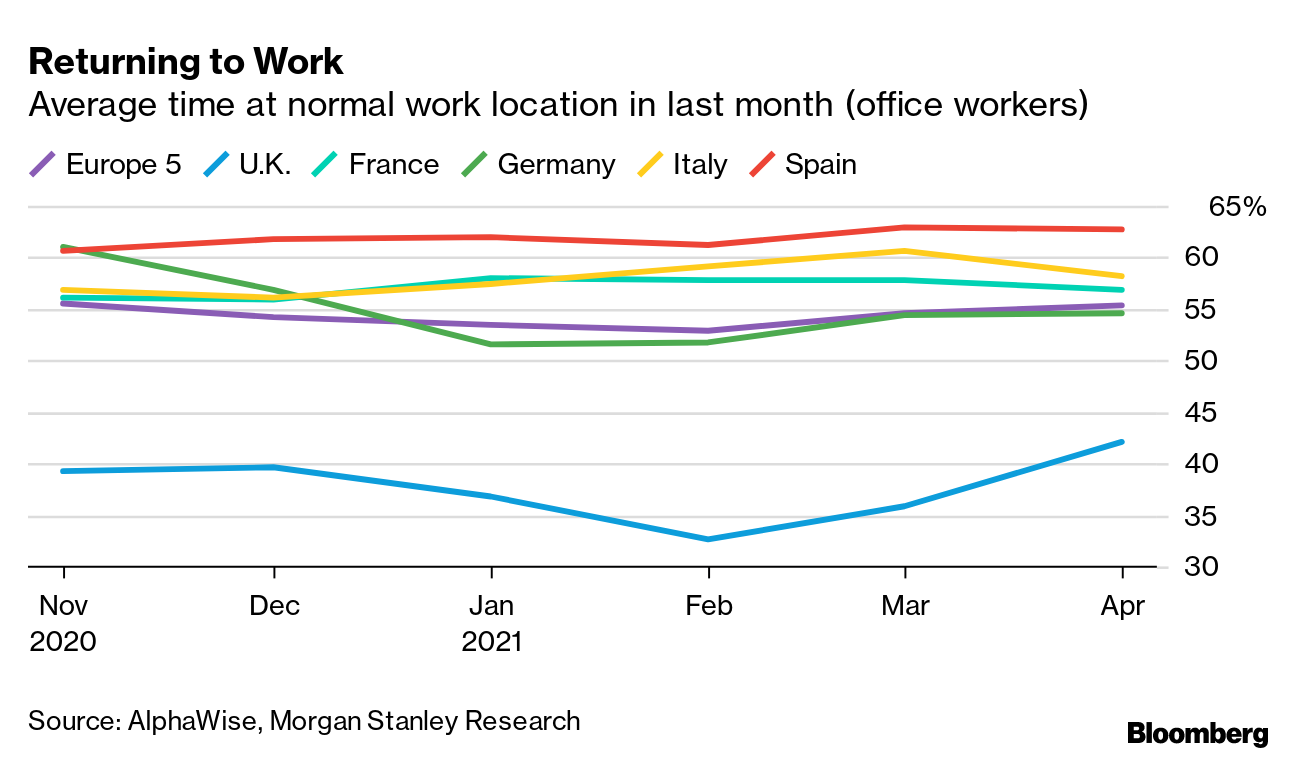

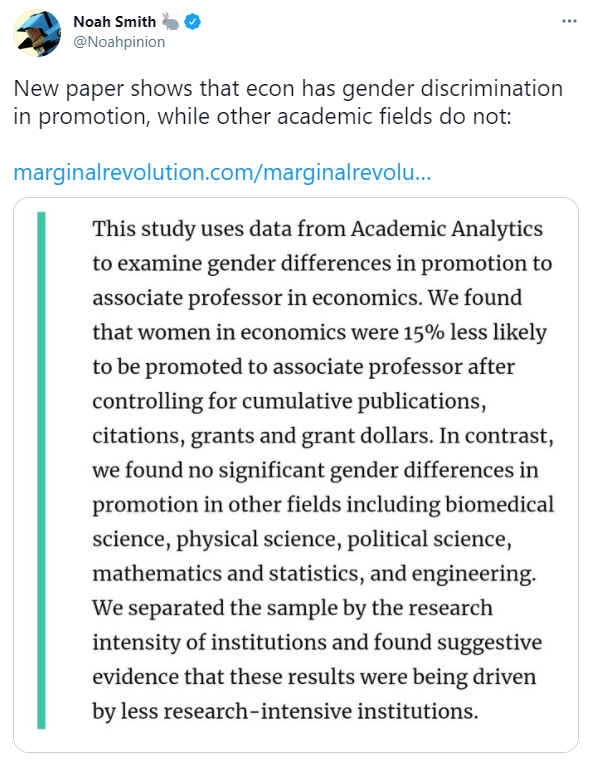

Need-to-Know ResearchU.K. workers are returning to the office, providing fresh evidence that life is getting back to normal. Morgan Stanley's Alphawise survey showed Britons spending more than 40% of their time at their usual place of employment last month compared with a third as recently as February. But, the figure is still well below those in other European countries.  On #EconTwitterWomen in economics are 15% less likely to be promoted to associate professor, according to a new study that shows no such gender difference in other fields.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment