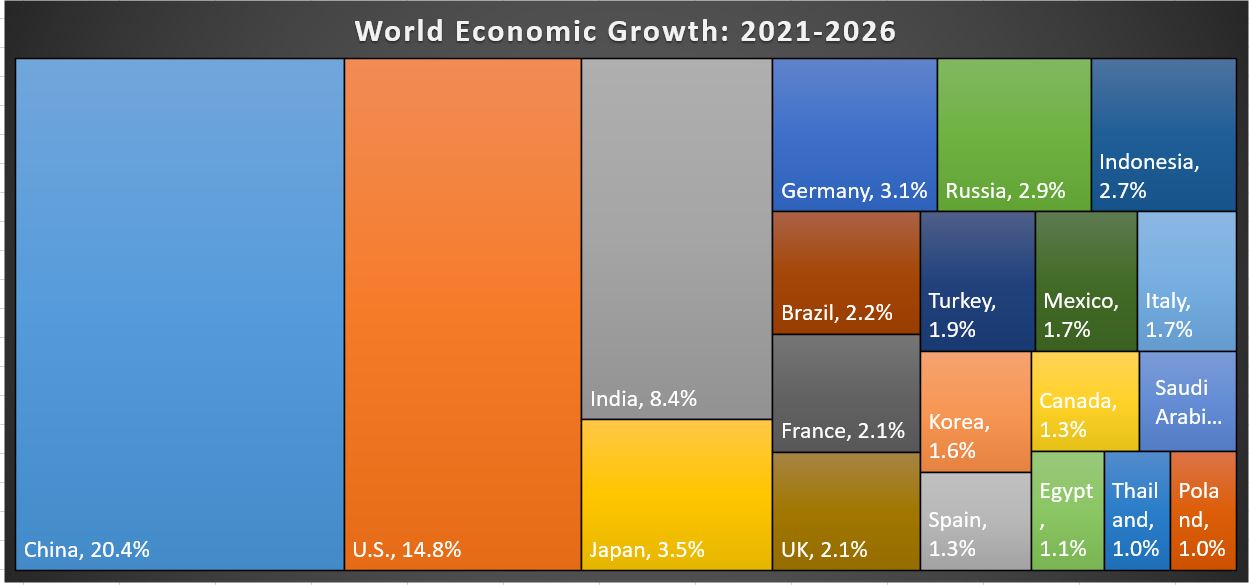

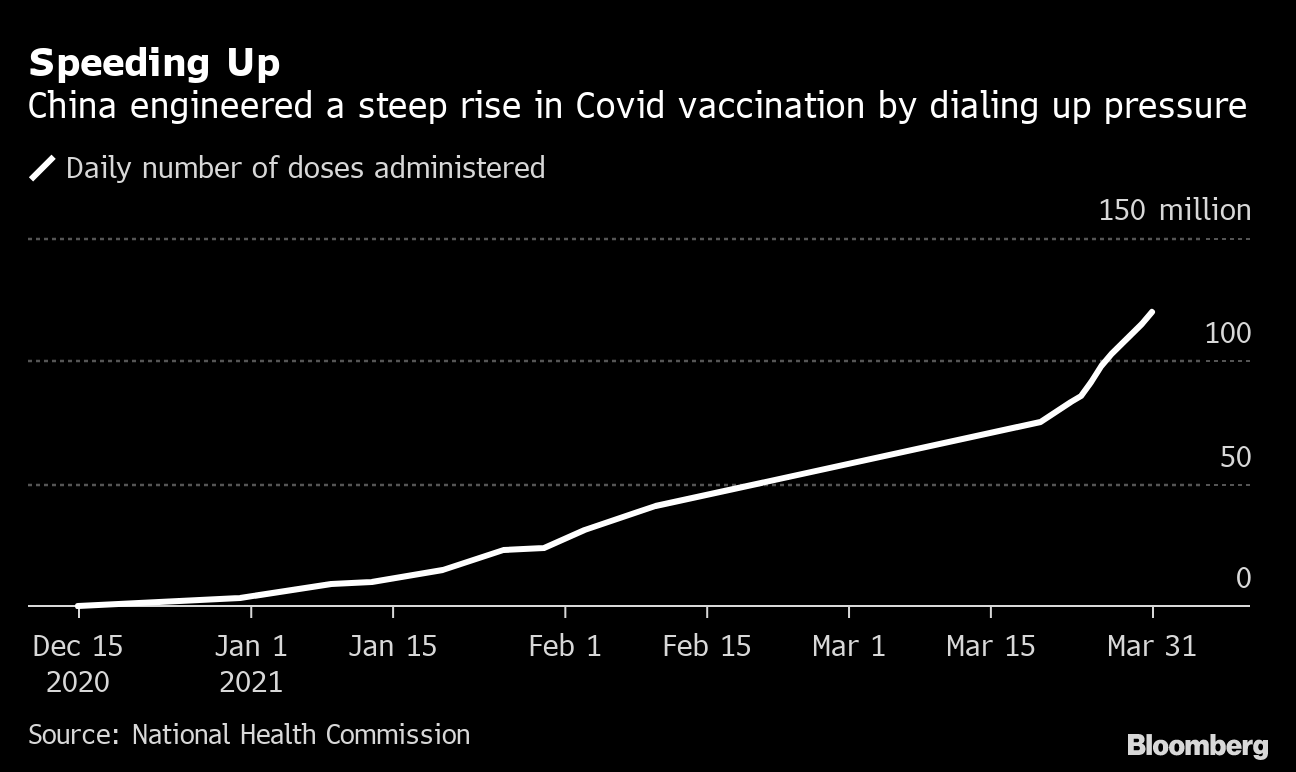

| The one thing that seems certain about the 2022 Winter Olympics in Beijing is that they will be anything but normal. This past week illustrated that fact. It began Tuesday when Ned Price, spokesman for the U.S. Department of State, said a boycott was "on the agenda" and "an area that we certainly wish to discuss" with allies. The White House quickly walked that back, with spokeswoman Jen Psaki saying Wednesday there were no talks about a boycott. But by then the debate about the games had already erupted. The idea of a boycott has been raised before. A public letter signed by 180 human-rights groups and activists called for just that in February. What made this week noteworthy, though, was that it made the likelihood of a boycott, at least before the White House's denial, look more real than ever. But there are also reasons to think that a boycott remains the less likely outcome. For one, Beijing will push back. Indeed, President Xi Jinping in a call this week with German Chancellor Angela Merkel emphasized how the Winter Olympics would promote exchanges between Europe and China. Foreign Minister Wang Yi had a similar message for his Japanese counterpart Toshimitsu Motegi when they spoke. It's also unclear how much leverage a boycott or the threat of one would offer. The issues of Xinjiang and Hong Kong are the most cited reasons for why countries shouldn't participate, but Beijing has publicly described these as part of China's core interests. That does not leave much room for maneuvering. There's also plenty of opposition in the U.S. to barring American athletes, some of whom have trained a lifetime for the chance to compete. That was why Mitt Romney, the U.S. senator and former presidential nominee, suggested last month that it should be American businesses that are instead asked to stay away. Even if Washington doesn't explicitly ask U.S. companies to avoid the games, there will likely still be pressure for firms to do so, such as from the rights groups advocating a boycott. That will leave companies with a prickly conundrum.  Bloomberg Bloomberg It's hard to overstate China's importance to commerce. According to the International Monetary Fund's latest estimates, the country will be the main engine for global growth from this year through 2026, accounting for more than a fifth of the world's total economic expansion. And China can boycott as well, as illustrated by the recent uproar that followed retailer H&M's statement that it won't use cotton grown in Xinjiang. Businesses may end up being forced to choose between criticism at home for participating in the Winter Olympics or being targeted in China for not. Japan's DilemmaReconciling Japan's defense alliance with the U.S and its economic relationship with China has been a tricky balance for Tokyo, as it has been for many countries. What has put Japan's situation in focus recently is that Prime Minister Yoshihide Suga is scheduled to meet with U.S. President Joe Biden at the White House next week. China will certainly be a topic of discussion. One issue the U.S. president may want to talk about is Tokyo's reticence to sanction China, its largest trading partner, over Beijing's actions in Xinjiang. Japan is the only member of the Group of Seven that's yet to do so. Beijing has made its position on the matter clear. In a phone call this week, Chinese Foreign Minister Wang told his Japanese counterpart Motegi that he hoped Japan would steer clear of "internal issues" such as Xinjiang and Hong Kong, and not be led by countries that are biased against China. Being stuck between the world's foremost powers is a position no country wants to be in, but a place more and more are finding hard to escape. Outflow ConcernsData released this week showed that foreign holdings of Chinese government bonds fell in March from a month earlier. It was the first reduction in two years.  While the dip of about $2.5 billion was relatively small compared with total foreign holdings of $312 billion, it will nonetheless add to concerns that China could face outflow pressures in the coming months. The main catalyst has been a stronger American economy, which has pushed up inflation expectations and yields for U.S. government debt. That's made it less attractive to hold Chinese government bonds as opposed to Treasuries. A recent slump in the yuan, which gave up all its 2021 gains in March, has added to that dynamic. Beijing has long been paranoid about outflows, especially after the yuan's sharp plunge in 2015. The worry is that a rapid movement of money out of the country could endanger financial stability. If this selling of Chinese government bonds continues and escalates, authorities may feel compelled to try to stem the outflow. Vaccine RolloutChinese state television has begun calling it a patriotic responsibility to get vaccinated against Covid-19. Goodies such as free eggs and shopping coupons are being dangled to lure people in for shots. Buildings in Beijing's financial district have started posting signs showing what percentage of their tenants have been inoculated. These are just some of the ways China has sought to supercharge its vaccination drive after a sluggish start saw it fall behind the U.S. and some other Western countries. At stake is how quickly nations can achieve herd immunity and return their economies to something closer to normal. Beijing's efforts appear to be working. In recent weeks, China has administered as many as 7 million doses a day, a significant increase from averaging less than a million a day at the start of 2021. Indeed, the push is working so well that the country's vaccine makers are struggling to keep up, with some residents now finding it hard to get a shot. That's just the tip of the iceberg given China's huge population. To hit Beijing's target of inoculating 40% of its citizens by the end of June, China will need to get out some 460 million doses in the next three months. That's more than double the goal the Biden administration has set for roughly the same time span.  What We're ReadingAnd finally, a few other things that caught our attention: |

Post a Comment