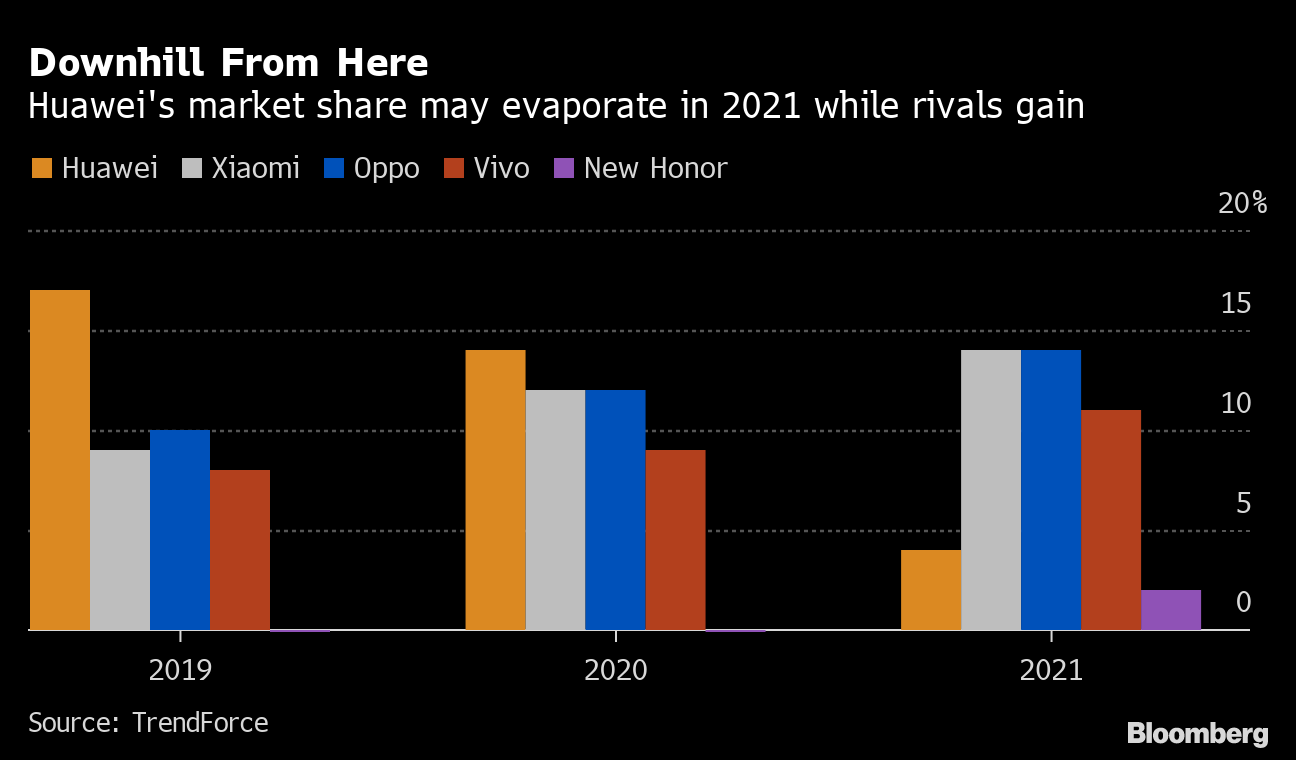

| There were many in Beijing who hoped President Joe Biden's election might pave the way for a reset in China's relationship with America. That optimism is increasingly in short supply. Displacing it has been a creeping suspicion that Biden may ultimately adopt much the same approach former President Donald Trump pursued. The acrimony on display in Alaska last month did much to stoke such conjecture. This week provided even more fuel.  U.S. and Chinese delegations meet on March 18, 2021 in Alaska. Photographer: Frederic J. Brown/AFP/Getty Images On the trade front, Biden has stayed put on the tariffs Trump imposed on Chinese imports. Indeed, newly appointed U.S. Trade Representative Katherine Tai told the Wall Street Journal that they won't be lifted anytime soon. Her office followed up by releasing a foreign trade estimate for 2021 that took aim at "Made in China 2025," a plan that was also much harangued by Trump. The continuity of American policy was also on display diplomatically. In its annual human-rights report released Tuesday, the U.S. Department of State reaffirmed a decision to label China's treatment of the ethnic Uyghur population in Xinjiang as "genocide." That designation came into effect in the final days of the Trump administration. Then there was the criticism directed this week at the World Health Organization's investigation into the origins of Covid-19 after its findings were released Tuesday. The controversy centered on whether the WHO team that conducted the probe had spent sufficient time looking into the theory favored by Trump that the virus originated from a laboratory in Wuhan, where the coronavirus first emerged. Surprisingly, one of those most direct in his disapproval of the report was WHO Director-General Tedros Adhanom Ghebreyesus, who said the investigators had been too quick to dismiss the theory of a lab leak. The U.S., along with more than a dozen other countries, issued a joint statement questioning if the probe had adequate access to data and samples, without mentioning the lab theory. A sudden shift away from Trump's policies was always unlikely. After all, Biden did make clear he wanted to a comprehensive review before making any major changes. But the longer Biden's team goes without clearly defining how its priorities will differ from those of the previous administration, the more Beijing will wonder if Trump has really left the White House. Grip Tightens on Hong KongHong Kong has been one of the most intractable issues fueling tensions between the U.S. and China. The events of this past week made any potential accommodation look even more remote. It began Tuesday with Beijing approving a sweeping overhaul of Hong Kong's electoral system. The measures included establishing a process for vetting candidates who stand for election to the city's Legislative Council. Critics lambasted the move as an effective end to open elections in the financial hub. Supporters say the changes are needed to ensure Hong Kong's security and stability. Two days later, several of the most prominent members of Hong Kong's political opposition were convicted of participating in an illegal protest in 2019. They included Martin Lee, known as the city's "father of democracy," and media mogul Jimmy Lai. These moves not only tighten Beijing's grip over Hong Kong, but will also put more pressure on the U.S. to respond. Just last month, the Biden administration imposed sanctions against 14 Chinese lawmakers, including a member of the 25-member Politburo, as part of the Hong Kong Autonomy Act. More may now be on the way.  Martin Lee, left, arrives at court in Hong Kong on April 1. Photographer: Chan Long Hei/Bloomberg Steely Resolve to Go GreenIt's hard to overstate how important China is to the global steel industry. The country is the metal's biggest producer, exporter and importer. That's why ears perk up around the world when Beijing begins signaling tweaks to how it manages domestic production, as it did this week. First was the news that China wants the industry's carbon emissions to peak before 2025 and then to cut them by 30% by 2030. It was then revealed that Beijing is also considering tax changes that would discourage steel exports while encouraging imports. With China's pledge to be carbon neutral by 2060, these measures make sense. Steel accounts for 15% of the country's emissions, the biggest of any manufacturing sector. Indeed, authorities have already begun punishing mills that flout production limits. The implication for supplies could be substantial. Optimism has been building as of late that a post-pandemic recovery will lift international steel demand. A substantial reduction in Chinese exports, combined with an uptick in the country's imports, could notably tighten the global market. The natural result would be higher prices.  Sanctions Finally Bite HuaweiIt's been almost two years since Washington began limiting Huawei's access to American technology products. During that time, the Chinese tech giant has been surprisingly resilient as it continued to report increases in revenue. But nothing lasts forever. This week Huawei announced that sales in the fourth quarter fell 11% from a year ago, the first such drop on record. It appears that Washington's ever-tightening sanctions are finally starting to bite. Most impactful have been efforts to cut Huawei off from supplies of advanced semiconductors. That's pummeled the company's smartphone business, which had once vied with Apple and Samsung for global leadership. Huawei is now losing market share even in its home market. The company is not sitting still, of course. It's expanding into new businesses such as supplying equipment for agriculture and mining. There have even been reports that Huawei may start making electric cars. None of that, however, will make the future any less uncertain.  What We're ReadingAnd finally, a few other things that caught our attention: Something new we think you'd like: The Hyperdrive newsletter is all about the future of cars, written by Bloomberg reporters around the world. Sign up to get it in your inbox. |

Post a Comment