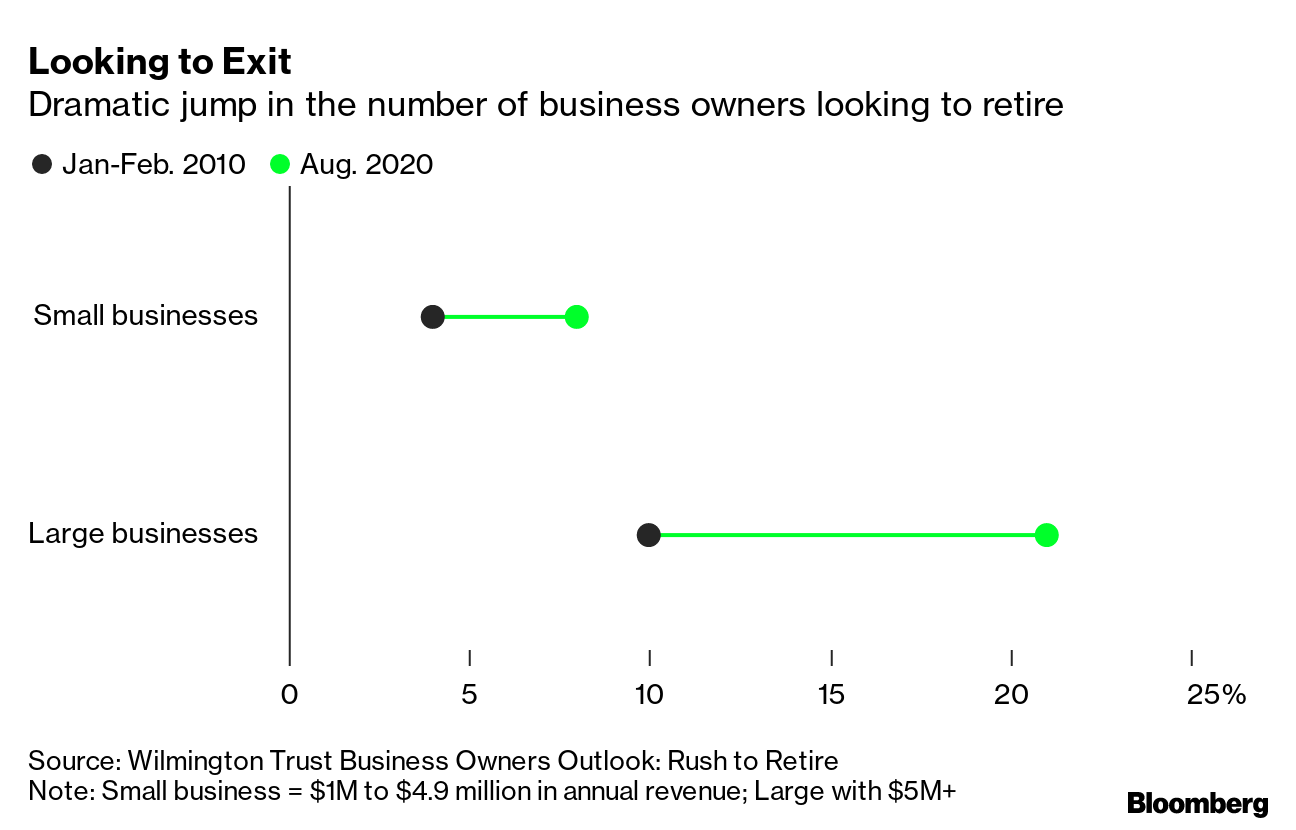

| Hello. Today we look at why many Americans are retiring early, how women have been hurt the most economically by the pandemic and highlight the surge in global demand. Not Going Back As most Americans prepare to go back to the office, many are planning never to return. Soaring stocks and house prices plus the monotony of Zoom calls and the experience of living through a deadly pandemic are combining to nudge some who can afford it into early retirement. Check out the numbers behind the trend, which you can read about here in a story by Alex Tanzi and Michael Sasso: - About 2.7 million Americans age 55 or older are contemplating giving up work years earlier than they'd imagined because of the coronavirus, government data show

- The number of people expecting to work beyond 67 fell to a record 32.9% last month, according to a New York Federal Reserve survey

- Assets for Americans ages 55 to 69 rose by $4.2 trillion in 2020, including a $2.2 trillion increase in equities and mutual fund shares, the Fed calculates. Real estate assets soared by almost $750 billion

As the lucky head for an easier life, their exit carries an economic cost by depriving companies of skills, productivity and mentors.

Federal Reserve Chairman Jerome Powell this week noted a "significant number" of people saying they've retired as a reason companies are starting to report labor shortages.

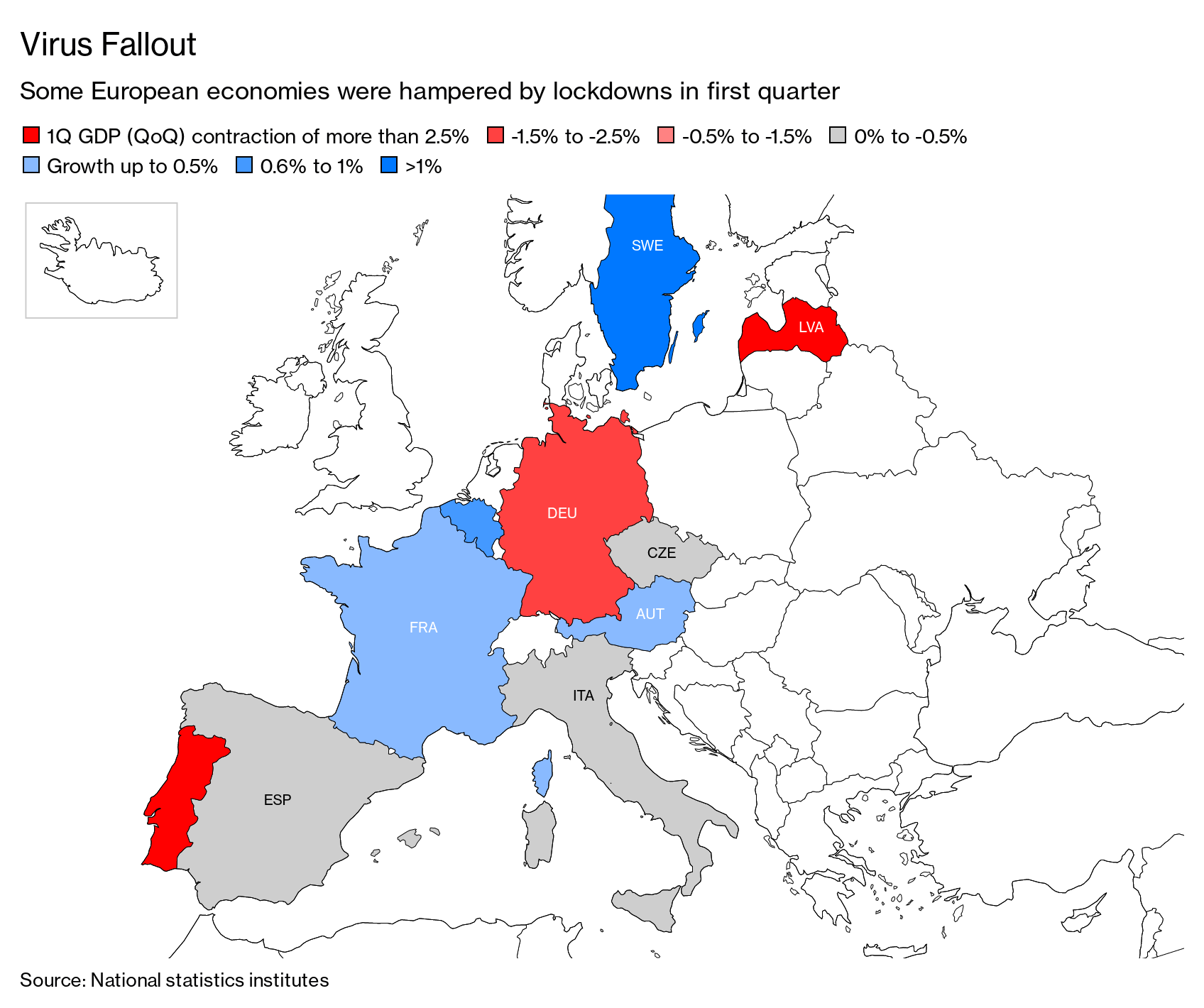

Fields such as healthcare and education may be particularly hurt. Almost a third of physicians are over 60, the Physicians Foundation estimates. "Older workers are especially strong in soft skills — things that develop over time and are difficult to teach," said Susan Weinstock of seniors advocacy group AARP. —Simon Kennedy The Economic Scene A day after the U.S. economy recorded a consumer-led surge in gross domestic product, the euro-area headed in the other direction. The 19-nation bloc succumbed to a double-dip recession in the first quarter amid the slow rollout of vaccines. All is not lost, however. The hope is that the summer arrival of a government-backed recovery fund along with increased global demand will spur activity. Today's Must Reads - Do you want fries with that recovery? Bellwethers of consumer demand reported good news on Thursday. McDonald's logged its first quarter of global sales growth in more than a year, while Caterpillar said earnings beat expectations. Amazon, a darling of the pandemic, announced record first quarter earnings.

- The Chinese factory outlook eases. A gauge of manufacturing activity slipped in April as did the services sector, signs the economy is still recovering yet at a slower pace.

- Commodity prices signal inflation concern. Copper is trading around its highest since February 2011, the cost of lumber is at an all time high and wheat is headed for its biggest monthly gain in almost four years. Some are blaming the weather.

- U.S. stimulus momentum. President Joe Biden is set to see some version of his $4 trillion economic plan passed by Congress by September or October if he can unite his Democrat party. Top earners are already seeking advice.

- London isn't calling. Young professionals are moving out of the U.K. capital. Demand on SpareRoom, a website that pairs up people seeking house shares and rooms to rent, has plunged 23% since the start of 2020. At the other end of the income scale, a record 84 Dubai properties, each worth 10 million dirhams ($2.7 million) or more, changed hands last month, according to Property Monitor.

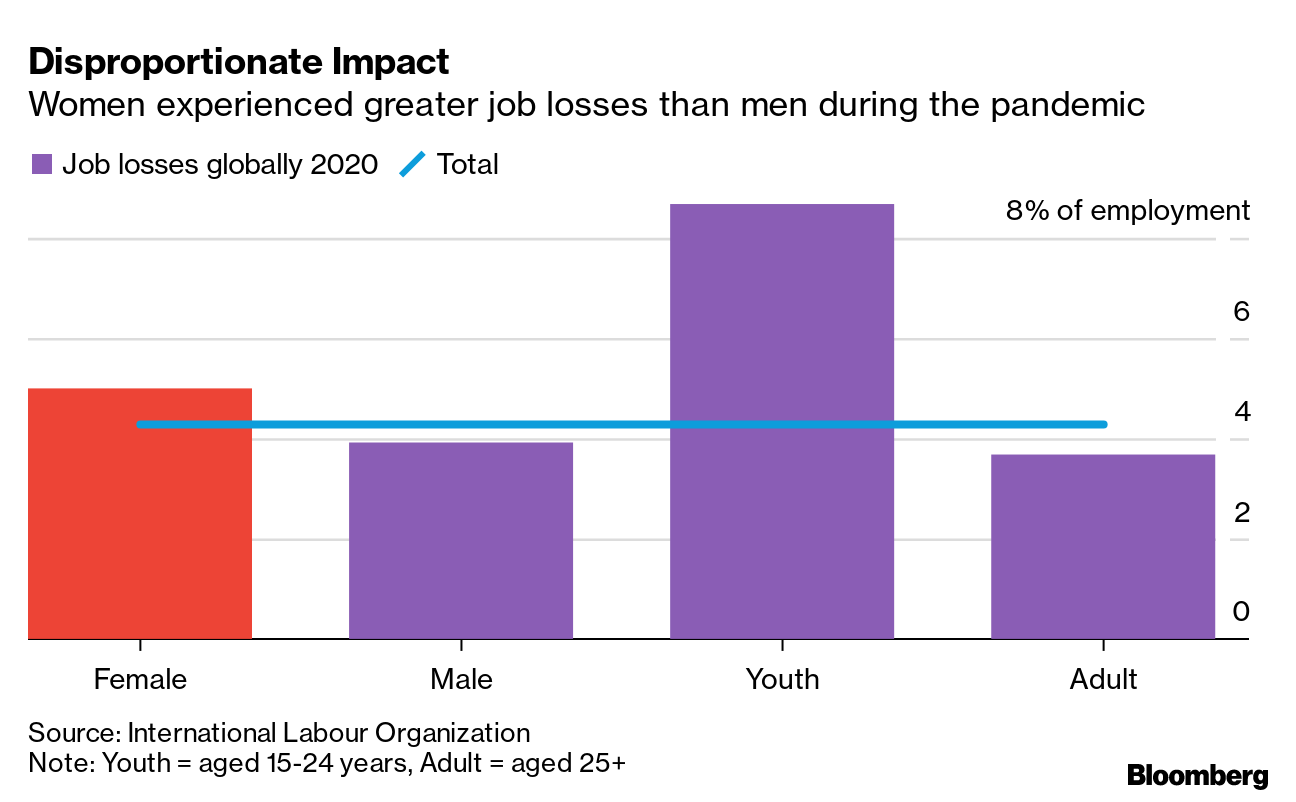

Need-to-Know ResearchThe Covid-19 pandemic had a greater economic impact on women due to over-representation in industries hardest hit by the crisis, according to Oxfam. Women around the world lost at least $800 billion in income in 2020. That's more than the combined output of 98 countries and the $700 billion in market capitalization that Amazon gained in 2020.

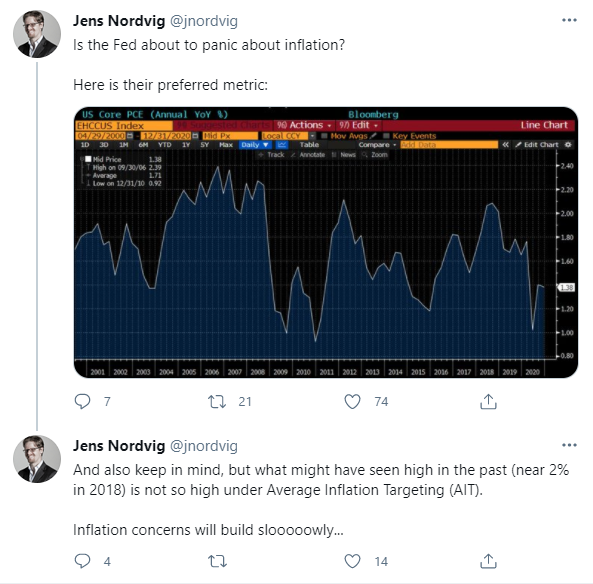

A separate report by the Inter-American Development Bank showed the virus has set back working Latin American women by over a decade.  On #EconTwitterDespite mounting fears of an inflation outbreak, the Fed's key gauge seems under control.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment