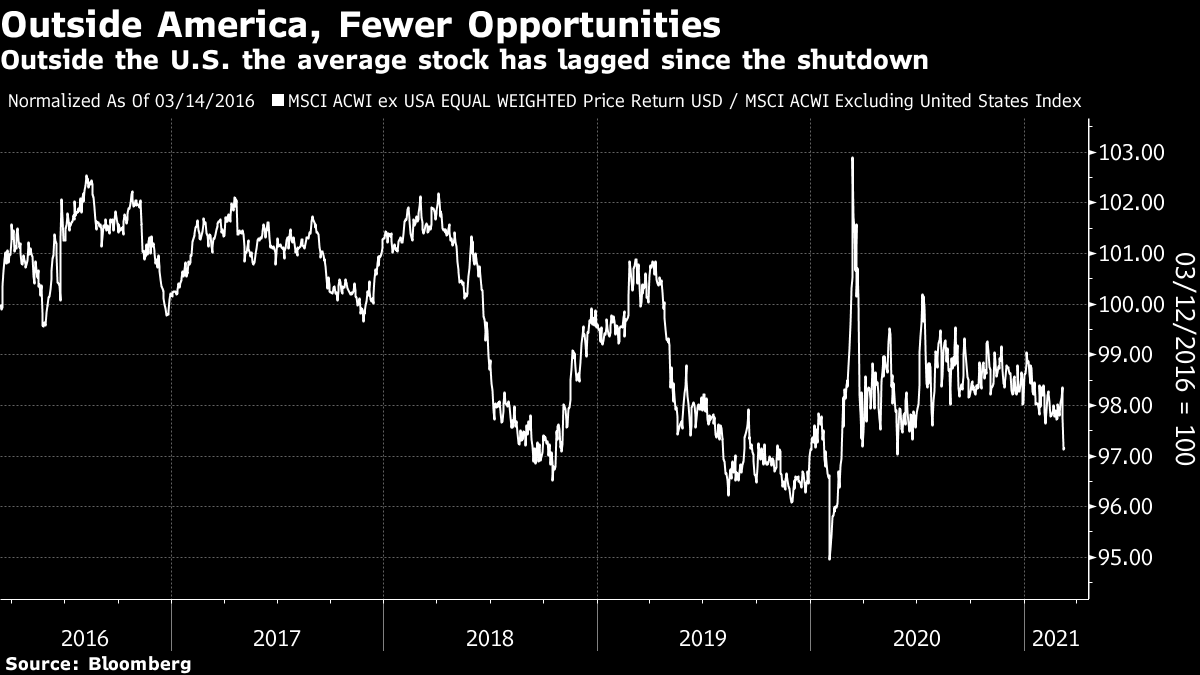

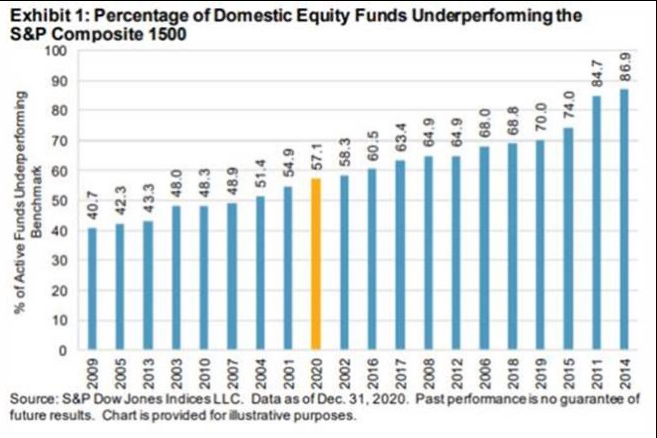

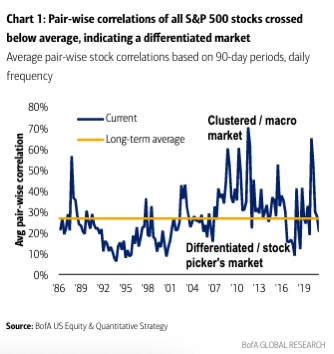

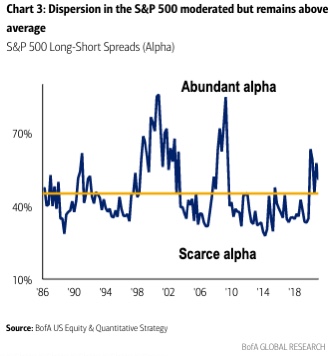

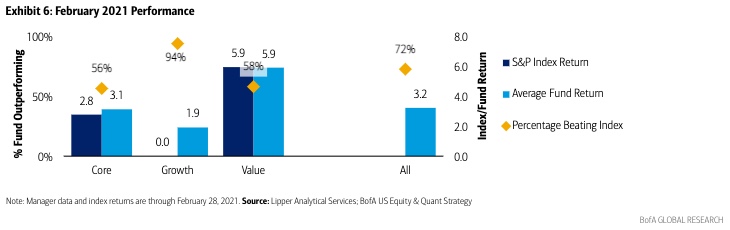

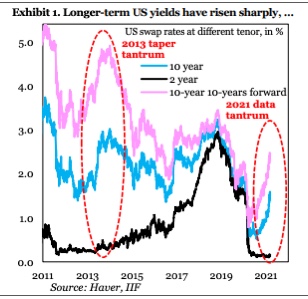

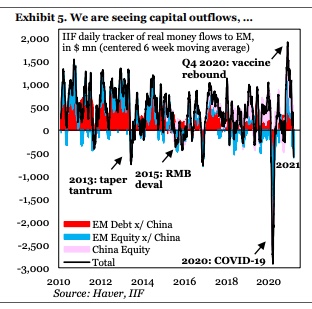

Winners and LosersAfter another day of screeching turns in the U.S. stock market, and an enthusiastic attempt by the European Central Bank to keep bond yields down, the winners and losers from the recent turbulence are growing clearer. Active managers, after a dreadful year, have enjoyed a revival. The question is how long it can last. The losers, following a script that has played out many times in the past, are the emerging markets. StockpickersLet's start with active managers. The market is so dominated by institutional investors these days that it grows ever harder for a majority of active managers to beat their benchmark, particularly after fees. Cruel mathematics suggests that after costs, most are bound to fail, and that good performance doesn't persist. But at least the last few months have given them an opportunity, which many have taken. One basic way to measure the opportunity for active managers is to compare the performance of the equal-weighted benchmark, in which every stock counts the same, with the market cap-weighted version. If the equal-weighted version is ahead, it means that the majority of stocks are beating the index, and that hence the opportunity set to outperform the benchmark is greater. Over history, as the equal-weighted version gives a greater weight to small companies, and small companies tend to do better over time, it does indeed tend to beat the cap-weighted version. That has not been true recently. Over the last five years, the equal-weighted version suffered steady underperformance, which turned into a rout with the Covid shutdown. But for the last six months, the average stock has done much better than the index:  The one-word explanation for this is "FANG." The dominance of the big internet platform companies has made beating the index very difficult in the U.S. Either they overweight the FANGs, which is very risky in the long term, or they lose. Interestingly, the trend is very different for the world excluding the U.S.. The same chart for the MSCI All-World excluding U.S. index shows a steady and much more limited underperformance, a rebound, and then poor performance of late. Outside the U.S., bigger companies have tended to do well recently. The absence of the FANGs means that the whole pattern of the last five years is far less dramatic:  Another way to measure the fate of active managers is to look at the performance of "pure" stockpickers. The equity market-neutral strategy involves going 50% "long" and 50% "short" (thus with no overall exposure to the level of the market). In a classic version, it involves a series of pairs. For example, if the manager is confident Ford Motor Co. will beat General Motors Co., it would go long Ford and short GM. There is no sector exposure, just a pure judgment on which company is more attractively priced. Judging by the HFRX index of equity market-neutral hedge funds, these pure stockpickers have done horribly over the last five years:  After a brief dive during the shutdown last year, market-neutral funds have been making money. This is another sign of the possibilities now open to them. These basic indicators are borne out in the overall statistics for active fund performance last year. Last year, according to the S&P Dow Jones Indices LLC "SPIVA" methodology, 57.1% of U.S. equity funds lagged behind the broad S&P Composite 1500. The last year a majority of funds managed to lead the index was 2013. With performance like this, it isn't surprising that passive index investors are growing ever more dominant:  But as we have seen, the opportunities to beat the index are growing. (To be clear, the opportunities to lose to it are also growing — the key point is that when stockpicking doesn't boil down to a decision on how much to trust the FANGs, stockpickers should have a chance to prove that they really are skillful.) Two factors crucially determine their opportunity. First is correlation; the less stocks are correlated with each other, the better the chance to stand out by choosing the right ones. In a crisis, everything tends to get correlated, which was certainly true last year. Now, as the following chart from BofA Securities Inc. shows, they have at least a decent shot to show their ability:  Second and possibly more important, stockpickers need dispersion. This refers to the amount by which stocks' returns vary from each other. Stocks can have low correlation, but if they all buzz around in a narrow range it is still very difficult to beat the index after costs. As we have seen of late, dispersion has been its highest since the global financial crisis, and it remains above its long-term average:  This has indeed translated into a spectacular change in active managers' fortunes. In February, 72% of U.S. active managers beat their benchmark, according to BofA. Among growth managers, an amazing 94% beat the growth benchmark, possibly because they were virtually all underweight in Tesla Inc.:  To be clear, no sensible person would ever choose a fund on the basis of one month's performance. Despite this, many people do exactly that. In the quite possible event that dispersion remains high with low correlation for another few months, there is that much more chance of a shift toward active managers again. That could be a big deal. Anniversary League TablesWith Joe Biden addressing the nation on live television Thursday night, it seems that we are treating this as the one-year mark of the pandemic. So, here are two screen-grabs from the terminal to give an idea of what kind of money was there to be made for those who called the pandemic and its effects correctly. The dispersion was remarkably wide. There are more than 1,500 companies in the MSCI World index. These are the top 10 in the 12 months of the pandemic, all of which gained more than 300%:  Some of those names, especially Moderna Inc. and Zoom Video Communications Inc., were virtually unknown back then, and there should be no surprise that Tesla is on top (though note from the first column that it is down slightly for the year so far). Enphase Energy Inc., less famous than some of the names around it, is a solar power producer. These are the bottom 10, again with some of the inadvertent "stars" of the pandemic:  It is no surprise to see a cruise company at the bottom of the heap, followed by airlines and oil companies. Galapagos NV, again a less familiar name, is a Belgian biotech group. To see the opportunities both to make and lose money, note that Occidental Petroleum Corp. is the third worst performer in the MSCI World over the last 12 months, even though it is up almost 79% for the year to date. Moves and changes of direction like this are very unusual. The opportunities to make and lose money are elevated — but ultimately, the case for minimizing costs and tracking the index seems even stronger after looking at these league tables. Emerging MarketsIf there are clear losers from the rise in yields and the subsequent risk rotation, they are in the emerging markets. This rise in yields isn't yet on the scale of the "taper tantrum" of 2013, and it hasn't had as serious an impact on the emerging world. But it is having an impact. In the last few weeks, the performance of MSCI's emerging markets index relative to its developed world index has overlapped almost perfectly with real Treasury yields — as these rise, emerging markets fall:  The following charts come from the Institute of International Finance, which suggests that this incident, the "data tantrum," is at least worthy of comparison with what happened in 2013:  The IIF says that the violence of the rise in U.S. longer-term rates has led to sizable outflows from EM, which are now near levels last seen at the height of the taper tantrum with outflows concentrated in non-China markets.  Coming at a time when a belief in global reflation and a return of risk appetite should mean strong flows into emerging markets, the incident is testimony to the enduring power of the U.S. and its bond market over international capital flows. If yields rise, they will attract money out of emerging markets and into the U.S., come what may. This prompts the IIF into an appeal for a dovish shift by the Fed, as soon as possible: Back in 2013, the taper tantrum ended when the Fed changed its rhetoric with a large dovish surprise in the form of the "no taper" at the September FOMC meeting. We think a similar shift in rhetoric is needed now. More guidance from the Fed on how the Q2 GDP rebound has few implications for the medium-term growth outlook will help anchor longer-term rates and keep financial conditions as accommodative as possible.

They may find that elusive unless there is a major selloff in U.S. equities, which seems to dominate the Fed's reaction function at present. With the main U.S. indexes at or near all-time highs despite the violence of the rotation, that seems unlikely. Thursday's ECB meeting, in which President Christine Lagarde countered allegations that she's lost control by stressing that she had the tools to limit any "undesirable" rise in European yields, did lead them to tick down in the U.S. as well. And this did indeed allow emerging market equities a day of outperformance. But the bottom line remains that emerging markets (outside China at least) remain at the mercy of capital flows, which in turn are driven by sentiment at the Federal Reserve and in the Treasury market. Survival TipsNow that we're a year into the pandemic, it's time for some context. This piece by Justin Fox shows that Covid-19 has been, indubitably, a lot worse than any of the postwar flu pandemics. Unfortunately, we don't and can't know how much worse it would have been without all the controversial attempts to mitigate it. And for the ultimate in perspective, I recommend The History of the Entire World, I Guess, a 20-minute YouTube video which my son appears to know off by heart. It's very good and is one of the many things that has helped sustain us through a miserable 12 months. If you have any other nominations for a single best survival tip after the last 12 months, feel free to share them. And have a good weekend. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment