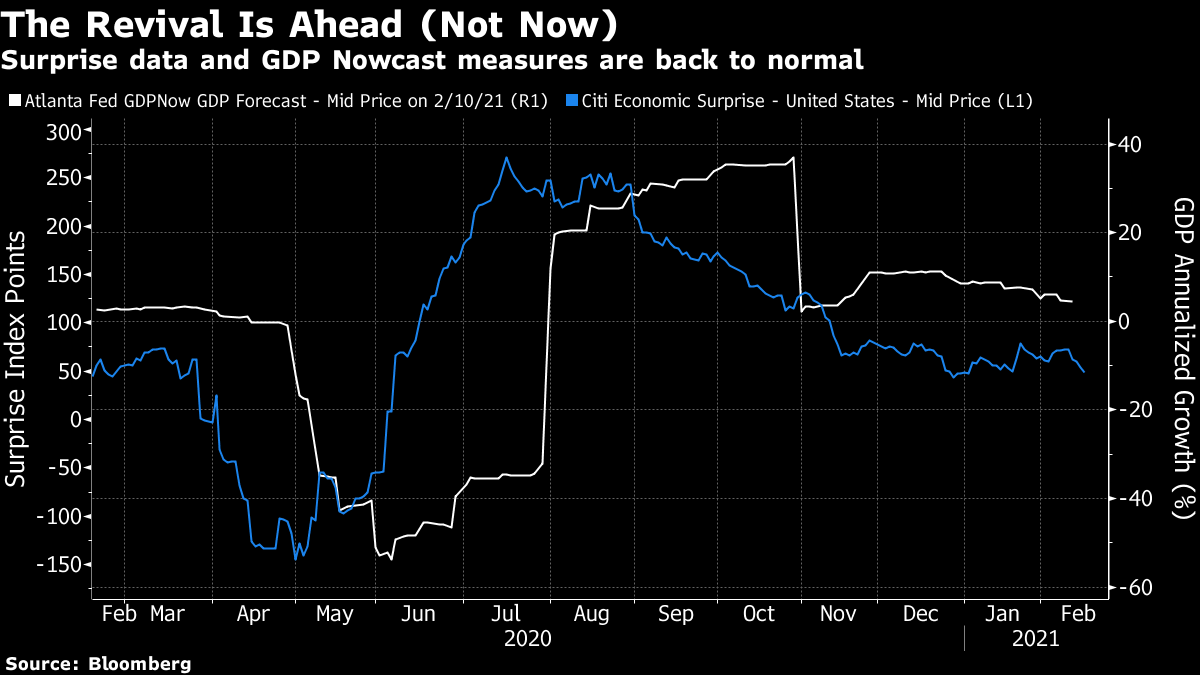

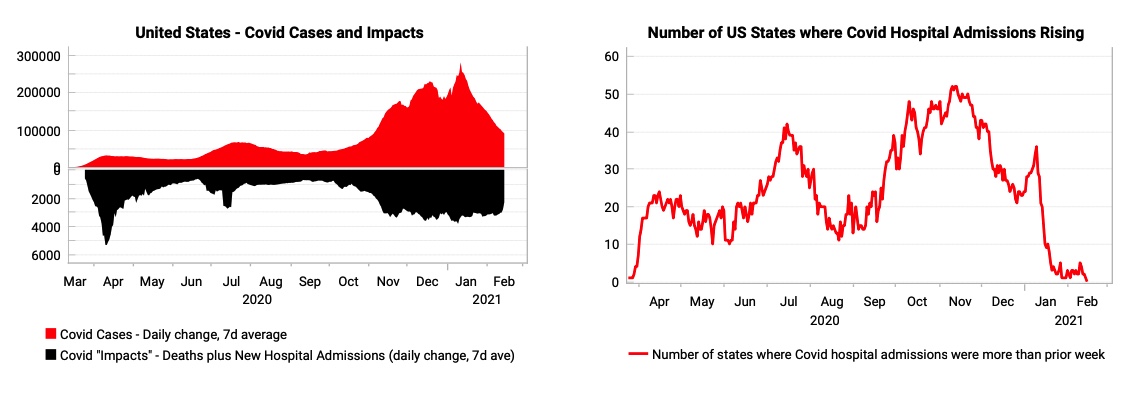

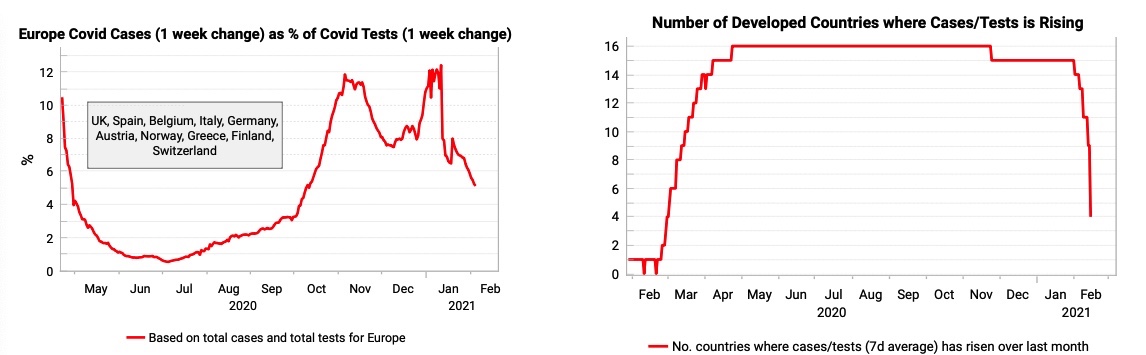

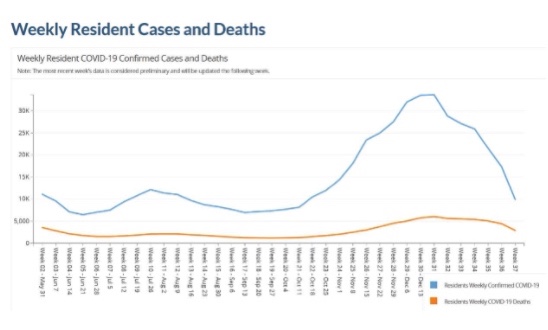

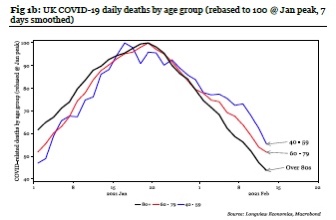

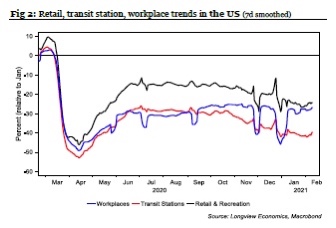

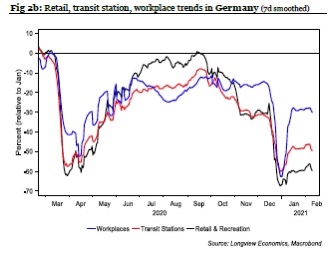

Stocks Beat BondsIt looks like I'm off the hook. Back on Oct. 8, 2018, I started a new chapter in life and reported to work at Bloomberg for the first time. That was also the day when U.S. stocks recorded an all-time high relative to bonds, and began a descent that would become an all-out collapse with the onset of the pandemic 17 months later. These events were, of course, completely unrelated. But I'm still a little relieved that stocks (as proxied by the popular SPY exchange-traded fund) have in the last few days eclipsed their October 2018 high relative to long bonds (as proxied by the TLT exchange-traded fund of Treasury bonds with maturities of 20 years or longer). In a classic signal of optimism about future growth, stocks have now beaten bonds for my Bloomberg career:  Other measures of the bond market confirm a reflationary call, with the yield curve steepening. Meanwhile, commodities are also signaling reflation. The following chart shows the performance since the beginning of 2016 of the Refinitiv/CoreCommodirty CRE index which aggregates a number of sectors, and Bloomberg's own commodity index. The former is sometimes held to underweight energy, while Bloomberg's is sometimes said to overweight it, but both measures are in agreement at present:  Even Japan, the country whose deflation provided a cautionary tale to the rest of the world, is giving out the same signal. The following chart shows 10-year government bond yields since the beginning of 2016, when the Bank of Japan embarked on yield curve control. Yields are positive again, and their highest in more than two years:  Japanese stocks have joined the party. The Nikkei 225, the best-known measure of the stock market, is above 30,000 for the first time in three decades. It first dropped below 30,000 in August 1990, on the news that Saddam Hussein's Iraq had invaded Kuwait. Much history has happened since then. (And incidentally, it started its fall, after peaking on the last trading day of 1989, on my first day at work at the Financial Times; again, I'm sure this is coincidental.)  What is intriguing about all of this is that markets are definitely doing what they are supposed to do, and moving to discount events before they happen. "Surprise" numbers have come down to earth recently, as forecasters have been disappointed by the way developed economies dealt with the resurgence of the pandemic over the winter. The widely followed "nowcast" of U.S. GDP kept by the Atlanta Fed suggests the economy is back to only inching forward:  So why is so much being taken for granted? The answers boil down to two factors. First, economic policy. The phrase "go big," as uttered by newly installed U.S. Treasury Secretary Janet Yellen, fairly screams out from the front of research notes. The return of Mario Draghi to a key position in Europe only strengthens the conviction that policymakers are determined to err on the side of too much action rather than too little. Plainly, the risk is that they will provoke inflation (as former Bank of England Governor Mervyn King argues for Bloomberg Opinion), but they don't want to be cowed by a specter that has remained unseen in decades. (This piece by Binyamin Appelbaum for the New York Times makes that case well). Second, there is the coronavirus itself. A huge market bet is under way that the pandemic is at last coming under control, with vaccines the critical weapon. The case is solid, although carrying a worrying amount of weight, and can be illustrated with some charts. First, Variant Perception shows that U.S. Covid cases and impacts are falling, while hospital admissions have stopped rising virtually everywhere in the country:  In Europe, off to a much slower start in vaccinating, the rate of positive tests is falling. This is happening across the great majority of developed world nations:  News on the most specific areas of risk, which would require the greatest dents in economic activity, is also good. This chart, from Whitney Tilson of Empire Financial Research, shows the number of confirmed cases and deaths in U.S. nursing homes. It certainly looks as though the vaccine is having an impact already:  Data from the U.K. are arguably even more encouraging. Britain was the first developed nation to be hit by a significant variant of the virus, which forced the government into a new and heavier lockdown policy — but it has also been very successful in rolling out the vaccine. The following chart, from London's Longview Economics, shows the trend in the number of deaths from three age groups, up to the peak in January. After an appalling spike as the mutation took hold, the fall-off has been impressive, and must raise hope (if not proof) that vaccines will be enough to counter further variants:  But, critically, while the war on the virus looks as though it might at last be reaching a final and victorious stage, levels of economic activity remain almost as subdued as ever. This is true across many countries. Here are Google mobility data for the U.S., as cited by Longview Economics:  And here are the same data for Germany:  Plenty of other data will confirm that our behavior, whether voluntary or forced upon us by governments, remains restrained. The potential for a sharp increase in economic activity, bringing with it the kind of jump in growth that bond markets should hate, is very real. In the last few weeks, the market has adopted it as a base case. There are plenty of risks. For a start, the vaccine rollout could be botched, or a virus strain could emerge that is impervious to vaccines. The risk of overheating amid huge amounts of liquidity is evident. And central banks might yet take fright at the first sight of inflation. Headline numbers are bound to look bad for the next few months. But as it stands, the market is telling us that final victory over the virus is in sight, and that this won't stop the authorities from going big in response, meaning quite an economic boom. It would be nice if they were right. LivestreamingLast week we attempted an experiment in livestreaming, to bring me together with Matt Levine, the other luckless person who produces a daily financial newsletter for Bloomberg Opinion. Our colleague Tara Lachapelle moderated, and we talked about the ramifications of the GameStop incident. What else was there to discuss? You can find the conversation here. Please let us know if this format is useful, or what others might be. All feedback is welcome. Survival TipsI hope everyone had a good and romantic Valentine's Day weekend. For one unavoidable reason and another (some connected with my ongoing dental joys), I spent the weekend in the apartment, with Andie, my 17-year-old daughter. At her suggestion, we attempted to retrieve something by going through a romcom marathon. It was fun. Here is our suggested rank-order of romantic comedies to watch in future. (As this order has been thrashed out by a teenage girl and a fifty-something man, with some luck it will have some universality (and no, we didn't get through all of these in one weekend, but we did get through most of them): - When Harry Met Sally — incomparably sharper and funnier than anything else we watched. Progenitor of all that was to follow. It's the writing that really makes it, although the acting by Billy Crystal and future-queen-of-the-romcom Meg Ryan is also impeccable. Also, even though it's a romcom, it's never trite or sentimental; quite an achievement.

- Clueless — Jane Austen's Emma, only with Alicia Silverstone. What could possibly go wrong? It's very, very funny, and hasn't lost its charm.

- Notting Hill — OK, Hugh Grant is exactly the same character as in Four Weddings and a Funeral, but the dialogue is great, and the plot isn't totally predictable.

- Love Simon — a contemporary high school tale, about a closeted gay boy who starts an anonymous relationship with another online. Will they discover each other? Well, you know the answer, but it's an intelligent and interesting move.

- Bridget Jones's Diary — Renee Zellweger with a perfect English accent, Hugh Grant as the baddy, and Colin Firth reprising his role as Darcy from the BBC's Pride and Prejudice (the best TV costume drama ever made, by a long way). Not as romantic as some of the others, but very much a comedy.

- 10 Things I Hate About You — a romcom set in Seattle that is almost a high school movie, it starts out as an unimaginative film about stereotypes, and ends up being sharp and surprising. Great soundtrack, and great acting, particularly by the young Heath Ledger.

- You've Got Mail — set on Manhattan's Upper West Side, I thought this was more a social comedy about the impact of a thinly disguised Barnes & Noble on the independent book store trade. You can tell you're in the presence of the people who brought you When Harry Met Sally, but it's nowhere near as funny. And the romance (two people fall in love over AOL without meeting each other) is a tad implausible.

- Sleepless In Seattle — the most "rom" romcom we watched, with a predictable ending. (Yes, Tom Hanks and Meg Ryan get together at the end). The course of true love to that point is intriguing and funny though, with a script that's almost as sharp as When Harry Met Sally. It is a bit of an issue, however, that the two protagonists don't even meet until the final scene, and never so much as kiss.

- Last Christmas — possibly the worst-reviewed mainstream movie of recent times, we did actually enjoy it, possibly because it was so bad it was good. Set in contemporary London, and the Wham! soundtrack is rather good. Yes, the plot twist is utterly absurd,

- Sliding Doors — Gwyneth Paltrow and her perfect English accent (even better than Renee Zellweger's) in the ultimate "what if?" drama. We see two plots, one if she interrupts her cheating boyfriend with his mistress, and one if she doesn't. The plotting is superlative and (unlike many romcoms) the end isn't totally predictable. Also brilliantly written, and beautifully set in '90s London. I might personally have ranked it higher.

Bottom line? If you haven't seen When Harry Met Sally, or like me you hadn't seen it in 30 years, go out of your way to watch it. It's a truly great movie, and it hasn't aged.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment