| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. Following a range of setbacks in its Covid-19 strategy, the EU is going on the offensive against variants of the virus that threaten to derail efforts to get the disease under control. The Commission wants to accelerate research, authorization, procurement and distribution of shots that protect against mutations, according to a draft of the proposal we've seen. The spread of new variants that are more transmissible and potentially less sensitive to existing shots has spooked EU governments and is seen as a major risk to the economy. After finally accepting some of the blame for the sluggish start to vaccinations, Commission President Ursula von der Leyen will make a personal appearance today to present the plan.

— Alexander Weber What's Happening Another Shot | Johnson & Johnson is seeking regulatory clearance for its Covid-19 vaccine in the EU, on track to become the fourth shot approved in the bloc and the first that can be given as a single dose. A decision is possible by mid-March, the European Medicines Agency said. NATO Meeting | NATO defense ministers begin a two-day video summit. On the agenda this afternoon is a proposed strategy for the alliance for the next decade, including increased funding, a shift in focus in areas such as climate and cyber security and the challenge posed by China. Ryanair Complaints | The EU's lower court will rule on challenges by Ryanair to the Commission's approval of airline aid in France and Sweden. In the first complaints against Covid-related aid for the struggling industry, Ryanair says the measures unfairly favored national carriers. Tech Flight | As Belarus's authoritarian leader faces down mass protests against his 26-year rule, the pioneers that turned the former Soviet republic into an unlikely tech hub are increasingly headed for the exit. Japan's Rakuten, which owns messaging app Viber, was one of the first to close its office after police beat protesters last August. Strategic Autonomy | The EU will hold another summit next week, and with it another call to reduce the bloc's dependency on imports of technology and raw materials, according to a draft of the communique we've seen. But what if the quest for sovereignty depends on becoming more open to foreigners? Here's more. In Case You Missed ItCovid Aid | European governments must find the right moment to wean the economy off unprecedented support, so they don't harm growth in the long run, financial supervisors warned. While a wave of liquidity stabilized lending and kept businesses and households afloat during the virus shutdowns, extending such stimulus for too long could complicate its removal and make any eventual restructuring more painful. More Jobs | The euro area added jobs at the end of last year, suggesting businesses are looking beyond the latest economic woes caused by lockdowns. Employment in the currency bloc rose 0.3% in the fourth quarter for a second consecutive gain. German investor confidence meanwhile jumped to the highest since September. Virtual Tulip | European Central Bank governing council member Gabriel Makhlouf said he wouldn't buy Bitcoin, comparing investment in the world's largest cryptocurrency to the 17th century Netherlands tulip craze, which ended in collapse. Bitcoin investors need to be prepared to "lose all their money," Makhlouf said, repeating a warning from last month. German Help | Chancellor Angela Merkel's government aims to establish a fund to help companies threatened with collapse, part of an effort to defuse mounting tension over the sluggish reopening of Europe's largest economy. After listening to the grievances of dozens of business lobbies on Tuesday, Economy Minister Peter Altmaier said he would lay out a path for easing lockdown measures.

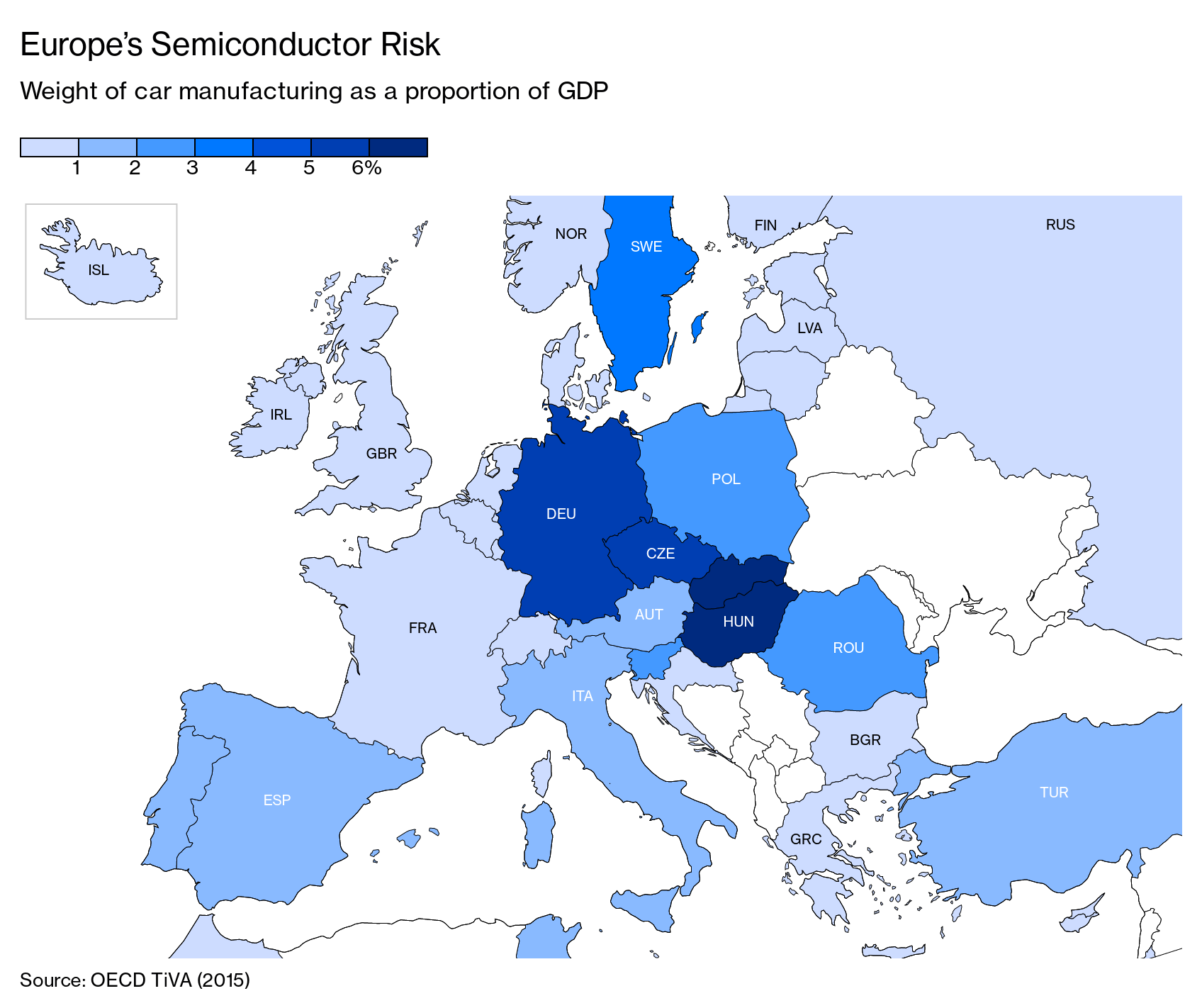

Curfew Challenge | A court in The Hague struck down a critical part of the Netherlands' push to contain the coronavirus, ruling the country's curfew must be lifted immediately. The suspension was postponed pending the outcome of an emergency appeal by Prime Minister Mark Rutte's government. Chart of the Day Mounting concern about a global chip shortage raises the possibility that the industry faces a supply-chain crunch. Bloomberg Economics used the OECD's input-output tables to identify which economies have the largest share of gross domestic product coming from sectors with a high dependence on electronics inputs. With automakers particularly at risk, countries like Germany stand out as most exposed. Today's AgendaAll times CET. - 9:30 a.m. The EU's lower court rules on Ryanair's challenges to European Commission approval of French and Swedish help for airlines

- NATO defense ministers meet via video conference

- EU Commission unveils plan for tackling the risk from virus variants

- EU climate chief Frans Timmermans participates in an event examining European business engagement in the Green transition

- German political parties hold Ash Wednesday events with speeches by the leading candidates to succeed Merkel as chancellor

Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment