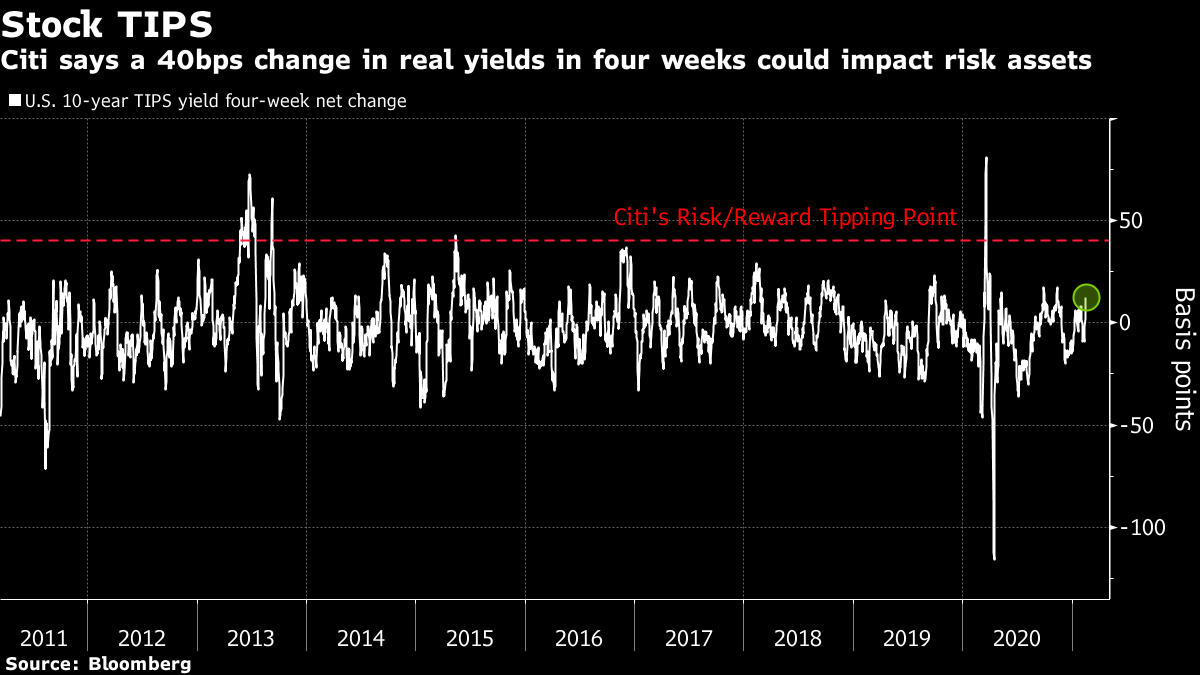

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Encouraging antibody data, hedge funds' newest positions and a massive water deal. Here's what's moving markets. Vaccinations WorkVaccination drives have begun delivering results, with a report in the U.K. suggesting that people over age 80 -- a high-priority group -- were the most likely to test positive for Covid-19 antibodies. That followed an Israeli study showing a 94% drop in symptomatic cases among the vaccinated. An additional shot is set to arrive in Europe, with Johnson & Johnson submitting a conditional marketing authorization for its single-dose vaccine candidate to the European Medicines Agency. The agency said a decision could be possible by mid-March, with European Commission approval immediately thereafter. Hedge Funds' MovesHedge funds' fourth-quarter holdings disclosures, so-called 13F filings, arrived overnight. They showed Warren Buffett's Berkshire Hathaway reducing its stake in Apple during recent months, while adding long positions in Verizon, Chevron and insurance broker Marsh & McLennan. Tiger Global sold a large portion of its profitable investment in solar power firm Sunrun. It added to its stake in Microsoft, alongside hedge fund peers Viking and Maverick Capital. Philippe Laffont's Coatue Management increased its stakes in 26 companies, including Walt Disney. Outside the hedge fund universe, the filings showed Saudi Arabia's sovereign wealth fund piling into video games, adding stakes in Activision Blizzard, Electronic Arts and Take-Two Interactive. Water DealNestle agreed to sell its bottled-water business in the U.S. and Canada to private-equity firm One Rock Capital Partners for $4.3 billion, as the food giant continues to revamp its portfolio. The sale to One Rock, which is partnering with Metropoulos & Co., involves well-known brands including Poland Spring and Deer Park. Nestle's international premium brands including Perrier, San Pellegrino and Acqua Panna are not part of the deal. Nestle in June announced its strategic review of the unit, as it planned to sharpen the focus of its global water portfolio. The food maker has been revamping its portfolios and divesting assets since Mark Schneider became chief executive officer, as he focuses on faster-growing areas like coffee and pet food while pivoting away from snacks. Crying FoulToday, Europe's General Court is expected to rule on Ryanair's lawsuits against French state aid for national flag carrier Air France and Swedish aid for SAS. They're the first two verdicts in a series of Ryanair lawsuits that also target aid for airlines including Lufthansa, KLM and TAP. The budget carrier contends that European Commission approval for the state aid packages failed to ensure governments don't unfairly help a favored company at the expense of others. It also called the support disproportionate, noting that Lufthansa itself said it did not need as much aid as it was offered by Germany. Coming Up…Mining giant Rio Tinto just posted better-than-expected profit for the year, joining peers BHP and Glencore in getting their mojo back as hope builds up for a new commodities supercycle. Chemicals group Akzo Nobel beat estimates and announced a new buyback. It continues to be a busy earnings morning, with highlights including tobacco behemoth BAT, retailer Ahold Delhaize, IT firm Capgemini and Gucci owner Kering on the schedule. After European markets close, Aeroports de Paris and mall owner Klepierre are expected to report earnings for a year that roughed up their sectors. Monthly European car sales, which haven't logged year-on-year growth since September, are due for January. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThe surge in benchmark Treasury yields to the highest level in a year turns the spotlight back on the question of how high can they climb before spoiling the global risk-asset rally. Some investors are concerned about a nascent rise in real yields, which suggests bonds are moving this week without the benign inflationary backdrop of recent months. Others expect at least verbal intervention from the Federal Reserve to cap the rise if yields push much higher past 1.30% -- and see trouble for equities if they hit 1.5%. Growth shares and emerging-market assets are judged to be at high risk should bonds continue to drop, while rallies in currencies such as the Australian and New Zealand dollars could falter if higher yields boost the greenback. The 10-year Treasury yield climbed almost 11 basis points Tuesday to 1.31%, its highest since February 2020. For me, one indicator to focus on is the level of real yields -- inflation-protected Treasuries -- as their fall deep into negative territory last year helped bolster the risk asset rally. Citigroup's rule of thumb is that alarm bells should start to ring when the four-week change in 10-year real yields reaches plus 40 basis points. Currently we're sitting on about 12 basis points, so still a bit away. But it's definitely a gauge worth watching.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment