| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. The first virtual meeting today between U.S. Secretary of State Antony Blinken and his EU counterparts will highlight that Donald Trump's departure wasn't enough to bring the transatlantic allies onto the same page on foreign policy. Take Russia, where the EU will most likely decide on sanctions over the jailing of Alexey Navalny that won't be of the sweeping nature that would burn all bridges with Moscow. "We need to preserve space for official engagement where it is in EU interest and seek to define a modus vivendi that will preserve our security interests," EU foreign policy chief Josep Borrell said in a policy paper ahead of the meeting. Any measures by the bloc also won't touch the Nord Stream 2 pipeline, a decision that has irked Washington.

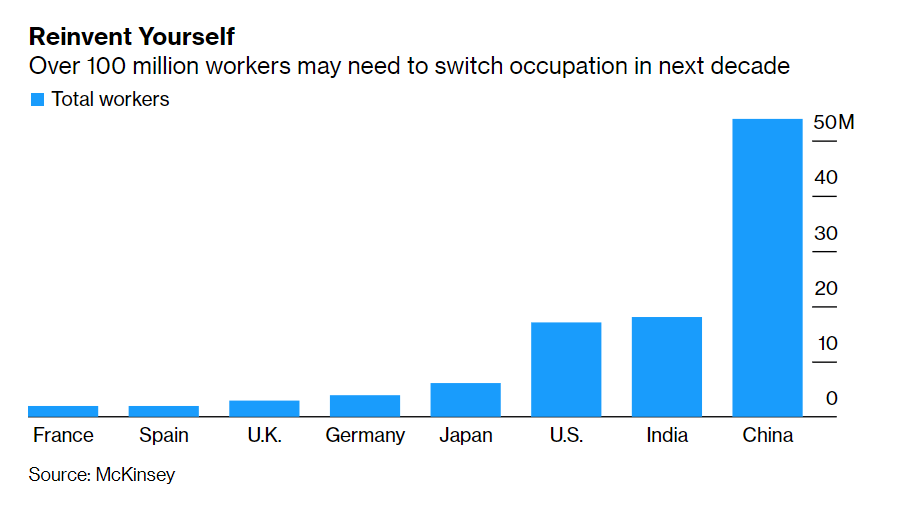

— Nikos Chrysoloras and Viktoria Dendrinou What's HappeningCircling China | The EU also doesn't have any appetite to be as tough on China as the U.S. would want. A paper circulated to foreign ministers with eight options for responding to the erosion of pluralism in Hong Kong includes little more than strongly worded declarations and symbolic visits, with no real punitive measures on the menu. Approaching Iran | Where the two sides of the Atlantic have converged is on reviving the Iran nuclear deal. But the devil is in the detail as Tehran and Washington have different approaches to the sequence of events required for restoring the accord. EU Army | Foreign ministers will also discuss working toward a "strategic compass" in defense before leaders take up the issue later this week. The aim is the eventual development of "mobile and deployable military forces," a more or less permanent maritime force with potentially global reach and the ability of the EU to act autonomously in a "security belt" around Europe, according to a preparatory document we've seen. Not quite an EU army, but it's getting there slowly. Space Boost | The EU is set to announce today measures to boost the civil, space and defense industries, including policies to ensure technological developments in these sectors also benefit civil uses and vice versa. The new programs include a low-earth orbit satellite constellation rivalling Elon Musk's Starlink network that will offer secure government communications. Price Pressures | Europe's consumer-facing companies will be confronted with a critical choice when the pandemic passes: Will business pick up strongly enough for them to raise prices? There's likely to be a rush to hairdressers, restaurants and tourism agencies, fueled by pent-up demand and a hoard of accumulated cash. Some economists predict a jump in inflation. In Case You Missed ItVirus Update | Italy may follow the U.K. approach on mass vaccination, while Hungary became the first EU nation to grant approval to use a Chinese Covid-19 vaccine. In Germany, the seven-day incidence rate inched up yesterday to the highest in over a week. Here's the latest. Stop the Spread | The Pfizer and BioNTech Covid-19 vaccine appeared to stop the vast majority of recipients in Israel becoming infected, providing the first real-world indication that immunization will curb transmission. The results on lab-confirmed infections are important because they show the vaccine may prevent the virus from spreading. G-7 Pledges | G-7 leaders pledged to sustain government spending to help economies recover from the pandemic as they attempted to start a new chapter in multilateral cooperation. During their call, which marked Joe Biden's debut as president on the world stage, they also committed to considering debt relief for developing nations and promised to eliminate net carbon emissions by 2050 the latest. Winners & Losers | A year after Covid-19 reordered world markets, sparking a brutal selloff for many stocks and creating new lockdown darlings, the prospect of vaccine-led reflation is turning the tide for the pandemic's main laggards like travel and retail. British Expansion | Around 1,000 EU financial firms are expected to open their first offices in the U.K. after losing their passporting rights because of Brexit. The influx is a potential boon to Britain's finance sector, whose decades-long dominance of European finance is under threat. Chart of the Day Over 100 million workers in eight of the world's largest economies may need to switch their occupation by 2030 as the Covid-19 pandemic accelerates changes in the labor force, according to research by McKinsey & Co. One-in-16 workers in China, France, Germany, India, Japan, Spain, the U.K. and U.S. will likely need to change their profession, a report last week found. The less educated, women, ethnic minorities and young people will be most affected and, for many, it will mean retraining to seek work in higher-skilled roles as the number of low-wage jobs declines. Today's AgendaAll times CET. - 9 a.m. EU foreign affairs ministers meet in Brussels to discuss sanctions against Russia, common European defense

- 11 a.m. The EU will announce plans to boost the civil, space and defense industries

- 2 p.m. EU Parliament hearing with EU Commissioner for Internal Market Thierry Breton on the digital services act, digital education, media literacy and cyber security

- 2:45 p.m. ECB President Christine Lagarde, EU chief Ursula von der Leyen and IMF head Kristalina Georgieva speak at conference on the European economy

- EU economy chief Paolo Gentiloni delivers opening remarks on recovering from the COVID-19 crisis as well as the economic and fiscal priorities for investment at the virtual European Parliamentary Week 2021

Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment