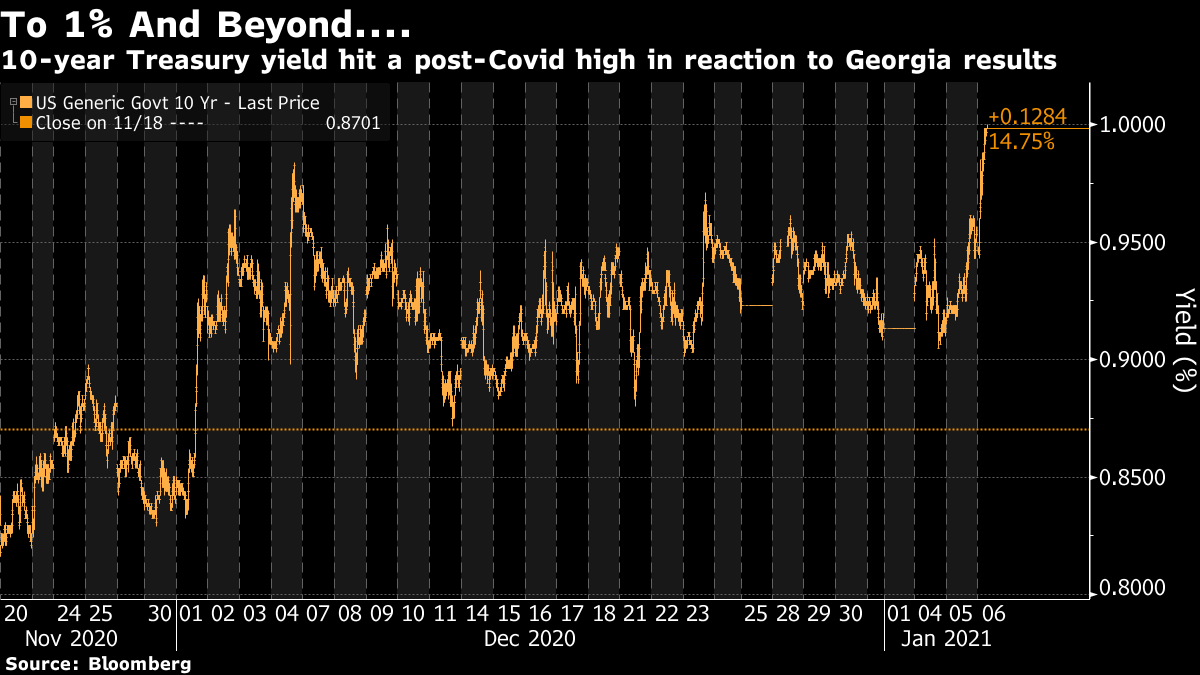

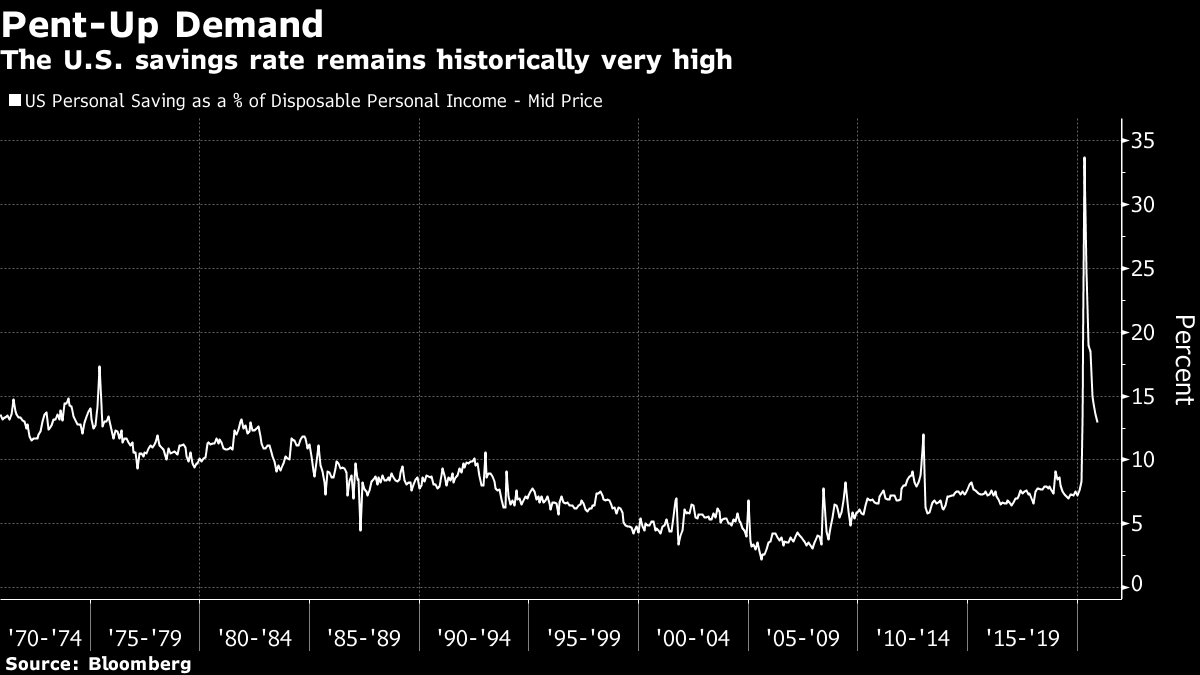

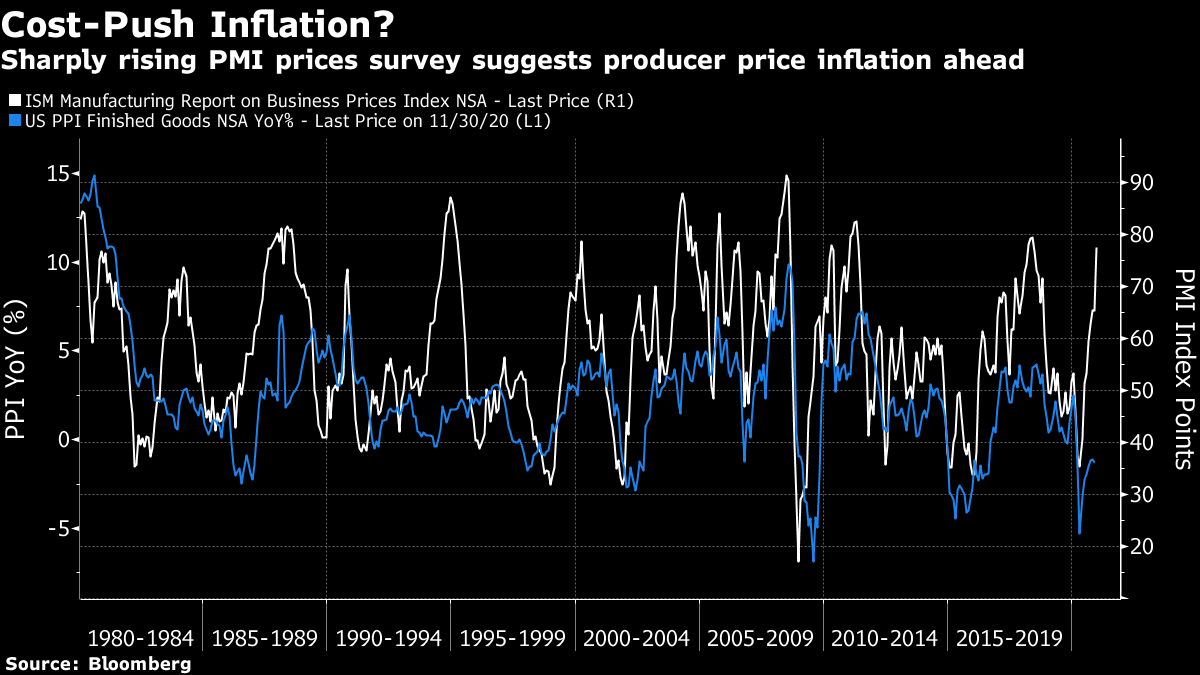

| To get John Authers' newsletter delivered directly to your inbox, sign up here. It's election night in America once more. As I write, just after midnight on the East Coast of the U.S., Democratic candidate Raphael Warnock appears likely to defeat incumbent Republican Senator Kelly Loeffler, while the other Republican incumbent, David Perdue, has a lead of about 1,000 votes over his Democratic opponent Jon Ossoff, with ballots from mostly democratic counties still to be counted. Virtually every forecaster in sight is predicting Democratic victories in both — although there is a strong chance that there will need to be a mandatory recount in the Ossoff-Perdue race. Financial markets are moving on the assumption that the Democrats have indeed won, which would mean they will control the Senate via the casting vote of future Vice President Kamala Harris. I won't attempt to analyze which candidates will win. We will know soon enough, although final certified results are unlikely before next week. Instead, I will assume the prediction markets (which put the chances of a Democratic Senate at 97% at the time of writing) and forecasters are right, and try to run through the implications. The most direct impact is on Treasury bonds. As the night continued, the 10-year yield surpassed the psychological barrier of 1% for the first time since the Covid shock:  As for stocks, S&P futures fell a bit in Asian trading, but this is nothing like a panic. We can expect stronger reactions, in the same directions, if both Democrats do indeed win. Perhaps the clearest response is in the shape of the yield curve. The 2s-10s curve is now its steepest since the fall of 2017. The prospect of unified Republican government under President Trump prompted a belief in reflation four years ago; now the prospect of unified Democratic government under Joe Biden (a belated "blue wave") is reviving the same hopes:  Directionally, it is hard to question any of this. With 50 senators, Democrats would take control of the chamber's agenda, and have far greater freedom of movement. The chance of somewhat more fiscal activism, and of some kind of significant healthcare reform, would rise significantly. More coronavirus relief checks would be likely; so, conceivably, would more infrastructure spending (which is what everyone expected from Trump and the united Republicans four years ago). A government able to respond swiftly to problems in the battle against the virus would make a positive difference, and reduce the risks to the positive scenarios that people now anticipate. Coordination between the Treasury (run by former Federal Reserve Chair Janet Yellen) and the Fed is likely anyway, and there would be more money for Fed lending programs of one stripe or another. All of this at the margin would stimulate the economy in the short term, and tend to push up bond yields. The critical question is whether this will go beyond a healthy reflation that buoys the post-pandemic economy, and surge into inflation. The market is positioned for the former, but not the latter; at present the idea is that the economy will recover but inflation will stay under control and interest rates will stay negligible. There are plentiful reasons to think that inflation is subdued, and would be difficult to rouse from its slumbers. A Democratic Senate wouldn't necessarily increase the risk of inflation much; there are enough party moderates to prevent any truly radical "Green New Deal" spending program. That said, there are inflation pressures around, as can be seen in rising commodity prices, and these dangers might grow with a government free of gridlock. The U.S. savings rate remains higher than at any time since the early 1970s, reflecting pent-up demand created by the pandemic, and the money the government paid people to tide them through. Optimistic reflation forecasts center on that money being spent in the latter half of this year. The political imperative on the new government will be to ease the population through the last few months of the virus — which might increase the risk of "demand-pull" inflation as people build up money that they spend once the pandemic finally ends:  Meanwhile, there are signs that the engine of the economy is heating up again. Tuesday brought a startlingly strong Manufacturing ISM number, which adds much ballast to the reflation trade. The problem is that the ISM survey also covers prices paid by manufacturers, and that number shot up in a way analysts hadn't predicted. As this chart shows, the ISM prices paid survey is a historically good leading indicator of producer price inflation. A rise in prices paid by manufacturers could then be expected to add pressure to consumer inflation.  Would a Senate controlled by Charles Schumer and a group of Democratic moderates increase the chance that these pressures tip over into enough inflation to put the market's current assumptions awry? Yes, it would. It wouldn't increase it by all that much. But the consensus that the economy can reflate without bringing higher inflation and interest rates in its wake looks too strong to me. A unified Democratic government might well awaken the markets to risks that have been understated. That in turn means the chance of a further upward adjustment in rates, and (in a sign that the system might even be working correctly), a further brake on the chance that the Democrats try to do anything profligate.

Welcome, and Welcome BackThe Bloomberg Opinion newsletter family is widening, as indeed is the family of Matt Levine. The Money Stuff newsletter is back after Matt returned from extended paternal leave. The New York Times helpfully kept him top of mind during his absence by writing this profile. Meanwhile, Michelle Leder is joining Bloomberg Opinion. Previously, she has done great work on @footnoted*, where she expertly dissects SEC filings. Check her first column for us, coming on the site a few hours after we send this newsletter, on the mystery behind the 13F, the form that institutional money managers must file on their holdings each quarter, which is often immediately mined for details by financial journalists. She doesn't give great marks to the SEC's most recent proposal on 13Fs: the SEC never prioritized a fix. Instead, in a 53-page document with 90-odd footnotes, filed in the middle of a pandemic, the SEC proposed a new rule that would have made things much worse. Most important, the rule would have raised the reporting threshold to $3.5 billion. By the SEC's estimate, this would have eliminated around 90% of all 13F filings, reducing the number of firms required to file from 5,100 to about 500. Such significant participants as Starboard Value and David Einhorn's Greenlight Capital would be allowed to operate completely in the dark. For an agency whose stated goal is to even the playing field and improve transparency in the markets, that's a strange position to take.

See her first column for more. Survival TipsHere is a health tip which was brought to my attention by a good friend. It's in the Twitter account of World Tapir Day, which apparently is a thing. In Guatemala, the locals see these signs as a handy aide-memoire to keep at two meters away from other people when walking down the street:  To translate, "If you're in the street and you don't know the convenient social distance to keep, imagine that there's a Central American tapir between you and the other person." This is obviously great advice for during the pandemic, although it is probably easier to apply in Central America, where people are a little more conscious of exactly how big a Central American tapir happens to be. But beyond that, I think it's great advice for life in general. If life is wearing you down and the stress is getting to you, imagine there's a tapir between you and the next person. It might well help. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment