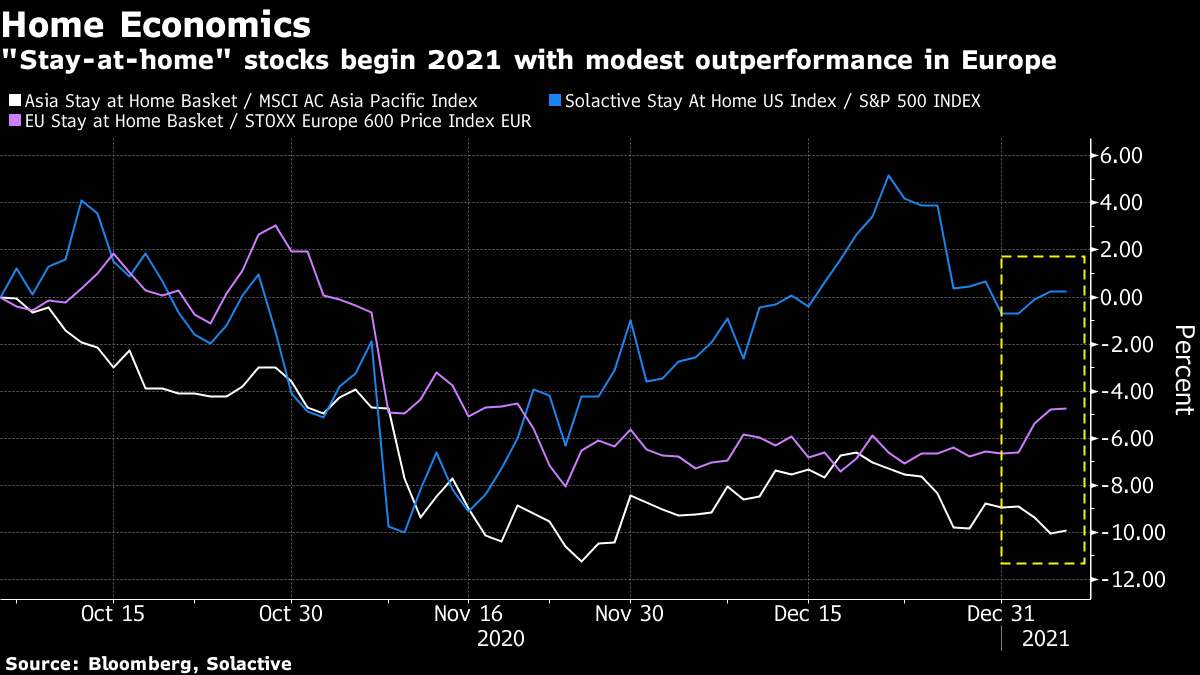

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Saudis take one for the team, Germany tightens its lockdown and control of the U.S. Senate remains undecided. Here's what's moving markets. 1 in 30Daily virus cases in the U.K. set a new record, as 1 in 30 Londoners is estimated to have the virus. The country's death toll stood at 76,423, according to Bloomberg's Coronavirus Tracker, after fatalities outpaced Italy's in recent days. Germany extended and tightened its lockdown, limiting travel to 15 kilometers for those living in worst-affected areas and restricting private gatherings. Meanwhile, a WHO team trying to enter China to investigate the virus's origins has been delayed by visa issues. The hold-up comes as Beijing faces criticism for stonewalling efforts to trace the virus's origins. WHO experts were kept out of Wuhan in 2020 and an independent probe was rebuffed. Saudi GiftsSaudi Arabia will unilaterally cut its crude oil production by a million barrels a day during February and March, in an OPEC+ deal that allows Russia to increase output. The concession late Tuesday was hailed as a ``new year gift'' to oil markets by Russia's deputy prime minister and sent Brent futures almost 5% higher by day-end. European energy shares outperformed all other sectors and rose the most since late November. The same evening, A Saudi-led bloc of Arab states agreed to restore ties with Qatar, following a sustained U.S. push for the region to unite against Iran. As part of the reconciliation, Saudi airspace and borders have been reopened to Qatar. Senate DecisionThe two runoff races for Georgia's U.S. Senate seats remained too close to call, with Democrat Raphael Warnock taking on incumbent Senator Kelly Loeffler and Democrat Jon Ossoff running against Republican incumbent David Perdue. The two races will determine control of the U.S. Senate and the fate of President-elect Joe Biden's agenda. Democrats taking control of both houses of Congress could potentially lead to upward pressure on inflation and interest rates, as well as higher taxes to pay for more fiscal aid. Conversely, should either or both Republican incumbents win re-election, the party would have enough votes to impede Biden's policy platform. Hell to PayU.S. President Donald Trump signed an order banning transactions with eight Chinese software apps including Ant Group's Alipay in 45 days, when he'll no longer be in office. The order is the outgoing administration's latest bid to use national security powers against China's largest technology companies, but it will be up to President-elect Joe Biden to decide whether to enforce the policy. It also deals another blow to Ant co-founder Jack Ma, who hasn't been seen in public since Chinese regulators halted Ant's $35 billion IPO and launched an antitrust probe into Alibaba. The executive order will also affect Tencent's QQ Wallet and WeChat Pay, as well as CamScanner, SHAREit, VMate and WPS Office. Coming Up…The earnings agenda is blank, except for bakery chain Greggs's fourth-quarter trading update. The economic data schedule holds German inflation and U.S. factory orders, forecast to grow more slowly than in the previous month. Final readings of Purchasing Managers' Index (PMI) data is due for service industries in the Eurozone, U.K. and U.S. In the evening, the U.S. Congress convenes to count Electoral College votes and confirm President-elect Joe Biden's victory. Later yet, the minutes of December's Federal Open Market Committee meeting will be released, shedding light on U.S. monetary policy officials' sentiment. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThe turn-of-year surge in fresh Covid cases coupled with concern over new variants of the virus has reignited interest in 2020's stay-at-home trade along predictable geographic lines. Stay-at-home stocks are doing best in Europe, where increased lockdowns are most apparent; they are showing a glimmer of life in the U.S. and continue to lag in Asia. A basket of European stocks chosen by SocGen strategists that benefit from home work and play -- food delivery, online entertainment, communication and household product companies -- has outperformed the Stoxx 600 by about 2 percentage points so far in the new year. A U.S. equivalent based on an index from Solactive has beaten the S&P 500 by one point, while a Bloomberg gauge of Asian stay-at-home stocks has lagged the regional benchmark by about the same. The continuing rollout of vaccines should keep demand for any stay-at-home trade short, though investors will be keeping a close eye on the efficacy of the shots against the new virus strains. The stay-at-home baskets had noticeably lagged in Europe and Asia over the last 3 months, underperforming benchmarks by about 5 and 10 percentage points respectively.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment