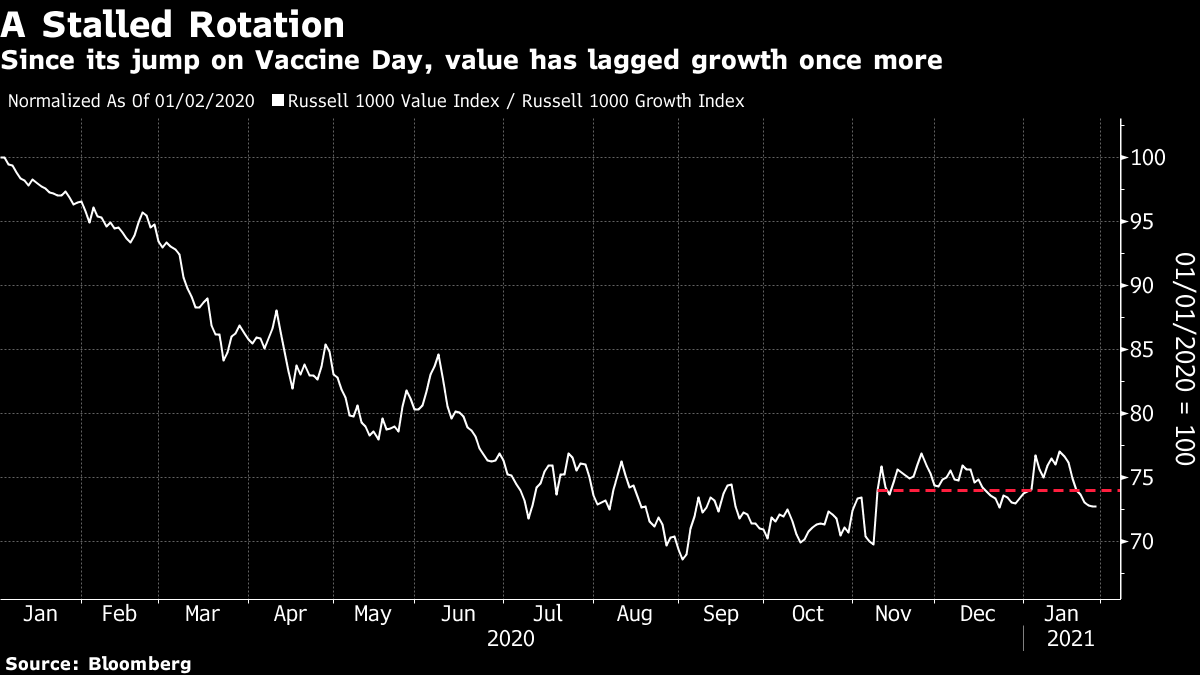

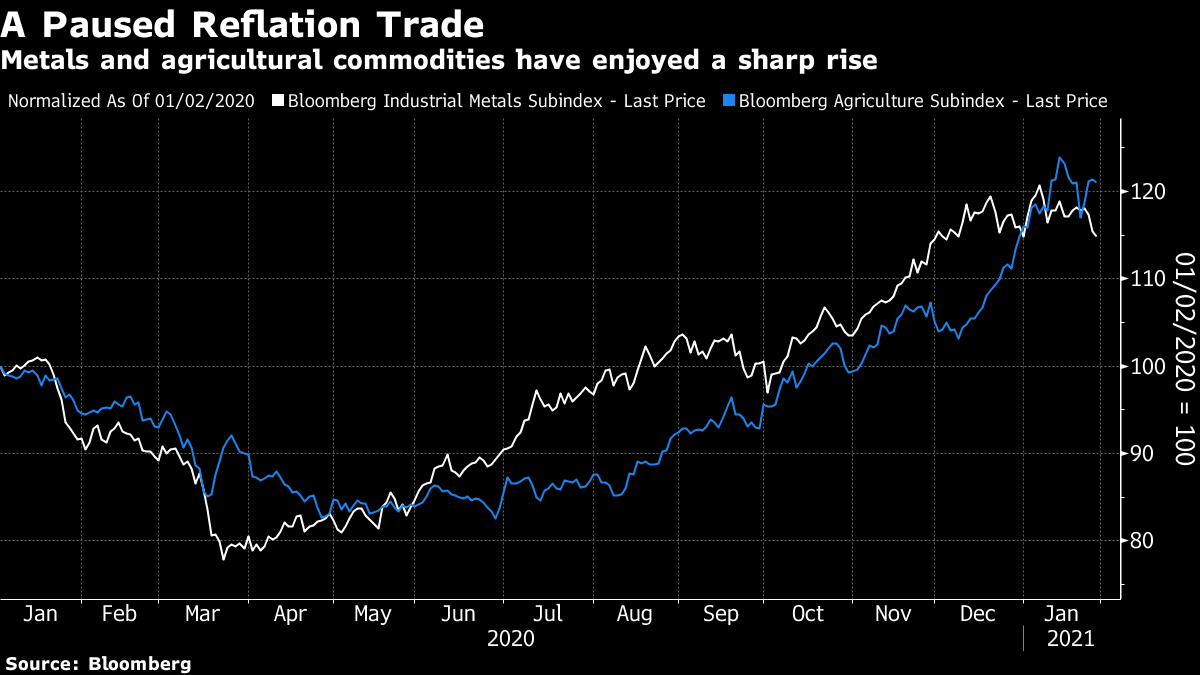

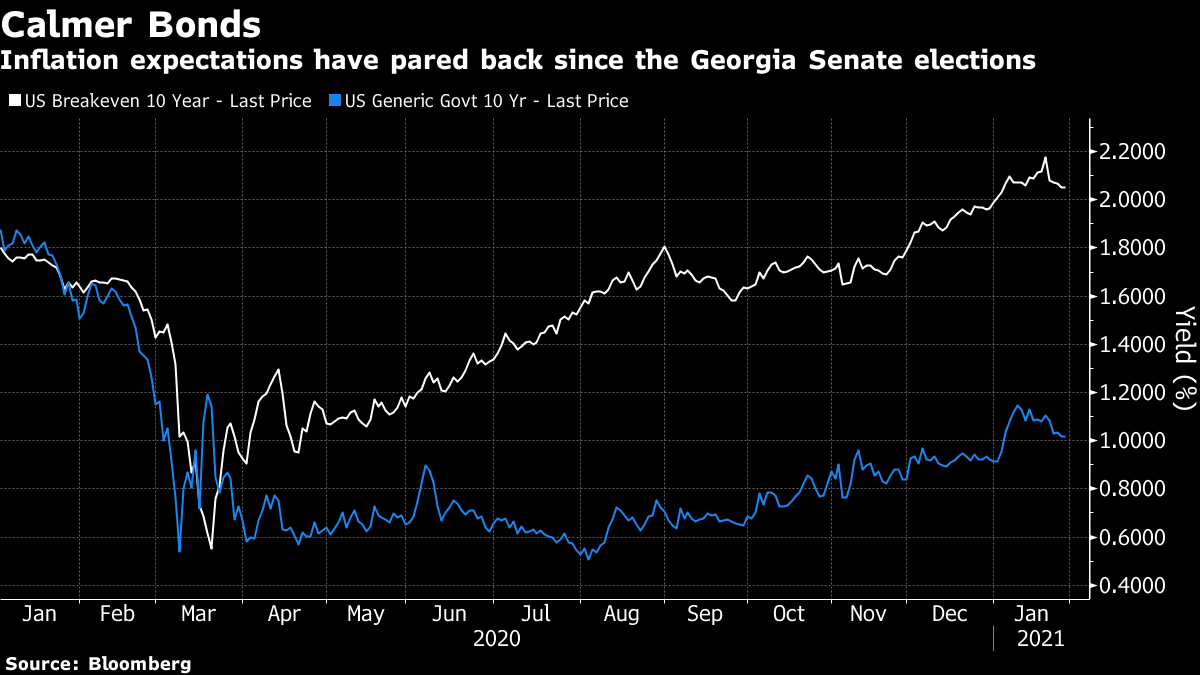

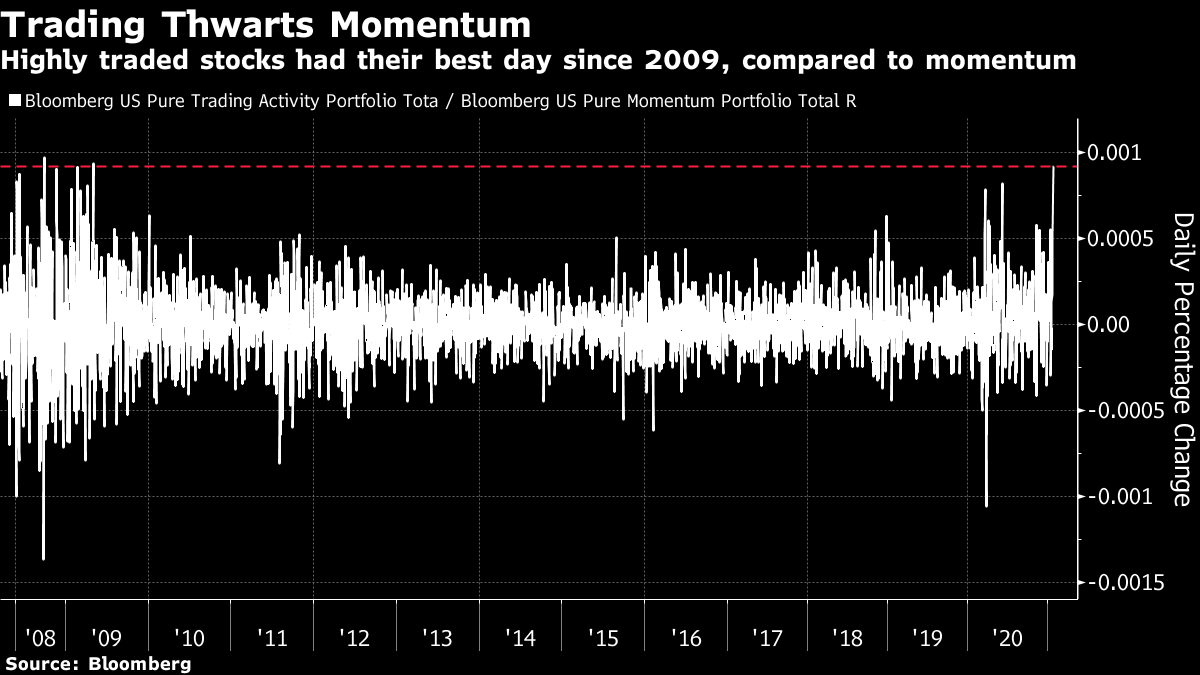

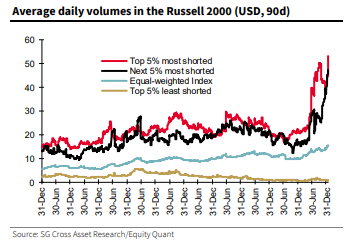

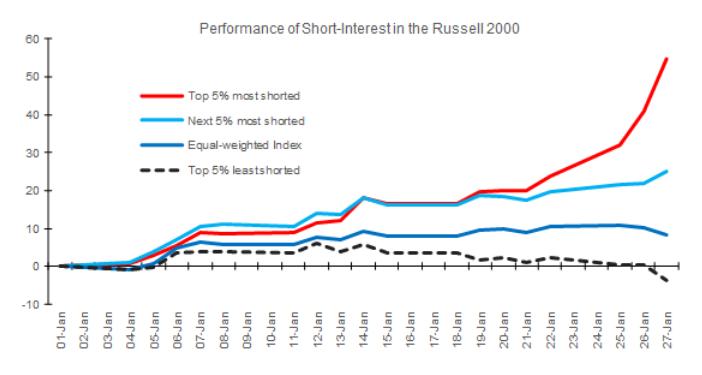

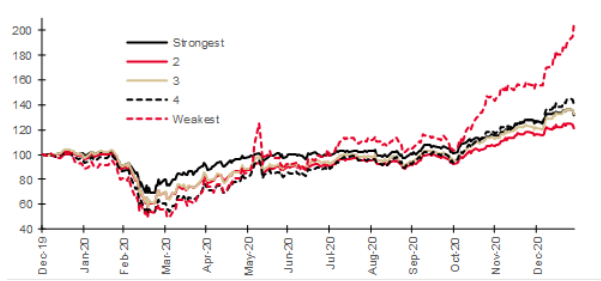

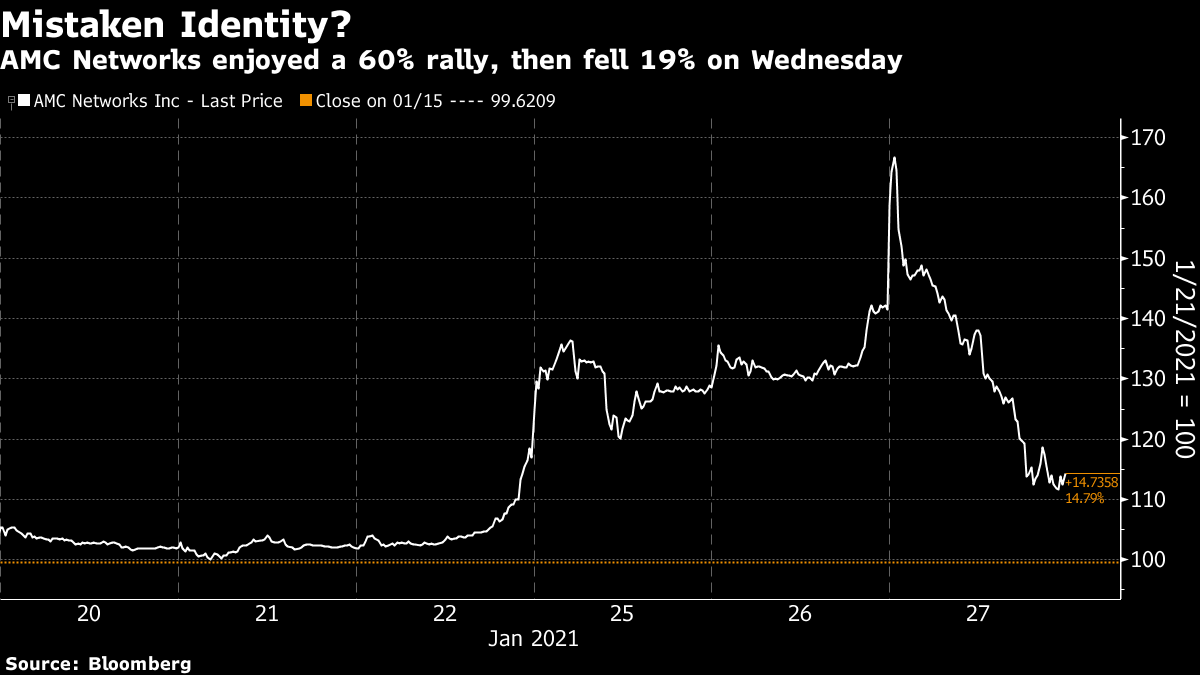

The News We Don't Care About…..Call it World-Weary Wednesday. The Federal Reserve held its first monetary policy meeting of the year and made clear that it was prepared to keep pumping money into the economy for even longer; the S&P 500 had its worst day since the election, falling more than 2.5%; and Apple Inc., Tesla Inc. and Facebook Inc., three of the six biggest companies in the U.S., revealed annual results to a frosty reception from investors. All the while, the Covid-19 pandemic raged on. And yet seemingly everyone in the market was transfixed by the price action in a company that started last month valued at less than $1 billion. The company, of course, is GameStop Inc. And it's causing excitement because it now has a market value of $25 billion. Nobody pretends that the outlook for a video-game seller has improved that much. Rather, it is because of an epic "short squeeze" coordinated on social media in an action that some now dub the "French Revolution of finance." The excitement is fully justified. So let me start by forcing myself to review events that I would have been writing about, if GameStop had continued to be a rather obscure retailer. Doubts are deepening over the "reflation trade," which took hold after the successful vaccine results were announced last November, and stepped up after Democrats won back control of the Senate in early January. This isn't a big reversal, but on a number of measures it appears investors need more confirmation that reflation is actually happening before they move further. For exhibit A), value stocks — which are supposed to perform well when the economy is expanding and growth is easy to come by — have failed to make good on their recovery compared to growth stocks. Value had a day for the ages on Nov. 9, when the results of the Pfizer/BioNTech vaccine trials were announced. Since then, at least in the world of larger U.S. stocks, growth has outperformed slightly. This isn't the much hoped-for rotation, at least not yet:  Looking at commodities, there is the same message, in more muted form. Industrial metals and agricultural commodities charged ahead in the last months of last year, in a move that more or less guarantees a degree of reflation. There has been no reversal, but both categories of commodities have paused for the last couple of weeks. Again, some confirmation that reflation is under way is needed:  Most importantly, there is the bond market. Yields and inflation expectations rose sharply in the wake of the Georgia election results that delivered the Senate to the Democrats. Inflation forecasts are their highest in years. Now, 10-year inflation expectations have been pegged back closer to 2%, while the 10-year yield is near 1%. This relieves widespread fears of a bond market "tantrum," in which sharply higher yields trigger a sell-off in stocks. The words of Fed Chairman Jerome Powell helped: He emphatically batted away any suggestion that he needed to start to thinking about when to taper support for the bond market, while shifting the Fed's language in a slightly more dovish direction. That may be the good news as far as the stock market is concerned. The bad news is that the bond market seems less convinced that a broad reflation in the economy is truly under way:  The reason can be given in one word: coronavirus. With new variants crossing the world, and growing understanding of the difficulties involved in vaccinating the population, there is a growing understanding that we need to wait to be sure that reflation is here. If virus mutations take hold before enough people can be vaccinated, then hopes of a return to normal by summer will be dashed. Powell made clear that nothing mattered more than the virus and the vaccine; it is impossible to disagree. This doesn't mean that the market is ready to crash. Fed support will make that very difficult. But the shifts in the last two weeks suggest tangible evidence of a successful vaccination campaign will be needed before the reflation trade can be taken further. A significant problem with one of the vaccines, or a breakout by a new and deadlier version of the virus would inflict major damage on asset prices (and, in those circumstances, falling asset prices would be the least of our concerns). Absent the drama in game-land, which has had no effect to date on any of the trends covered so far, that is what I would be writing about. Now, about that drama: So, GameStop managed to double again Wednesday. It is now bigger than more than 200 companies in the S&P 500, although whether it can hold on to its lofty valuation long enough to be admitted to the index is a big question. I've written a lot about this already. So have many colleagues. Its potential symbolic impact is hard to overstate. For now I want to look at exactly what effect the Reddit revolt is having on broader markets. The Bloomberg Factors To Watch service (FTW [GO] on the terminal) reveals that the market is in turmoil. It isolates the impact of various factors on stocks' performance compared to the market. The two critical factors in this incident are: momentum, the tendency for winners to keep winning and losers to keep losing, which is a staple of many trading strategies; and trading activity — how much trading is going on in a stock, and how that is affecting performance. On this basis, highly traded stocks had their best day compared to stocks that had entered showing some momentum since May 2009, when the market was going through the beginning of its great post-crisis rally. Indeed, this was the third-best day for highly traded stocks compared to momentum since Bloomberg started tracking the data; the biggest, which saw an only slightly greater convulsion, was on Sept. 30, 2008, the day when lawmakers shocked markets by voting down the proposed TARP rescue plan:  When we look at the internal dynamics of the market, then, the WallStreetBets subreddit group has managed to deliver a shock that deserves comparison to Congress deciding to withhold $800 billion in aid for banks. This was an extraordinarily potent intervention. That increase in trading activity overlaps almost precisely with the attempt to squeeze short-sellers. It is usual for trading volumes to be higher in the most heavily shorted stocks. But the way trading in those stocks is now hogging activity in the entire market for smaller companies is quite extraordinary. The following chart, provided by Societe Generale SA's chief quantitative strategist Andrew Lapthorne, shows volumes in the most-shorted stocks going back a decade. The explosion in the past year is remarkable:  The activity of the Redditors is obvious, then. So is the impact they have had. The following chart compares the performance of small-caps in the Russell 2000 index, depending on how heavily they have been short-sold. The 5% that have the least short interest have actually fallen slightly for the year. The 5% with the greatest short interest are up more than 50%. This is unprecedented:  Short-sellers aren't infallible. That is one of the points that the Redditors want to make, and they are quite correct. But the shorts tend not to be stupid, and to be pretty good at analyzing balance sheets. They want to find companies with a really good chance of going bust. This has led to another disquieting development. This year's best-performing companies among small-caps are, by a mile, the companies with the weakest books. The following chart, also from Lapthorne, divides the Russell 2000 into five equal groups according to the strength of their balance sheet:  The move to bring down the short-sellers is creating a range of strong-looking companies that could be at risk of insolvency if the pandemic forces us into a W-shaped recession. To date, GameStop isn't a genuinely systemic incident. Within the world of U.S. small-caps, however, it has had an unmistakable impact already. If the next "shoe" drops, it will involve sales by funds that have taken a loss in the short-selling firms at the center of the drama, and need to deleverage. That would most likely involve taking profits in their best long positions. And that would a) create opportunities while b) scaring the living daylights out of a lot of people as the overall market moved south. Meanwhile, there is an intense debate over how regulators should respond. As ever, paternalism faces off against libertarianism. Powell isn't interested in tightening margin debt requirements. The Securities and Exchange Commission is investigating. And battle lines are being drawn. Former SEC Chairman Arthur Levitt wrote for Bloomberg Opinion on how the SEC could tighten up straight away, but will need to move with great caution. Discriminating against retail investors and in favor or large institutions at this point could fatally undermine trust in the regulators. Meanwhile, there is a strong libertarian case against interfering in the right of people to involve themselves in the markets, made forcefully by Jennifer Schulp of the Cato Institute. She rails against Wall Street's persistent description of retail investors as "dumb money," and points out that crowds often have wisdom. She is right about this. Improved investor education will come with greater retail access to the market, not from new rules to exclude retail investors. However, there are limits. "Mistaken money" (let's not call it "dumb") has been able to push some dramatic misallocations of capital in the last few months. And at least some of the money currently squeezing the shorts appears to be badly mistaken, if not dumb. AMC Networks Inc. is a U.S. company involved in the lucrative business of streaming. This is what has happened to its share price in the last six days:  There has been no news to drive these remarkable developments. Meanwhile, AMC Entertainment Holdings Inc. is a large cinema chain, and has thus been grievously hurt by the pandemic. It had attracted the interest of short-sellers. And in the last week, its stock has risen about 750%:  Squeezing the shorts in AMC Entertainment may or may not turn out to be smart. But buying enough stock in a different company to push its share price up 70% in less than a week, because of a case of mistaken identity, looks pretty dumb. Regulators must protect people from self-damaging behavior, just as other regulators insist that car manufacturers install seat belts. But they mustn't infringe people's liberties. And they must tread very carefully in a debate in which the entire model of shareholder capitalism is now up for discussion. Even though the extraordinary drama around GameStop has not sent ripples far beyond the world of small-cap stocks, the stakes for the future are high. Survival TipsYesterday, plenty of people thought that it was odd to end a piece about anger and rebellion with a survival tip about sleep and lullabies. So, here are some songs to help you channel rage. The Kaiser Chiefs came up with a couple of great ones: Angry Mob and I Predict a Riot. There's also White Riot by The Clash, with a title that's a little unfortunate. My beloved Arcade Fire started their career with Rebellion (Lies) and recently produced Generation A, which both hit the mood. Rage Against the Machine's Killing in the Name channels rage for five minutes, but you need to be really angry to be in the mood for it. The same applies to Metallica's St Anger. But if there's one song that titanically captures the current mood better than any other, for my money it's Won't Get Fooled Again by The Who, from 50 years ago. After another day of some interesting online communications from people I've never met, I've enjoyed listening to that lot at high volume. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment