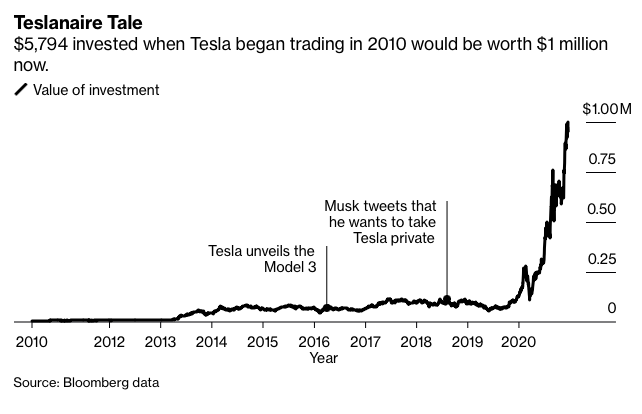

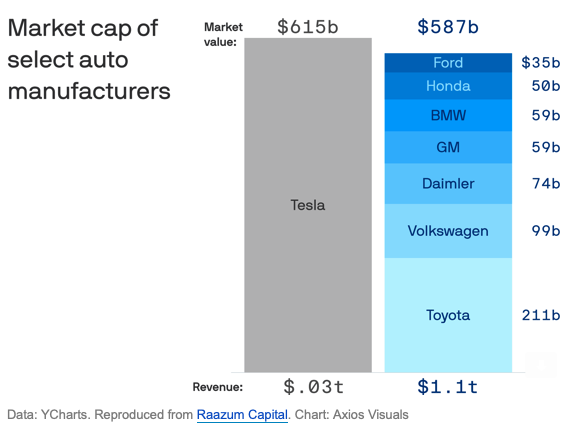

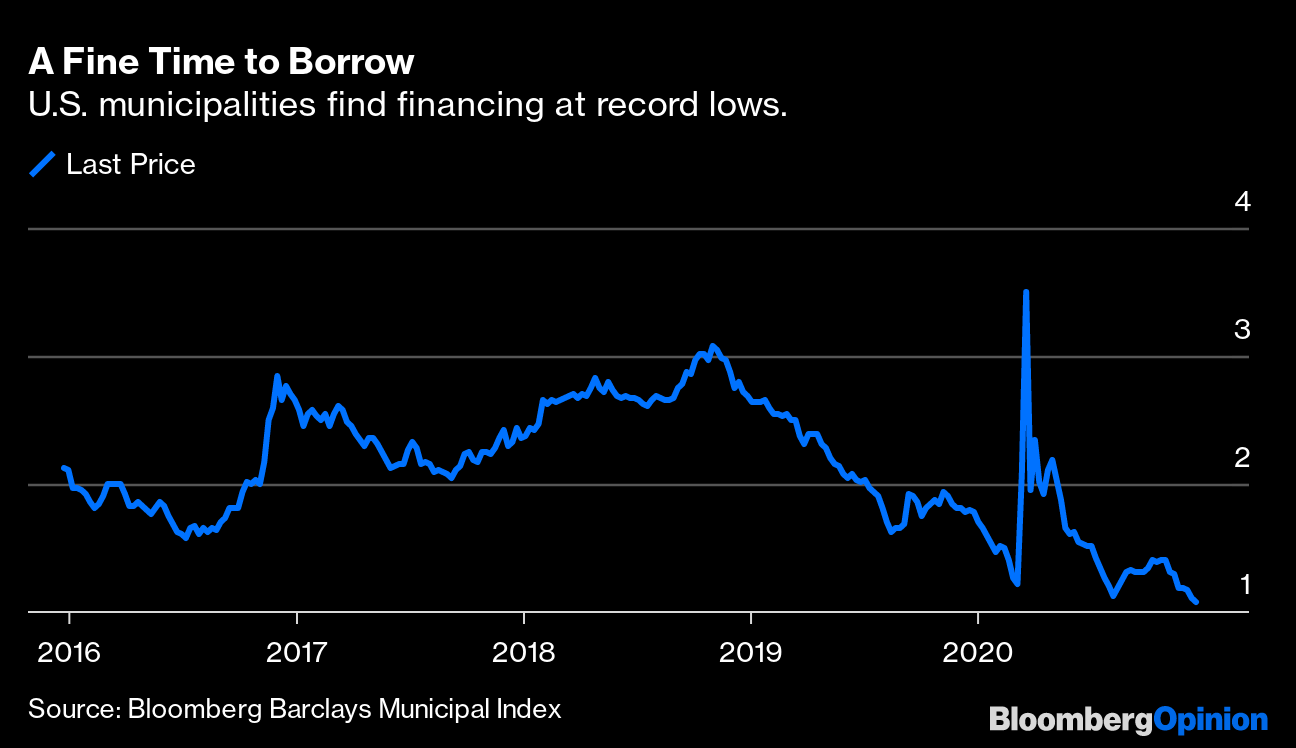

| This is Bloomberg Opinion Today, an assembly line of Bloomberg Opinion's opinions. Sign up here. Today's AgendaApple Car Looms in Tesla's Rearview Mirror A common time-travel fantasy involves going back to buy a bunch of, like, Apple stock just before it takes off. A handful of lucky Tesla fans have been living that dream this year, watching modest investments in the electric-car maker turn them into paper millionaires basically overnight. But something about this hockey-stick-shaped chart feels less Apple and more Pets.com:  There are of course a bunch of good reasons to buy Tesla stock. But there are also a bunch of good reasons to wonder if it should be quite this expensive. Here's another chart, via Axios:  Electric vehicles are the future and deserve every bit of our enthusiasm and investment. But all of those companies in the blue column of that chart get this just as much as Tesla does. And now another very worrisome competitor is apparently in the hunt: Apple. It's been dabbling halfheartedly in car design for years but reportedly is on track to crank out a self-driving EV by 2024. It's too soon to call the Apple Car or iCar or whatever a Tesla-killer. You'll probably have to buy an annoying Lightning connector to plug the thing in. And yet, as Tim Culpan points out, Apple knows something about making consumer products that Tesla doesn't: It keeps branding and design in-house while outsourcing the actual manufacturing. As Liam Denning has chronicled for years, Tesla struggles to churn out cars, perhaps partly because it insists on keeping the whole process so close that Elon Musk can camp out on the factory floor. Tim Cook sleeps in a nice house, and his company has a more sustainable stock price, partly because Apple understands that's not necessary. This Is More Down Payment Than ReliefAfter half a year of dithering and bickering, Congress is finally delivering half a firetruck-load of water for an American economy that is fully on fire. Half a truckload is more than no truckload, you may observe. But it will not fully put out the fire, writes Bloomberg's editorial board. Somehow President-elect Joe Biden will have to rally this fractious brigade all over again immediately to get the economy what it really needs. Too much has already been lost. Of course, this is the truck-half-empty view. You could also point out that, at a time when the current president is trying to overthrow the elected government, we're lucky Congress managed to get any deal done at all, writes Karl Smith. Maybe it's reason to hope we really can get more relief next year. Further Relief Package Reading: Airlines Won't Check Your Bags But Will Take Your CheckOne place you won't hear any beefing about the relief package is in the airline industry. U.S. carriers will get $15 billion to save about 32,000 jobs, Joe Nocera writes. Meanwhile, small restaurants will once again have to compete with each other for scraps in the PPP. That didn't work out so great for restaurants last time: Already 2.1 million restaurant employees have lost their jobs, Joe writes. U.S. airlines also happen to have billions of dollars in cash on hand, which Sal's Pizzeria lacks, along with Delta's lobbying chops. That's not to say the global airline industry has a bright future. New travel restrictions put in place after the emergence of a new, possibly more virulent, strain of the coronavirus highlight just how far the airline business is from normal, writes Chris Bryant. Telltale ChartsThe new relief package also doesn't give state and local governments what they need. Fortunately, super-low municipal-bond yields have helped carry these governments through the crisis so far, writes Matthew Winkler. But the market partly depended on the Federal Reserve's backstop, which the new deal takes away.  Peleton's Precor purchase will relieve its supply woes, broaden its product lineup and maybe help justify its expensive stock price, writes Tara Lachapelle.  Further ReadingSenate Republicans could shut down President Donald Trump's insanity right now if they wanted to. — Jonathan Bernstein Mark Zuckerberg is trying to bring Libra back, and regulators must be on their toes. — Lionel Laurent GE sure did make it awfully easy for CEO Larry Culp to get a huge bonus. — Brooke Sutherland Sorry, sci-fi fans, but asteroid mining will always be impractical and unprofitable. — David Fickling You may not be as behind on your finances as you think. — Erin Lowry ICYMIThe mutant Covid strain may be in the U.S. already. But vaccine makers aren't worried. Trump's personal Deutsche Bank banker resigned. Biden's @POTUS Twitter account will lose all of Trump's followers. Kominers's ConundrumsIf you're still trying to find the missing monoliths in our most recent Conundrum, we just received a video clue from Sean Altman, founding leader of Rockapella (now of the Everly Set). Check it out here for hints as to how you can figure out where in the world those monoliths could be. We've also extended the solution deadline to Friday night, December 25 — so feel free to keep solving over the holidays! — Scott Duke Kominers KickersSnowflakes are cool. (h/t Ellen Kominers) So is this mummified Ice Age wolf pup. (h/t Scott Kominers) Also this underwater roundabout in the Faroe Islands. There's a link between Covid and sleep. Note: Please send snowflakes and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment