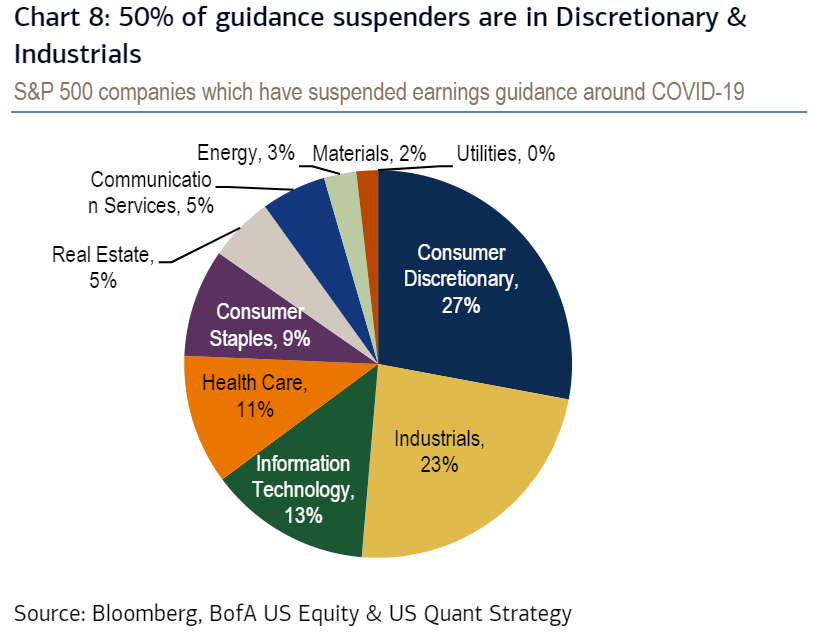

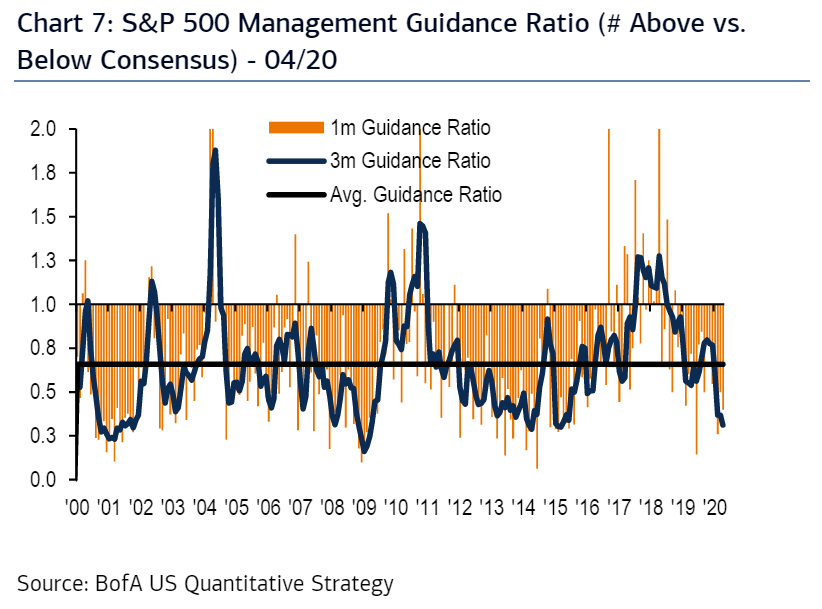

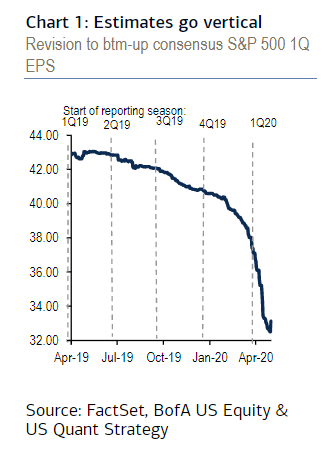

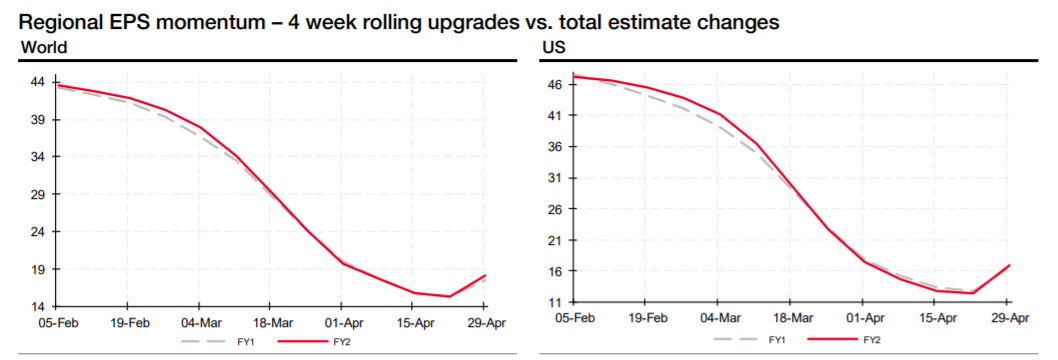

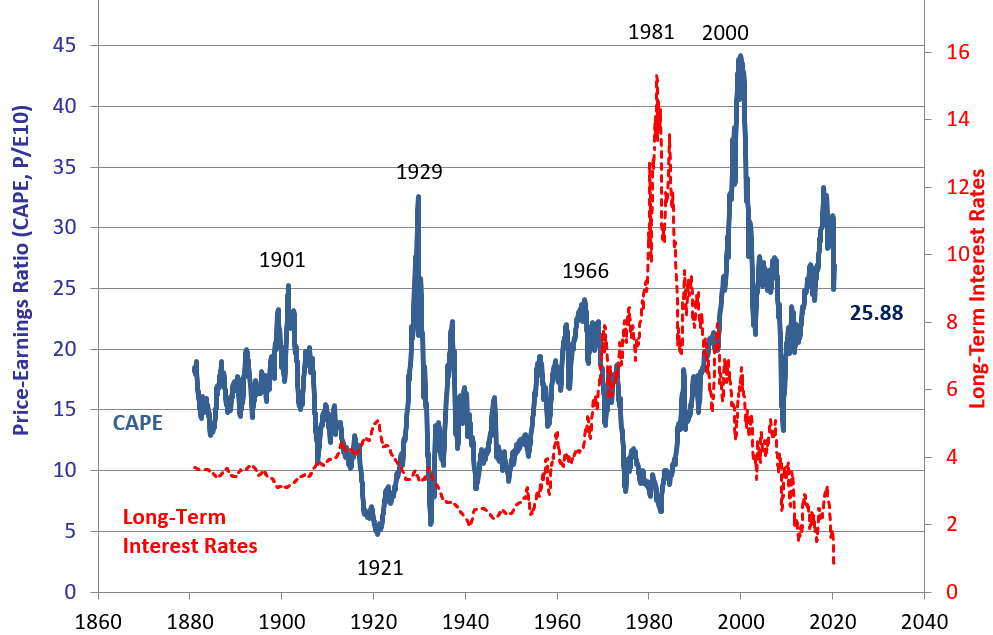

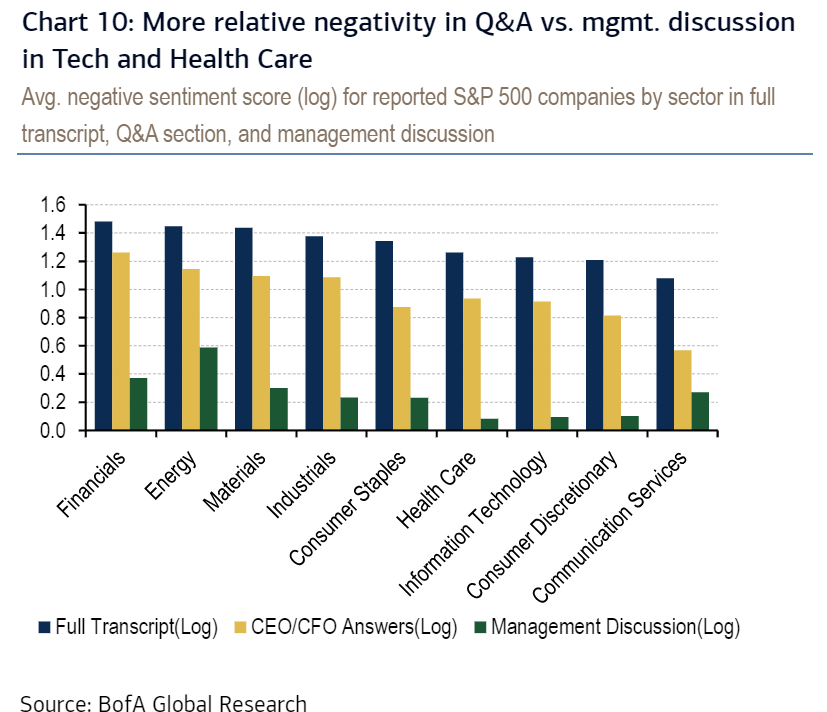

Silence Is Golden The first-quarter earnings season is limping to a close this week, bringing two childhood sayings back to mind. First: "If you can't find anything positive to say, don't say anything." And second: "Do as I say, not as I do." Companies are following the first. Investors appear to be observing the second, responding to what companies are saying rather than the cold facts of the numbers they are announcing. Executives are deciding to withdraw their guidance in record numbers, making the responsible decision that if the pandemic is making them uncertain about the future they are best keeping their own counsel. As the quantitative team at BofA Securities Inc. shows, the preponderance of the 114 S&P 500 companies withdrawing all guidance come from the highly cyclical consumer discretionary and industrials sectors:  The guidance from those still offering it is running more negative than at any time since the worst of the Great Recession. Without company suspensions of guidance, we can assume that it would have been even worse:  As for the projections of brokers following companies, they are terrible — although they do appear to have hit bottom. This is what has happened to consensus projections for the first quarter, again from BofA:  Meanwhile, earnings momentum, where the number of positive upgrades by analysts is shown as a percentage of all changes in forecasts, has also dropped coyote-like off a cliff, but appears to have reached a trough, as shown in this chart from Societe Generale AG's cross-asset research. This is true both for the U.S. and the world:  As for forecasts for the next year, they have been hit as never before. This chart shows Bloomberg's own measure of prospective S&P 500 earnings, and actual trailing numbers.  The market's ability to look through this has been nothing short of extraordinary. Prospective earnings multiples haven't been this high since 2001:  Looked at in broader perspective, the market doesn't look quite this rich, but still looks overdone. This is the latest read-out of the cyclically adjusted price-earnings multiple, or CAPE, as taken from the website of Robert Shiller at Yale University:  My rough and ready estimate is that the ratio has increased to a little above 27 since Shiller revised it last month. That makes it less overblown than it was a few years ago, and far cheaper than at the top of the bubble in 2000. But it is still way above the historic average, above its peak in 1966 and also above its level before share prices collapsed in 2008. Why are markets this positive? My guess is that investors are drawing the best possible conclusions from what clues companies are giving them during earnings calls. There are numerous attempts to quantify guidance these days, and BofA's suggests that executives become far more negative in their Q&A sessions with investors than they have been in the officially drawn up management guidance, which tends to be far more positive:  This effect is most marked in health care (where executives had to express opinions on the virus itself during their Q&As) and — much more intriguingly — in technology. This attempt at quantification gives little reason for optimism. But an exhaustive subjective analysis by the quantitative team of Bankim Chadha at Deutsche Bank AG found that executives were spinning a positive story about the issues that most worried investors. In particular, they found that companies were trying to avoid their mistake of 2009 in not being ready for recovery, while those exposed to China made positive noises about the speed of the return to normality there. This is the key section from Chadha's report: This view reflects their experience of a gradual rebound in China and the tentative stabilization seen through April in other regions. Many companies highlighted the rebound they are already seeing in China as the economy re-opened, with supply and production largely back to pre-outbreak levels and demand also improving gradually. As Caterpillar noted "all of our facilities are operating in China again and our suppliers are doing much better in China as well," while Starbucks thinks "barring any new disruptions, our business in China is on a path to substantial recovery." However Yum China pointed out that while "approximately 99% of our stores are open," their "volume has not yet returned to pre-outbreak levels." Looking through the other quotes identified by Chadha's team, I found reasons for concern, and a lot of the positivity was conditional on the economy reopening. The following quotes come from the CEO of Fastenal Co. (which has beaten the S&P by 10% since announcing results April 14) and Abbott Laboratories Inc., which outpaced the market by 6% in the first week after announcing April 16, but has now given that all back. I would characterize both as very guardedly optimistic, but maybe people in the markets are picking up on a dog whistle of greater positivity: Fastenal: At this point, we just don't know. The message that I've given our team is with shelter-in-place orders, you see a bunch of customers, a bunch of businesses that are shut down. You also see examples where our business is operating. And I believe the bias right now towards pieces of the economy turning back on is stronger today than it would have been a couple weeks ago. And I've said to our team we [are] actually prepared for elements of the economy turning back on as we get into May. I don't know if that's going to happen, but elements of our economy [are] turning back on. So I wouldn't see the drop-off being as acute as you saw back in 2009. Abbott: We can see a recovery into Q3 and into Q4 especially for these more elective procedures… It will be a V-shape. I don't think it will be -- I think the right-hand side of that V-shape will be definitely a little less steeper than the left-hand side of that V-shape. But I think we're going to see that recovery in Q3 and Q4, at least that's what our data is suggesting. I would want something a little stronger and less conditional before bidding up stock prices as far as they have gone. But it appears the market is hearing what it wants to hear. Survival Tips Corporate travel is off at present. Later this month, I was due to have a trip to Atlanta for the CFA Institute's annual conference, but that has inevitably been canceled. However, I do at least get to take part in the replacement virtual conference, where I will be interviewing Howard Marks, the hugely influential head of Oaktree Capital Management LLC. The interview will go live on May 18, and I would appreciate any thoughts on questions to ask. To give you some food for thought, his website, including his regular letters to investors, can be found here. His latest memo, on the coronavirus, is a classic of the genre. I have always enjoyed the event, which tends to have much more long-termist and thought-provoking fare than found elsewhere on the conference circuit. This year, the disappointment that it has to be virtual is balanced by the fact that it is now free. So my survival tip, for maintaining sanity in a time of seclusion, would be to register for the conference here. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment