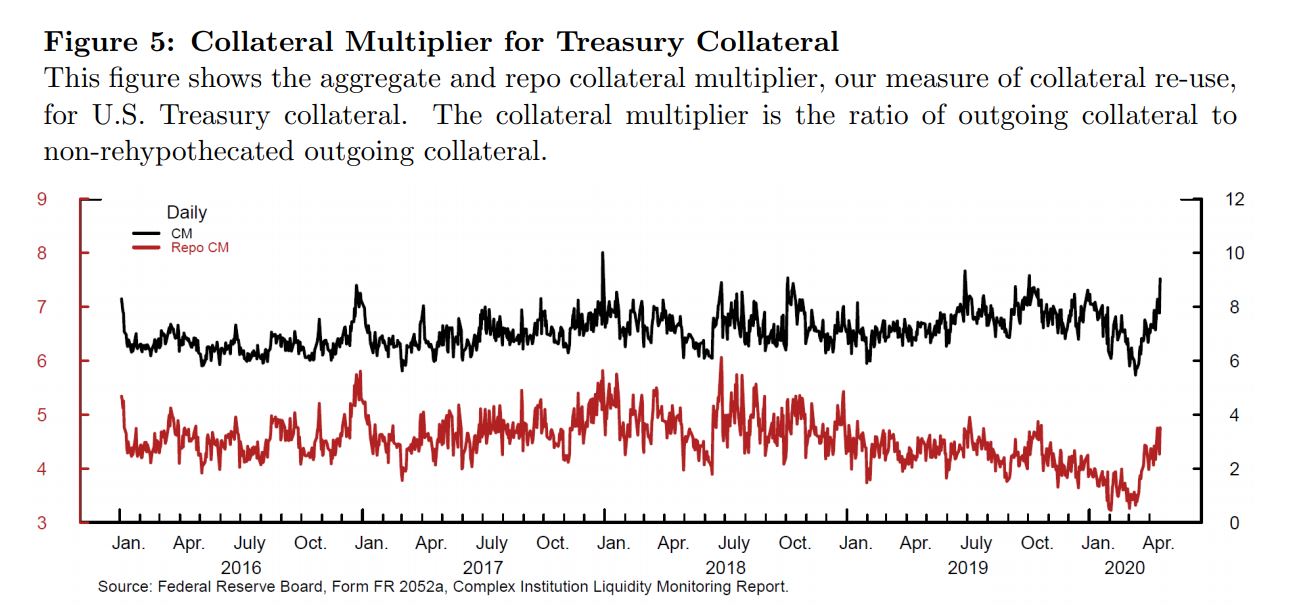

| The new Covid strain is unsettling markets. Israel's government collapses. How China lost patience with its loudest billionaire. The new Covid-19 strain that emerged in the U.K. may already be in the U.S., Germany, France and Switzerland, officials in those countries said. Ireland imposed new restrictions to stem an "extraordinary growth" in cases, and said the nation should assume the new variant has arrived. Pfizer's partner BioNTech is exploring options to boost vaccine production, and its chief executive officer said its shot will probably work against the new virus strain. Taiwan reported the first locally transmitted infection since April, ending what was the world's longest stretch without a domestic case. Deaths are up in New York City. Anthony Fauci, the U.S. government's top infectious-disease doctor, received Moderna's vaccine. Meanwhile, U.S. hospitals are being deluged, and Japan is grappling with its tense public history with vaccines. Stock futures in Asia pointed to a muted start as optimism over a Covid-19 relief bill was tempered by the new variant of the virus and a slew of lockdowns and travel curbs to contain it. The dollar advanced and Treasuries gained. Equity contracts edged up in Japan and Australia, while those in Hong Kong were flat. The S&P 500 fluctuated between gains and losses before closing lower earlier, with consumer services and energy the biggest sector decliners. The Nasdaq Composite and Russell 2000 set record highs in what is a holiday shortened week. The European Union came under mounting pressure to slow down its push for a major investment deal with China, as opposition grew to any agreement with Beijing that fails to tackle forced labor. Jake Sullivan, national security adviser to U.S. President-elect Joe Biden, weighed in with a tweet late on Monday referencing a story on the proposed EU-China accord. He urged "early consultation with our European partners on our common concerns about China's economic practices." Meanwhile, Canadian Prime Minister Justin Trudeau's government rejected a plan by China's Shandong Gold Mining Co. to acquire a gold miner that operates in the Canadian Arctic Israel's brittle governing coalition collapsed after just seven months, sending the election-fatigued country to its fourth vote in two years. The ballot is to take place on March 23 after parliament failed to approve a national budget for the second year in a row.The campaign will feature a new challenger who might win enough support to dethrone the long-serving Prime Minister Benjamin Netanyahu, polls suggest. The race will be especially bruising as the virus defies efforts to tame it, talk of a third national lockdown is percolating, and unemployment is a steep 15%. The sudden cancellation of Ant Group's IPO shocked many investors, but flamboyant billionaire Jack Ma's fall from grace had been years in the making. While his wealth and influence are being curbed, Ma isn't on the verge of a personal downfall, say those familiar with the situation. Instead, the public rebuke of the man most associated with China Inc's rise is a warning that Beijing has lost patience with the outsize power of its technology moguls, increasingly perceived as a threat to the political and financial stability President Xi Jinping prizes most. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayIt's rarely discussed outside of the backwater that is dealer-banks' repo desks, but rehypothecation — or the recycling of collateral underpinning secured financing transactions — is an important lubricant for the financial system as a whole. It typically involves an investor lending out a security, such as a U.S. Treasury bond, in exchange for short-term financing. The dirty secret is that the same U.S. Treasury can be lent out multiple times, effectively forming a chain of collateral that adds to the amount of money sloshing around the financial system.  Bloomberg Bloomberg The importance of rehypothecation is highlighted in a new working paper from the Federal Reserve, penned by Sebastian Infante and Zack Saravay. They argue that the recycling of U.S. Treasuries as collateral for secured funding transactions tends to increase as supply goes down —especially when the Fed limits supply via asset purchases through quantitative easing. That suggests that QE helps boost the economy in multiple ways: through the portfolio rebalancing channel that encourages investors to seek out riskier assets as yields on safer assets like U.S. Treasuries fall, and also by increasing the length of "collateral chains" and adding additional leverage into the system. That dynamic was on full display during the worst of this year's market rout. Collateral chains shortened significantly back in March, as dealer-banks pulled back on secured financing while other investors were selling U.S. Treasuries. That led to the lowest reuse of U.S. government bonds on record, according to the Fed paper. Once the U.S. central bank stepped in to soothe the market, collateral chains started lengthening once again, helping to boost available financing in the financial system. That sounds like a good thing. But of course leverage can easily morph into a vulnerability if there's too much of it, or even if the value of the collateral underpinning it were to suddenly fall. Rehypothecation "alleviates some of the costs associated with safe asset scarcity, as Treasury re-use distributes safe assets to counterparties that need them most," the paper's authors write. "However, it also increases leverage and interconnectedness with safe asset collateral, which raises other possible sources of risk, such as collateral runs." You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment