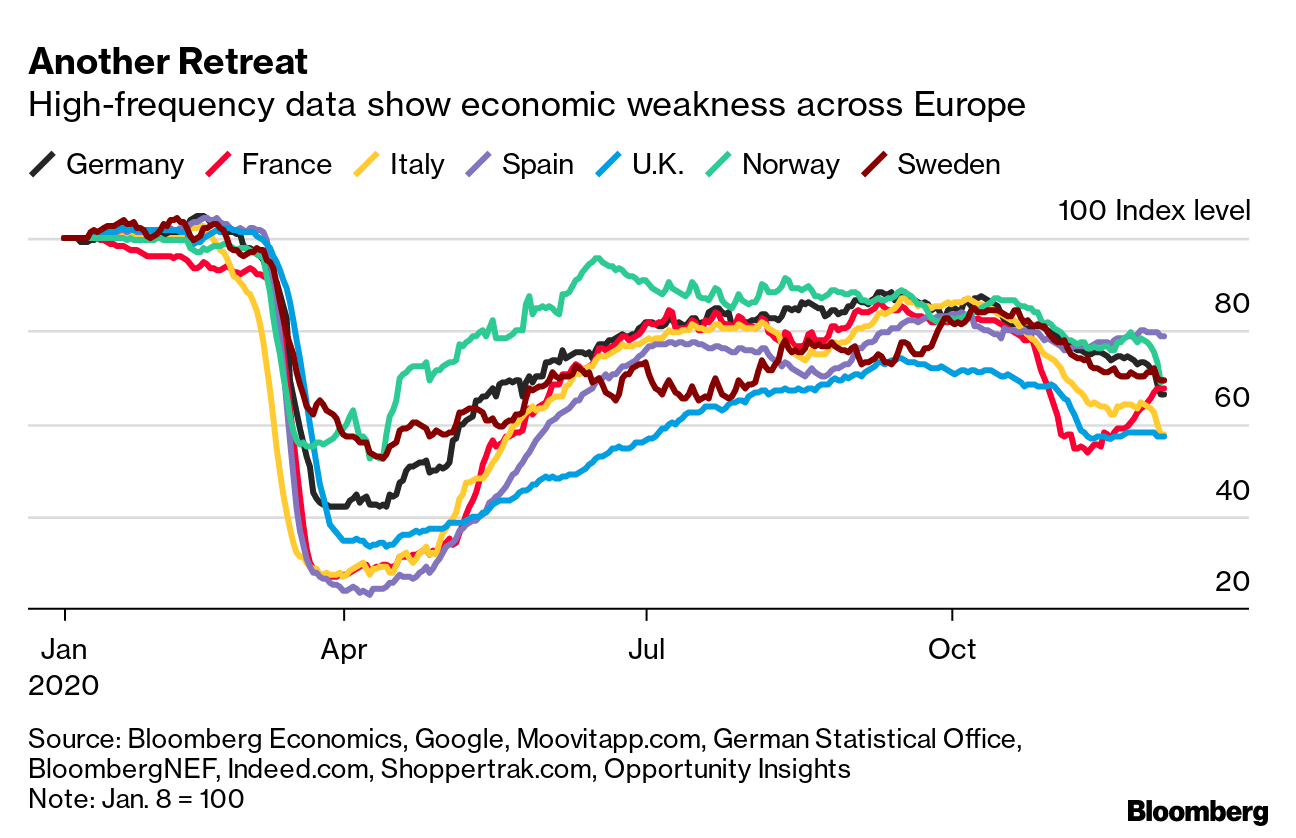

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. If Hungary and Poland were hoping to make a show in this week's summit of EU leaders, they may be in for a disappointment. We're told there's a plan to not let them hijack the meeting, not least because their demands to unlink the disbursement of grants from the EU's next budget and recovery fund from the adherence to rule-of-law standards isn't going to garner enough support. So instead of having a long, tedious and ultimately pointless debate, the tentative plan is to go ahead with an announcement before the summit that the rest of bloc will set up a recovery fund which excludes the two holdouts. In short, unless they offer a clear signal that they will lift their veto over the EU's stimulus plan today, they risk losing dozens of billions of euros in aid. Will this threat of a Plan B convince them to change tack? We'll know soon enough. — Nikos Chrysoloras and Viktoria Dendrinou What's HappeningNever-Ending Brexit | U.K. Prime Minister Boris Johnson will head to Brussels for crisis talks with Commission President Ursula von der Leyen, amid growing fears on both sides that Brexit trade talks will fail. The move is a sign that eight months of negotiations have gone as far they can, and if there is to be a deal, political leaders will now need to step in and broker a compromise. Britain First | The U.K. will today become the first Western country to vaccinate its citizens, a turning point in the battle to halt a pathogen that has killed more than 1.5 million people globally. Governments across the world will be watching closely as they look to manage a logistically-challenging vaccine deployment and convince the public it's safe. Future Networks | Nokia is leading a group of companies and universities in an EU-funded project to help jump-start a new generation of mobile technology already being called 6G. While 5G deployment is still in its infancy, preparation is already starting around the world to develop 6G technology that could even link up to the human body and brain starting in 2030. Virus Update | Germany is looking to impose tougher restrictions after a nationwide partial shutdown failed to bring contagion rates down to manageable levels, and France probably won't meet a target for an average of 5,000 daily Covid-19 cases by mid-December, a condition to lift lockdown measures. Check out the latest. In Case You Missed ItTurkish Sanctions | Greece seems determined this time to push its demand for tough EU sanctions against Turkey over the line. Here's what Athens is asking for ahead of this week's summit of EU leaders, which is supposed to decide on the way forward. German Strength | German industrial production rose for a sixth month in October, highlighting the sector's relative resilience to pandemic restrictions that have battered economies elsewhere. Europe's largest economy has benefited from its strong industrial focus during the crisis, as countries with bigger services sectors have fared worse. Romanian Election | Romania's Prime Minister Ludovic Orban stepped down a day after his ruling Liberal Party lost elections. While finishing second in Sunday's vote, behind the opposition Social Democrats, the Liberals have more potential coalition partners and remain favorites to lead the next government. Search Results | Internet firms such as Google and Amazon and travel websites should explain how they rank search results on their platforms, according to EU guidelines published yesterday that could help businesses increase their online visibility. Alibaba Stumbles | As Alibaba's push into European markets takes on greater urgency with Beijing's crackdown on internet and fintech giants, Asia's biggest company is learning that what works in China doesn't always cut it on the continent. This is how Alibaba's efforts to expand into our continent run into Europe's Great Wall of culture and competition. Chart of the Day Alternative, high-frequency data show that economic activity in Europe slid at the beginning of December, reflecting a surge in the rate of Covid-19 infections and stricter containment measures. After a temporary period of stability in November, activity slowed further in Germany, Italy and Spain, according to Bloomberg Economics gauges that integrate data such as mobility, energy consumption and public transport usage. Today's AgendaAll times CET. - 9 a.m. EU's European affairs ministers to discuss relations with the U.K over video conference

- 9 a.m. The EU's top court rules on challenges by Hungary and Poland against EU rules on the posting of workers

- 10 a.m. EU foreign policy chief to speak on transatlantic ties at online event

- 10 a.m. Video conference of EU transport ministers

Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment